Tokenized Stocks on BounceBit: Features, Use Cases, and DeFi Integration

BounceBit is redefining the landscape of on-chain global equities with its upcoming launch of tokenized stocks in Q4 2025. By bridging traditional equity markets from the United States, Europe, Hong Kong, and Japan to a permissionless blockchain environment, BounceBit aims to unlock new liquidity streams and financial strategies for both institutional and retail investors. This move is not just about digitizing shares – it’s about embedding these assets natively into the decentralized finance (DeFi) ecosystem from day one.

BounceBit Tokenized Stocks: Core Features Driving Adoption

What sets BounceBit tokenized stocks apart? The platform’s Tokenized Stock Environment (TSE) introduces a suite of features designed for maximum capital efficiency and utility:

Key Features of BounceBit Tokenized Stocks

-

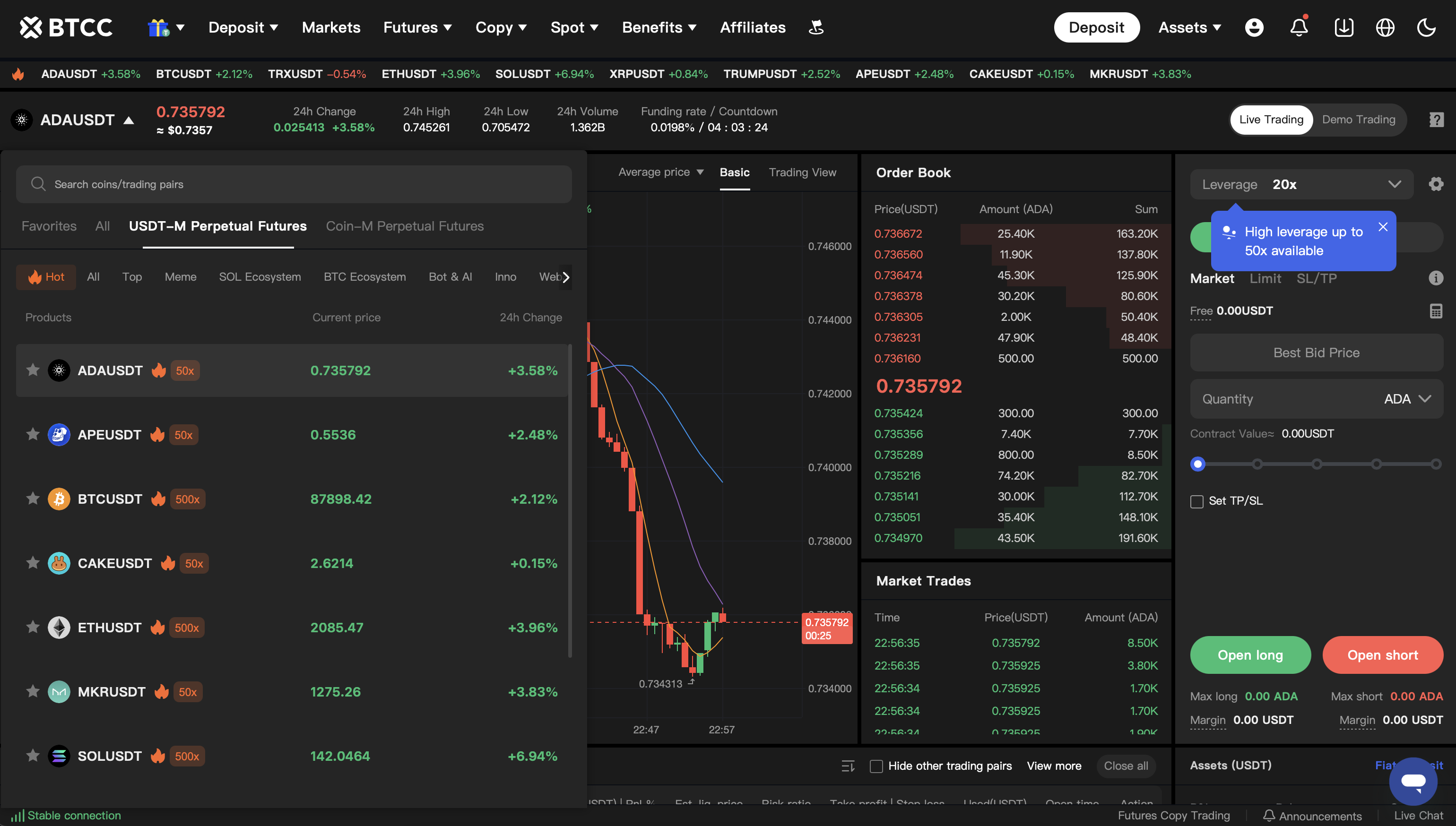

Spot Trading: Trade tokenized stocks directly on BounceBit’s platform, enabling immediate, peer-to-peer transactions without intermediaries.

-

DEX Liquidity Provision: Add tokenized stocks to decentralized exchange (DEX) liquidity pools, enhancing market depth and earning trading fees.

-

Collateral in Lending Agreements: Use tokenized stocks as collateral in DeFi lending protocols, unlocking liquidity while maintaining exposure to equity assets.

-

Structured Income Strategies: Integrate tokenized stocks into DeFi yield-generating products for diversified, innovative income opportunities.

-

Re-pledge Functionalities: Re-pledge tokenized stocks within the DeFi ecosystem, optimizing capital efficiency and enabling advanced financial strategies.

Spot trading allows users to transact tokenized equities instantly without intermediaries. Liquidity provision on decentralized exchanges (DEXs) enables participants to earn trading fees while deepening market depth. Importantly, these assets can be used as collateral in lending protocols – a crucial leap toward composability in DeFi. Structured income strategies and re-pledge functionalities further empower investors to optimize returns through innovative yield products.

DeFi Integration: Bridging Traditional Equities with On-Chain Finance

The integration of tokenized stocks into DeFi protocols is a game changer. From launch, BounceBit will enable seamless use cases such as lending, yield farming, collateralization for borrowing other assets, and participation in complex structured products. This interoperability not only enhances capital efficiency but also democratizes access to global equities by lowering barriers for non-institutional participants.

BounceBit’s approach extends beyond mere asset digitization; it embeds real-world assets directly into the heart of decentralized finance. By doing so, it unlocks new opportunities for portfolio diversification and risk management that were previously inaccessible outside traditional brokerages or prime finance platforms.

Market Context: Price Action and Regulatory Landscape

BounceBit’s native token (BB) has demonstrated technical strength recently, forming a rounding bottom pattern that suggests a potential 70% price surge above the $0.19–$0.2015 resistance zone (source). This bullish momentum reflects growing investor confidence in BounceBit’s CeDeFi infrastructure and its RWA integration roadmap.

However, regulatory uncertainty remains an ongoing challenge – particularly in jurisdictions like the United States where the SEC has yet to provide clear guidance on tokenized equities. Despite this hurdle, industry sentiment is optimistic that platforms like BounceBit will drive broader adoption by offering compliant pathways for both issuers and investors.