How Solflare Stocks is Bringing Tokenized U.S. Equities On-Chain: Features, Benefits, and What Investors Need to Know

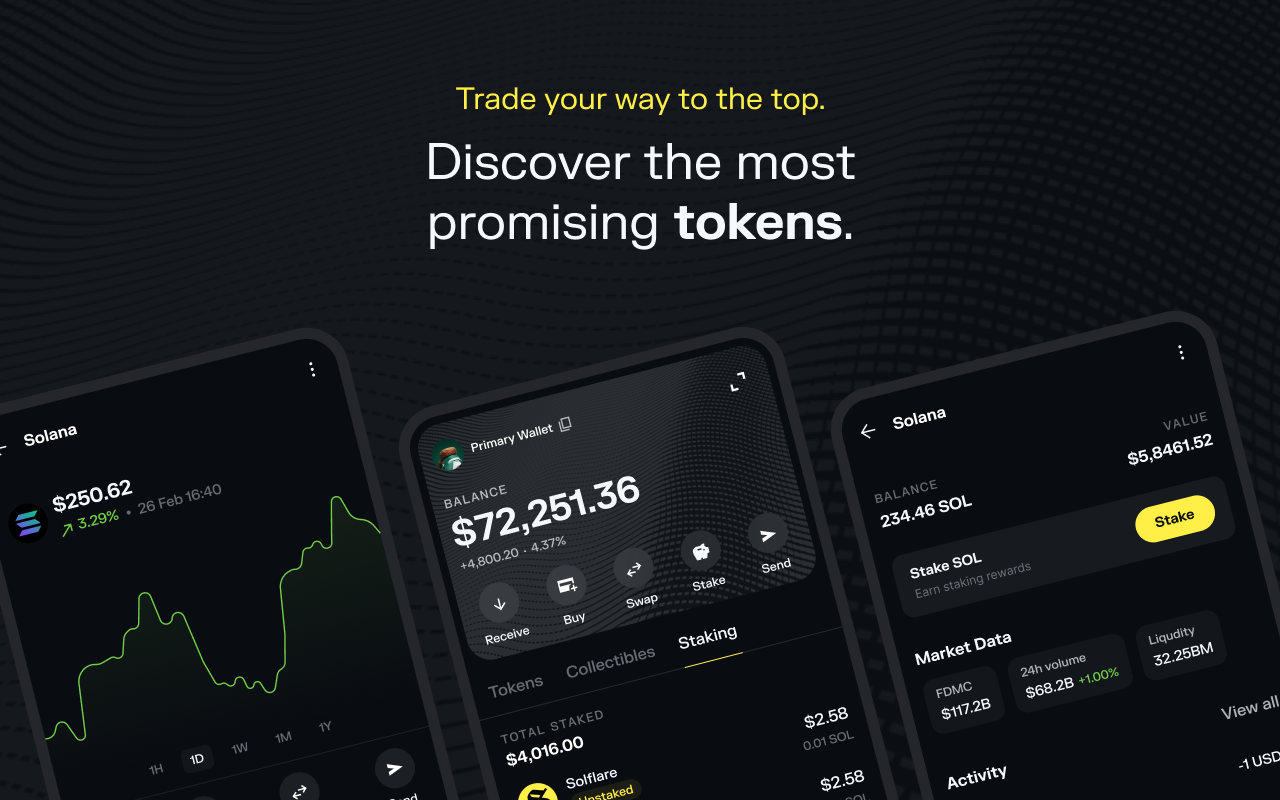

Tokenized equities have emerged as one of the most promising intersections between traditional finance and blockchain technology. With Solflare Stocks, investors now have the ability to access U. S. equities on-chain, blending the security and regulation of real-world assets with the flexibility and composability of decentralized finance (DeFi). The launch of xStocks on Solana marks a pivotal moment for both seasoned equity investors and crypto-native users eager to diversify their portfolios in new ways.

How Solflare Stocks Brings U. S. Equities On-Chain

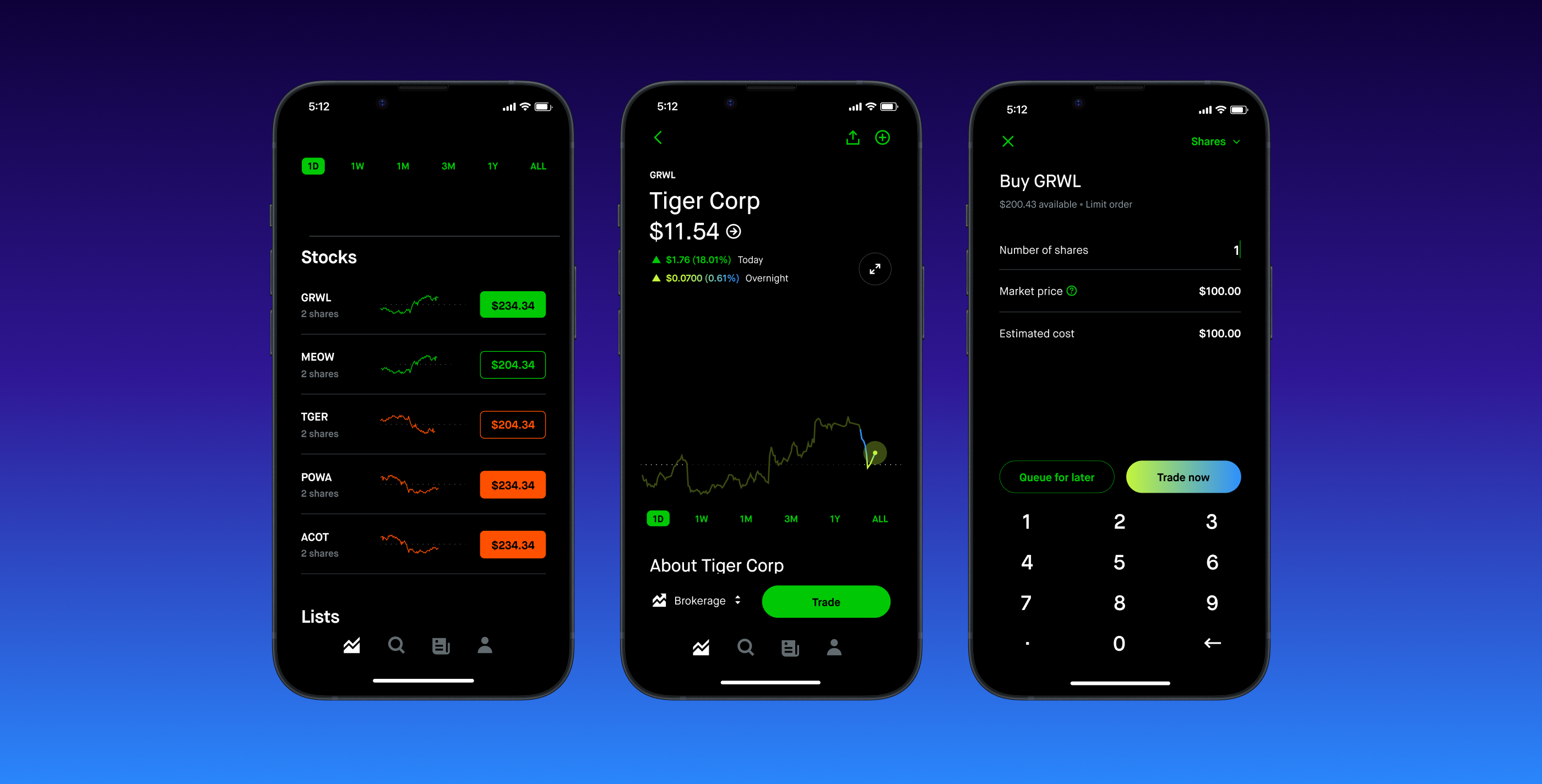

At its core, Solflare Stocks lets users trade tokenized versions of popular U. S. stocks, including Tesla, NVIDIA, and even broad market ETFs like the S and P 500, directly from their Solflare wallet using USDC or other supported assets. Each xStock is backed 1: 1 by a real share held with a regulated custodian. This structure ensures that every token truly represents an underlying equity, adding an important layer of transparency and investor protection.

The process is straightforward: when you purchase an xStock, you’re acquiring a blockchain-based token that mirrors the price movements and dividend rights of its real-world counterpart. These tokens are issued by Backed Finance AG, a Swiss-regulated entity, which helps address compliance for global users while maintaining robust asset backing.

Key Features That Set Solflare xStocks Apart

Key Features of Solflare Stocks (xStocks)

-

24/7 Trading: Trade tokenized U.S. equities any time, day or night—unlike traditional markets limited by opening hours.

-

Fractional Ownership: Buy fractions of stocks, making it easy to diversify portfolios without large capital requirements.

-

On-Chain Dividends: Receive dividends automatically through blockchain-based rebasing, simplifying and speeding up the process.

-

Instant Settlement: Enjoy nearly immediate trade settlements on the Solana blockchain, reducing counterparty risk and wait times.

-

DeFi Integration: Use xStocks within Solana’s DeFi ecosystem—for collateral, liquidity pools, and future integrations.

Solflare Stocks tokenized equities offer several unique advantages over traditional shares:

- 24/7 Trading: Unlike Wall Street’s limited hours, xStocks are available for trading at any time. This enables global participation without being tied to New York’s clock.

- Fractional Ownership: Investors can buy fractions of high-priced stocks, opening opportunities for broader diversification even with modest capital outlays.

- On-Chain Dividends: Eligible xStocks pay dividends automatically through a rebasing mechanism. There’s no need to track payment dates or chase down your earnings; everything happens transparently on-chain.

- DeFi Integration: Because these tokens live natively on Solana, they’re composable with DeFi protocols. Use your stocks as collateral for loans or add them to liquidity pools, possibilities that simply don’t exist in legacy brokerage accounts.

- Instant Settlement and Self-Custody: Trades settle near-instantly thanks to Solana’s performance. Plus, you maintain full control over your holdings inside your own wallet, no middlemen required.

The Benefits for Investors: Accessibility Meets Control

The implications are profound for both retail investors and institutions seeking exposure to U. S. markets without geographic or bureaucratic barriers. Non-U. S. residents can participate in American stock markets without jumping through hoops to open brokerage accounts, subject always to local regulations and eligibility checks.

This democratization is further enhanced by self-custody: you hold your assets directly in your wallet rather than trusting third-party brokers or banks with custody. For those who value financial sovereignty, this is a game-changer.

The composability within DeFi also means that these assets aren’t siloed; they can be integrated into broader strategies such as lending protocols or yield farming opportunities once supported by partner platforms.

Navigating Risks and Regulatory Considerations

No investment is without risk. While each xStock is backed by actual shares held with regulated custodians through Backed Finance AG, it’s crucial for investors to understand jurisdictional restrictions before participating. Availability may vary depending on where you live and local regulatory frameworks governing securities and digital assets.

I always advise thorough research before allocating significant capital to any new asset class, especially one as innovative as tokenized stocks for DeFi applications.

Market volatility is another factor to weigh carefully. Tokenized stocks like xStocks reflect the real-time price action of their underlying equities, mirroring both the upside potential and downside risk. While instant settlement on Solana reduces counterparty risk, price swings in U. S. equities still impact the value of your on-chain holdings. It’s wise to diversify and consider your personal risk profile before making allocation decisions.

For those new to this space, the process of acquiring xStocks is refreshingly simple compared to traditional brokerage onboarding. You can fund your Solflare wallet with USDC and purchase fractional or whole stock tokens with just a few clicks, no paperwork, no waiting periods. This streamlined user experience is a major draw for crypto-native investors who value speed and autonomy.

How to Get Started: Buying xStocks with Solflare

Accessing xStocksFi onchain US equities starts by setting up a Solflare wallet if you don’t already have one. Once funded with USDC or supported stablecoins, navigate to the Stocks tab within the wallet interface and select from over 60 leading U. S. stocks and ETFs available for tokenization. The entire process is non-custodial, transparent, and typically completes in seconds thanks to Solana’s high throughput.

An added benefit for active traders is the ability to move seamlessly between assets, stocks, crypto, NFTs, within a single wallet ecosystem. This kind of interoperability is unique to platforms like Solflare that embrace composability at their core.

Future Outlook: Where Tokenized Equities Go From Here

The launch of Solana stock tokens via xStocks represents only the first chapter in a broader transformation of capital markets infrastructure. As regulatory clarity improves and DeFi protocols mature, we’re likely to see richer integrations, think lending markets that accept on-chain dividend yielding tokens as collateral or automated portfolio strategies spanning both digital assets and traditional equities.

This convergence isn’t just about convenience; it’s about unlocking entirely new financial primitives that empower investors worldwide. The promise lies in combining transparency (blockchain), regulation (real-world asset backing), and programmability (DeFi) into a single investable product.

[list: Top benefits of holding tokenized stocks for DeFi investors]

As always, patience remains a key virtue when adopting emerging technologies. Early adopters should keep abreast of evolving compliance requirements and platform updates from trusted sources like Solflare Stocks. For those willing to do their homework, tokenized equities present an unprecedented opportunity to shape the future of investing, on your own terms.