How Tokenized Stocks Are Enabling 24/7 Global Equity Markets On-Chain

In the last two years, a seismic shift has begun to reshape the global equity landscape: tokenized stocks are making 24/7, borderless stock trading a reality. As traditional exchanges shutter their doors at 4 p. m. in New York or 5 p. m. in London, on-chain equities keep the market’s pulse alive around the clock. This innovation is not just about extending trading hours – it’s about fundamentally reimagining access, liquidity, and transparency for investors worldwide.

The Rise of On-Chain Equities: Why Now?

The convergence of blockchain technology with real-world assets has set the stage for tokenized stocks to flourish. Platforms like Ondo Finance have rapidly emerged as institutional-grade leaders, leveraging secure custodianship and smart contract automation to track underlying equities such as Apple (AAPL) and Tesla (TSLA) on-chain. Notably, Ondo Global Markets recently crossed $240M in total value locked (TVL), highlighting surging demand for these digital proxies of real stocks.

Unlike conventional equities that trade during fixed exchange hours, tokenized stocks such as those issued by Ondo are available to qualified investors across Asia-Pacific, Europe, Africa, and Latin America – all without waiting for Wall Street’s opening bell. This continuous access means that market-moving news or macroeconomic events can be priced in immediately, not hours later.

How Tokenized Stocks Work: Anatomy of a Digital Equity

The mechanics behind tokenized stocks are elegantly simple yet powerful. Each digital token represents a claim on an underlying share held by a regulated custodian. For example, Ondo’s tokens are total return trackers: they reflect both price appreciation and dividends from the real asset. However, investors should note that while these tokens mirror economic exposure to companies like Apple or Nvidia, they typically do not confer shareholder voting rights.

Key Benefits of 24/7 Tokenized Stock Trading

-

Continuous Global Access: Tokenized stocks on platforms like Ondo Global Markets and Kraken xStocks enable investors worldwide to trade equities 24/7, eliminating traditional market hours and allowing immediate response to global news.

-

Enhanced Liquidity: By leveraging blockchain and stablecoins, tokenized equities facilitate deeper liquidity pools, enabling efficient trading and tighter spreads even outside of conventional exchange hours.

-

Fractional Ownership: Platforms such as Robinhood and Ondo Finance allow users to purchase fractions of high-value stocks, increasing accessibility for retail investors and broadening market participation.

-

On-Chain Transparency and Security: Tokenized stocks are backed by real shares held with regulated custodians, providing verifiable on-chain records and reducing counterparty risk.

-

Seamless Settlement: The integration of stablecoins and smart contracts enables near-instant settlement of trades, minimizing delays and reducing operational risks compared to traditional clearing systems.

-

Global Regulatory Compliance: Leading platforms ensure adherence to securities regulations, as emphasized by the SEC, providing a compliant environment for institutional and retail investors alike.

Stablecoins, such as USDC or USDT, play a crucial role by facilitating instant settlement and cross-border transfers. This integration removes friction from traditional banking rails and opens up new liquidity avenues for both retail and institutional participants.

Ondo Finance Tokenized Stocks: Institutional-Grade Access at $0.92 Per ONDO

The current price of Ondo Finance‘s native token stands at $0.92 per ONDO, according to Coinbase’s latest data (source). This price milestone underscores growing confidence in Ondo’s model as it expands its roster of over 100 U. S. -listed securities available on-chain – with hundreds more expected soon.

This momentum is not isolated; it reflects a broader trend where platforms like Kraken’s xStocks and Robinhood’s tokenized offerings are pushing synthetic equities further into mainstream portfolios (source). The key differentiator remains regulatory compliance – tokenized securities must adhere strictly to existing frameworks as emphasized by the SEC (source). Platforms that can balance innovation with oversight are best positioned to capture institutional inflows.

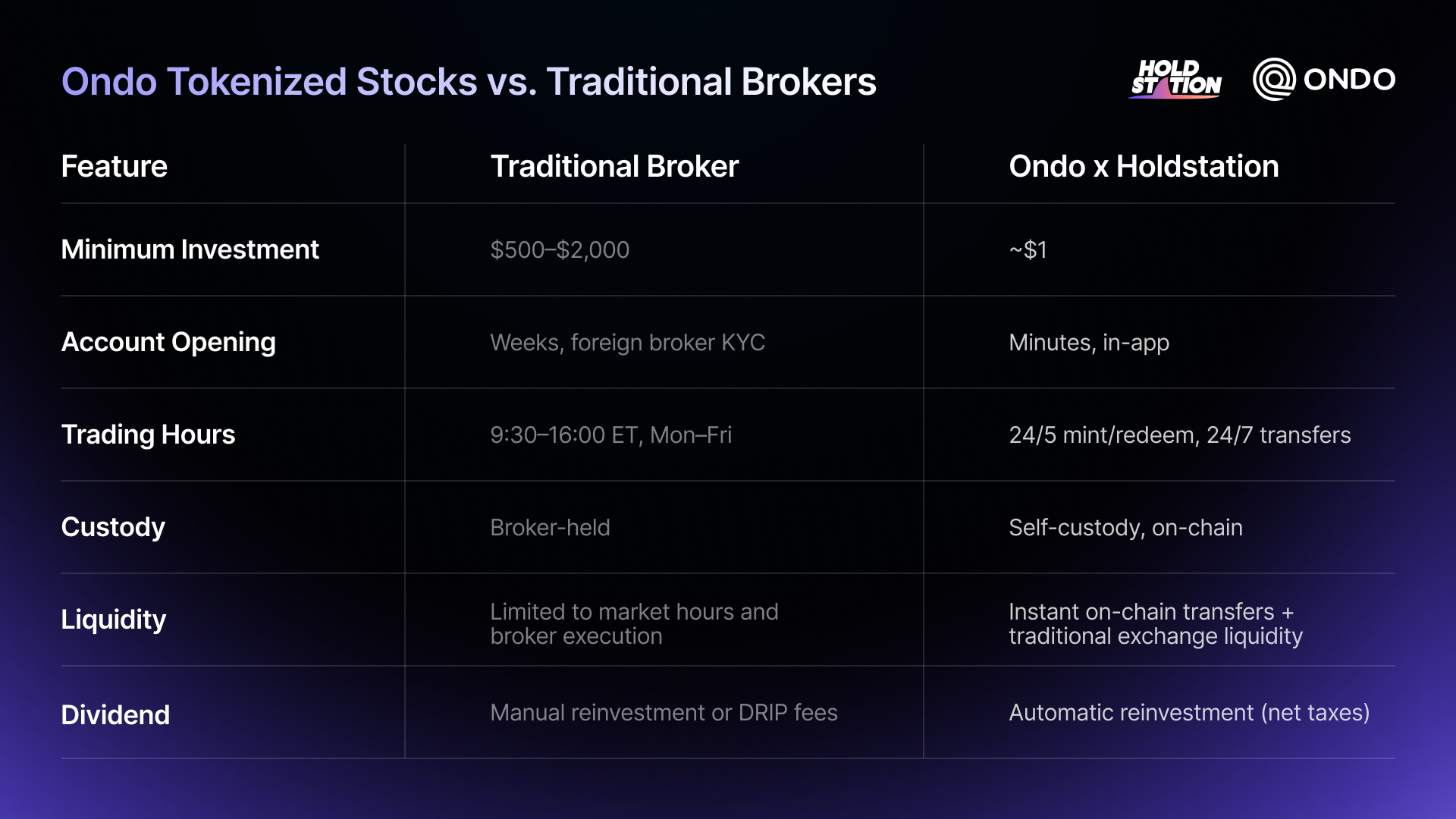

As tokenized stocks like those from Ondo Finance gain traction, the competitive landscape is rapidly evolving. Ondo’s recent integration with Trust Wallet and its collaboration with Alpaca are pivotal for expanding access, especially for non-US investors seeking exposure to U. S. equities. This marks a pronounced shift from legacy brokerage models, empowering users to transfer, trade, and settle assets peer-to-peer, anytime, anywhere.

Real-Time Liquidity and Global Reach: The New Market Standard

The promise of 24/7 stock trading extends far beyond convenience. For global investors in volatile regions or those reacting to after-hours earnings or geopolitical events, on-chain equities offer a vital edge. No longer constrained by regional market closures or slow settlement cycles, traders can enter or exit positions as soon as news breaks, potentially transforming risk management and hedging strategies across portfolios.

Liquidity is the lifeblood of any market. With over $240M TVL now locked in Ondo Global Markets (source), tokenized stocks are demonstrating that deep liquidity can exist outside traditional exchanges. As more assets migrate on-chain and stablecoin rails mature, expect bid-ask spreads to narrow and arbitrage opportunities to diminish, further aligning on-chain markets with their Wall Street counterparts.

Key Challenges: Regulation and True Equity Rights

Despite these advances, challenges persist. The SEC’s stance is unequivocal: tokenized securities are still securities (source). Platforms must adhere to KYC/AML standards and ensure that investor protections remain robust even as assets move onto decentralized rails. Moreover, while total return trackers replicate economic exposure, including dividends, they do not yet grant voting rights or direct participation in corporate governance. This distinction will be crucial as institutional adoption accelerates.

It’s also worth noting that regulatory clarity varies by jurisdiction. While Europe and parts of Asia-Pacific have moved swiftly to accommodate digital securities, the U. S. remains cautious but engaged, a dynamic that will shape global participation in these markets over the coming years.

What Comes Next? The Roadmap for On-Chain Equities

The trajectory for on-chain equities points toward increasing asset variety, improved user experience, and deeper integration with DeFi protocols. As platforms like Ondo Finance continue to expand their offerings, now boasting over 100 tokenized U. S. stocks and ETFs, the focus will shift toward seamless cross-chain interoperability and enhanced compliance tooling.

The current price of $0.92 per ONDO reflects growing confidence in this sector’s future potential. For forward-thinking investors, the ability to trade real stocks onchain 24/7 is no longer a theoretical advantage, it’s an emerging standard that could redefine capital markets for decades to come.