How to Track Real-Time Prices of Tokenized Stocks on the Blockchain

Tokenized stocks are rapidly reshaping how investors access and trade equity markets. By bringing traditional shares onto public blockchains, these digital assets offer 24/7 liquidity, fractional ownership, and unprecedented transparency. Yet, the true power of tokenized equities comes from the ability to track real-time prices with on-chain data feeds and analytics tools. In today’s decentralized landscape, reliable price discovery is critical for portfolio management, compliance, and risk mitigation.

Why Real-Time Price Tracking Matters for On-Chain Equities

Unlike legacy markets with limited trading hours and opaque settlement processes, tokenized stocks operate around the clock. This always-on environment demands robust tools that deliver up-to-the-second price data directly from the blockchain. Real-time tracking not only supports active trading but also enhances auditability by recording every transaction transparently.

The following platforms have emerged as industry leaders in delivering precise tokenized equity pricing:

Top 5 Tools for Tracking Tokenized Stock Prices

-

RWA.xyz: A leading analytics platform for exploring and tracking tokenized real-world assets, including equities, on public blockchains. RWA.xyz provides transparent, real-time data on tokenized stocks, investors, issuers, and service providers, making it a go-to resource for on-chain equity analytics.

-

Kraken Pro (xStocks): Kraken Pro offers xStocks, enabling users to trade and monitor tokenized stocks and ETFs with advanced charting, price alerts, and technical indicators. The platform supports real-time price tracking and market comparison for tokenized equities.

-

Synthetix (Synths for Equities): Synthetix is a DeFi protocol that issues synths—synthetic assets representing real-world equities and indices. Users can track live prices, trade synthetic stocks, and gain exposure to traditional equities directly on-chain.

-

Moralis Tokenized Stock APIs: Moralis provides robust APIs for fetching real-time pricing, ownership, and transfer data for tokenized stocks. These APIs are widely used by fintech platforms and exchanges to integrate live tokenized equity data into their services.

-

Chainlink Data Feeds for Tokenized Stocks: Chainlink delivers real-time, tamper-resistant price feeds for tokenized U.S. equities and ETFs across multiple blockchains. These data feeds power DeFi applications and ensure accurate pricing for synthetic and tokenized stocks.

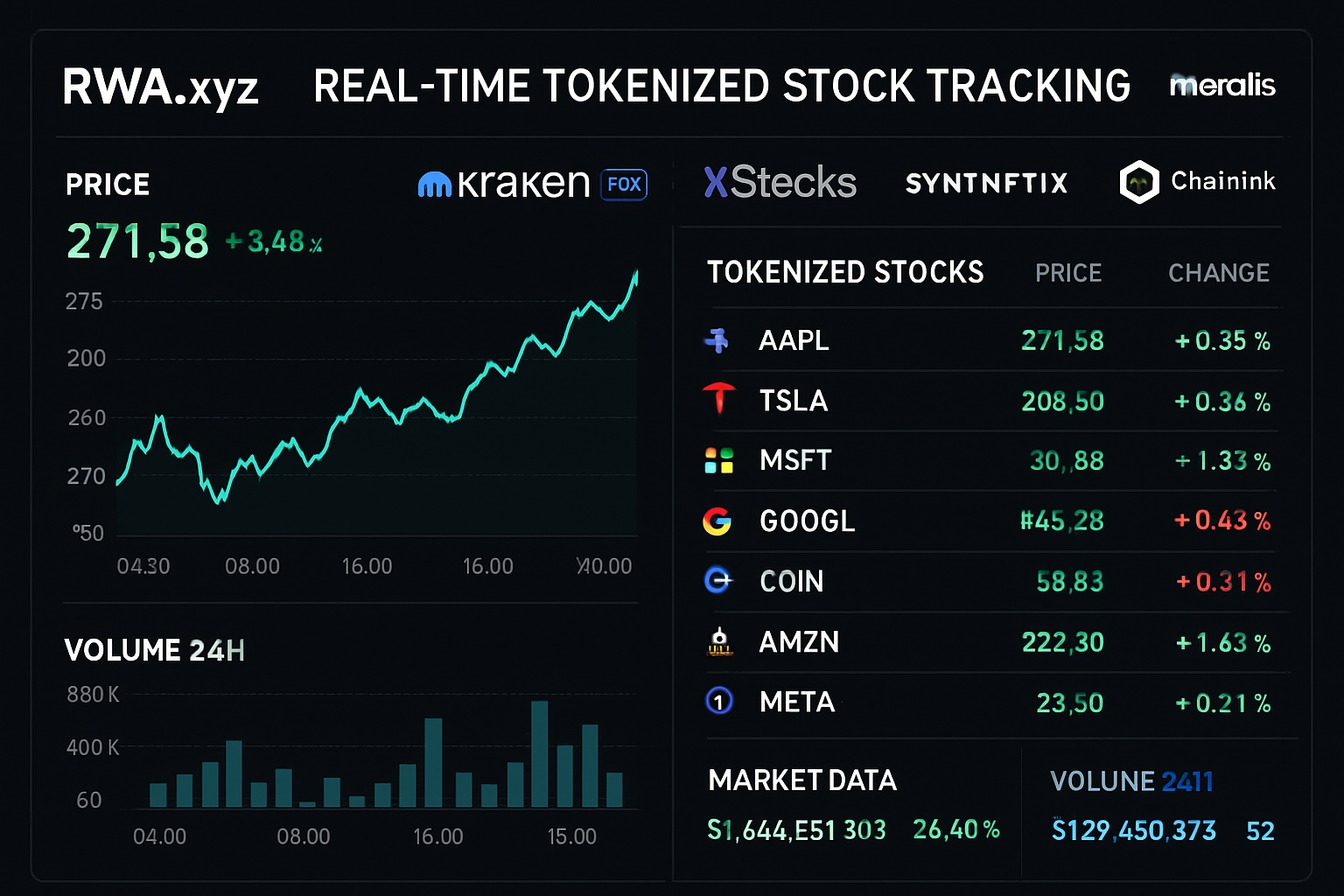

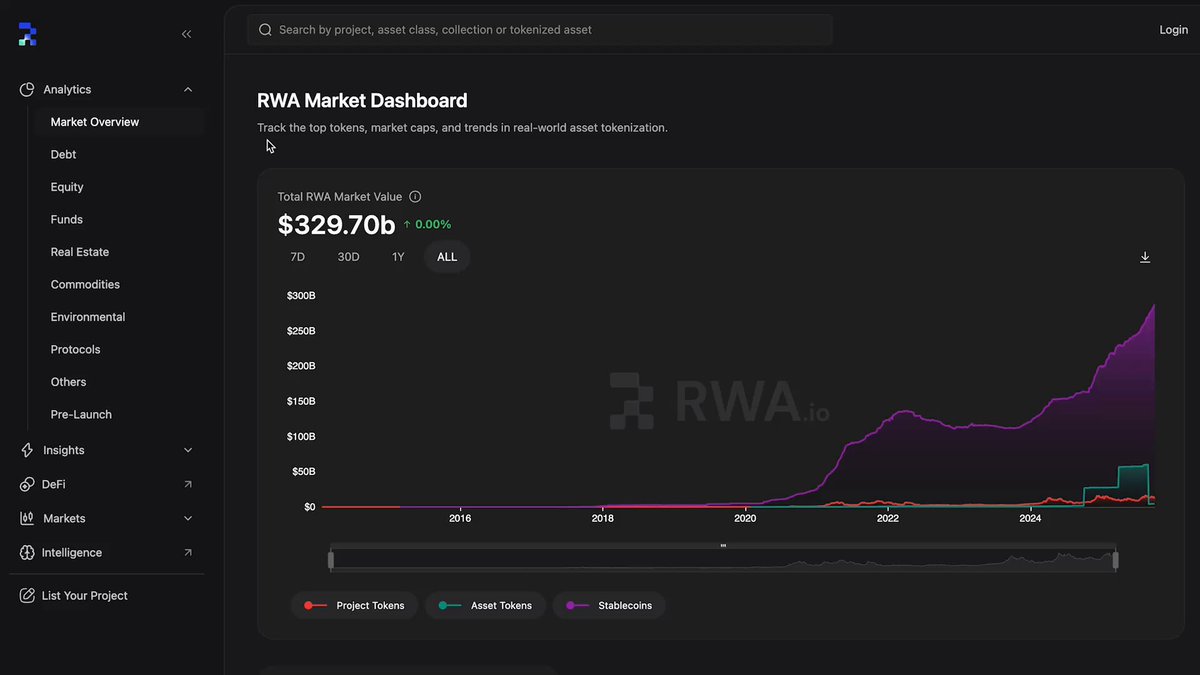

1. RWA. xyz: Comprehensive Analytics for Tokenized Real-World Assets

RWA. xyz is a cornerstone analytics platform dedicated to tracking the universe of tokenized real-world assets (RWAs), including equities. Investors and institutions rely on RWA. xyz to visualize flows between issuers, service providers, and buyers across major public blockchains. The platform aggregates live data on trading volumes, price fluctuations, market capitalization, and wallet activity for each listed asset.

This holistic view empowers users to compare synthetic stocks side by side with other RWAs like real estate or commodities – all within a transparent interface designed for both due diligence and daily monitoring. For those seeking granular insights into liquidity or adoption trends in tokenized equities, RWA. xyz is an essential resource.

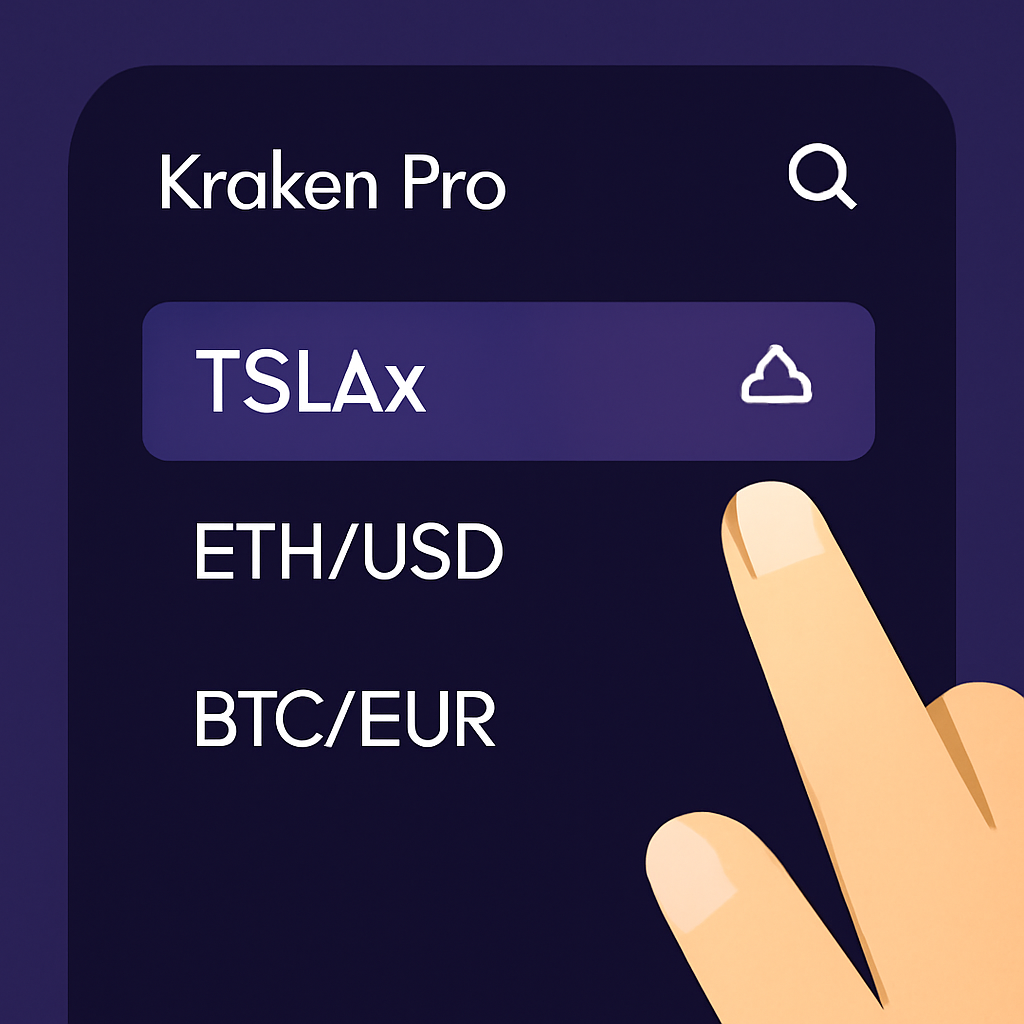

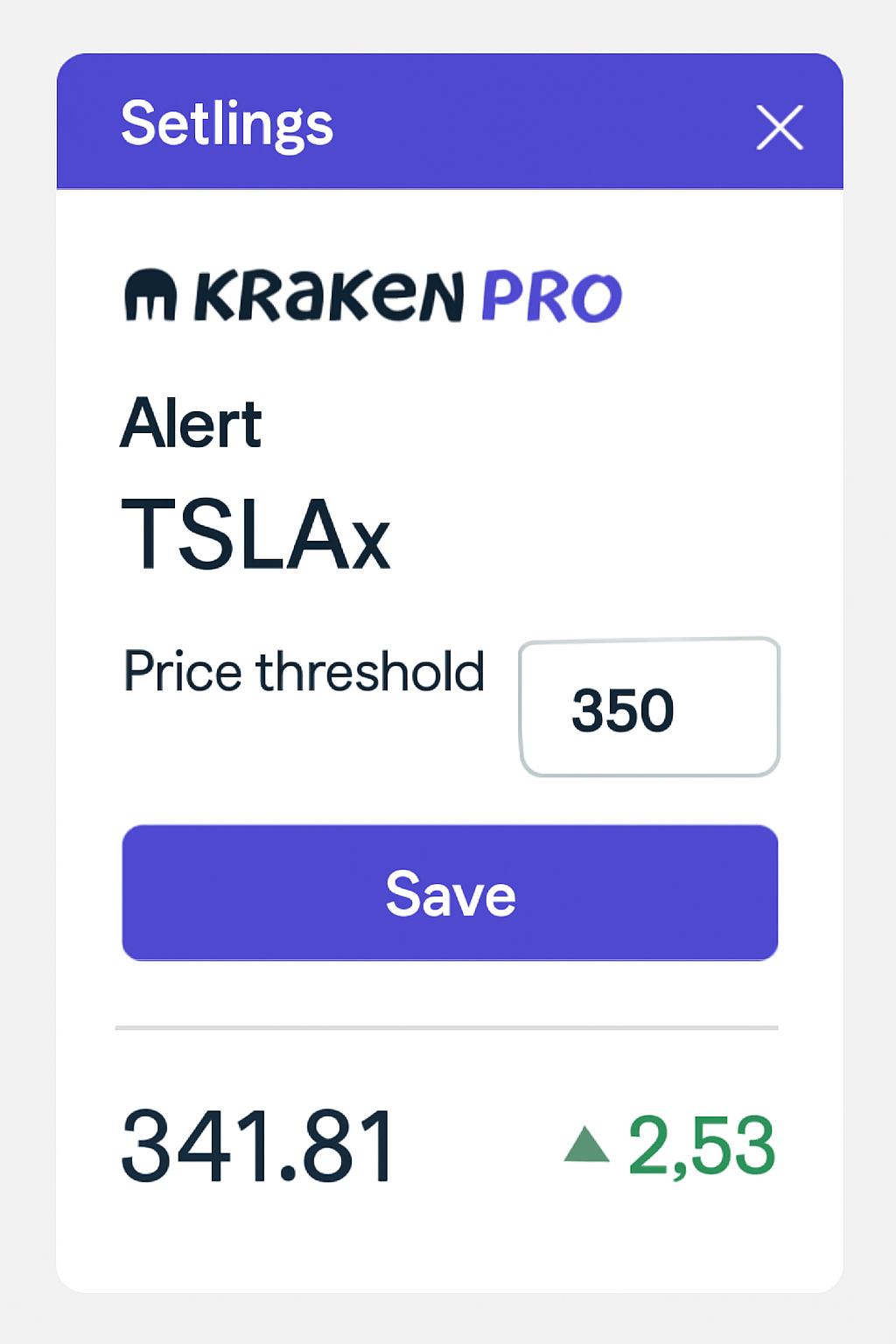

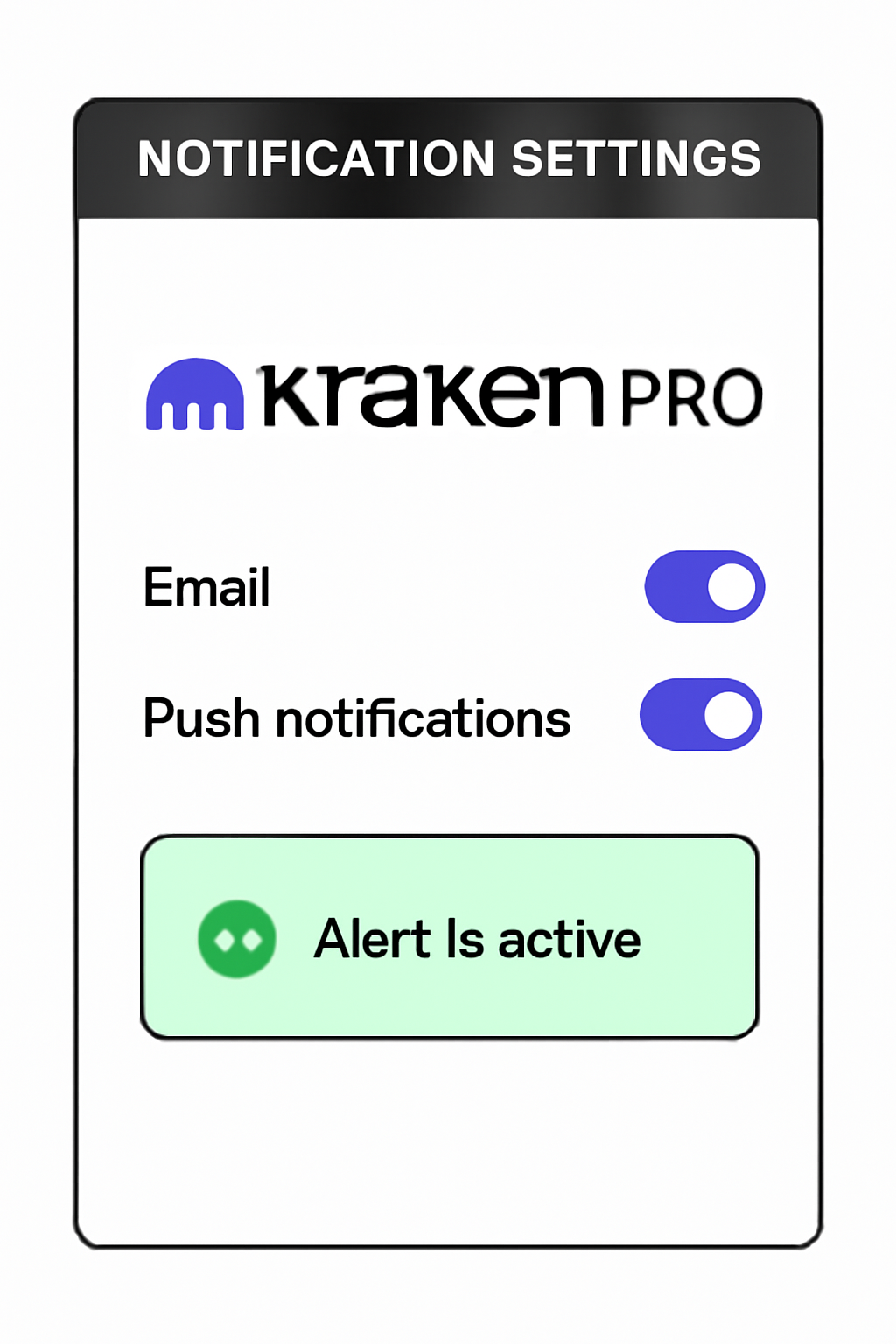

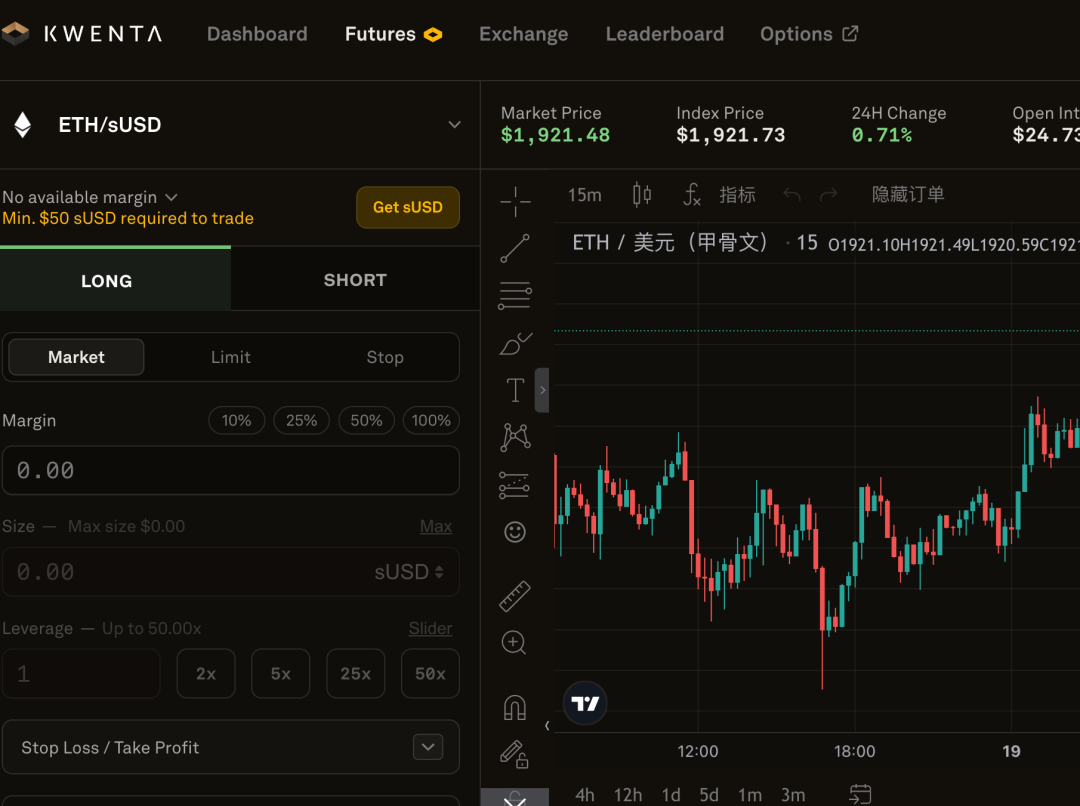

2. Kraken Pro (xStocks): Advanced Trading and Charting of Tokenized Stocks

Kraken Pro has integrated xStocks, enabling traders to buy and sell leading U. S. equities as blockchain-based tokens right alongside crypto assets. The platform’s advanced charting suite supports technical analysis with indicators such as RSI, MACD, moving averages, and customizable price alerts – all powered by live market feeds.

Kraken Pro’s multi-market comparison tool lets users analyze up to eight tokenized stocks or ETFs simultaneously. This makes it possible to spot relative strength or arbitrage opportunities between synthetic shares in real time – a capability rarely matched by traditional brokerages.

3. Synthetix: On-Chain Synthetic Equities with Decentralized Price Feeds

Synthetix pioneered decentralized synthetic assets (“Synths”) that track global equities using blockchain-based oracles rather than custodial backing. With Synths like sTSLA or sAAPL mirroring actual stock prices through smart contracts fed by trusted data sources, traders can gain exposure to U. S. , European, or Asian stocks without leaving DeFi protocols.

Synthetix’s open architecture ensures every price update is verifiable on-chain – reducing settlement risk while supporting composability across lending platforms or derivatives markets. For active DeFi investors seeking exposure to equity markets without intermediaries or off-chain risk, Synthetix offers a robust solution backed by transparent pricing mechanisms.

Reliable price data is the backbone of Synthetix’s synthetic equities ecosystem. Every movement in the underlying stock is reflected on-chain, allowing traders and protocols to interact with up-to-date market information. This direct connection between real-world equity prices and decentralized finance unlocks new arbitrage strategies and risk management tools for sophisticated investors.

4. Moralis Tokenized Stock APIs: Developer-Grade Access to Real-Time Equity Data

For fintech innovators and institutional platforms aiming to offer real-time blockchain equities, Moralis Tokenized Stock APIs provide a powerful backend. These APIs aggregate live pricing, ownership updates, and transfer events for tokenized stocks across multiple blockchains, all accessible through a unified interface. By integrating Moralis, developers can build custom dashboards, trading engines, or portfolio trackers that display the latest on-chain prices for assets like synthetic AAPL or tokenized TSLA.

This API-driven approach is particularly valuable for exchanges, custodians, or asset managers who require reliable feeds without maintaining their own blockchain infrastructure. With Moralis’s commitment to low latency and comprehensive coverage, users gain confidence in their ability to react swiftly to market shifts in the fast-evolving world of on-chain synthetic stocks.

5. Chainlink Data Feeds for Tokenized Stocks: Decentralized Oracle Infrastructure for Price Accuracy

No discussion of real-time blockchain equities would be complete without Chainlink Data Feeds. Chainlink’s decentralized oracle network delivers high-frequency price updates for tokenized U. S. stocks and ETFs directly onto smart contracts. This infrastructure ensures that every trade or settlement involving synthetic equities is based on tamper-resistant data aggregated from top-tier sources.

The importance of this cannot be overstated: accurate pricing not only underpins fair trading but also supports automated liquidation mechanisms, collateral valuations, and compliance reporting within DeFi protocols. Chainlink’s transparent audit trail further reduces settlement risk, one of the key pain points in traditional equity markets, and brings institutional-grade trust to tokenized assets.

Choosing the Right Tracker: Practical Considerations

The optimal tool depends on your specific needs as an investor or builder:

- Active traders may prefer Kraken Pro for its advanced charting and alerting capabilities.

- Portfolio managers seeking cross-asset analytics gravitate toward RWA. xyz.

- DeFi-native users benefit from Synthetix’s fully on-chain exposure with transparent pricing logic.

- Developers building new products rely on Moralis APIs or direct Chainlink feeds for seamless integration.

Top 5 Platforms for Tracking Tokenized Stock Prices

-

RWA.xyz: A comprehensive analytics platform dedicated to tokenized real-world assets. RWA.xyz provides transparent, real-time data on tokenized stocks, including trading volumes, issuer details, and on-chain activity, helping investors monitor market dynamics and asset flows across major blockchains.

-

Kraken Pro (xStocks): Kraken Pro’s xStocks feature allows users to track and trade tokenized stocks and ETFs with advanced charting, technical indicators, and real-time price alerts. This platform supports comparison across multiple markets, enhancing decision-making for on-chain equities.

-

Synthetix (Synths for Equities): Synthetix offers synthetic equities via its decentralized protocol, enabling users to track and gain exposure to stock prices on-chain. Synths mirror real-world asset prices and are fully transparent, with all transactions recorded on the blockchain for auditability.

-

Moralis Tokenized Stock APIs: Moralis provides robust APIs for tokenized stock data, offering real-time pricing, ownership, and transfer information. Developers and fintech platforms use these APIs to integrate live tokenized equity data into their products, ensuring up-to-date and accurate market insights.

-

Chainlink Data Feeds for Tokenized Stocks: Chainlink delivers real-time market data feeds for tokenized stocks and ETFs directly on blockchain networks. These decentralized oracles ensure reliable, tamper-proof pricing, improving transparency and reducing settlement risk for on-chain equities.

The Future of On-Chain Equity Price Discovery

The convergence of advanced analytics platforms like RWA. xyz, exchange-grade interfaces from Kraken Pro (xStocks), composable DeFi synths via Synthetix, robust APIs from Moralis, and decentralized oracle networks by Chainlink signals a new era in equity investing. Investors are no longer bound by legacy infrastructure or opaque pricing; instead, they can access transparent market data around the clock with confidence in its accuracy.

This shift not only democratizes access but also enables more sophisticated strategies, whether you’re optimizing yield across protocols or simply monitoring your portfolio in real time. As adoption accelerates and liquidity deepens across these platforms, expect even greater innovation at the intersection of traditional finance and decentralized markets.