Comparing Synthetic vs Fully-Backed Tokenized Equities: What Investors Need to Know

Tokenized equities have quickly become a focal point for investors aiming to bridge traditional finance with the agility of blockchain. As digital representations of real-world stocks, these assets promise 24/7 access, fractional ownership, and borderless trading. However, not all tokenized stocks are created equal. Two primary models dominate the landscape: fully-backed tokenized equities and synthetic tokenized stocks. Understanding the structural differences between these approaches is crucial for anyone navigating this rapidly evolving sector.

Fully-Backed Tokenized Equities: Real Shares on Chain

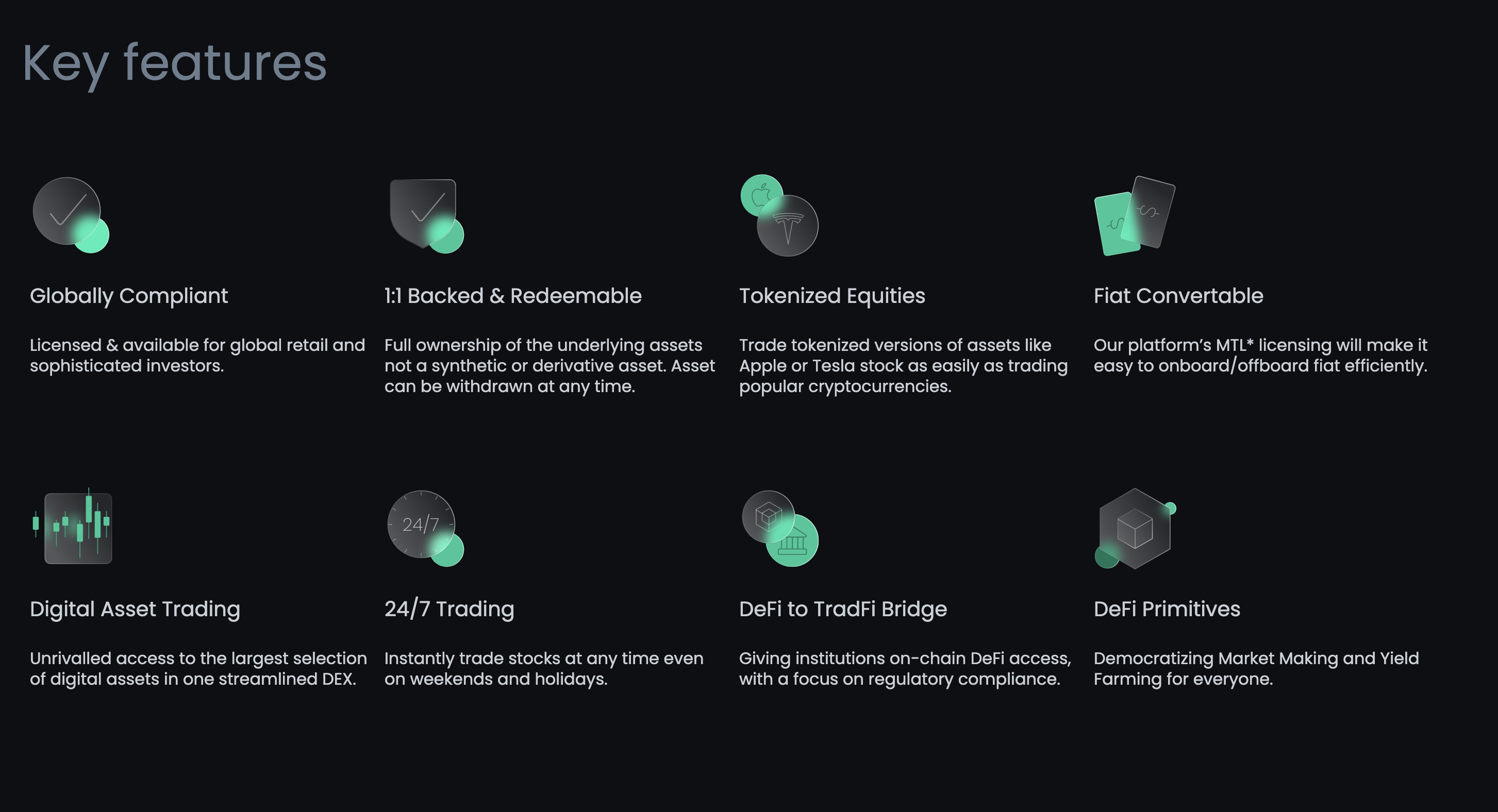

Fully-backed tokenized equities are digital tokens that represent actual shares held by a regulated custodian. Each token is backed 1: 1 by a real share, ensuring its value tracks the underlying asset precisely. This model aligns closely with traditional securities in terms of legal ownership and investor rights.

- Ownership Rights: Investors may receive dividends and sometimes even voting rights attached to the underlying shares.

- Transparency and Security: The presence of real backing provides a layer of trust uncommon in many DeFi assets.

- Regulatory Compliance: These tokens often operate within established frameworks, making them more palatable for institutional players.

An example is xStocks by Backed Finance, where tokens mirror popular equities like Tesla or Google and dividends are automatically reinvested into the asset. However, this model isn’t without trade-offs:

- Custodial Trust: Investors must rely on third-party custodians to safeguard their shares.

- Liquidity Constraints: Trading volumes can lag behind traditional exchanges, which may impact price discovery and execution speed.

- Market Hours Alignment: While tokens can trade 24/7, their underlying shares do not, leading to potential price dislocations outside normal market hours.

This approach has gained traction among investors seeking exposure to equities via blockchain while retaining tangible rights and regulatory protections. For more on how fully-backed models work in practice, see this analysis from MEXC.

Synthetic Tokenized Stocks: Price Exposure Without Ownership

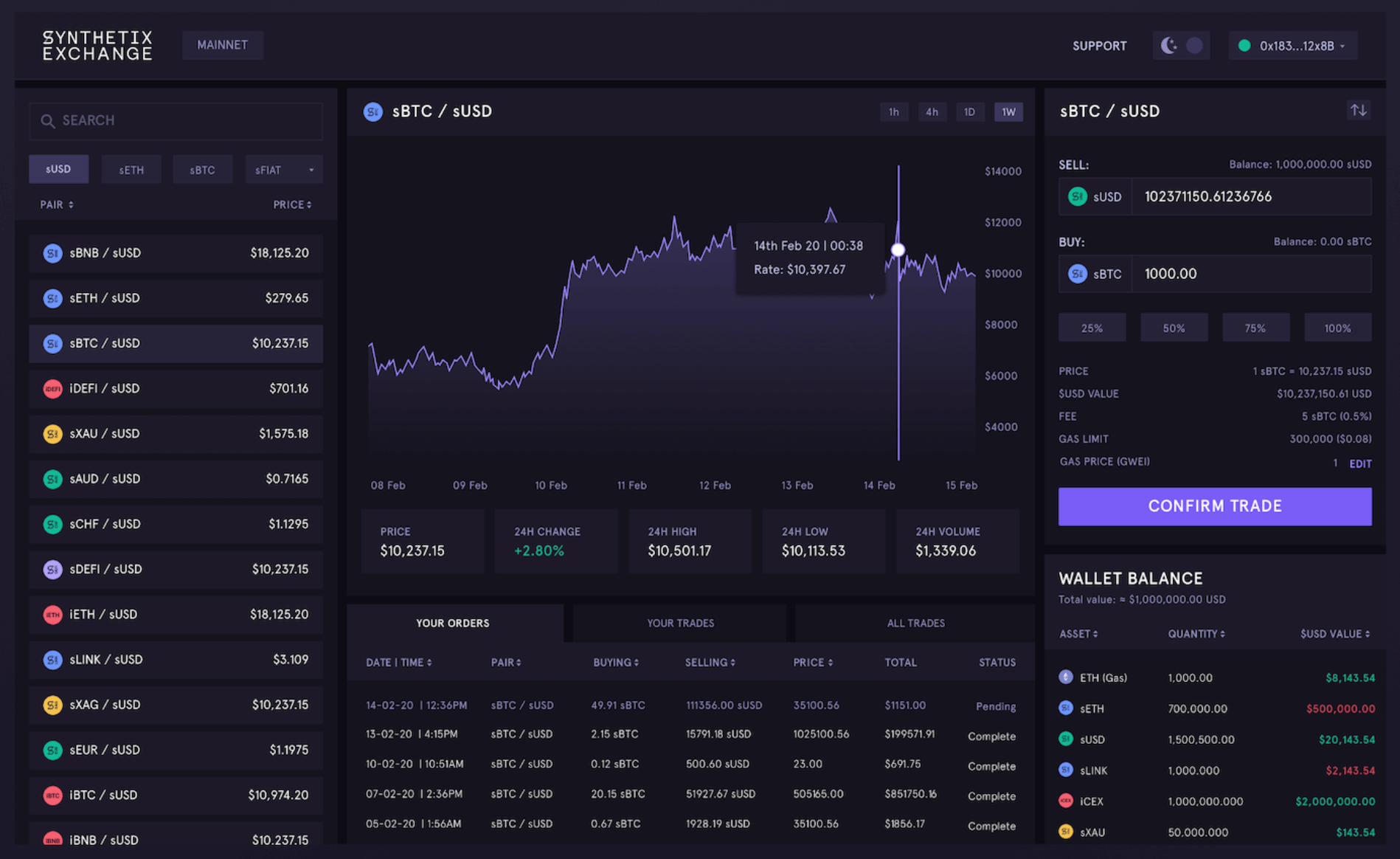

Synthetic tokenized stocks take a different route. Rather than being anchored to real shares held in custody, these tokens use smart contracts and decentralized oracles (such as Chainlink) to track stock prices algorithmically. Platforms like Synthetix pioneered this approach by allowing users to mint synthetic assets provides “Synths”: collateralized by native tokens (e. g. , SNX).

- No Legal Ownership: Investors do not own actual shares; they simply gain exposure to price movements.

- No Dividends or Voting Rights: Since there’s no underlying share, there are no associated shareholder privileges.

- No Reliance on Custodians: Everything is managed via smart contracts, removing custodial risk but introducing new technical risks.

- Permanently Open Markets: Synthetic tokens can be traded 24/7 without restriction from traditional market hours.

The flip side? Synthetic models introduce unique risks around collateral management and platform solvency. If Tesla’s price surges unexpectedly, users who minted sTSLA must add more collateral or risk liquidation, a dynamic that demands active management. Regulatory clarity also remains elusive; some jurisdictions have begun scrutinizing these products due to their derivative-like nature and lack of direct asset backing (see Keyrock’s guide).

Key Risks: Synthetic vs Fully-Backed Tokenized Equities

-

Custodial Risk (Fully-Backed): Fully-backed tokenized equities, such as xStocks by Backed Finance, require you to trust a custodian to securely hold the actual shares. If the custodian fails or is compromised, your tokens may lose their value.

-

Counterparty Risk (Synthetic): Synthetic tokenized equities, like those issued by Synthetix, depend on the solvency and reliability of the issuing protocol. If the platform faces technical issues or insolvency, token holders could suffer losses.

-

Ownership Rights (Fully-Backed): With fully-backed tokens, investors may have legal rights to dividends and, in some cases, voting power. In contrast, synthetic tokens do not confer any ownership rights—you only gain price exposure, not shareholder privileges.

-

Regulatory Uncertainty (Synthetic): The legal status of synthetic tokens is often ambiguous. Regulatory bodies may impose restrictions or take action against platforms offering synthetic equities, potentially leading to sudden loss of access or forced liquidation.

-

Liquidity Constraints (Fully-Backed): Fully-backed tokenized equities may experience limited trading volumes compared to traditional markets, which can lead to wider spreads and difficulties exiting positions quickly, especially during volatile periods.

-

Collateral Management (Synthetic): Platforms like Synthetix require users to over-collateralize their positions (often 400–600% with SNX tokens). If the underlying asset’s price rises, users must add more collateral to avoid liquidation, introducing additional risk and complexity.

-

Market Hours Misalignment (Fully-Backed): While tokenized equities can trade 24/7, the underlying stock markets have fixed hours. This can cause price discrepancies and increased volatility during off-market hours for fully-backed tokens.

Navigating Blockchain Investing Risks and DeFi Compliance

The choice between synthetic and fully-backed tokenized stocks ultimately hinges on your investment objectives and risk appetite. Those prioritizing legal clarity, compliance, and shareholder rights may gravitate toward fully-backed models, even if it means accepting lower liquidity or occasional market misalignments. By contrast, investors seeking frictionless global access or leverage may find synthetic assets appealing but should remain vigilant about counterparty risk and regulatory developments.

Market participants should also factor in the evolving landscape of DeFi compliance. Fully-backed tokenized equities are increasingly structured to fit within existing securities laws, often requiring KYC/AML checks and limiting direct access to qualified investors. This bolsters legitimacy but can restrict participation. Synthetic tokenized stocks, meanwhile, typically operate in a more permissionless environment, lowering barriers to entry but raising questions about long-term regulatory acceptance and consumer protection. As regulators sharpen their focus on DeFi protocols, platforms offering synthetic exposure may face sudden changes in operational status or user restrictions.

Accessibility & Compliance: Synthetic vs Fully-Backed Tokenized Equities

-

Accessibility: Synthetic Tokenized Equities — Platforms like Synthetix allow users worldwide to gain exposure to stock price movements without traditional brokerage accounts or KYC. Synthetic tokens can be traded 24/7 and often support fractional ownership, making them highly accessible to a global, retail audience.

-

Accessibility: Fully-Backed Tokenized Equities — Providers such as Backed Finance issue tokens backed 1:1 by real shares held in custody. Access is typically restricted to qualified or professional investors who must complete full KYC/AML checks, and trading may be limited to certain jurisdictions, reducing broad accessibility.

-

Compliance Hurdles: Synthetic Tokenized Equities — Synthetic tokens operate in a legal gray area. Since they are not backed by actual shares, they often fall outside traditional securities regulations, but this exposes issuers and investors to regulatory uncertainty and potential enforcement actions. Platforms must carefully navigate evolving global regulations.

-

Compliance Hurdles: Fully-Backed Tokenized Equities — Fully-backed models like those from Backed Finance are structured to comply with securities laws, including investor qualification, KYC/AML, and custody requirements. This clear regulatory framework offers greater legal certainty but adds onboarding friction and restricts participation to vetted investors.

Another key consideration is platform resilience. The collapse of synthetic stock offerings on some networks (such as Synthetix’s decision to sunset tokenized equities) underscores the importance of assessing platform health, oracle reliability, and collateral management practices. In contrast, fully-backed tokens depend on the ongoing solvency and legal standing of custodians, risks that shouldn’t be underestimated given the checkered history of off-chain asset custody in crypto.

What Do Investors Need to Watch?

Here’s a concise checklist for those weighing an allocation into either model:

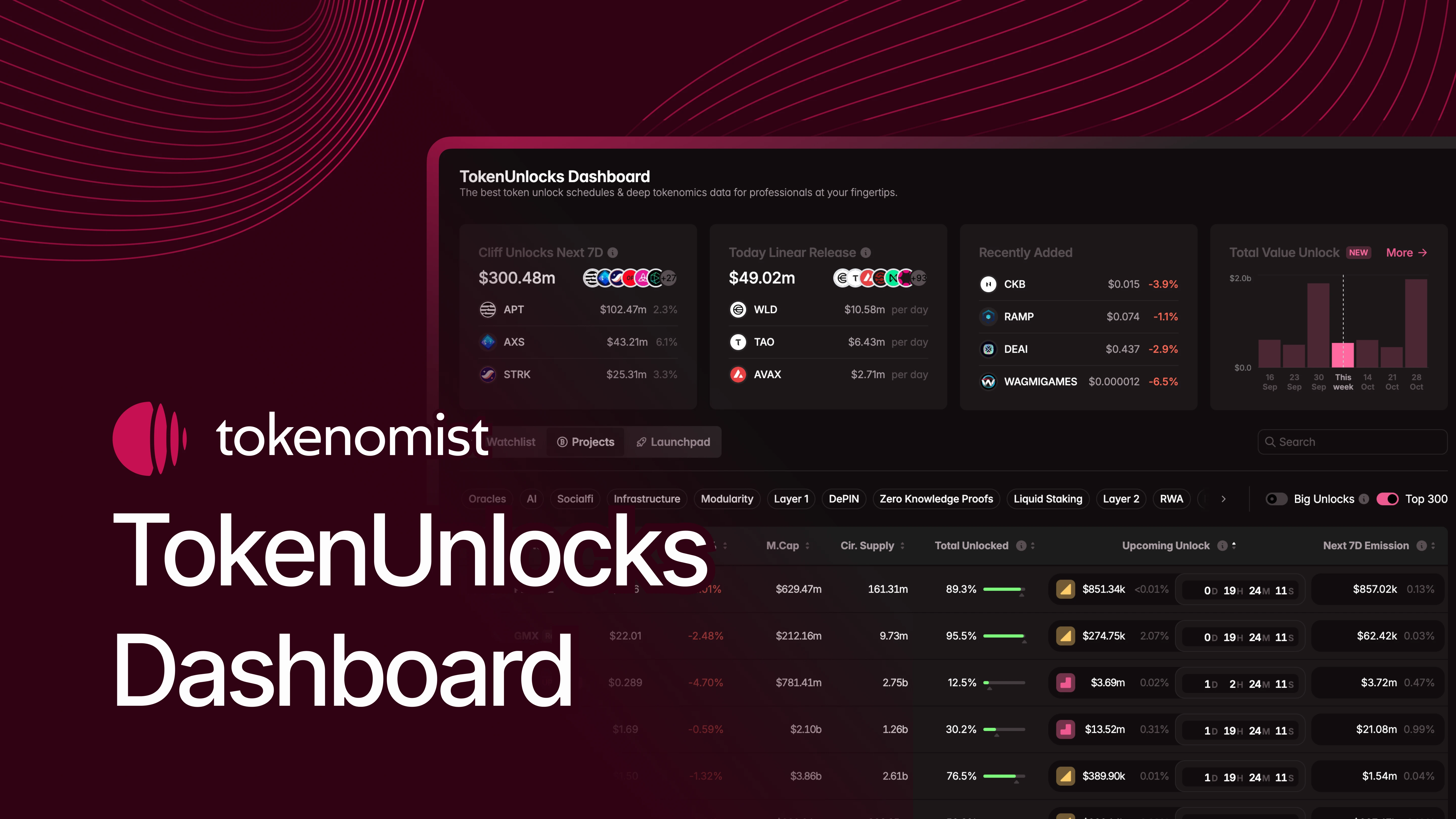

Liquidity analysis is essential. While both models tout 24/7 trading, real-world liquidity varies widely across platforms and assets. Price slippage can be significant for less popular names or during periods of market stress, especially for synthetic tokens where liquidity pools may be thin.

Transparency also distinguishes leading projects from the rest. Look for regular third-party audits (for both smart contracts and custodial reserves), open-source codebases, and clear disclosures around fees, collateralization ratios, and redemption mechanics. If you can’t easily verify how tokens are backed or priced, or who stands behind them, consider it a red flag.

Future Outlook: Tokenized Equities Beyond 2025

The next phase of growth for this sector will likely involve hybrid models that blend the strengths of both approaches, offering price exposure with optionality for physical settlement or even partial rights participation. Projects are already experimenting with structures that allow users to convert synthetic exposure into fully-backed tokens upon demand (and vice versa), potentially unlocking new forms of liquidity while maintaining regulatory flexibility.

Ultimately, blockchain investing risks aren’t going away, but neither is the relentless innovation driving this market forward. For now, investors should keep their research sharp, stay abreast of jurisdictional changes affecting DeFi compliance, and diversify across both models if appropriate for their risk profile. The promise of democratizing equity access remains compelling; just remember that not all on-chain stocks are created equal, and due diligence is your best defense against emerging pitfalls.