How to Buy Tokenized Tesla Stock on the Blockchain: Step-by-Step Guide for 2024

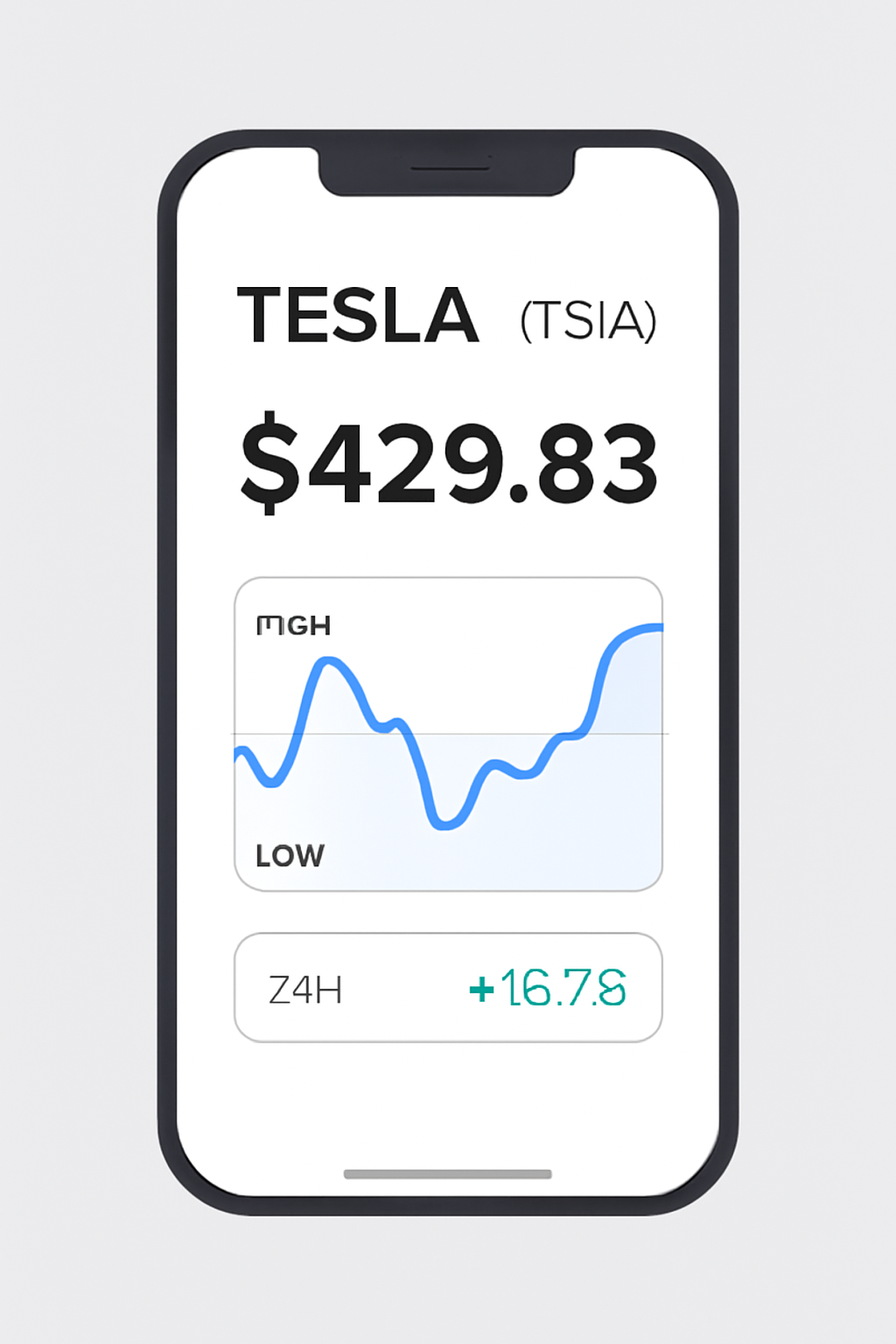

Tokenized Tesla stock is revolutionizing the way investors access one of the world’s most talked-about equities. As of October 5,2025, the price of Tesla Inc (TSLA) sits at $429.83, and its tokenized versions are now available on multiple blockchain platforms, including Kraken, PandaTool, and Bitget. This new frontier in investing offers 24/7 trading, fractional ownership, and global participation, all without needing a traditional brokerage account.

Why Buy Tokenized Tesla Stock in 2024?

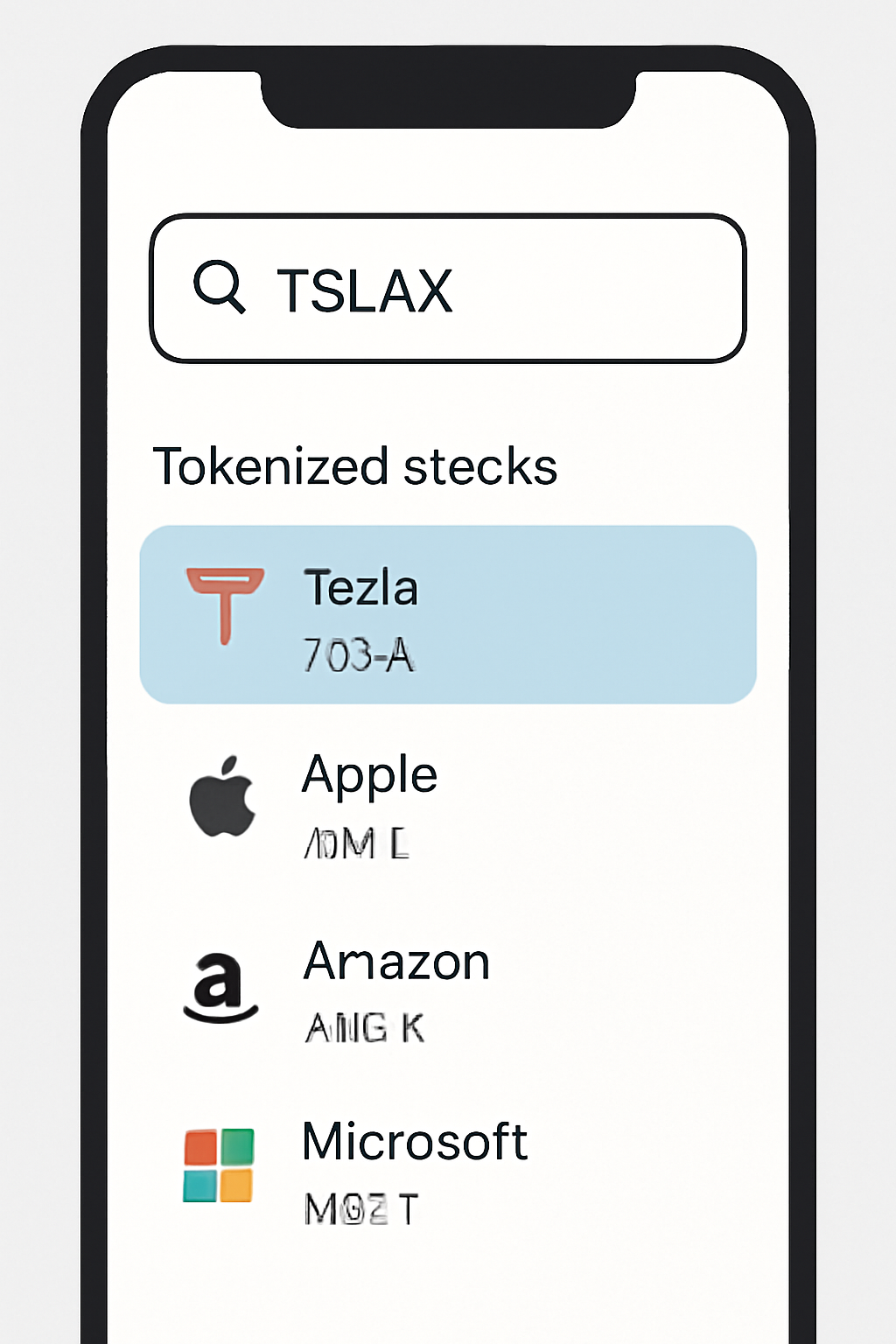

Before diving into step-by-step instructions, let’s clarify why so many investors are exploring synthetic TSLA blockchain assets this year. Tokenized stocks like TSLAX or xTSLA are digital representations of real Tesla shares held by regulated custodians. They allow you to:

- Trade anytime: Blockchain markets never close, buy or sell TSLA tokens even on weekends.

- Start with less capital: Fractional tokens mean you can own a piece of Tesla for much less than a full share price.

- Diversify globally: No matter where you live, if your jurisdiction allows it, you can access U. S. equities in seconds.

However, remember: owning tokenized Tesla does not grant shareholder voting rights or dividends unless specified by the platform. You’re gaining exposure to price movements, not direct corporate participation.

Where Can You Buy Tokenized Tesla Stock Right Now?

The landscape for buying on-chain equities has matured rapidly since Kraken introduced their xStocks lineup in May 2025. Today’s top options for purchasing tokenized TSLA include:

- Kraken: Offers TSLAX tokens fully backed by real shares and supports BTC or fiat purchases through their mobile app.

- PandaTool: Features xTSLA on Solana for fast transactions and low fees.

- Bitget: Provides easy onboarding with KYC verification and access to Ethereum-based xStocks, including tokenized Tesla shares launched in September 2025.

- Phemex and Binance: List variants like TSLAON and TSLAX with competitive fees and robust security features.

- DeFiChain DEX: Focuses on decentralized trading of DTSLA tokens using MetaMask-compatible wallets.

The most popular exchanges offer both centralized (CEX) and decentralized (DEX) options depending on your preference for custody, privacy, and compliance requirements. Always check whether your region is eligible before proceeding, regulatory restrictions may apply.

Tesla Tokenization: How It Works and What You’re Really Buying

The mechanics behind synthetic TSLA blockchain assets are straightforward but crucial to understand. Each token is typically collateralized by an equivalent number of actual Tesla shares held by a licensed custodian or trust company. This ensures that every TSLAX or xTSLA is pegged to the real-time value of $429.83 per share as tracked on NASDAQ.

Tokenized Tesla Stock (TSLAx) Price Prediction 2026-2031

Forecast based on latest market data as of October 2025. All prices reflect tokenized TSLA stock per token, mirroring underlying Tesla Inc. stock performance with crypto market factors.

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | Potential Annual % Change (Avg) |

|---|---|---|---|---|

| 2026 | $370.00 | $445.00 | $510.00 | +3.5% |

| 2027 | $390.00 | $475.00 | $560.00 | +6.7% |

| 2028 | $410.00 | $505.00 | $615.00 | +6.3% |

| 2029 | $430.00 | $540.00 | $670.00 | +6.9% |

| 2030 | $465.00 | $585.00 | $735.00 | +8.3% |

| 2031 | $505.00 | $630.00 | $810.00 | +7.7% |

Price Prediction Summary

The tokenized Tesla stock (TSLAx) is projected to follow the underlying Tesla Inc. (TSLA) share price trend, with additional volatility and potential premiums driven by crypto market demand, global access, and 24/7 trading. Regulatory clarity, expanding token adoption, and technological improvements could bolster price appreciation. However, macroeconomic uncertainty, regulatory restrictions, and competition from other tokenized equities may introduce downside risk. The average price is expected to rise moderately each year, with bullish scenarios reflecting strong adoption and market optimism, while bearish scenarios consider global market corrections or regulatory headwinds.

Key Factors Affecting Tokenized Tesla Stock Price

- Correlation to underlying Tesla Inc. share price and traditional equity market cycles.

- Growth in adoption of tokenized equities and expansion of trading platforms (e.g., Kraken, Solana, Ethereum).

- Regulatory developments impacting access and legality of tokenized stocks globally.

- Technological improvements in tokenization protocols and custodial solutions.

- Market competition from other tokenized stocks and synthetic assets.

- Potential for increased volatility and liquidity premiums unique to crypto-traded assets.

- Macroeconomic factors influencing both traditional and crypto markets (e.g., interest rates, recession risk, tech sector performance).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This means when you buy a tokenized share at $429.83 today, its value will rise or fall in sync with underlying TSLA stock performance, minus any platform fees or spreads. However, these tokens do not represent legal ownership of the underlying shares unless explicitly stated by your provider; they are a derivative product designed for exposure rather than corporate control.

The Regulatory Landscape and Investor Considerations

With growing adoption comes increased scrutiny from regulators worldwide. Some exchanges may restrict access based on your location due to securities laws or licensing requirements. It’s vital to review each platform’s terms before committing funds, and consider storing your tokens in a self-custodial wallet if possible for maximum control over your assets.

As you navigate the world of buying on-chain equities, it’s important to weigh the trade-offs between centralized and decentralized exchanges. Centralized platforms like Kraken and Bitget provide a familiar user experience, streamlined onboarding, and customer support. Decentralized options, such as DeFiChain DEX or PandaTool on Solana, offer greater autonomy and privacy but may require more technical know-how.

Practical Tips for First-Time Buyers

Whether you’re a crypto native or a traditional investor branching into blockchain Tesla investment, here are some practical tips to help you get started safely:

Essential Tips for Securely Buying & Storing Tokenized Tesla Stock

-

Verify Regulatory Compliance: Ensure the platform complies with your local regulations. Some exchanges may restrict access to tokenized stocks based on your jurisdiction, so always check eligibility before registering.

-

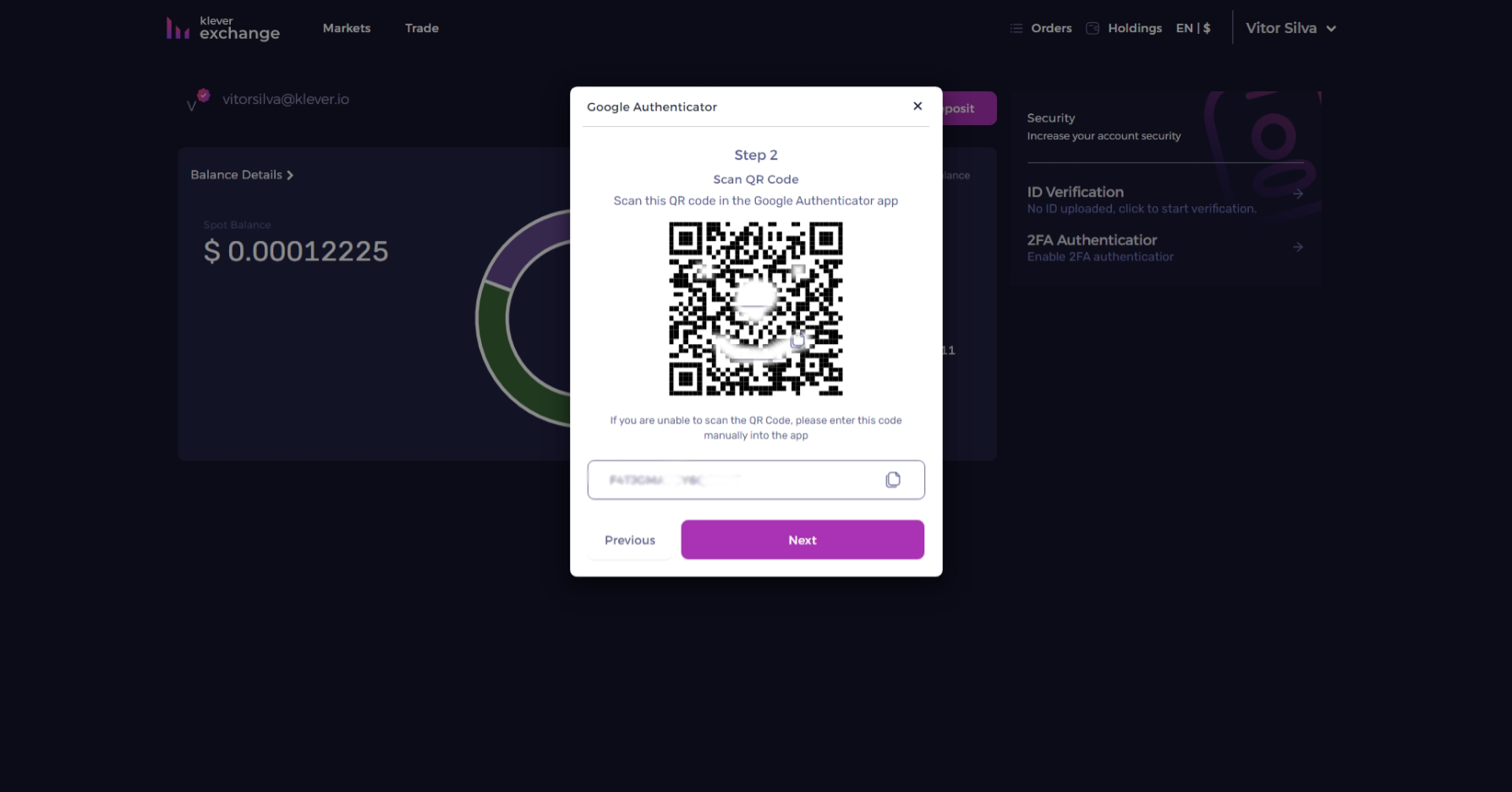

Enable Two-Factor Authentication (2FA): Activate 2FA on your exchange account to add an extra layer of security, reducing the risk of unauthorized access and potential asset loss.

-

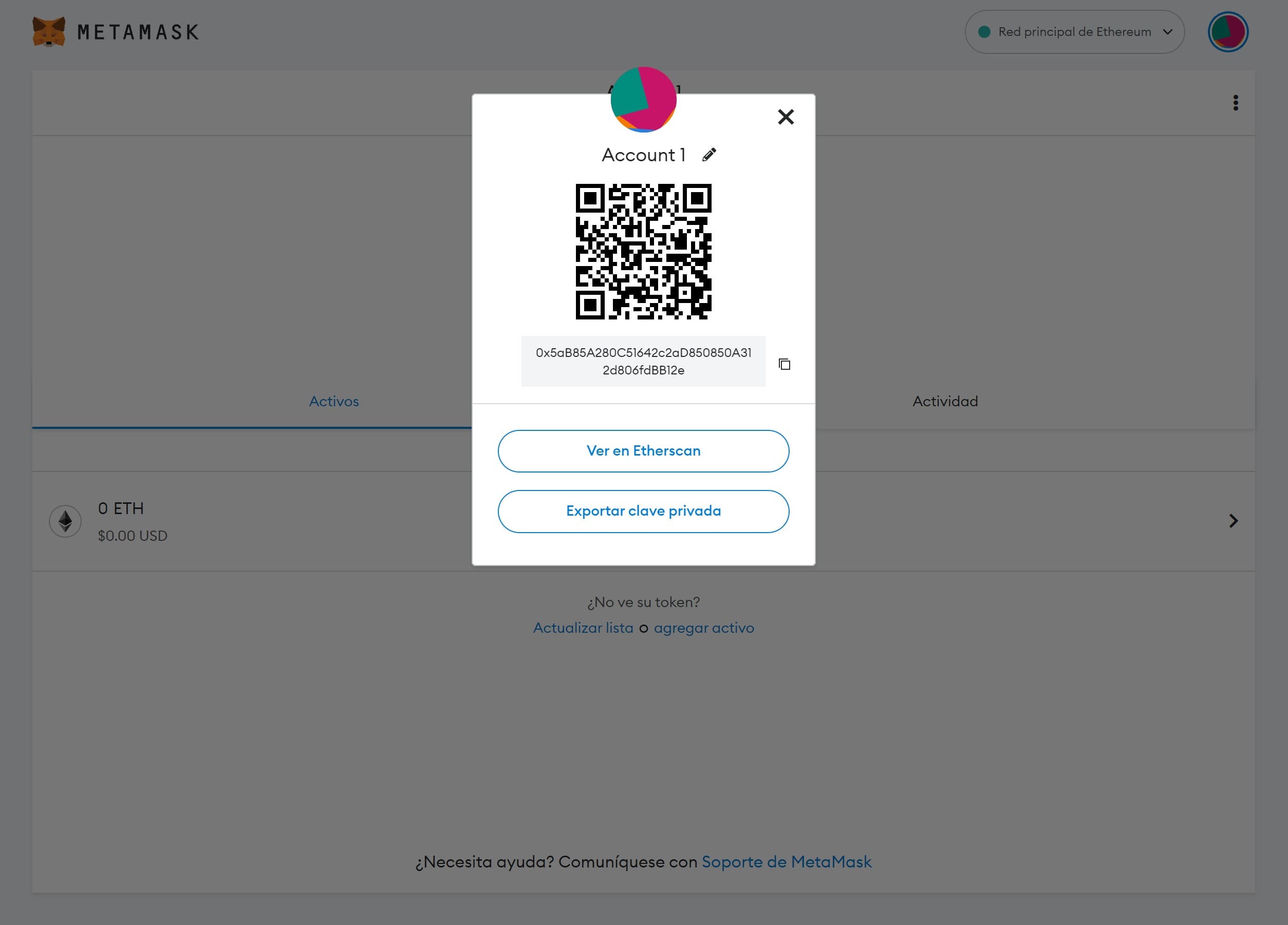

Use a Secure Wallet for Storage: After purchasing, transfer your tokenized Tesla stock to a secure wallet such as MetaMask (for Ethereum-based tokens) or Trust Wallet (for multiple blockchains). Avoid leaving large balances on exchanges.

-

Double-Check Token Contract Addresses: Always verify the official contract address of tokenized Tesla stock on the platform’s website or a trusted blockchain explorer to avoid scams or counterfeit tokens.

-

Keep Recovery Phrases Safe: Securely store your wallet’s recovery phrase offline. Never share it online or with anyone, as it grants full access to your assets.

-

Monitor Market Prices and Fees: Stay updated on the current price of tokenized Tesla stock (TSLAX), which is $429.83 as of October 5, 2025. Compare trading fees across platforms to optimize your investment.

-

Stay Informed About Platform Updates: Follow official channels of your chosen exchange or wallet for updates on supported tokens, security advisories, and regulatory changes that could affect your holdings.

- Double-check platform legitimacy: Only use reputable exchanges with transparent collateralization and regulatory disclosures.

- Understand fees: Review trading, withdrawal, and custody fees before making your first purchase. These can vary widely across platforms.

- Consider liquidity: Larger exchanges tend to have tighter spreads and deeper order books for tokenized TSLA.

- KYC and compliance: Be prepared to complete identity verification for most CEXs. DEXs may offer more flexibility but require careful self-custody practices.

If you’re new to self-custody wallets, start with small amounts until you’re comfortable with the process. Remember: blockchain transactions are irreversible. Always verify wallet addresses when transferring assets.

Tracking Your Tokenized Tesla Investment

The beauty of tokenized stocks is real-time transparency. You can monitor your holdings around the clock using exchange dashboards or third-party portfolio trackers that support synthetic TSLA blockchain tokens. Many platforms now offer advanced analytics, price alerts, and portfolio breakdowns, making it easier than ever to stay informed about your exposure as Tesla’s price moves from its current level of $429.83.

If you’re looking to automate your strategy or set up recurring purchases, some platforms allow scheduled buys or integration with DeFi protocols for earning yield on idle TSLA tokens.

Risks and Final Thoughts

No investment is risk-free, especially in rapidly evolving markets like tokenized stocks. Price volatility remains high, regulatory clarity is still developing in many regions, and counterparty risk exists if custodians fail to properly back tokens with real shares. Stay vigilant by keeping up-to-date with platform announcements and broader regulatory news.

For long-term investors who value flexibility and global access, buying tokenized Tesla stock at today’s price of $429.83 represents a compelling way to gain exposure without traditional brokerage barriers. As always, balance innovation with caution, patience is your most valuable asset in this new era of on-chain investing.