Programmable Equities: How Tokenized Stocks Enable DeFi Lending and Yield

Programmable equities are rapidly rewriting the rules of capital markets. By turning traditional shares into blockchain-native, programmable assets, tokenized stocks are driving a surge in DeFi lending and yield generation that’s impossible for legacy finance to match. In 2025, DeFi lending has shot up 72%, propelled by institutional demand for real-world assets (RWAs) as collateral, according to Cointelegraph. The catalyst? Programmable equities that unlock new financial primitives on-chain.

How Programmable Equities Bridge TradFi and DeFi

Tokenized stocks – digital representations of real-world shares on blockchain platforms – have evolved from experimental instruments to critical infrastructure for global finance. Unlike traditional equities, programmable stocks can be traded 24/7, fractionally owned, and integrated directly into DeFi protocols. This enables investors to use their equity holdings as blockchain collateral or deploy them in liquidity pools for yield without ever leaving the on-chain ecosystem.

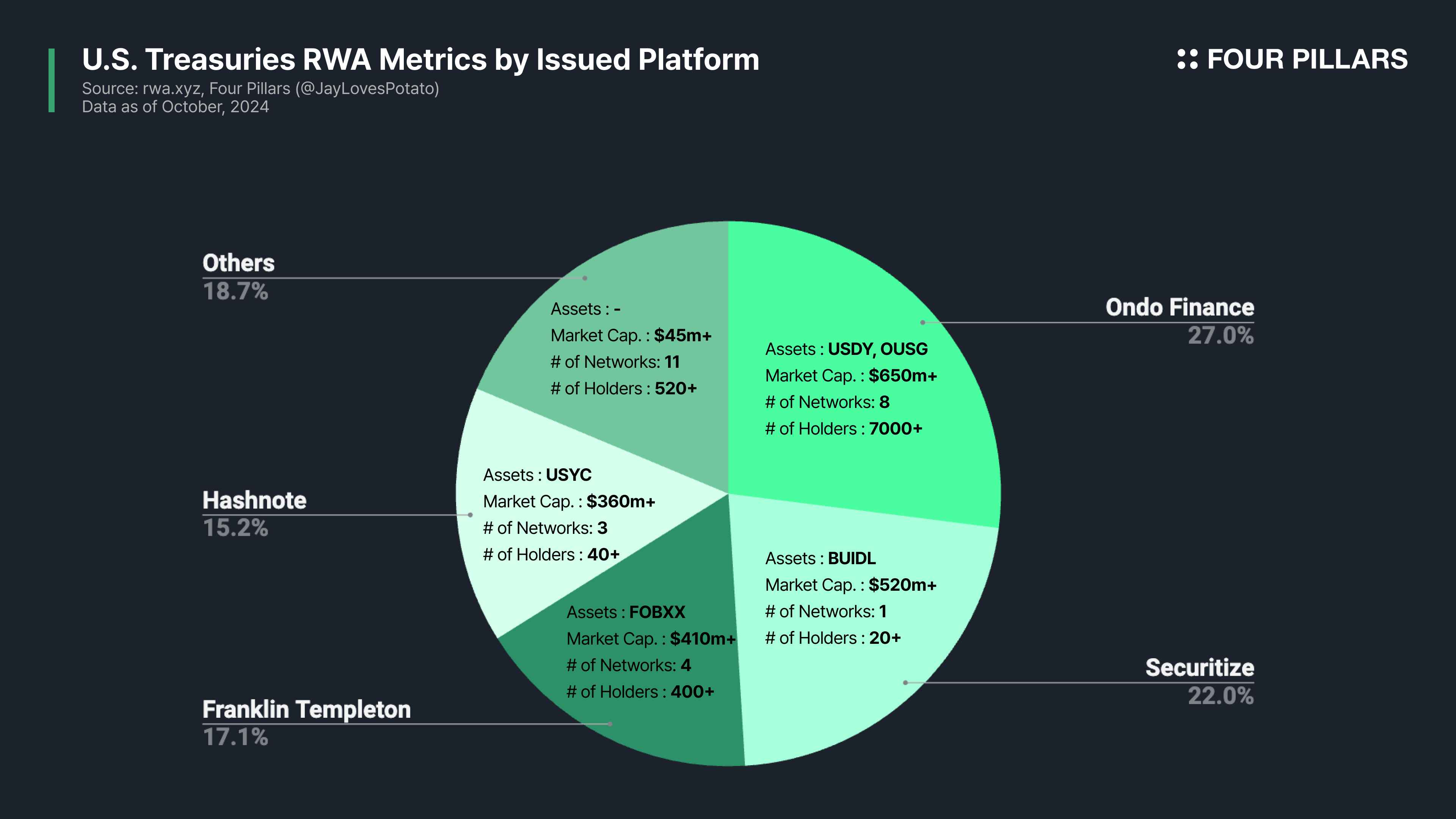

Projects like Ondo, Chromia, and Centrifuge are at the vanguard of this movement, offering yield-bearing tokens and advanced lending mechanisms that bring TradFi-grade assets onto decentralized rails (UD Blockchain). Meanwhile, top exchanges such as Kraken and Gemini are expanding their support for tokenized equities – a clear signal that Wall Street is taking notice.

DeFi Lending: Tokenized Stocks as Blockchain Collateral

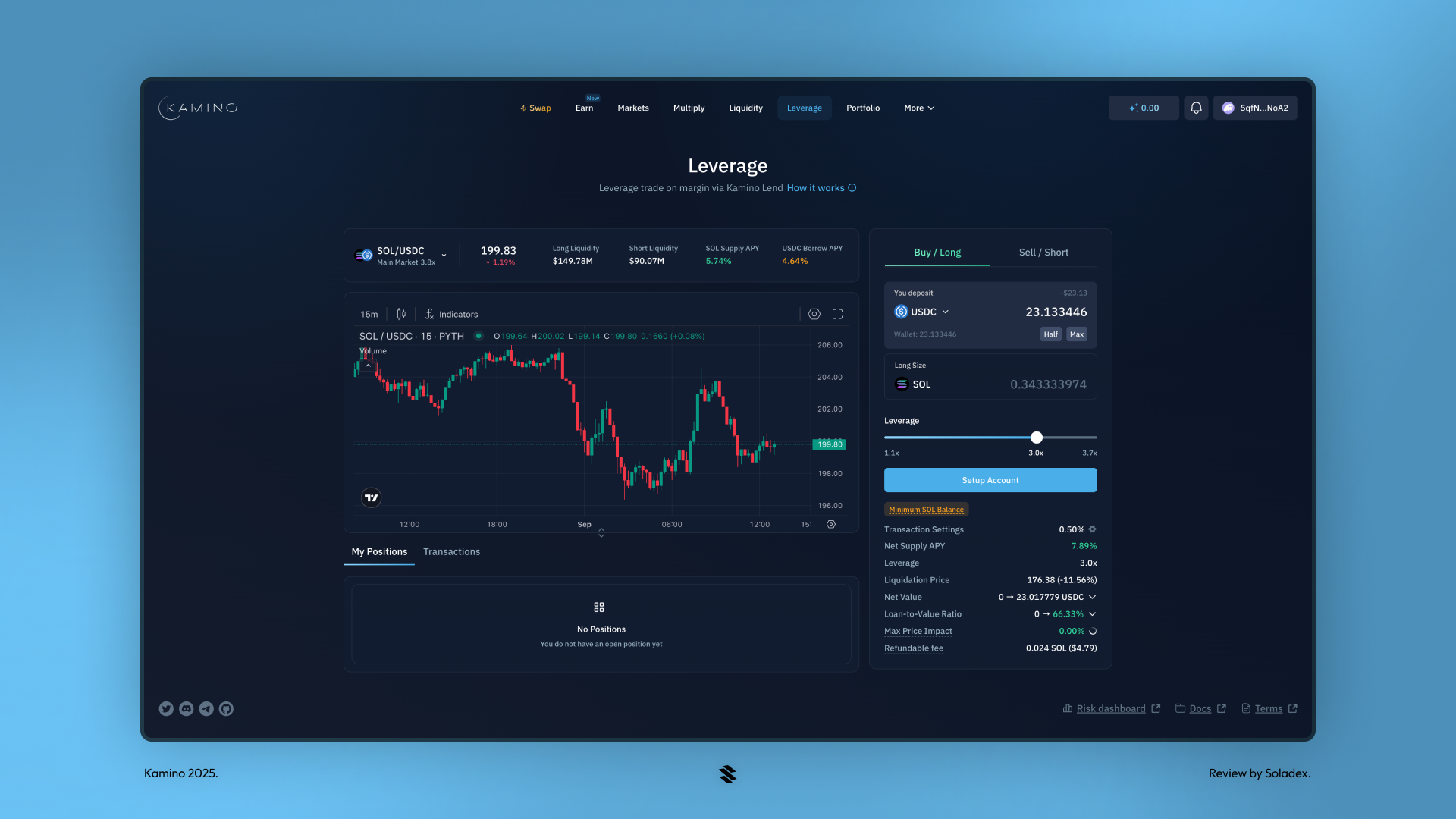

The most transformative application of programmable equities is their role as on-chain collateral. Platforms like Kamino on Solana have integrated xStocks – tokenized versions of U. S. blue-chip equities – into their lending protocols. This means users can now borrow stablecoins or crypto against their equity positions without liquidating their core assets (The Defiant).

This model fundamentally alters liquidity management for both retail and institutional investors:

Key Advantages of Programmable Equities as DeFi Collateral

-

24/7 Liquidity Access: Tokenized stocks enable round-the-clock trading and collateralization, letting users borrow or lend at any time—unlike traditional markets with limited hours.

-

Fractional Ownership & Accessibility: Programmable equities allow investors to use fractional shares as collateral, lowering entry barriers and democratizing access to DeFi lending platforms.

-

Instant Settlement & Rapid Collateralization: Blockchain-based tokenized stocks compress traditional T+2 settlement cycles into seconds, enabling immediate use as collateral in DeFi protocols.

-

Yield Generation Opportunities: Platforms like Swarm and Kamino let users earn yields by lending or staking tokenized equities, unlocking new passive income streams beyond traditional dividends.

-

Institutional-Grade Security & Transparency: Major platforms such as Kraken, Gemini, and Robinhood are integrating tokenized equities, providing robust security, regulatory oversight, and transparent on-chain records.

-

Enhanced Diversification & Portfolio Efficiency: Investors can combine traditional equities with crypto assets in a single DeFi portfolio, optimizing risk and return through broader collateral options.

-

Growing Institutional Adoption: The RWA sector’s on-chain value has surpassed $25 billion, with increasing institutional participation fueling deeper liquidity and mainstream acceptance of tokenized equities as collateral.

The result is a more fluid market structure where stocks become composable building blocks within the broader DeFi economy. According to OKX, Swarm’s protocol allows immediate redemption and liquidity for tokenized shares, bypassing legacy settlement bottlenecks entirely.

Yield Generation: Turning Equities into Yield-Producing Assets

The next frontier is yield generation. Investors can lend out their tokenized stocks within DeFi platforms or contribute them to structured products like covered call vaults or tranching mechanisms (QuickNode Blog). This transforms passive stock holdings into active, yield-generating assets – a concept foreign to most traditional equity investors.

Swarm’s redemption pool mechanism exemplifies this shift by providing instant on-chain liquidity while allowing lenders to earn interest from borrowers seeking exposure to synthetic equities. These innovations are not just theoretical; they’re already boosting Ethereum’s total value locked (TVL), which climbed 400% following the integration of tokenized U. S. stocks according to AInvest.

As programmable equities mature, DeFi protocols are racing to offer more sophisticated yield products. Covered call vaults, equity-backed liquidity pools, and tranching strategies, once the preserve of institutional desks, are now available to any on-chain investor. This democratization is not just about access; it’s about efficiency and composability. Tokenized stocks settle instantly, can be programmatically transferred between protocols, and support automated strategies that optimize returns in real time.

The implications for portfolio construction are profound. Investors can now blend traditional stock exposure with DeFi-native yields, creating hybrid portfolios that maximize both upside and passive income. For example, a user might deposit tokenized Tesla shares into a lending pool on Ethereum or Solana, earning yield while retaining price exposure, something simply not feasible in legacy brokerage accounts.

Navigating Risks: Regulation and Smart Contract Security

Programmable equities are not without their risks. Regulatory clarity remains elusive as jurisdictions grapple with how to classify and oversee tokenized stocks. Compliance frameworks are evolving but fragmented, protocols must ensure KYC/AML standards while maintaining user privacy and global accessibility.

Technical risk is equally critical. Smart contract vulnerabilities or oracle failures could jeopardize collateral integrity or trigger unintended liquidations. As the sector scales, robust audits, insurance protocols, and transparent governance will be non-negotiable for sustainable adoption.

The Path Forward: Institutionalization and Mass Adoption

The numbers tell the story: over $25 billion in on-chain RWA value (OKX), 72% growth in DeFi lending (Cointelegraph), and a wave of new integrations from both DeFi upstarts and TradFi giants like Kraken and Robinhood. The message is clear, programmable equities are moving from the periphery to the core of global markets.

This trend is accelerating as institutions seek compliant exposure to blockchain collateral without sacrificing regulatory safeguards or operational security. Expect deeper liquidity pools for tokenized blue chips, more advanced structured products tailored for on-chain equities, and seamless bridges between CeFi platforms and DeFi rails.

What’s Next for Yield-Generating Assets?

The synthesis of programmable equities with decentralized finance is only beginning to unlock new capital efficiencies. As technical standards mature and regulatory frameworks solidify, expect an explosion of creative financial engineering around tokenized stocks, from algorithmic rebalancing vaults to synthetic ETF baskets tradable 24/7 worldwide.

Top Protocols Powering Yield with Tokenized Stocks

-

Kamino – As the first major DeFi lender to accept tokenized stocks as collateral, Kamino (on Solana) enables users to borrow stablecoins against xStocks (tokenized U.S. equities), unlocking on-chain liquidity and yield opportunities.

-

Swarm – Swarm integrates tokenized stocks into DeFi, allowing users to lend their tokenized equities and earn interest. Its redemption pool mechanism provides instant liquidity, making it a leader in programmable equity yield.

-

Ondo Finance – Ondo specializes in real-world asset (RWA) tokenization, including equities, and offers yield-bearing products by integrating tokenized stocks into DeFi lending and liquidity pools.

-

Chromia – Chromia is advancing programmable equities by supporting tokenized stock infrastructure for DeFi lending and structured yield products, bridging TradFi assets with decentralized protocols.

-

Centrifuge – Centrifuge brings real-world assets, including tokenized equities, into DeFi lending markets, enabling users to earn yield by providing liquidity against tokenized stock collateral.

The bottom line: programmable equities have transformed static stock ownership into an active engine for liquidity, collateralization, and yield generation on the blockchain. Investors who adapt early stand to capture asymmetric opportunity as the boundaries between TradFi and DeFi dissolve.