How to Invest in Synthetic Stocks Using Decentralized Exchanges (DEXs)

Ready to break free from Wall Street’s hours and gatekeepers? Investing in synthetic stocks via decentralized exchanges (DEXs) is your tactical entry into a 24/7, borderless equities market. Synthetic assets – or “synths” – are blockchain-based tokens that mirror the price of real-world stocks, giving you exposure without ever touching the underlying shares. No brokers, no paperwork, just direct access and total control from your crypto wallet.

What Are Synthetic Stocks and Why Should You Care?

Synthetic stocks represent traditional equities on-chain as ERC-20 tokens (or their equivalents on other blockchains). They’re not actual shares, but they track real stock prices via decentralized oracles like Chainlink. This means you can invest in Tesla, Apple, or even global indices without needing a brokerage account or worrying about cross-border restrictions. The result? Global liquidity, instant settlement, and the ability to build sophisticated strategies with DeFi composability.

The kicker: you’re not limited by trading hours or local regulations. DEXs let you buy, sell, and hedge synthetic equities anytime, anywhere. The catch? You need to understand how collateralization works and manage risks unique to DeFi.

Top Platforms for Synthetic Equities Trading

Top DEX Platforms for Synthetic Stock Trading

-

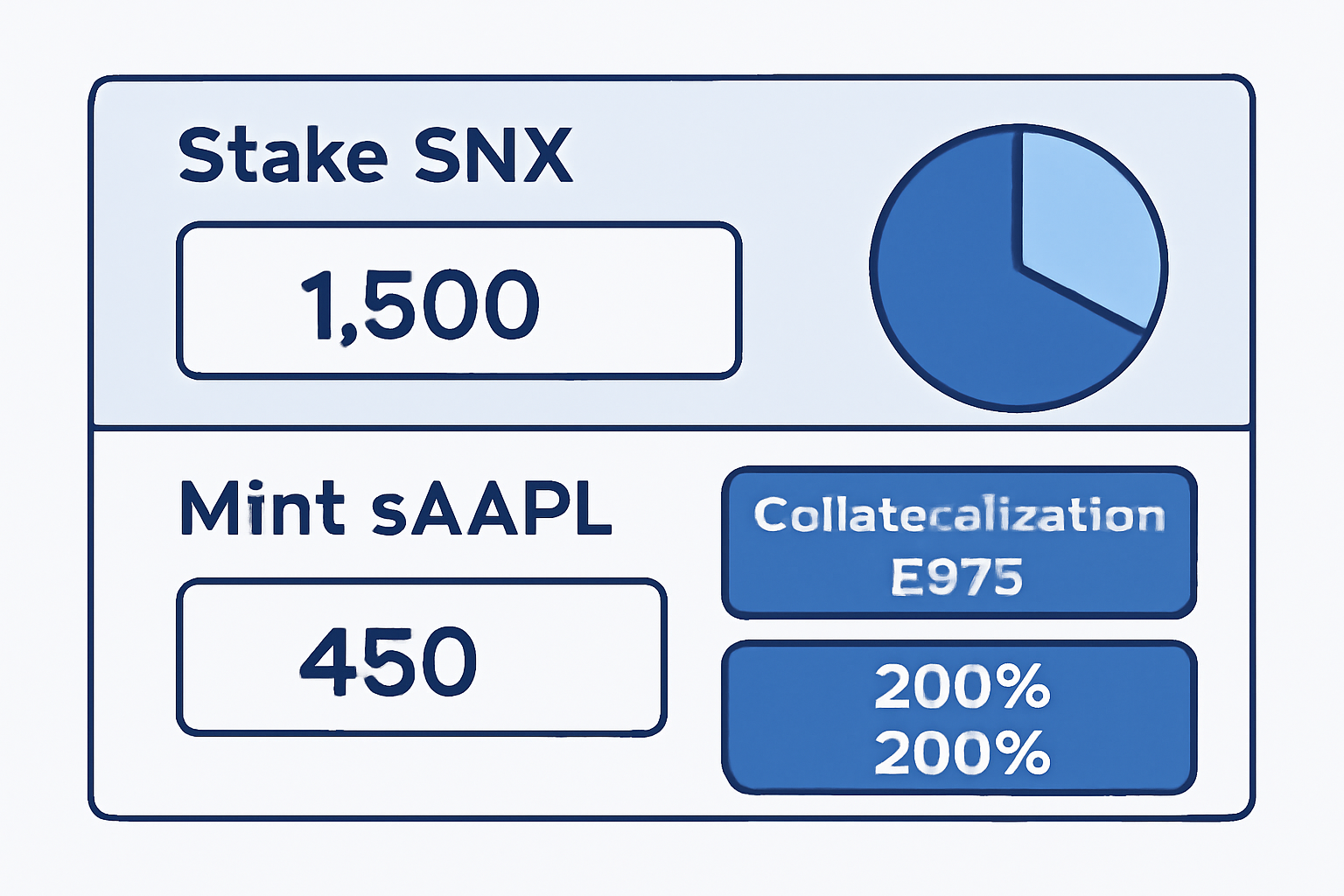

Synthetix: A leading Ethereum-based protocol for minting and trading synthetic assets, including stocks. Users stake SNX tokens as collateral and benefit from decentralized oracles for accurate price tracking.

-

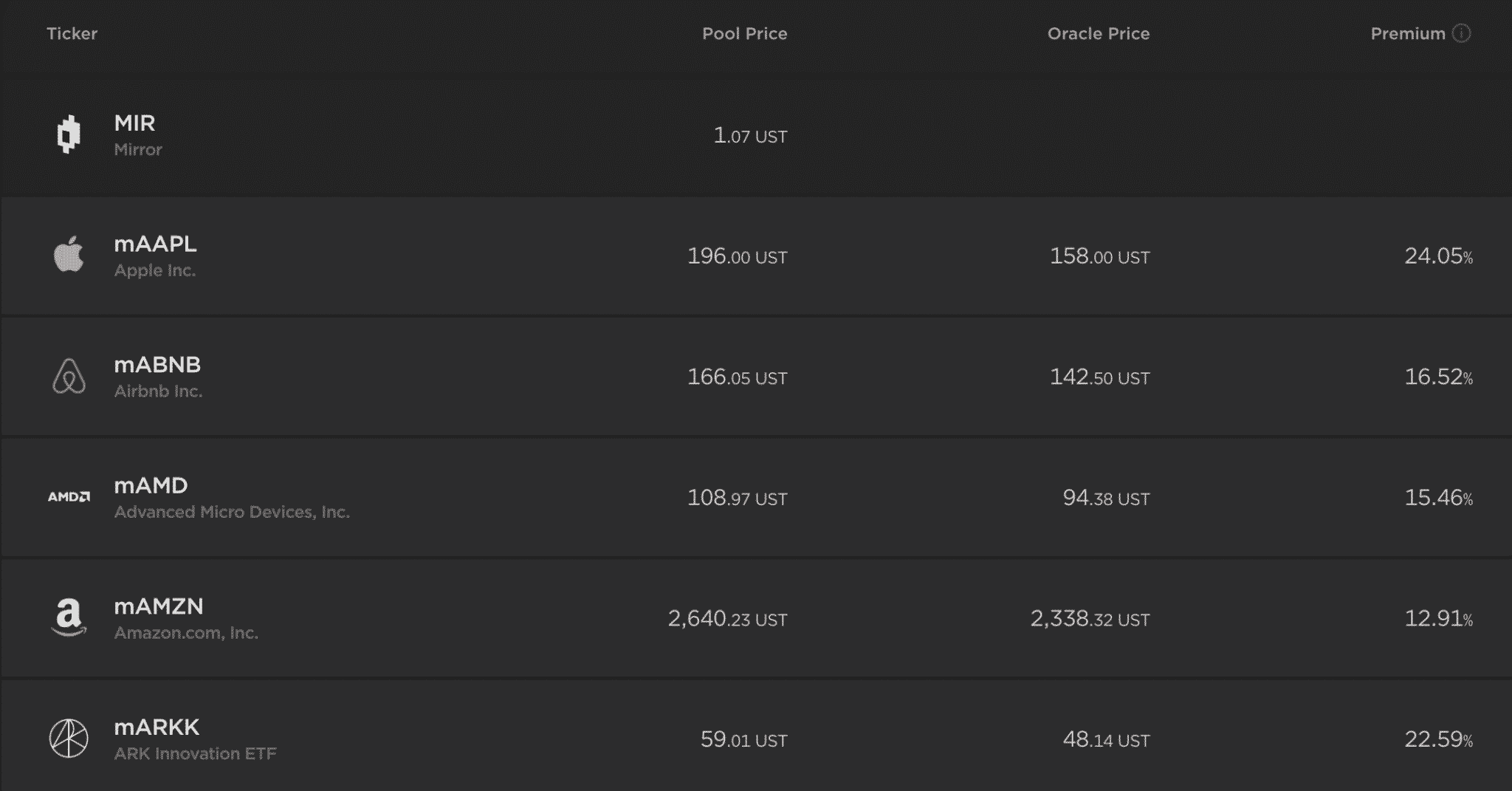

Mirror Protocol: Built on the Terra blockchain, Mirror Protocol enables users to create and trade synthetic stocks (mAssets) that mirror real-world equities. Collateral is provided in TerraUSD (UST).

-

UMA (Universal Market Access): UMA offers a decentralized infrastructure on Ethereum for creating custom synthetic tokens representing stocks and other assets, empowering users to design and trade their own synths.

Let’s get tactical. Here are the major battle-tested protocols powering this revolution:

- Synthetix: The OG of DeFi synths on Ethereum. Stake SNX as collateral to mint sTSLA, sAAPL, sAMZN and more. Price feeds come from decentralized oracles for transparency (details here).

- Mirror Protocol: Runs on Terra blockchain; lets you mint mStocks by locking up UST or LUNA. Focuses heavily on US equities (see overview).

- UMA: DIY platform for creating any synthetic asset imaginable – including custom stock trackers – using Ethereum smart contracts (learn more).

Your Step-by-Step Guide: How to Buy Synthetic Stocks on a DEX

If you want in on tokenized stocks via DEXs, here’s how it plays out:

- Create/Connect Your Crypto Wallet: Use MetaMask or Trust Wallet for seamless DEX access.

- Acquire Collateral Tokens: Buy SNX for Synthetix or UST/LUNA for Mirror Protocol from any major exchange.

- Stake Collateral and Mint Synths: Lock up your tokens following platform-specific collateralization ratios (Synthetix typically requires around 400%). This step mints your desired synthetic stock asset.

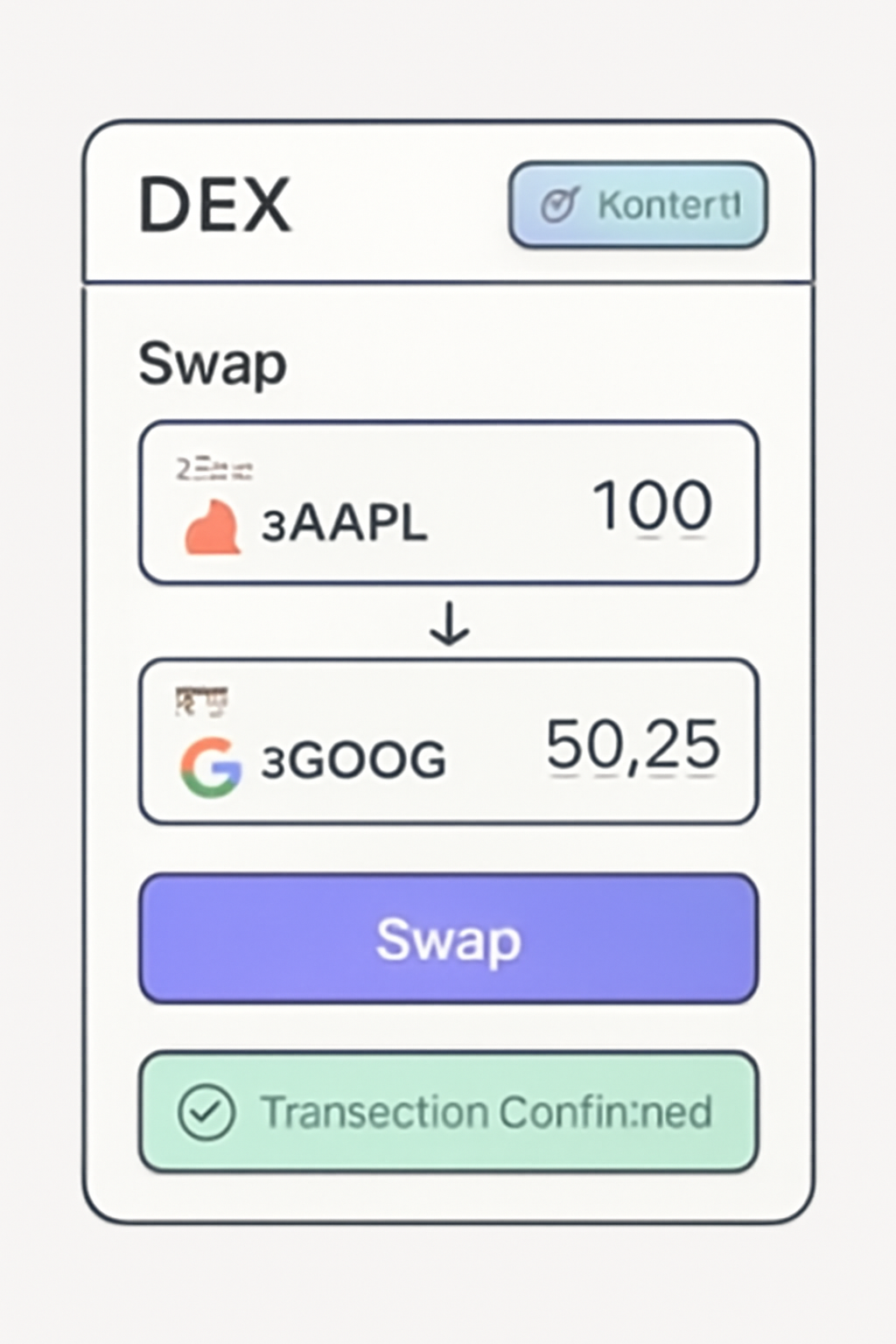

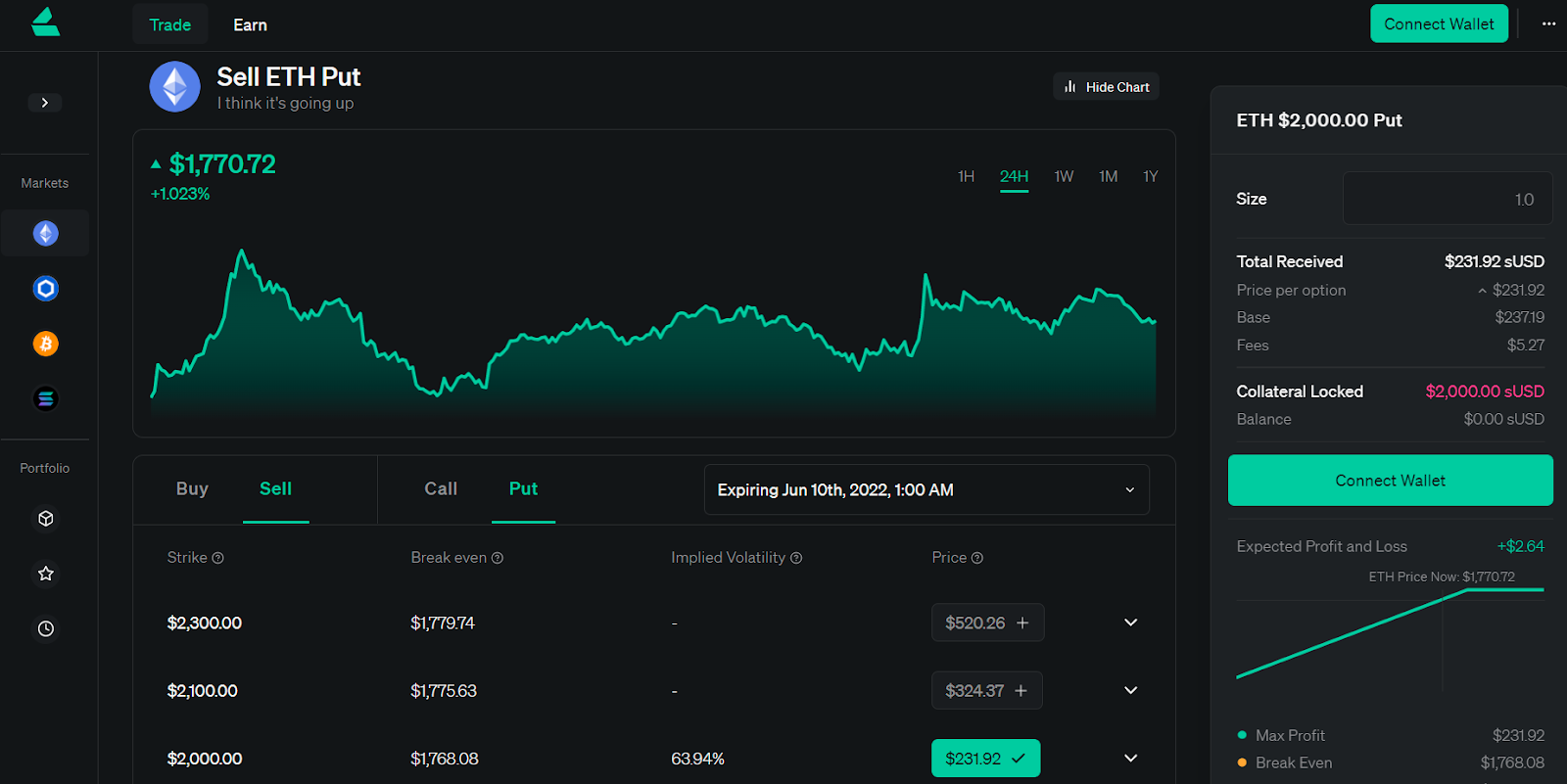

- Trade On the DEX: Head over to Uniswap/Kwenta/Synthetix Exchange (or Mirror’s native interface) and start swapping your synths with full peer-to-contract execution.

The process is fast but demands attention to detail – especially around wallet security and understanding liquidation thresholds if prices swing against your position.

Risk Management and Trading Strategies for Synthetic Equities

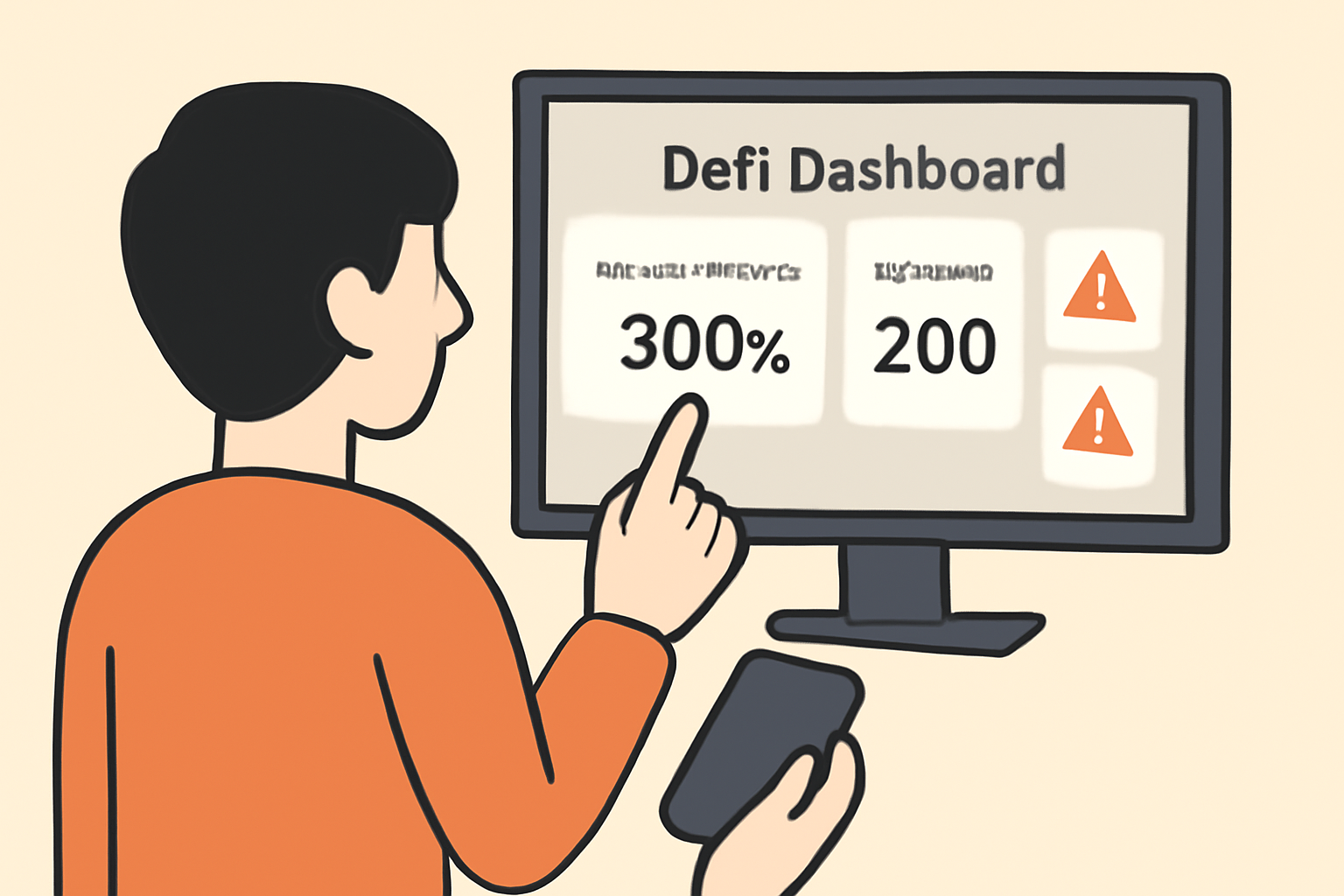

Once you’re live on the DEX, it’s time to think tactically. Risk management isn’t optional in DeFi – it’s your edge. Synthetic stocks are volatile and collateral-backed; if the value of your collateral drops too low, you risk liquidation. Platforms like Synthetix require you to keep a close eye on your collateralization ratio (usually around 400%). If your SNX falls in price, top up or risk losing your synths. Set alerts, use portfolio trackers, and never let your guard down.

Trading strategies for synthetic equities mirror those in traditional markets but with DeFi twists:

- 24/7 Arbitrage: Exploit price discrepancies between DEXs and CEXs or even between different synth platforms.

- Hedging: Use synthetic stocks to hedge real-world equity exposure without moving capital across borders.

- Leveraged Plays: Some synth protocols offer leveraged tokens or composite indices for aggressive positioning – just be crystal clear on how leverage interacts with collateral requirements.

Your best weapon? Discipline. React fast, but never without a plan.

Oracle failures, smart contract bugs, and sudden regulatory moves can all impact prices or platform functionality. Do your due diligence on each protocol’s audit history and governance structure before locking up capital.

Staying Ahead: Tools and Resources for On-Chain Stock Investors

The decentralized synthetic asset ecosystem moves fast. To stay sharp:

- Track real-time prices: Use dashboards that aggregate synth prices across DEXs for instant market reads.

- Dive into analytics: Protocol-specific explorers like Kwenta or Mirror provide deep stats on liquidity, volume, and open interest.

- Join communities: Telegram groups, Discord servers, and Twitter threads are where alpha leaks first – just filter the noise from the signal.

Ready to Trade Synthetic Stocks?

If you want borderless access to equity markets with full self-custody control, decentralized exchanges are where the action is. Master the basics of wallet security, collateral management, and protocol selection – then deploy your strategy with confidence. The future of equities is liquid, global, and always-on. Don’t get left behind.