How Synthetix Powers Synthetic Stocks: A Deep Dive into On-Chain Tokenized Equities

In the rapidly evolving landscape of decentralized finance (DeFi), synthetic stocks and on-chain tokenized equities are redefining how investors gain exposure to traditional markets. At the heart of this transformation is Synthetix, a protocol that enables users to mint and trade synthetic assets, ERC-20 tokens that mirror the price of real-world assets such as equities, commodities, and currencies. With Synthetix, investors can access a wide range of financial instruments without ever holding the underlying assets.

The Synthetix Liquidity Engine: Foundation of Synthetic Stocks

Synthetix operates as a decentralized protocol on Ethereum and Optimism, empowering users to create synthetic assets (Synths) by locking up collateral, primarily its native token, SNX. The current market price for Synthetix Network Token (SNX) sits at $0.676343, reflecting a slight decrease of 0.01519% in the last 24 hours. This price point is critical for participants who must lock up SNX at a high collateralization ratio, typically between 400% and 600%: to mint new Synths like sAAPL (Apple) or sTSLA (Tesla).

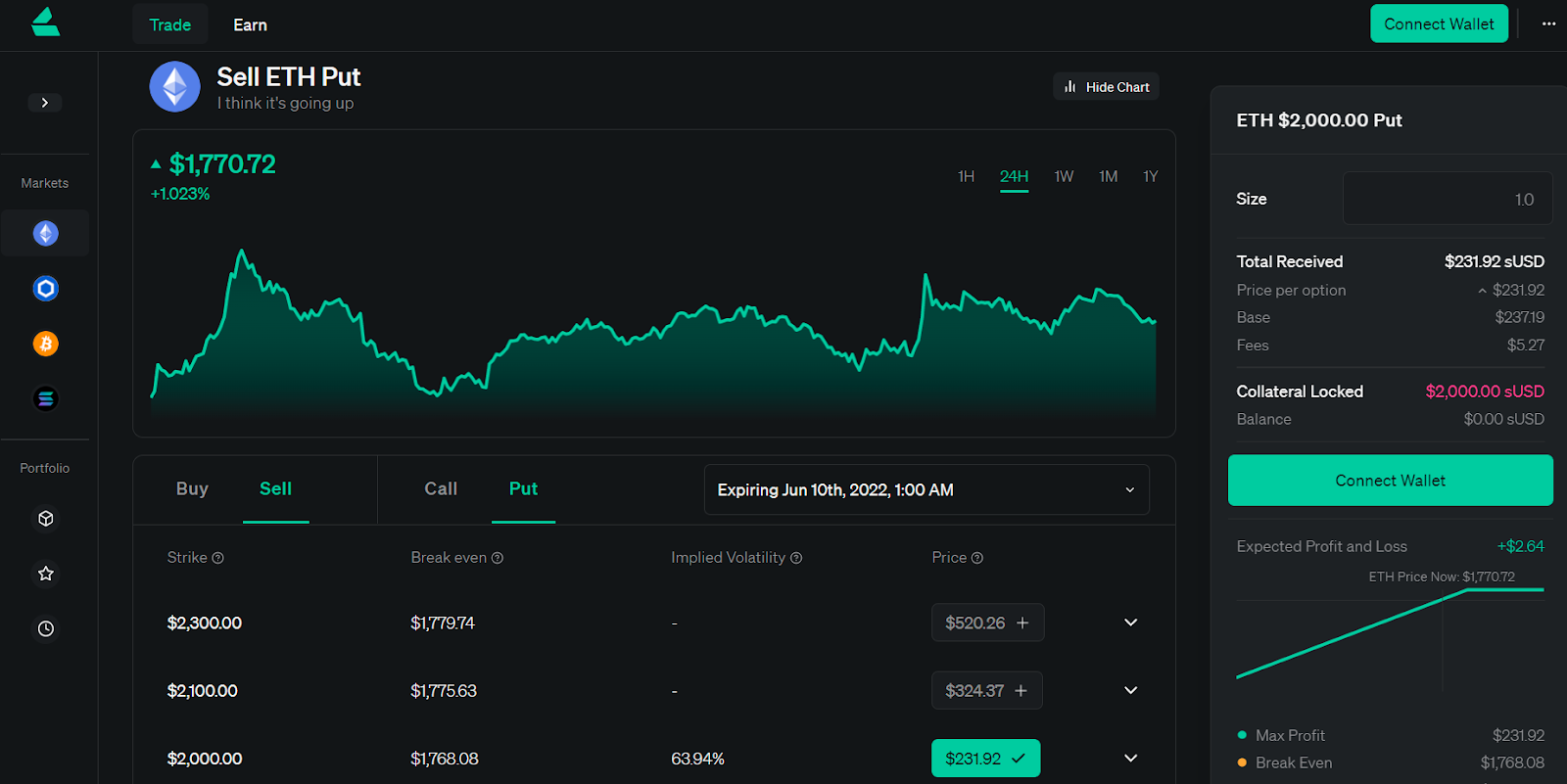

This pooled collateral model is what powers the liquidity engine behind Synthetix’s synthetic equities. By aggregating collateral from across the ecosystem, Synthetix can offer deep liquidity and low slippage for traders on decentralized exchanges such as Kwenta. The protocol relies on decentralized oracles like Chainlink to provide real-time price feeds for these assets, ensuring that each Synth accurately tracks its underlying counterpart.

How Synthetic Stocks Work on Synthetix

The process begins when a user stakes SNX tokens into a smart contract, locking them up as collateral. For example, to mint $100 worth of sAAPL, one would need to deposit between $400 and $600 worth of SNX at today’s rate ($0.676343 per token). This overcollateralization is crucial in mitigating volatility risk inherent in both crypto and equity markets.

Once minted, these synthetic stocks can be traded permissionlessly on-chain, providing global access 24/7, without the friction or settlement delays typical in traditional finance. The value of each Synth is kept in line with its real-world equivalent through continuous updates from trusted oracle networks.

Market Evolution: From Tokenized Equities to Derivatives Innovation

Synthetix’s journey with synthetic equities has not been without challenges. Regulatory uncertainty and relatively low demand led to the phasing out of U. S. -based stock Synths starting in 2021. However, this pivot did not slow innovation; instead, it prompted Synthetix to expand into new derivatives markets such as forex products and decentralized perpetual futures.

The platform’s recent acquisition of leveraged token provider TLX demonstrates its commitment to broadening user options by introducing leveraged trading strategies, a move designed to enhance both liquidity and risk management for DeFi participants.

Synthetix (SNX) Price Prediction 2026-2031

Professional outlook based on current DeFi trends, protocol developments, and broad market factors as of September 2025.

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.55 | $0.82 | $1.20 | +21% | Recovery phase; SNX benefits from leveraged token expansion but faces continued regulatory headwinds. |

| 2027 | $0.68 | $1.08 | $1.60 | +32% | Layer-2 scaling and new derivative products drive higher adoption; macro uncertainty persists. |

| 2028 | $0.85 | $1.35 | $2.10 | +25% | Broader DeFi recovery, increased institutional interest in synthetic assets, but competition intensifies. |

| 2029 | $1.10 | $1.70 | $2.70 | +26% | Mainstream integration of DeFi; regulatory clarity improves, boosting synthetic asset trading volumes. |

| 2030 | $1.30 | $2.05 | $3.30 | +21% | Synthetix leverages advanced oracle solutions and cross-chain compatibility; institutional adoption accelerates. |

| 2031 | $1.45 | $2.40 | $4.00 | +17% | DeFi matures with strong real-world asset integration; Synthetix remains a key protocol in synthetic markets. |

Price Prediction Summary

Synthetix (SNX) is positioned for gradual recovery and growth through 2031, propelled by ongoing protocol innovation, expansion into leveraged and synthetic products, and the maturation of the DeFi sector. Although regulatory and competitive challenges may limit explosive gains, steady adoption and technological improvements suggest a progressive uptrend in SNX price over the next six years.

Key Factors Affecting Synthetix Price

- Adoption of synthetic and leveraged products on Synthetix and partner platforms.

- Regulatory developments affecting DeFi and synthetic assets globally.

- Expansion of Layer-2 solutions (like Optimism) enhancing scalability and reducing fees.

- Competition from other synthetic asset and DeFi derivatives protocols.

- Market cycles and broader crypto sentiment (bullish/bearish phases).

- Integration with real-world assets and institutional DeFi participation.

- Advancements in decentralized oracle infrastructure ensuring fair pricing.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The ability to invest in on-chain stocks via Synthetix has fundamentally changed access dynamics for global investors seeking exposure outside their local markets or regulatory regimes. As tokenized equities continue to evolve alongside DeFi infrastructure, understanding protocols like Synthetix becomes essential for anyone interested in the future of investing on the blockchain.

Yet, the story of Synthetix and synthetic stocks is more than just technological innovation, it’s a case study in how DeFi adapts to real-world pressures. The high collateralization requirements (with SNX priced at $0.676343) reflect a risk-conscious approach, balancing user protection with capital efficiency. This model has proven resilient, even as Synthetix phased out certain equity Synths due to regulatory headwinds and shifting market appetite.

Key Benefits and Limitations for Investors

For forward-thinking investors, the appeal of on-chain tokenized equities lies in their accessibility and programmability. With Synthetix, users can gain synthetic exposure to assets like stocks or indices without jurisdictional barriers or traditional brokerage accounts. Settlement cycles are compressed from days to seconds, enabling 24/7 trading, a paradigm shift from legacy finance.

Top 5 Advantages of Synthetix for Synthetic Assets

-

Decentralized and Permissionless Access: Synthetix allows anyone to mint and trade synthetic assets without relying on traditional financial intermediaries, enabling global 24/7 access to markets.

-

Diverse Asset Exposure: Users can gain exposure to a wide range of assets—including cryptocurrencies, commodities, and equities—through Synths, all on-chain and without holding the underlying assets.

-

Deep Liquidity and Low Slippage: The pooled collateral model on Synthetix provides deep liquidity for traders and minimizes slippage, especially when trading on integrated DEXs like Kwenta.

-

Real-Time Price Tracking via Oracles: Synthetix utilizes decentralized oracles, such as Chainlink, to ensure that Synths accurately track the real-time prices of their underlying assets.

-

Innovative Derivative Products: The platform continually evolves, now offering leveraged tokens and decentralized perpetual futures, expanding trading strategies and opportunities for DeFi users.

However, risks remain. Overcollateralization means capital is locked up and not always optimally deployed. Additionally, the value of Synths depends on the reliability of decentralized oracles and the solvency of the collateral pool. Regulatory clarity is still evolving for synthetic equities globally; this uncertainty can impact both protocol development and investor confidence.

Current State and Future Outlook

As of September 21,2025, Synthetix Network Token (SNX) trades at $0.676343. The protocol’s shift toward derivatives, like perpetual futures and leveraged tokens, signals a strategic adaptation to market demand while maintaining its role as a liquidity engine within DeFi. Its pooled collateral model continues to underpin deep liquidity for new financial products on-chain.

Looking ahead, protocols like Synthetix will likely play a pivotal role in bridging traditional finance with blockchain-based markets. As infrastructure matures and regulatory frameworks become clearer, we may see renewed interest in synthetic stocks alongside other tokenized real-world assets.

For investors seeking exposure to global equities without intermediaries, or those interested in programmable financial instruments, the evolution of synthetic assets via DeFi remains an area worth watching closely.