How to Trade U.S. Stocks On-Chain: Platforms, Leverage, and 24/7 Market Access Explained

Trading U. S. stocks on-chain is no longer a theoretical exercise. Thanks to rapid innovation in tokenized equities, investors can now access Apple, Tesla, and S and P 500 ETFs directly on the blockchain, often with features that surpass traditional brokers. From perpetual contracts with high leverage to seamless 24/7 market access, the landscape for on-chain stock trading is evolving at breakneck speed.

Key Platforms Powering On-Chain U. S. Stock Trading

The gateway to trading U. S. stocks on blockchain is a new breed of platforms specializing in tokenized equities. Each offers unique advantages in terms of asset coverage, custody model, and user experience.

Top On-Chain U.S. Stock Trading Platforms in 2025

-

Ondo Global Markets: Offers non-U.S. investors access to over 100 tokenized U.S. stocks and ETFs on Ethereum, with full backing by securities held at U.S.-registered broker-dealers. Expansion to BNB Chain and Solana is planned, targeting 1,000+ assets by year-end.

-

Robinhood (EU Tokenized Stocks): Enables EU users to trade over 200 tokenized U.S. stocks and ETFs on the Arbitrum blockchain, commission-free. Tokens are 1:1 backed by real shares, with future plans for a custom Layer 2 chain and 24/7 trading.

-

Dinari: The first U.S.-registered broker-dealer for tokenized stocks, offering “dShares” on Arbitrum. Each token is 1:1 backed by real equities, with dividend payouts in USD+ stablecoin. Available to U.S. and Canadian users, with strict KYC/AML compliance.

-

Kraken xStocks: Provides non-U.S. customers with 24/7 trading of over 50 tokenized U.S. stocks and ETFs, including Apple, Tesla, and Nvidia. Tokens are available directly within the Kraken Pro app.

-

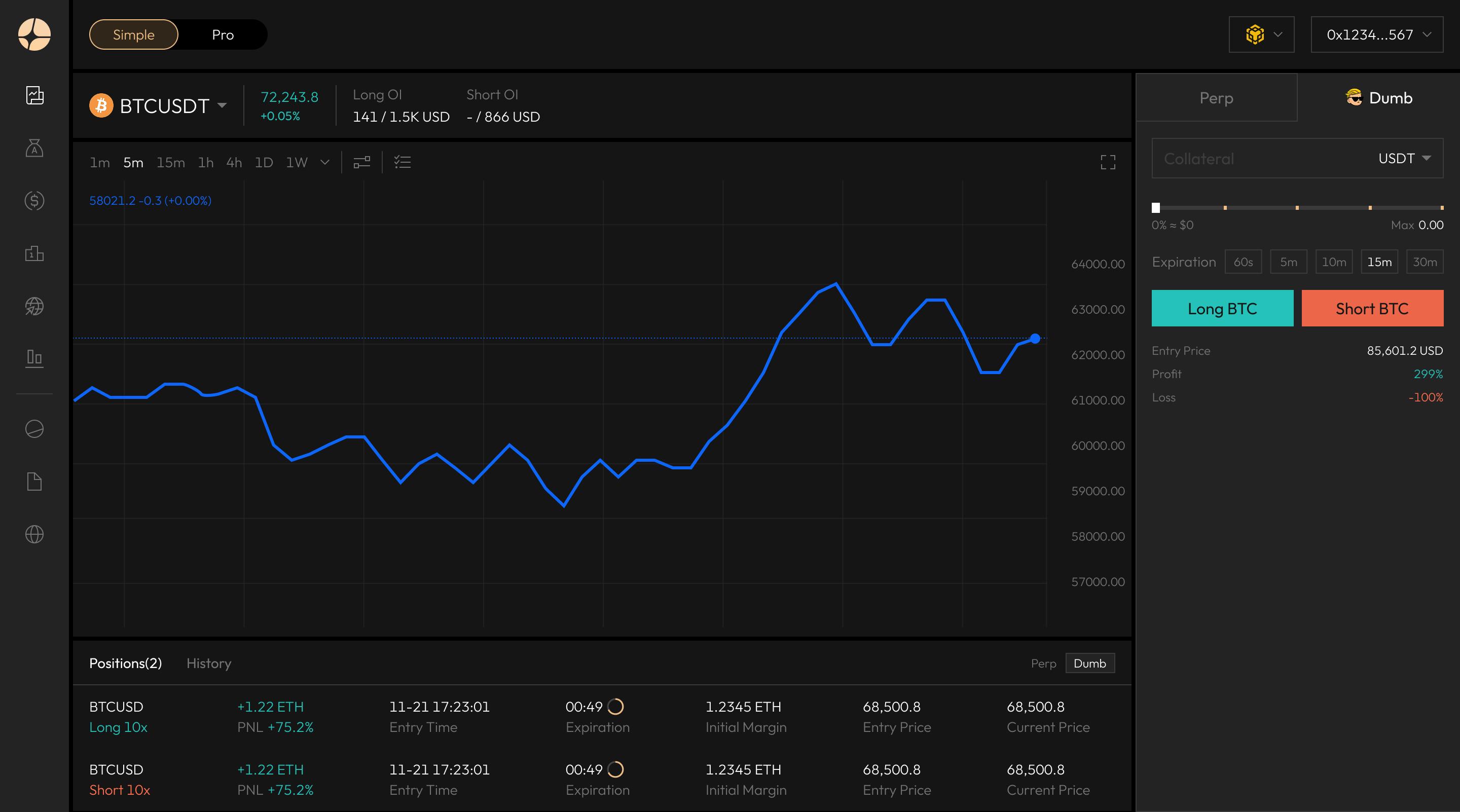

Aster: A decentralized perpetual exchange offering 24/7 leveraged trading (up to 50x) on leading U.S. stocks such as Amazon, Apple, and Tesla. No signups or intermediaries required, enabling global access to equity markets.

-

MyStonks: Features a fully custody-backed, on-chain U.S. stock token marketplace with assets held by Fidelity. The platform connects U.S. stock custody to the Base blockchain for secure token minting and burning.

- Ondo Global Markets: Non-U. S. investors gain access to over 100 tokenized U. S. stocks and ETFs on Ethereum, with plans to expand to 1,000 and assets by year-end. All tokens are fully backed by securities held at regulated broker-dealers for security and compliance (source).

- Robinhood: EU users can trade over 200 tokenized U. S. stocks commission-free via Arbitrum-based tokens, each backed 1: 1 by real shares through a broker-dealer partner (source).

- Dinari: The first U. S. -registered broker-dealer for tokenized stocks issues “dShares” minted on Arbitrum and strictly backed by real stock purchases; supports dividend payouts via USD and stablecoin.

- Kraken xStocks: Allows non-U. S. customers to trade over 50 blue-chip U. S. stocks as tokens with round-the-clock access (source).

- Aster DEX: Offers decentralized perpetual contracts with up to 50x leverage on leading names like Amazon, Apple, and Nvidia, no signups or paperwork required.

- MyStonks: Delivers fully custody-backed stock tokens with Fidelity as custodian and transparent mint/burn cycles linked to the Base blockchain.

How Does On-Chain Stock Trading Work?

The core innovation behind on-chain stock trading is the creation of “tokenized equities”: blockchain-based representations of real-world shares or synthetic exposures. These tokens can be bought, sold, or used as collateral just like their traditional counterparts, but without legacy market restrictions.

The process typically involves:

- Custody-backed models: A regulated entity holds the underlying shares in trust while minting equivalent tokens on-chain (e. g. , Ondo Global Markets, Robinhood).

- Synthetic/perpetual models: Smart contracts allow traders to take long or short positions against reference prices without direct share ownership (e. g. , Aster DEX).

- KYC/AML compliance: Platforms like Dinari enforce rigorous identity checks for legal compliance; others offer more permissionless access depending on jurisdiction.

The Appeal: Leverage and True 24/7 Market Access

The blockchain-native structure of these platforms unlocks two critical advantages: leverage and uninterrupted trading hours.

- Leverage: Platforms such as Aster DEX offer up to 50x leverage on select U. S. equities, a feature rarely available outside professional derivatives markets. This allows traders to amplify exposure but also increases risk substantially.

- 24/7 Access: Traditional equity markets operate within fixed windows; most brokers restrict after-hours trading even further. By contrast, exchanges like Kraken xStocks and Robinhood’s upcoming Layer 2 solution aim for continuous availability, even during weekends or public holidays, as long as blockchain infrastructure remains operational.

- No Geographic Barriers: Tokenization enables non-U. S. investors (subject to local regulations) direct exposure to American stocks without navigating complex cross-border brokerage setups.

These advances are not just about convenience. For active traders and global investors, the ability to enter and exit positions at any hour, whether reacting to geopolitical news or macroeconomic shifts, represents a fundamental shift in market dynamics. The traditional “market open” and “market close” are rapidly losing relevance for on-chain stock trading participants.

Leverage also brings a new dimension of strategy. On Aster DEX, for example, users can access up to 50x leverage on perpetual contracts tied to major U. S. equities like Apple and NVIDIA. This opens the door for sophisticated hedging, speculation, and capital efficiency, but it also means that risk management is absolutely critical. Unlike margin accounts at legacy brokers, liquidations on DeFi platforms can be instantaneous and unforgiving.

Risks, Regulatory Nuance, and Best Practices

While the promise of 24/7 access and high leverage is compelling, investors must approach on-chain stock trading with clear-eyed diligence. Regulatory frameworks remain in flux. For example, Dinari’s broker-dealer registration signals a move toward mainstream acceptance in the U. S. , but many platforms still restrict access based on local securities laws.

- Asset Backing: Always verify if your tokenized equity is fully backed by underlying shares or if you’re trading a synthetic contract. Custody-backed tokens (e. g. , Ondo Global Markets) offer greater transparency than most synthetic models.

- Liquidity: While platforms like Kraken xStocks boast deep order books for blue chips, decentralized venues may have thinner liquidity, especially during off-peak hours or for less popular stocks.

- KYC/AML: Some platforms require full identity verification (Dinari), while others prioritize permissionless access (Aster DEX). Choose according to your jurisdiction’s requirements and your own risk tolerance.

The regulatory landscape will continue to evolve as adoption grows. For now, non-U. S. residents enjoy broader access via Kraken xStocks and Ondo Global Markets (source). EU-based traders can leverage Robinhood’s commission-free offering (source). U. S. -based investors may find Dinari’s compliant approach most suitable as the regulatory fog lifts.

Future Outlook: The Road Ahead for On-Chain Equities

The ecosystem is expanding quickly: Ondo Global Markets aims for over 1,000 tokenized assets by year-end; Robinhood’s planned “Robinhood Chain” will further blur lines between DeFi and traditional finance; MyStonks’ integration with Fidelity custody sets a new standard for institutional-grade security in tokenized equities.

This rapid innovation is drawing increasing attention from both retail traders seeking flexibility and institutional players demanding transparency. As volumes grow and infrastructure matures, from cross-chain interoperability to improved KYC tooling, expect even greater convergence between blockchain rails and global equity markets.

The bottom line: On-chain stock trading delivers unprecedented access, flexibility, and innovation, but also requires careful platform selection and robust risk controls. Whether you’re seeking leveraged trades at midnight or simply want direct blockchain-based exposure to Apple or Tesla shares, today’s best on-chain equity platforms offer tools that were unthinkable just a few years ago.