How Tokenized Stocks Enable 24/7 Trading and Fractional Ownership on the Blockchain

Tokenized stocks are reshaping the landscape of equity trading by leveraging blockchain technology for unprecedented accessibility and flexibility. Unlike traditional markets bound by limited trading hours, tokenized stocks exist as digital representations of real equities on public or permissioned blockchains. This enables features such as 24/7 trading and fractional ownership, two pillars driving the next evolution in on-chain equities.

How Tokenized Stocks Enable 24/7 Trading

Traditional equity markets like the NYSE or NASDAQ operate within fixed windows, typically 9: 30 a. m. to 4: 00 p. m. EST, Monday through Friday. In contrast, tokenized stocks are powered by blockchain infrastructure, which is decentralized and operates continuously without centralized downtime. This means investors can buy or sell tokenized shares anytime – including weekends and holidays – providing unmatched flexibility for global participants.

For example, platforms such as Robinhood and Kraken have recently launched tokenized stock offerings for EU and non-U. S. users, allowing commission-free trading of over 200 U. S. stocks and ETFs outside regular market hours (source). This always-on access is enabled by smart contracts that automate order execution and settlement, reducing friction and latency compared to legacy systems.

Fractional Ownership: Lowering Barriers to Entry

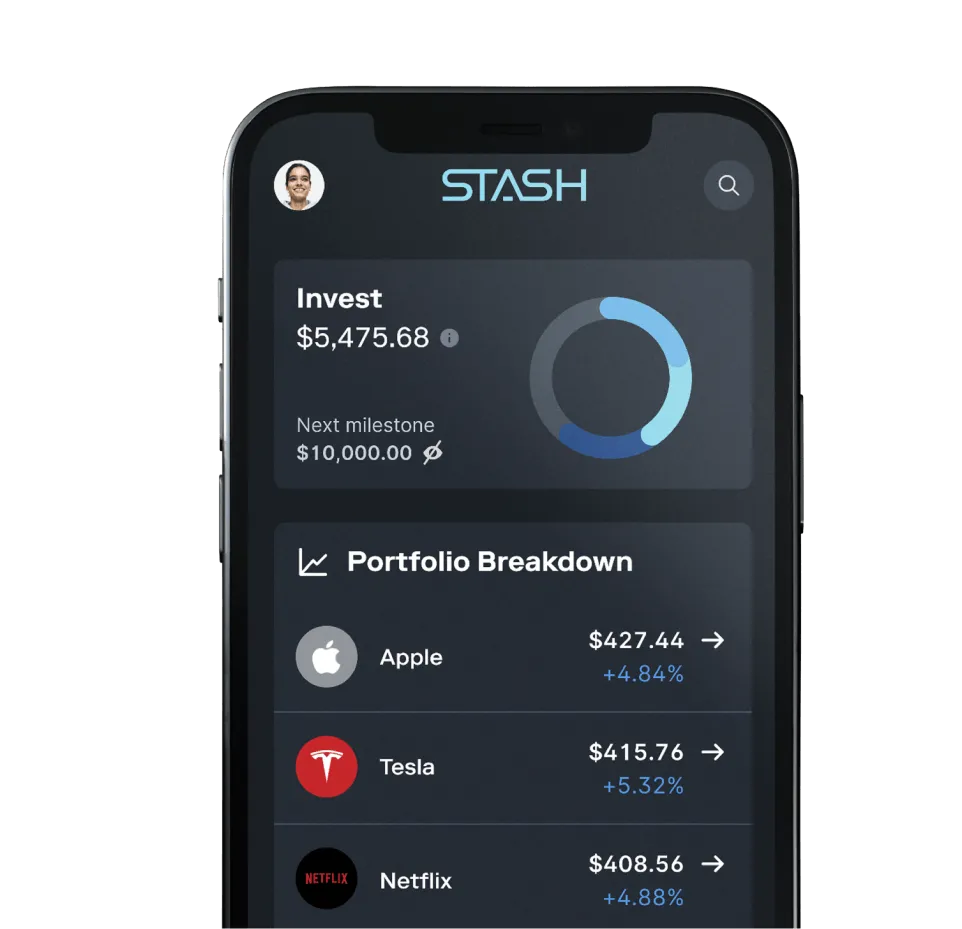

One of the most significant advantages of tokenized equities is the ability to offer fractional ownership. High-value stocks like Nvidia, Apple, or Tesla can be prohibitively expensive for many investors to purchase as whole shares. Tokenization allows these assets to be divided into smaller units, so users can buy fractions of a share based on their investment capacity.

This democratizes access to blue-chip stocks and enhances portfolio diversification, especially for retail investors who were previously priced out of certain markets. Fractionalization also boosts liquidity, as smaller denominations can be more easily traded at any time. According to Gemini, this model reduces settlement times from days to near-instantaneous, further streamlining the user experience.

Top Benefits of Fractional Ownership in Tokenized Stocks

-

Access to High-Value Stocks: Fractional ownership lets investors buy portions of expensive shares like Apple, Nvidia, or Tesla—making blue-chip investments accessible with minimal capital.

-

Enhanced Liquidity: Tokenized stocks can be traded in smaller increments, increasing market liquidity and enabling faster entry and exit for investors.

-

24/7 Trading Flexibility: Unlike traditional markets, platforms such as Robinhood and Kraken offer round-the-clock trading of tokenized equities, including weekends and holidays.

-

Lower Barriers to Diversification: Investors can allocate small amounts across multiple tokenized stocks and ETFs, improving portfolio diversification without large upfront costs.

-

Instant Settlement: Blockchain-based token transfers enable near-instant settlement of trades, reducing counterparty risk and administrative delays.

On-Chain Settlement: Speed and Transparency

Settlement in traditional stock markets can take up to two business days (T and 2) due to clearinghouse processes and intermediaries. In contrast, blockchain-based tokenized stocks use smart contracts to facilitate peer-to-peer trades with immediate settlement. This not only reduces counterparty risk but also improves transparency – all transactions are recorded on-chain and can be audited in real time.

The combination of 24/7 trading, fractional ownership, and instant settlement is transforming how investors access global equity markets. However, regulatory bodies like ESMA have raised concerns about investor protection and the need for clear legal frameworks, especially since some tokenized stocks may not confer actual shareholder rights (source). As the sector matures, balancing innovation with robust oversight will be critical for sustainable growth.

Despite rapid progress, tokenized stocks introduce a new set of challenges that both investors and platforms must navigate. Regulatory clarity remains a central issue, with organizations such as the World Federation of Exchanges urging stricter oversight to address questions around ownership, custody, and investor rights (source). For instance, while tokenized stocks often mirror the price of their underlying assets, they may not provide the same voting rights or dividends as traditional shares. This distinction is crucial for users to understand before engaging in on-chain equity trading.

Security, Custody, and Compliance in On-Chain Equities

With assets digitized on a blockchain, questions about the security of private keys and the custody of tokens become paramount. Unlike traditional brokerages, where securities are held with centralized custodians, tokenized equities may be self-custodied or managed by third-party wallets. This model introduces both increased control for users and new risks related to wallet security, smart contract vulnerabilities, and regulatory compliance. Platforms must implement rigorous KYC/AML protocols and maintain robust cybersecurity practices to protect users from fraud or unauthorized access.

For compliance-focused investors, it is important to note that jurisdictions vary widely in their approach to tokenized equities. In the EU, for example, recent warnings from ESMA highlight the need for clearer disclosures and consumer protections. Meanwhile, the SEC in the U. S. continues to explore frameworks for blockchain-based securities, signaling that regulatory landscapes will remain dynamic for the foreseeable future.

The Future of Tokenized Equities: Growth, Innovation, and Caution

Looking ahead, the market for tokenized stocks is poised for significant expansion as more platforms, such as Robinhood and Kraken, roll out offerings to global users. The ability to trade high-demand stocks like Nvidia, Apple, and Microsoft on a 24/7 basis is already attracting new retail and institutional participants. As the technology matures, expect further integration with DeFi protocols, enhanced interoperability between chains, and greater adoption of synthetic stocks tied to real-world assets.

However, widespread adoption will depend on resolving key compliance hurdles and ensuring that users are fully informed about the rights and risks associated with tokenized assets. Education around differences in shareholder privileges, settlement finality, and regulatory status is essential for building trust in this new asset class.

Top Platforms for 24/7 Tokenized Stock Trading

-

Robinhood (EU): In June 2025, Robinhood launched tokenized equities for EU users, offering commission-free, 24/7 trading of over 200 U.S. stocks and ETFs—including Apple, Nvidia, and Microsoft. Fractional ownership is supported, enhancing accessibility for retail investors.

-

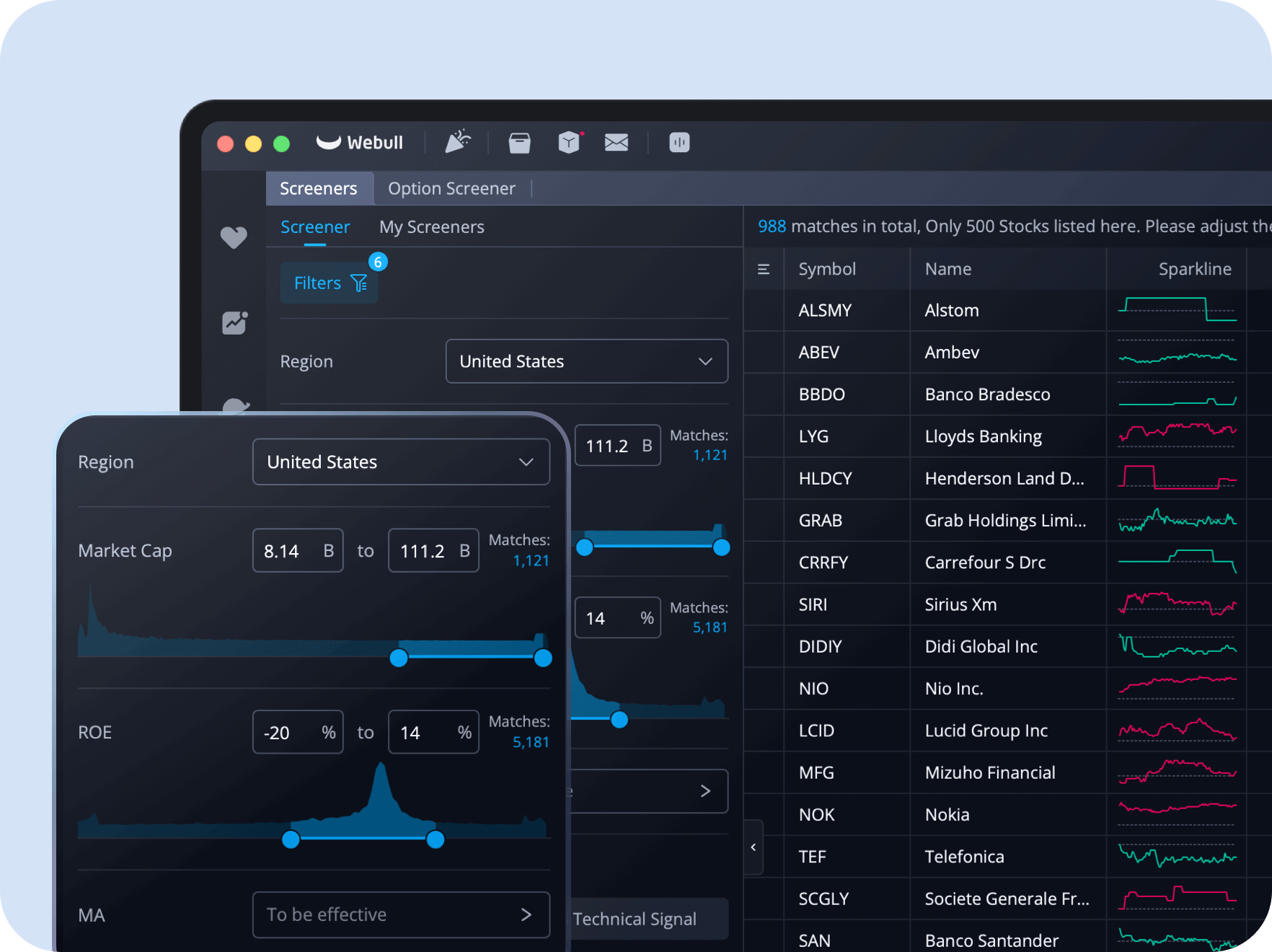

Kraken: Kraken announced plans to provide tokenized versions of over 50 stocks and ETFs (such as Apple, Tesla, and Nvidia) to non-U.S. customers, enabling around-the-clock trading and fractional ownership via blockchain technology.

-

eToro: eToro offers tokenized stocks to global users, allowing fractional investment and 24/7 trading of major U.S. equities and ETFs, with instant settlement and transparent blockchain records.

-

OSL: OSL, a regulated digital asset platform, supports tokenized stock trading with 24/7 access and fractional ownership, focusing on compliance and security for institutional and retail clients.

-

BTSE: BTSE enables tokenized equity trading with continuous market access and fractional shares, leveraging blockchain for instant settlement and global reach.

Ultimately, tokenized stocks exemplify how blockchain can break down traditional barriers in finance – enabling 24/7 trading, fractional ownership, and near-instant settlement. As adoption accelerates, stakeholders must collaborate to create transparent standards that protect investors while fostering continued innovation in on-chain equities.