How SEC Approval Could Accelerate On-Chain Stock Trading: What Investors Need to Know

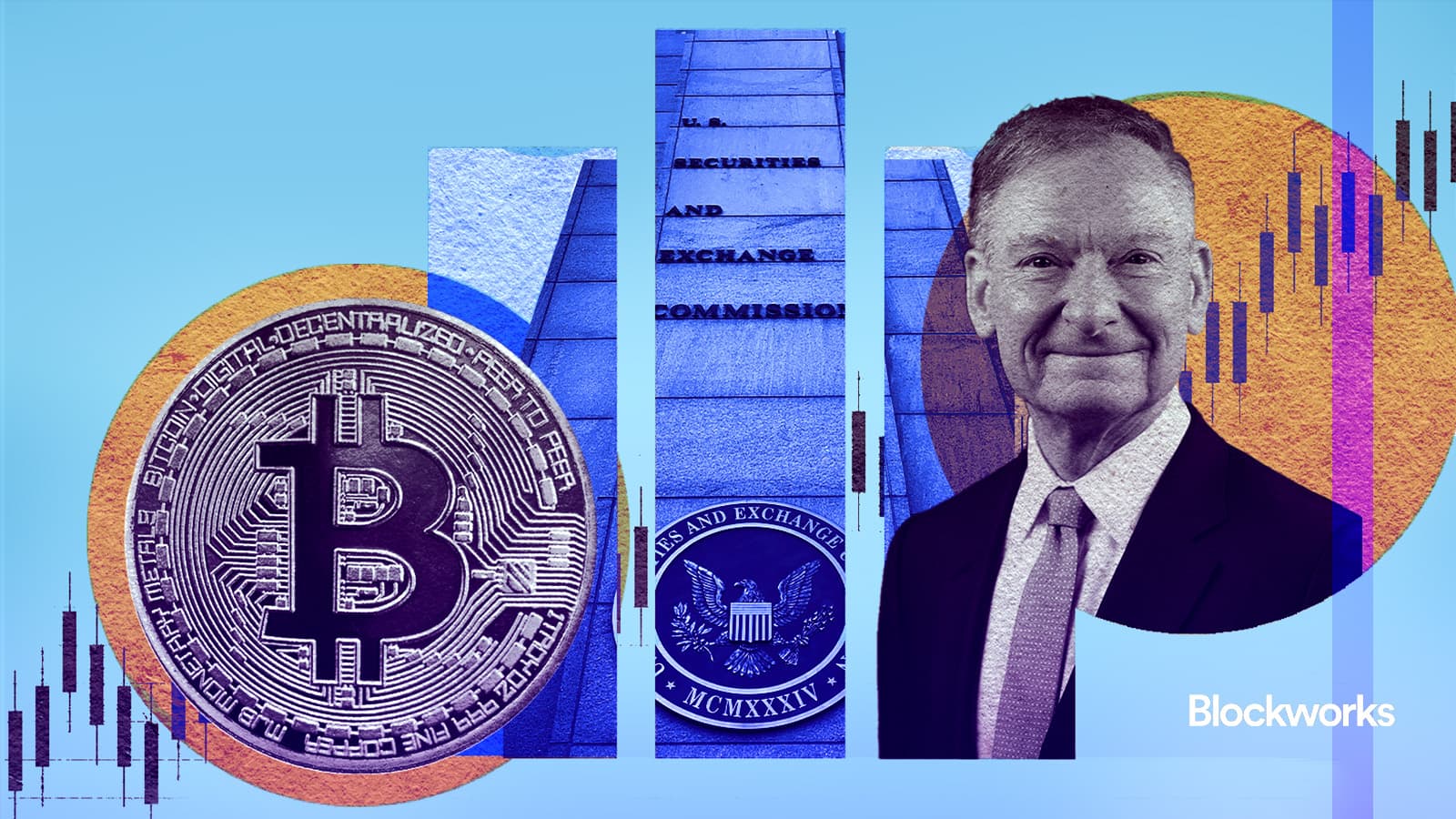

In a landmark move that signals the next phase of capital market evolution, the U. S. Securities and Exchange Commission (SEC) has launched ‘Project Crypto, ‘ a regulatory initiative designed to bring U. S. financial markets on-chain. This effort, supported by recent Nasdaq filings and policy changes around crypto asset exchange-traded products (ETPs), could fundamentally change how investors access and trade equities. For those tracking SEC on-chain stocks and tokenized equity SEC approval, the implications are profound: faster settlements, reduced costs, and around-the-clock market access are no longer theoretical, they’re becoming regulatory priorities.

SEC’s Project Crypto: Laying the Regulatory Rails for Tokenized Equities

The SEC’s recent actions reflect mounting pressure to modernize legacy infrastructure that underpins U. S. securities trading. Through Project Crypto, regulators aim to accommodate blockchain-based trading platforms, enabling stocks to be tokenized as real-world assets (RWAs) and traded 24/7 via Web3 protocols. This initiative has already led to approved orders permitting in-kind creations and redemptions for crypto ETPs, a significant expansion from previous cash-only rules (source).

Nasdaq’s application to introduce on-chain tokenized stock trading alongside its traditional platform is now under SEC review, marking a pivotal moment for both TradFi giants and DeFi-native investors. If greenlit, this dual system would allow seamless transitions between conventional brokerage accounts and blockchain-based wallets, potentially bypassing many current limitations faced by retail traders.

Why On-Chain Stock Trading Matters: Speed, Transparency, and Accessibility

The promise of on-chain equities is rooted in three core advantages:

Key Benefits of Tokenized Stocks for Retail Investors

-

24/7 Trading Access: Tokenized stocks on blockchain platforms like Nasdaq (pending SEC approval) could allow investors to trade equities around the clock, eliminating the traditional market’s limited hours.

-

Lower Transaction Costs: By leveraging blockchain technology, tokenized stocks can reduce reliance on intermediaries, potentially lowering trading fees compared to legacy brokerage models.

-

Direct Wallet Custody: Investors can hold tokenized stocks directly in secure digital wallets (e.g., MetaMask), reducing counterparty risk associated with traditional brokerages.

-

Global Accessibility: Blockchain-based platforms make it easier for investors worldwide to access U.S. equities, bypassing geographic and regulatory barriers often present in traditional finance.

-

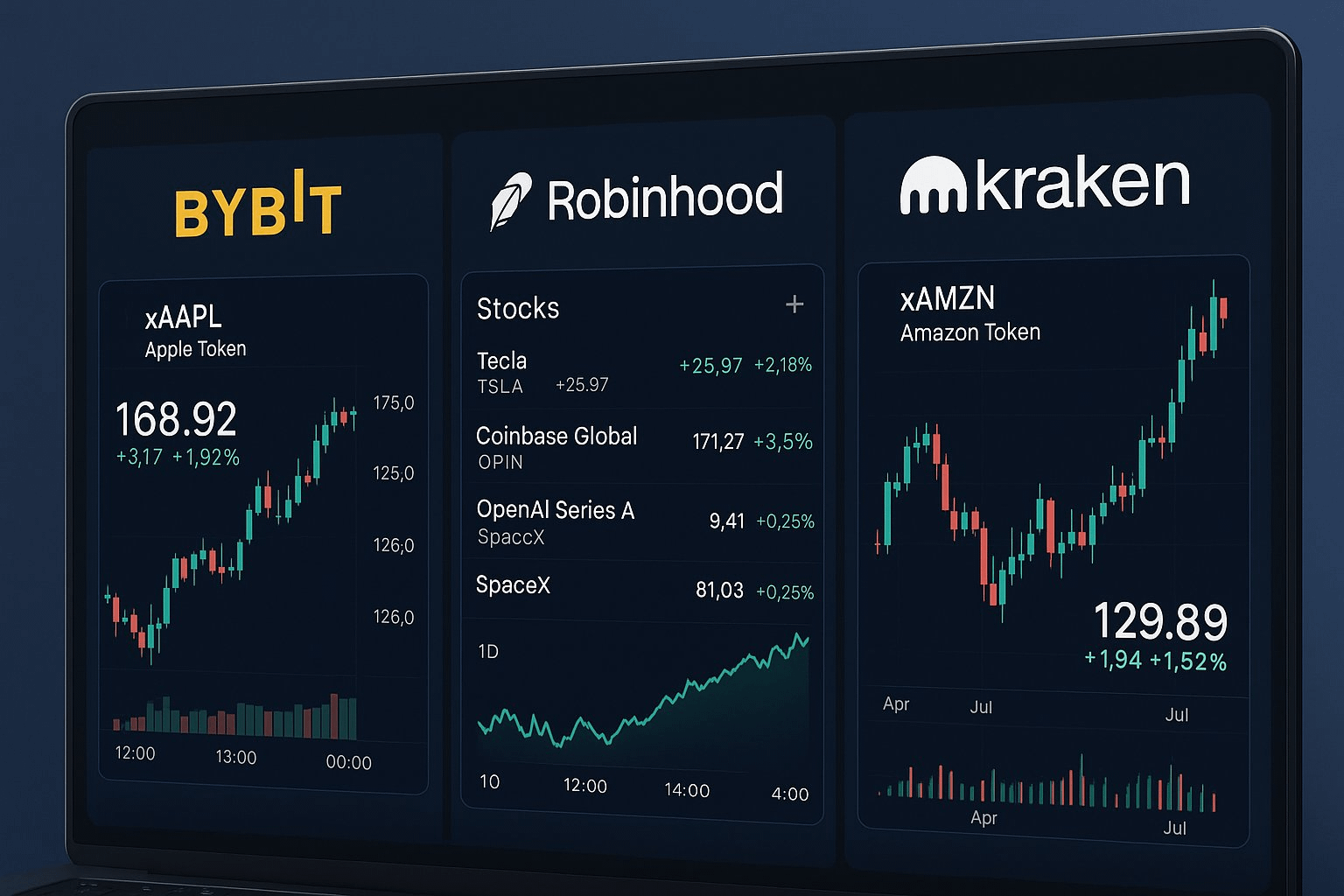

Seamless Integration with Crypto Assets: On-chain stocks can be traded alongside cryptocurrencies on platforms such as Coinbase (pending regulatory approval), enabling portfolio diversification within a single ecosystem.

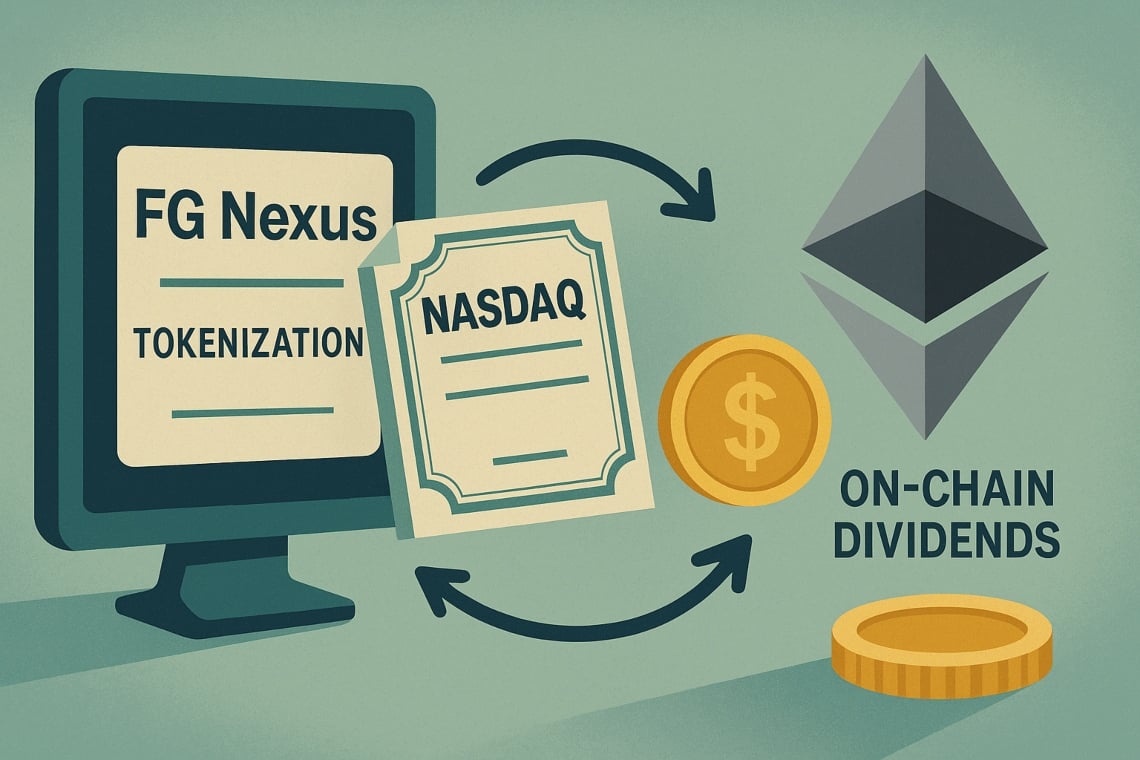

1. Instantaneous Settlement: Current U. S. equity markets rely on T and 2 settlement cycles, a relic of slower banking networks. Blockchain technology enables near-instant settlement, reducing counterparty risk for all market participants.

2. Lower Transaction Costs: By automating clearing functions through smart contracts, tokenized equity platforms can dramatically reduce fees associated with intermediaries.

3.24/7 Market Access: Perhaps most transformative is the shift from limited trading windows to round-the-clock access. Investors can buy or sell tokenized stocks at any hour, mirroring the flexibility seen in crypto markets.

This regulatory shift also opens new doors for global participation in U. S. -listed equities without the friction of cross-border brokerage accounts or time zone constraints.

The Regulatory Balancing Act: Opportunities, and Risks, for Investors

The SEC’s willingness to approve tokenized stocks US market-wide comes with both opportunities and challenges for investors seeking exposure through blockchain rails.

- Enhanced Liquidity: Tokenization could increase liquidity by fractionalizing shares and lowering minimum investment thresholds.

- Simplified Compliance: Programmable compliance via smart contracts may streamline KYC/AML checks, but also introduces new technical risks if not properly audited.

- Evolving Custody Models: With assets held directly in digital wallets rather than through brokerages, questions around security, recovery, and investor protection become paramount.

This rapidly evolving landscape will require vigilance from both regulators and investors as new frameworks are tested in live markets.

For investors, the potential for 24/7 stock trading blockchain access is both exciting and complex. While the advantages are clear, the new market structure will demand a deeper understanding of digital asset custody, compliance protocols, and smart contract risk. Investors should be prepared to navigate a hybrid environment where traditional protections may not always translate seamlessly to on-chain assets.

The move toward on-chain equities regulations is also generating significant debate within the financial sector. Some established players, such as Citadel Securities, have voiced concerns about operational risks and market fragmentation if blockchain-based trading becomes mainstream. Meanwhile, crypto-native platforms and advocates argue that programmable securities offer superior transparency and efficiency compared to legacy systems.

What Should Investors Watch For? Key Developments Ahead

As the SEC reviews proposals like Nasdaq’s on-chain trading application, several critical factors will shape the future landscape:

Key Regulatory Milestones for On-Chain Stock Trading

-

SEC Launches ‘Project Crypto’: The SEC’s official initiation of Project Crypto marks a foundational step towards integrating blockchain into U.S. securities regulation. This project aims to modernize market infrastructure and create a pathway for on-chain trading of traditional assets.

-

Nasdaq Files for On-Chain Tokenized Stock Trading: Nasdaq has submitted a formal application to the SEC to enable on-chain trading of tokenized stocks alongside traditional equities. This milestone signals institutional readiness for blockchain adoption in mainstream markets.

-

SEC Approves In-Kind Creations and Redemptions for Crypto ETPs: The SEC’s approval of in-kind (non-cash) creations and redemptions for crypto asset exchange-traded products (ETPs) reflects a shift towards more flexible and blockchain-friendly fund structures.

-

SEC Reviews Proposals for Blockchain-Based Stock Trading Platforms: The SEC is actively evaluating proposals from major exchanges and technology providers to list and trade tokenized stocks on blockchain platforms, a critical step before any public launch.

-

Development of a Comprehensive Regulatory Framework for Tokenized Securities: The SEC is working on a new regulatory framework tailored to tokenized securities, addressing investor protections, market surveillance, and compliance for on-chain trading.

- Platform Security: The robustness of smart contracts and wallet infrastructure will be tested at scale. Investors should prioritize platforms with transparent audit histories and robust insurance or recovery mechanisms.

- Market Structure Shifts: The introduction of parallel trading venues, traditional exchanges alongside blockchain-based systems, could create arbitrage opportunities but also new forms of volatility.

- Taxation and Reporting: Regulatory clarity around tax treatment for on-chain equities remains in flux. Investors must stay informed about evolving IRS guidance and reporting standards for digital securities.

The SEC’s Project Crypto is not just about technology, it’s a signal that U. S. capital markets are entering an era where regulatory agility is as important as technological innovation. For those willing to embrace these changes, early adoption may offer unique portfolio diversification opportunities as well as first-mover advantages in accessing global liquidity pools.

The next 12-18 months will be pivotal. As regulatory frameworks solidify and major exchanges roll out live pilots, retail and institutional investors alike should focus on due diligence, evaluating platform credibility, understanding custody solutions, and monitoring ongoing policy developments from both the SEC and other international regulators.

The integration of tokenized stocks US market-wide is no longer speculative; it’s an imminent reality shaped by deliberate regulatory action. For forward-thinking investors, staying informed, and adaptable, will be essential as the lines between traditional finance and decentralized protocols continue to blur.