Fractional Ownership: Investing in Real-World Assets through Tokenized Equities

Fractional ownership through tokenized equities is rapidly transforming how investors access and participate in global markets. No longer limited to the ultra-wealthy or large institutions, everyday investors can now own a slice of high-value assets like real estate, fine art, or even rare collectibles. This democratization is powered by blockchain technology, which enables the seamless representation of real-world assets (RWAs) as digital tokens on decentralized platforms.

Why Fractional Ownership Matters in 2025

Traditionally, investing in prime commercial property or blue-chip private equity required substantial capital and often complex legal arrangements. Tokenization has upended this paradigm. By breaking assets into smaller, tradable units, fractional ownership tokenized stocks allow investors to diversify across multiple asset classes with lower entry barriers. According to Zoniqx, this model opens doors for retail participation in previously inaccessible markets.

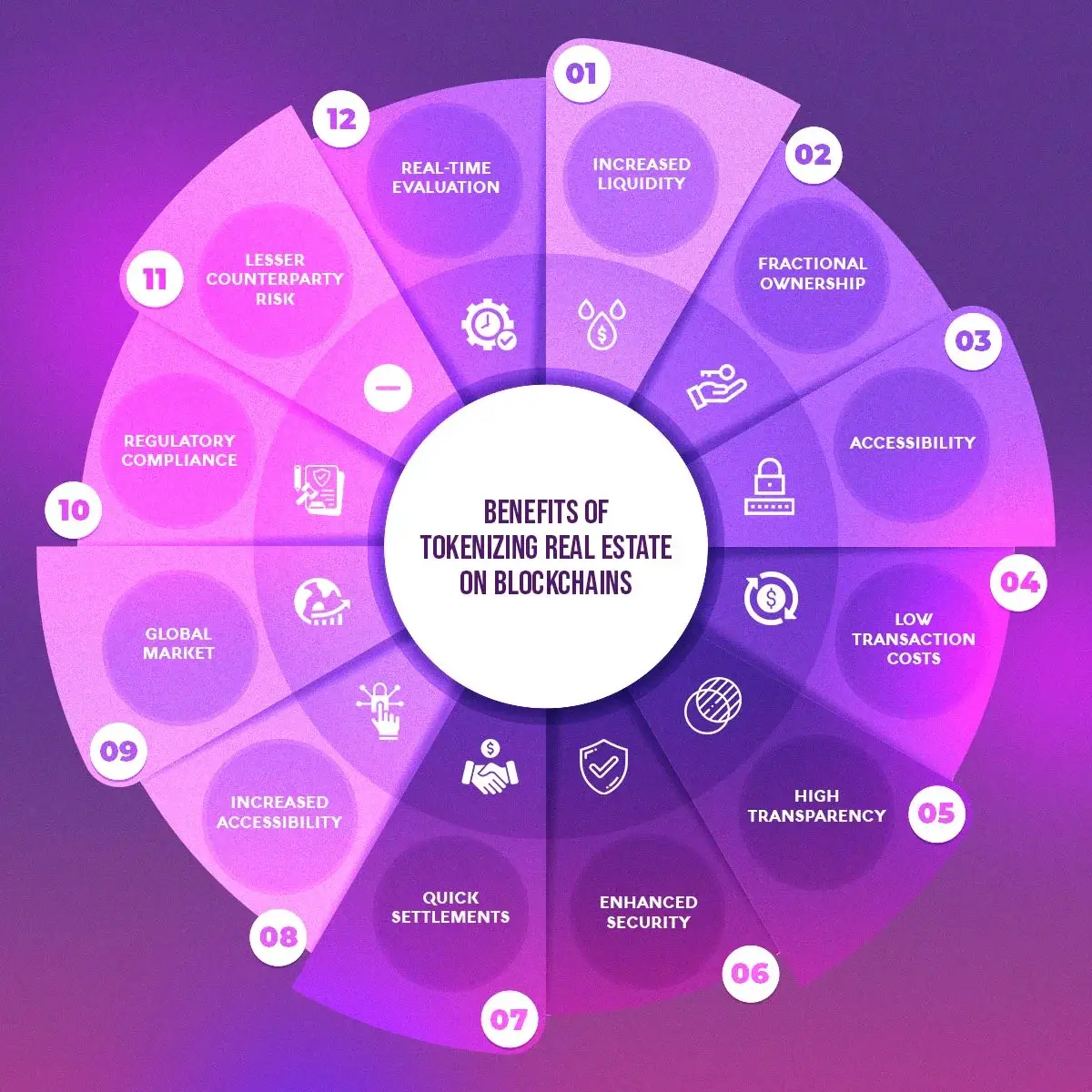

Key Benefits of Fractional Ownership via Tokenized Equities

-

Lower Barriers to Entry: Fractional ownership allows investors to purchase small portions of high-value assets, such as real estate or art, making these markets accessible to a broader range of participants.

-

Enhanced Liquidity: Tokenized equities transform traditionally illiquid assets into digital tokens that can be easily traded on blockchain-based secondary markets, increasing flexibility for investors.

-

24/7 Trading Access: Unlike traditional stock markets with limited hours, tokenized assets can be traded around the clock, offering real-time responsiveness to global market events.

-

Global Accessibility: Blockchain technology enables investors worldwide to access and trade tokenized equities, removing geographical restrictions and democratizing investment opportunities.

-

Portfolio Diversification: With fractional ownership, investors can diversify across multiple asset classes and geographies, reducing risk and optimizing returns.

The benefits extend beyond accessibility:

- Liquidity: Assets once considered illiquid – think trophy real estate or infrastructure projects – can now be traded 24/7 on secondary markets.

- Global Reach: Blockchain equities investing eliminates geographical barriers, enabling anyone with an internet connection to participate.

- Transparency and Security: Blockchain records every transaction immutably, reducing fraud and increasing investor trust.

The Mechanics of Real-World Asset Tokenization

Real-world asset tokenization works by converting ownership rights of a physical asset into digital tokens that live on a blockchain. Each token represents a fraction of the underlying asset, whether it’s an apartment building in Manhattan or a Picasso painting. These tokens are typically issued as either fungible (interchangeable) or non-fungible (unique) depending on the asset’s nature and investment structure.

This innovation is more than technical wizardry; it’s fundamentally reshaping how value is created and exchanged worldwide. For example, platforms like ADDX are granting retail investors access to private markets that were once the exclusive domain of institutional players (OKX Learn). The ability to buy and sell fractions of an asset increases market liquidity and provides price discovery around the clock.

Navigating Regulatory Waters: Opportunities and Risks

The promise of fractional ownership via blockchain comes with regulatory scrutiny. As highlighted by the World Federation of Exchanges and SEC Commissioner Hester Peirce, these digital instruments must comply with existing securities laws (Reuters). Regulators are concerned that while tokenized stocks mimic traditional equities, they may not always provide equivalent investor protections or voting rights.

This evolving landscape means that due diligence is essential for anyone considering exposure to these new financial products. Investors should be aware that not all platforms offering fractionalized assets operate under the same legal standards as traditional exchanges. Still, major financial institutions – including Coinbase and Bank of America – are actively exploring blockchain-based stock trading solutions as reported by PYMNTS, signaling growing institutional confidence in this model.

As the regulatory environment matures, platforms are sharpening their compliance frameworks to align with global standards. The push for clarity is not just about satisfying watchdogs; it’s about building trust among retail and institutional investors alike. In regions like the EU and Asia-Pacific, we’re seeing a surge in pilot programs and sandbox initiatives designed to test tokenized equity offerings under real-world conditions. These efforts are paving the way for a more robust secondary market where liquidity, transparency, and investor protections are paramount.

Yet, the path forward is not without friction. Key challenges include verifying asset provenance, ensuring that digital tokens accurately represent legal ownership, and managing cross-border regulatory discrepancies. For example, while some jurisdictions embrace real-world asset tokenization as a bridge between traditional finance and DeFi, others maintain a cautious stance, insisting on strict KYC/AML protocols and real-time auditability of underlying assets.

What Investors Should Watch in 2025

The next phase of growth in fractional ownership tokenized stocks will be shaped by several forces:

- Institutional Adoption: As major banks and exchanges enter the space, expect more sophisticated products, ranging from tokenized government bonds to ESG-focused infrastructure funds.

- Technology Integration: Smart contracts will automate dividends, governance votes, and compliance checks, reducing administrative overhead for issuers and investors alike.

- Global Liquidity Pools: Interoperable blockchains could soon enable cross-border trading of fractionalized assets with instant settlement, reshaping how capital flows across continents.

The strategic investor should focus on platforms that prioritize transparency, offering regular audits, clear legal documentation, and robust secondary market infrastructure. It’s also wise to consider the underlying asset’s quality: not all tokenized real estate or art is created equal. Look for projects backed by reputable custodians or insurers who can vouch for both authenticity and ongoing management.

The Global Perspective: Democratizing Wealth Creation

If there’s one undeniable trend in 2025, it’s that think globally, invest locally has never been more actionable. Blockchain equities investing is dissolving borders, not just geographically but socioeconomically. From São Paulo to Singapore, individuals are pooling capital into assets that were once off-limits due to high minimums or opaque ownership structures.

This shift isn’t just about diversification; it’s about inclusion. By lowering barriers through fractionalization and digital access points, tokenized equities have the potential to unlock trillions in dormant value across global markets. As this ecosystem matures, and as regulators provide clearer guardrails, the winners will be those who combine rigorous due diligence with an appetite for innovation.

The bottom line? Fractional ownership via real-world asset tokenization isn’t hype, it’s a structural evolution in how wealth is built and shared worldwide. With careful attention to regulatory trends and platform credibility, investors can tap into new opportunities while managing risk intelligently.