Top 5 Tokenized Stocks Platforms for Blockchain Investors in 2024

The landscape for tokenized stocks platforms is evolving at a breakneck pace in 2024, as the convergence of blockchain technology and equity markets unlocks new frontiers for investors. Synthetic stocks and on-chain equities are no longer fringe experiments; they’re fast becoming core pillars of the decentralized finance (DeFi) ecosystem. For blockchain investors seeking exposure to real-world assets with 24/7 liquidity, transparency, and global access, choosing the right platform is paramount. In this article, we spotlight the top five tokenized stock platforms that are leading the charge in 2024.

Synthetix: The Pioneer of Synthetic Stocks Trading

Synthetix has long been at the vanguard of synthetic asset creation on-chain. Built on Ethereum and now expanding to Optimism and other L2s, Synthetix enables users to mint and trade synths: tokens that track the price of real-world assets including stocks, indices, and even commodities. This protocol’s decentralized model means anyone can gain exposure to US equities like TSLA or AAPL without traditional brokerage barriers.

- No Counterparty Risk: Synths are overcollateralized by SNX tokens, reducing reliance on centralized custodians.

- Global Liquidity: Trade synthetic stocks 24/7 from anywhere in the world.

- Composability: Integrates deeply with DeFi apps for yield strategies and hedging.

Synthetix’s approach is especially attractive for traders who want programmable exposure to equities or wish to leverage DeFi-native features like staking rewards and liquidity incentives.

Mirror Protocol: Democratizing Access to U. S. Stocks via Terra

If Synthetix blazed the trail for synthetic assets, Mirror Protocol brought tokenized equities to a new audience via the Terra blockchain. Mirror allows users to mint mAssets, which mirror (pun intended) prices of popular US stocks such as Google or Netflix. These mAssets can be traded permissionlessly or used in DeFi strategies across both Terra and Ethereum ecosystems.

- Decentralized Oracle Feeds: Prices are updated by a distributed network of oracle providers for reliability.

- Lending and Farming: Use mAssets as collateral or earn yield by providing liquidity.

- Accessible Worldwide: No KYC required – anyone with a wallet can participate.

This platform stands out for making U. S. -listed equities accessible to a truly global audience without intermediaries or regional restrictions. Mirror has become a favorite among international investors seeking dollar-denominated exposure without traditional roadblocks.

Synthetix vs Mirror Protocol: Key Feature Comparison

-

Synthetix:One of the largest decentralized protocols for synthetic assets, Synthetix enables users to mint and trade synthetic stocks (Synths) that mirror real-world equities. Built on Ethereum and Optimism, it offers deep liquidity and integrates with DeFi platforms for leveraged trading.Key Features: Wide range of synthetic assets, including stocks, indices, and commoditiesDecentralized governance and staking rewardsHigh liquidity via Synthetix Exchange and integrations

-

Mirror Protocol:Mirror Protocol is a decentralized platform on Terra (now on Terra Classic) that allowed users to create and trade mAssets—synthetic tokens tracking the price of real-world stocks. It focused on accessibility and composability within the Terra and Cosmos ecosystems.Key Features: Tokenized synthetic stocks (mAAPL, mTSLA, etc.)Permissionless asset creation and tradingIntegration with Terra DeFi apps

-

DeFiChain:DeFiChain brings decentralized finance to the Bitcoin ecosystem, offering tokenized stocks and ETFs as dTokens. Users can mint, trade, and hold these assets on-chain, with a focus on transparency and security.Key Features: dTokens representing major stocks and ETFsBuilt on a Bitcoin-linked blockchainCommunity-driven governance

-

Swarm Markets:Swarm Markets is a regulated DeFi platform based in Germany, providing tokenized securities including stocks and bonds. It combines DeFi accessibility with full regulatory compliance, making it attractive for institutional and retail investors.Key Features: Regulated tokenized stock tradingInstitutional-grade compliance (BaFin licensed)On-chain KYC/AML and secure asset custody

-

Ondo Finance:Ondo Finance bridges traditional finance and DeFi by offering tokenized securities and funds, including exposure to U.S. Treasuries and blue-chip stocks. It focuses on providing yield-bearing, real-world asset tokens to on-chain investors.Key Features: Tokenized exposure to stocks, bonds, and fundsYield-generating on-chain assetsPartnerships with major asset managers

DeFiChain: Bringing Tokenized Equities On-Chain with Bitcoin Security

DeFiChain, purpose-built for decentralized finance applications, offers a unique proposition: tokenized stocks secured by Bitcoin’s robust hash power through periodic anchoring. Its dToken system lets users mint tokens that represent shares in companies like Tesla, Apple, or even ETFs, enabling both long and short positions via decentralized price oracles.

- dTokens: Tradeable representations of real-world equities with transparent on-chain supply tracking.

- No Central Custodian: All assets are created and managed through smart contracts, no single point of failure.

- Ecosystem Integration: dTokens can be used in DEXes, lending protocols, and yield farms within DeFiChain’s ecosystem.

This combination of Bitcoin-level security with flexible synthetic equity trading makes DeFiChain an appealing choice for both crypto-native users and those seeking familiar blue-chip stock exposure in a decentralized format.

Swarm Markets: Regulated Tokenized Stocks for Institutional and Retail Investors

Swarm Markets is carving out a niche as the world’s first regulated decentralized exchange (DEX) for tokenized securities, including synthetic and asset-backed stocks. Operating under BaFin regulation in Germany, Swarm brings institutional-grade compliance to DeFi while preserving user sovereignty. This hybrid approach bridges the trust gap for both traditional financial institutions and crypto-native investors.

- Real-World Asset Onboarding: Swarm enables tokenization of stocks, bonds, and funds with full regulatory oversight.

- KYC/AML Integrated: Users complete streamlined verification, unlocking compliant access to a wide range of tokenized equities.

- Permissionless Trading: Once onboarded, investors can trade on-chain 24/7 with deep liquidity pools.

The platform’s commitment to compliance doesn’t come at the expense of innovation. Swarm leverages Ethereum smart contracts, allowing composability with other DeFi protocols and making it possible to use tokenized stocks as collateral or in automated strategies. For those who want regulatory clarity without sacrificing DeFi flexibility, Swarm Markets is setting the benchmark in 2024’s on-chain stocks platforms.

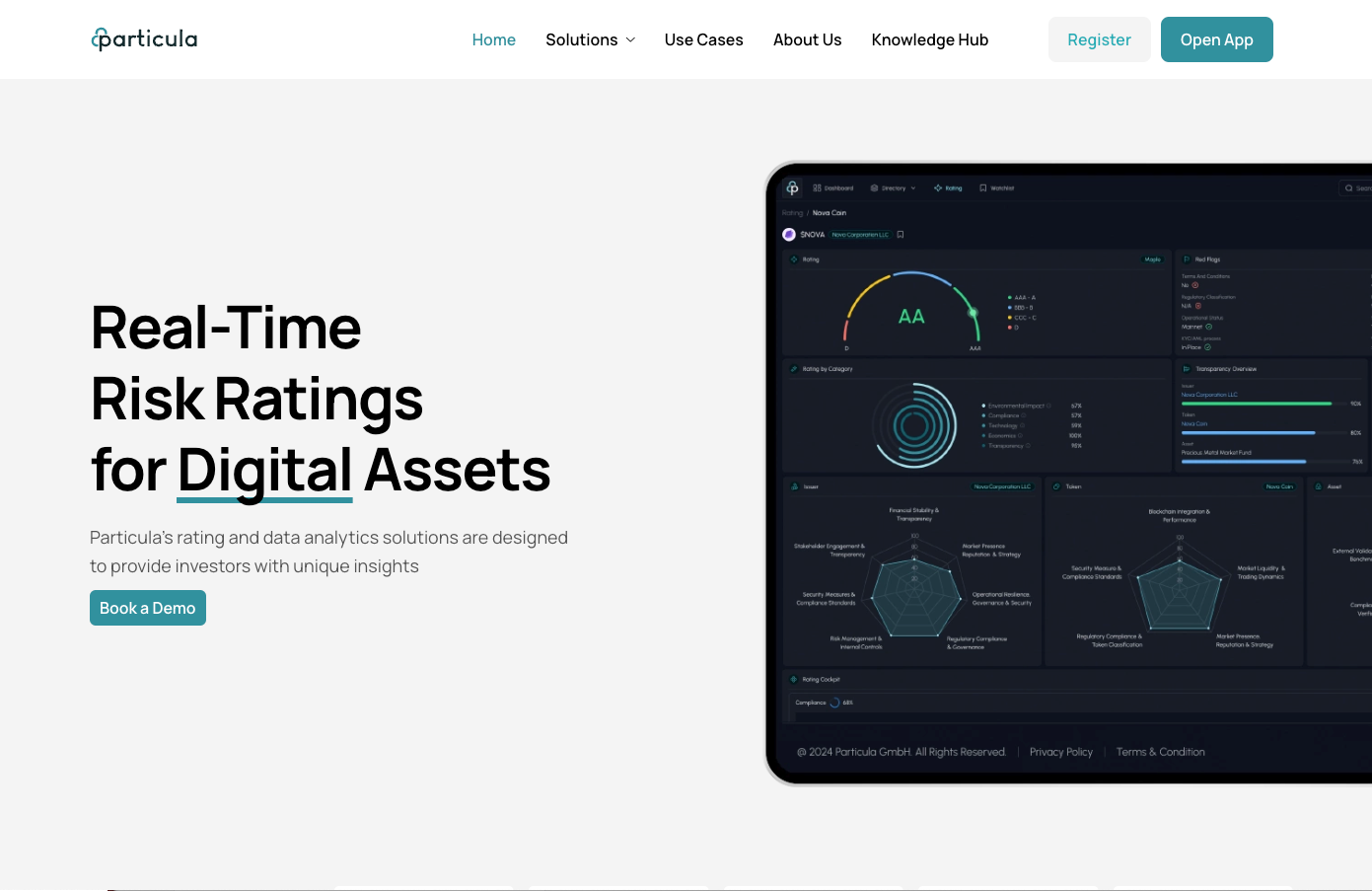

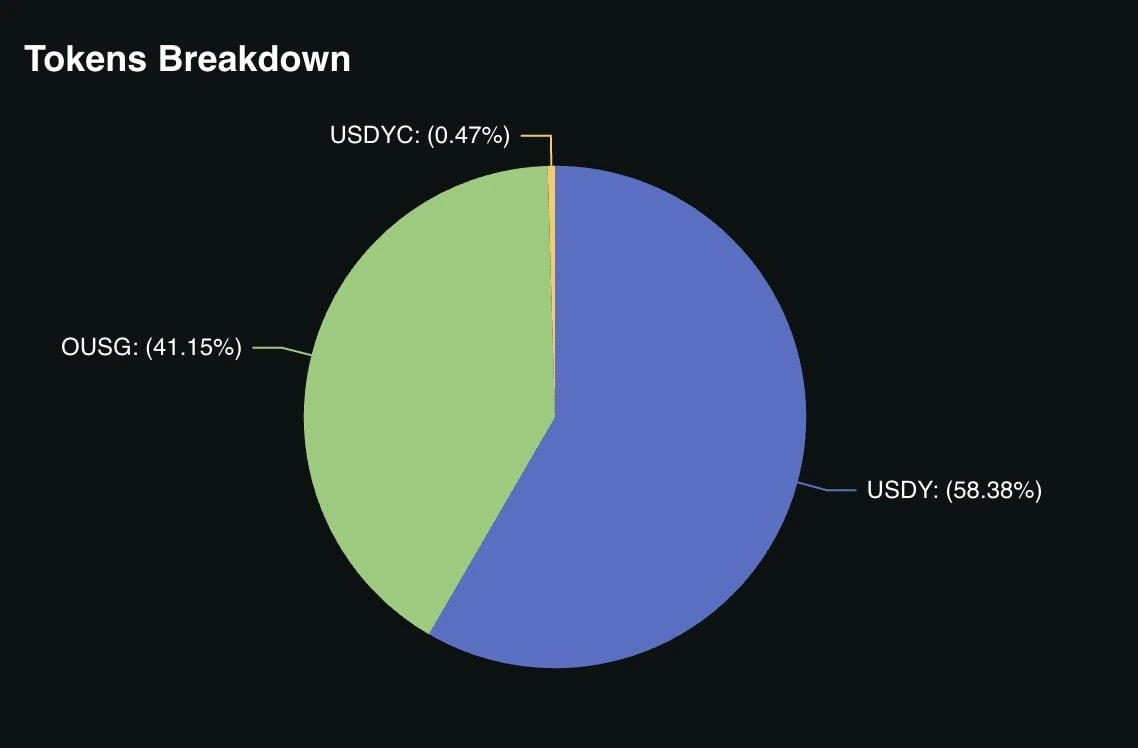

Ondo Finance: Bridging Traditional Assets and DeFi Liquidity

Ondo Finance sits at the intersection of traditional finance and DeFi by offering tokenized exposure to real-world assets, including stocks, via blockchain-native wrappers. Ondo partners with leading custodians and asset managers to tokenize equity baskets, ETFs, and even private market shares. These tokens are then made available on-chain for trading, lending, or use as collateral across major DeFi protocols.

- Institutional Partnerships: Collaborates with established financial firms for asset custody and management.

- Yield Opportunities: Users can earn yield by providing liquidity or participating in structured products tied to tokenized equities.

- Multi-Chain Support: Ondo assets are accessible on Ethereum, Polygon, and other leading blockchains for maximum liquidity reach.

This platform exemplifies the spirit of composable finance, where real-world assets flow seamlessly into DeFi rails. For investors seeking both yield generation and blue-chip exposure without leaving the blockchain ecosystem, Ondo Finance is a standout choice among best tokenized equities.

Top 5 Platforms for Tokenized Stock Trading in 2024

-

Synthetix is a leading decentralized protocol for synthetic assets, enabling users to mint and trade tokenized stocks and other real-world assets on-chain. Built on Ethereum and Optimism, Synthetix offers deep liquidity and composability with DeFi protocols. Key features: decentralized governance, on-chain oracles, and a wide range of synthetic equities.

-

Mirror Protocol allows users to create and trade synthetic assets called mAssets, which mirror the price of real-world stocks and ETFs. Originally launched on Terra, Mirror Protocol now operates on multiple blockchains, providing global access to tokenized equities and innovative DeFi strategies.

-

DeFiChain specializes in decentralized finance for Bitcoin, offering native tokenized stocks and ETFs through its dToken system. Investors can gain exposure to traditional equities with decentralized trading, lending, and liquidity mining, all secured by Bitcoin’s network.

-

Swarm Markets is a regulated DeFi platform based in Germany, providing compliant trading of tokenized securities, including stocks and bonds. Swarm enables institutional and retail investors to access real-world assets on-chain, combining regulatory oversight with decentralized infrastructure.

-

Ondo Finance bridges traditional finance and DeFi by tokenizing real-world assets, including stocks, bonds, and funds. Ondo’s platform offers transparent, on-chain investment products with institutional-grade security and compliance, making it a top choice for tokenized equity exposure.

The Big Picture: Where On-Chain Equities Are Headed Next

The emergence of these five platforms, Synthetix, Mirror Protocol, DeFiChain, Swarm Markets, and Ondo Finance, signals a new era where global equity markets are being reimagined on open blockchain infrastructure. Each platform offers its own blend of decentralization, compliance rigor, synthetic versus asset-backed models, and ecosystem integration. The result? Investors now have more choice than ever before when it comes to accessing synthetic stocks trading around the clock, with programmable logic that simply isn’t possible in traditional markets.

The next wave will likely see even tighter integration between real-world financial institutions and on-chain protocols. Expect more regulatory clarity (and competition), deeper liquidity pools spanning multiple chains like Ethereum and Polygon, as well as innovative products that blend yield farming with equity exposure. If you’re looking to stay ahead in blockchain equities 2024, keeping these five platforms on your radar is essential, because this is where tomorrow’s capital markets are being built today.