How Tokenized Stocks on Solana Are Changing 24/7 Trading: A Deep Dive Into xSTOCKS and Synthetic Equities

Solana tokenized stocks are not just a technical novelty – they represent a seismic shift in how global investors access, trade, and interact with traditional equities. By leveraging the speed, efficiency, and composability of the Solana blockchain, platforms like xSTOCKS have unlocked 24/7 trading for U. S. equities, fractional ownership, and seamless DeFi integrations. This evolution is redefining what it means to hold and trade stocks in a digital-first world.

How xSTOCKS Bring Real Equities On-Chain

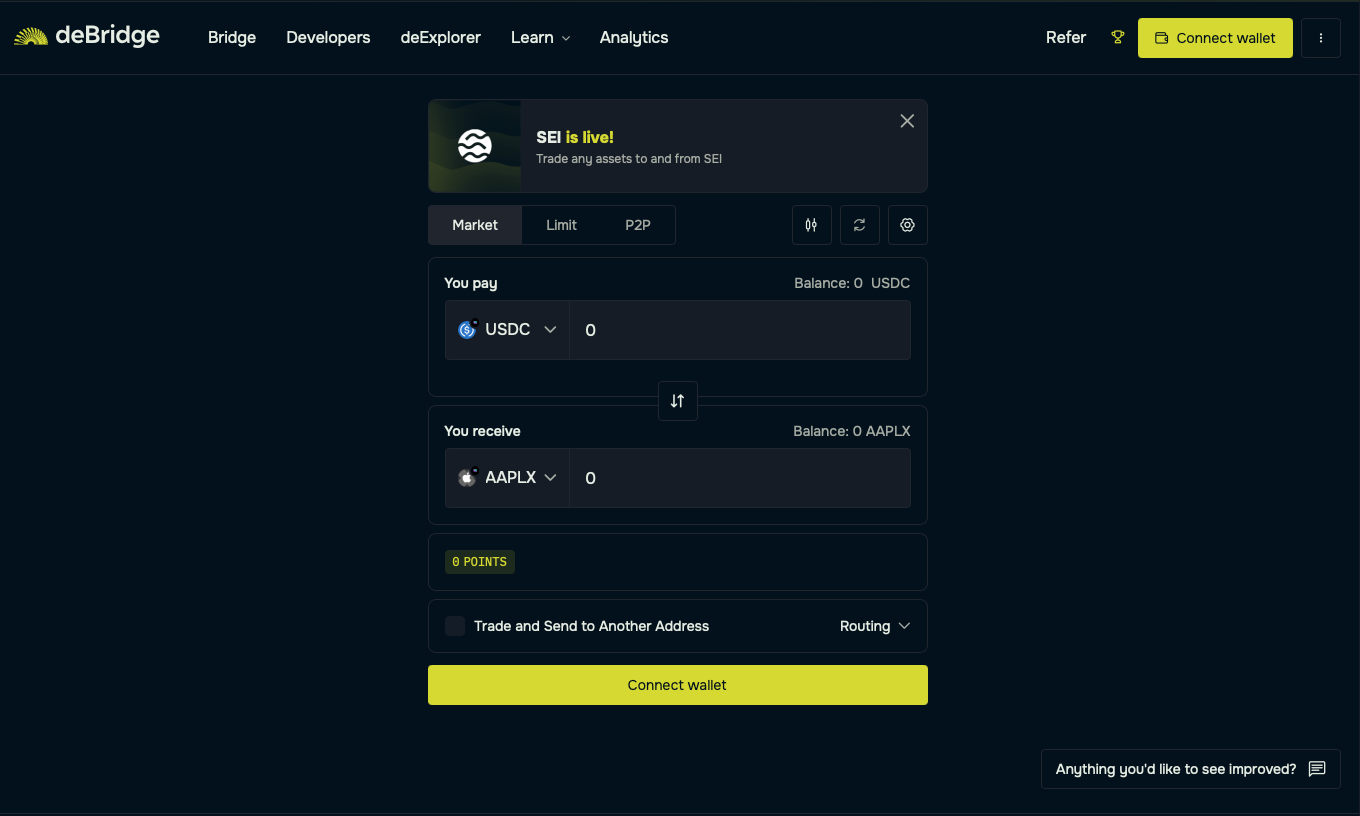

xSTOCKS on Solana are blockchain-based representations of real-world shares such as Apple (AAPL), Tesla (TSLA), and Nvidia (NVDA). Each xSTOCK is backed 1: 1 by an actual share held with a regulated custodian. This structure ensures that the token’s price closely tracks the underlying asset while enabling all the benefits of blockchain settlement. When you buy NVDAx or TSLAx on Solana, you’re purchasing a digital claim on real equity – not just a derivative or synthetic exposure.

Solana’s high throughput and low transaction fees make it an ideal platform for this innovation. Trades settle in seconds at negligible cost compared to legacy brokers or even other blockchains. This technical advantage has helped Solana capture over 95% market share of all tokenized stock trading volume according to recent analysis. The result: instant execution, global accessibility, and no more waiting for Wall Street to open.

The 24/7 Stock Market Is Here

The most disruptive feature of Solana tokenized stocks is round-the-clock trading. Traditional U. S. exchanges operate Monday through Friday from 9: 30 a. m. to 4 p. m. ET – any activity outside these windows is relegated to illiquid after-hours markets or inaccessible altogether for global participants. With xSTOCKS on Solana, buying and selling is possible at any hour, any day of the week.

This always-on market structure fundamentally alters risk management and opportunity capture for both retail and institutional traders. No longer do investors need to wait through weekends or holidays to react to macro news or earnings releases; positions can be adjusted instantly as events unfold worldwide.

Key Advantages of 24/7 Stock Trading via xSTOCKS on Solana

-

Continuous Market Access: xSTOCKS on Solana enable 24/7 trading of tokenized U.S. equities, removing the limitations of traditional market hours and allowing investors to react instantly to global events.

-

Fractional Ownership: Investors can purchase fractions of high-value stocks like Apple or Tesla, lowering entry barriers and enabling more diversified portfolios.

-

Seamless DeFi Integration: xSTOCKS can be used within DeFi platforms for lending, borrowing, and yield farming, unlocking new financial strategies and liquidity options.

-

Instant Settlement: Trades settle almost instantly on the Solana blockchain, reducing the delays associated with traditional equities trading.

-

Global, Borderless Participation: Tokenized stocks on Solana allow non-U.S. users to access U.S. equities without geographic restrictions, expanding access to global investors.

-

Self-Custody and Transparency: Users maintain direct control over their assets in blockchain wallets, with transparent on-chain proof of ownership and backing.

Fractional Ownership and DeFi Integration

Another core benefit is fractional ownership. High-priced shares like NVDA can be split into smaller units through tokenization, letting investors buy exactly as much exposure as they want – whether $10 or $10,000 worth. This democratizes access for users globally who might otherwise be priced out by minimum lot sizes at traditional brokers.

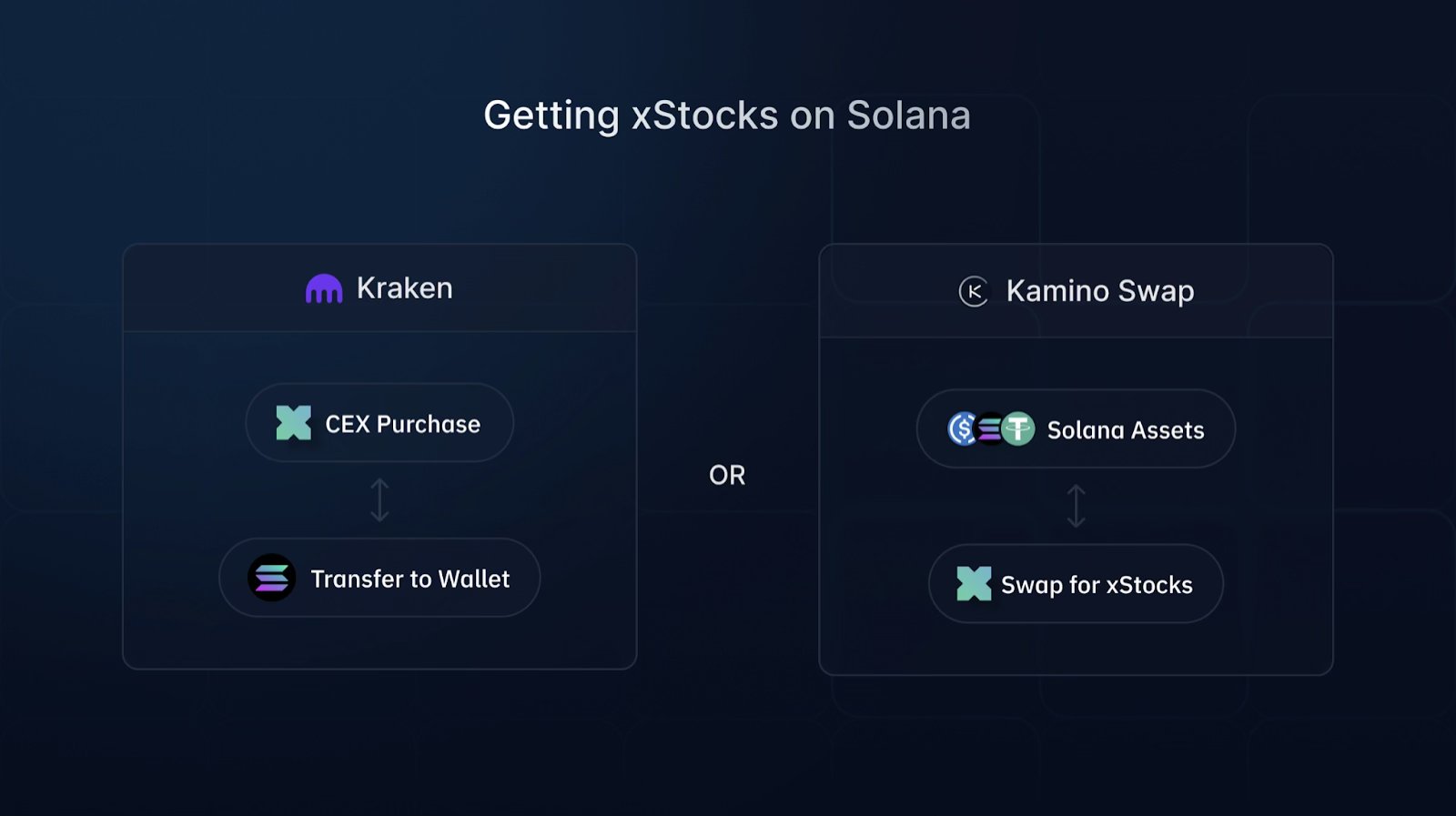

Even more transformative is how on-chain synthetic equities integrate with DeFi protocols across Solana’s ecosystem. Tokenized stocks can be used as collateral for loans on platforms like Kamino or swapped instantly within decentralized exchanges such as Jupiter Aggregator. Some protocols are even exploring yield strategies tied to real-world equity dividends reinvested into more tokens.

This composability opens up entirely new strategies unavailable in legacy finance – from leveraged synthetic stock positions using Uranus Perps to portfolio rebalancing via automated smart contracts.

While the promise of 24/7 stock trading and DeFi composability is compelling, investors must also weigh the unique risks associated with on-chain synthetic equities. Counterparty risk remains a central concern: xSTOCKS depend on issuers like Backed Finance to maintain a 1: 1 backing with real shares held by regulated custodians. The system’s integrity relies on these third parties’ solvency, transparency, and compliance. Any lapse here could break the parity between tokenized and underlying assets.

Regulatory uncertainty is another critical factor. Jurisdictions differ widely in how they treat tokenized stocks, with some regions outright restricting access to synthetic equities for their residents. For instance, U. S. users are currently unable to participate in xSTOCKS markets due to regulatory limitations (source). This patchwork environment means that global accessibility, while improved, is not yet universal.

Additionally, holders of Solana tokenized stocks do not enjoy traditional shareholder rights such as voting or direct dividend participation. Instead, dividends are often reinvested into additional tokens or distributed through alternative mechanisms determined by the issuer (source). For investors seeking active engagement with corporate governance or precise dividend control, this is an important distinction from holding shares through conventional brokerages.

Market Growth and User Adoption

The adoption curve for xSTOCKS Solana has been steep. Within just four weeks of launch, Backed Finance reported over $300 million in trading volume, cementing Solana’s dominance in this emerging sector (source). The S and P 500 ETF (SPYx) alone has attracted more than 10,000 unique holders and led all assets with $7.6 million in trades during its first days on-chain.

This explosive growth highlights both pent-up demand for borderless equity exposure and the technical advantages Solana brings, namely low latency and minimal fees at scale. As more DeFi protocols integrate synthetic stock leverage (such as Uranus Perps) and expand utility beyond simple spot trading, user engagement is expected to deepen further.

Top Tokenized Stocks Traded on Solana Platforms

-

Apple Inc. (AAPLx): As one of the world’s most valuable companies, tokenized Apple shares (AAPLx) are consistently among the most traded assets on Solana-based platforms like xSTOCKS, Solflare, and Kraken. These tokens allow for 24/7 trading and fractional ownership, mirroring the value of real Apple shares.

-

Tesla Inc. (TSLAx): Tokenized Tesla shares (TSLAx) are highly popular due to the company’s volatility and global recognition. Solana users can trade TSLAx around the clock, gaining exposure to one of the most dynamic equities in the market via DeFi applications.

-

NVIDIA Corporation (NVDAx): With the AI boom, tokenized NVIDIA shares (NVDAx) have surged in demand. NVDAx is frequently listed among the top traded synthetic equities on Solana, appealing to investors seeking exposure to the tech sector.

-

Amazon.com Inc. (AMZNx): Tokenized Amazon shares (AMZNx) offer global investors the ability to access and trade one of the largest e-commerce and cloud computing companies 24/7, with seamless integration into DeFi protocols.

-

S&P 500 ETF (SPYx): The tokenized S&P 500 ETF (SPYx) has emerged as a leading index token on Solana, providing diversified exposure to the U.S. market. SPYx recently recorded over $7.6 million in trades and more than 10,000 holders within days of launch.

What’s Next for On-Chain Synthetic Equities?

If current trends hold, we can expect continued innovation around both product offerings and infrastructure supporting Solana tokenized stocks:

- Expanded asset lists: More U. S. and international equities will likely be brought on-chain as regulatory clarity improves.

- Advanced derivatives: Markets for options, perps, and structured products will emerge atop existing xSTOCKS liquidity.

- Deeper DeFi integration: Tokenized stocks will increasingly be used as collateral or yield-bearing assets across lending protocols and automated investment strategies.

- User experience improvements: Wallets like Solflare are making it easier than ever to access these markets directly from your phone or browser (source).

The fusion of blockchain technology with traditional equities via platforms like xSTOCKS marks a pivotal moment for capital markets. The ability to trade real-world assets 24/7, fractionally, globally, and composably, is no longer theoretical but live today on Solana.