How to Invest in Tokenized U.S. Tech Stocks on the Blockchain: Platforms, Risks, and Opportunities

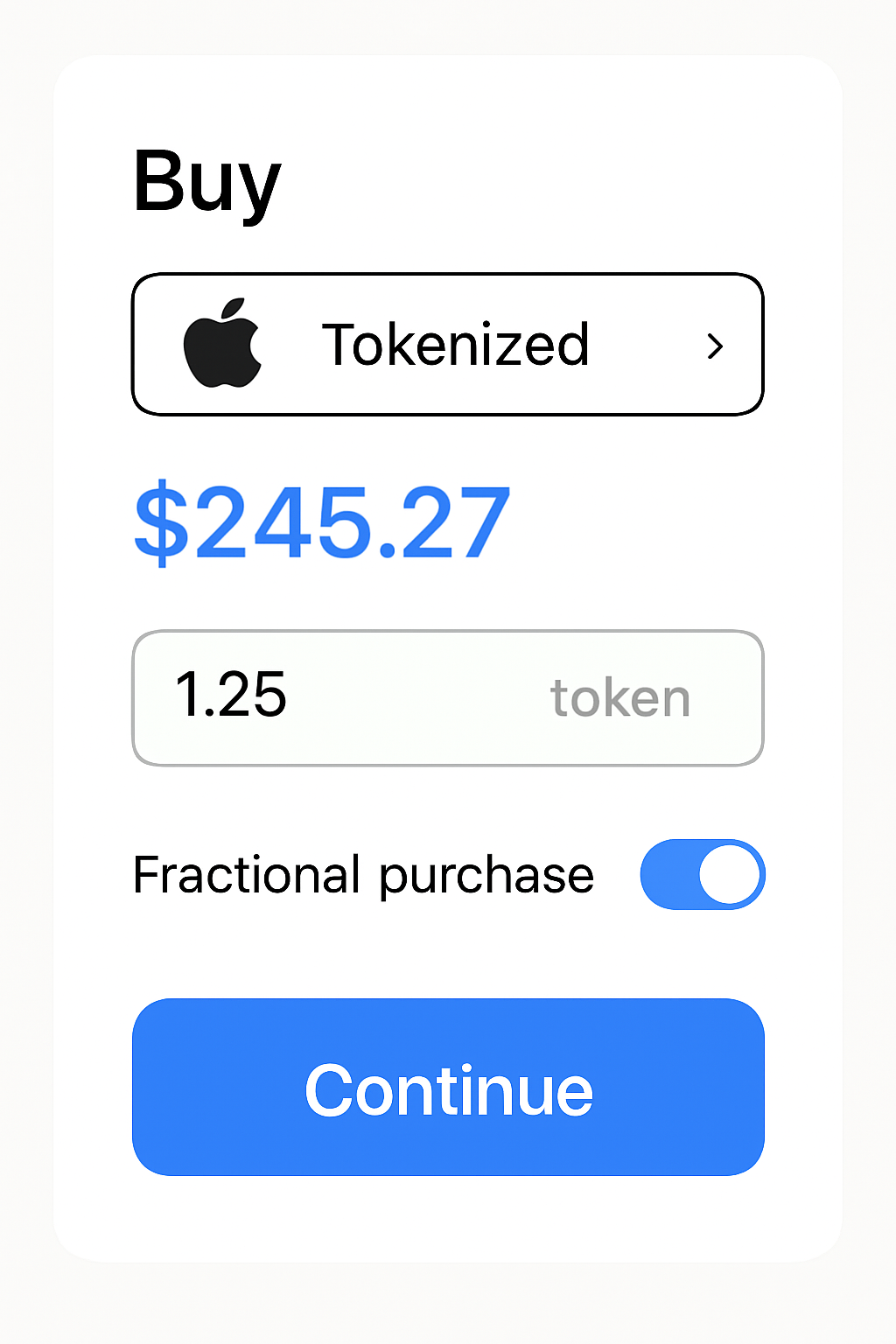

Investors worldwide are increasingly exploring tokenized tech stocks as a way to access U. S. equities around the clock, with the added benefits of blockchain transparency and fractional ownership. As of October 11,2025, major U. S. tech stocks like Apple ($245.27), Microsoft ($510.96), Alphabet ($236.57), Amazon ($216.37), and Tesla ($413.49) are all available in tokenized form on select blockchain platforms, making this an opportune moment to learn how blockchain is reshaping the equity landscape.

What Are Tokenized U. S. Tech Stocks?

Tokenized stocks are digital representations of traditional equity shares issued on a blockchain, allowing investors to buy, sell, and trade shares of leading companies without the limitations of traditional market hours or geographic barriers. These tokens can be backed by real-world assets (like actual shares held in custody) or created synthetically via decentralized finance (DeFi) protocols that mirror price movements.

The appeal is clear: instant settlement, global accessibility, and fractional investing. Whether you want exposure to Apple’s latest innovations or Tesla’s volatility, tokenized stocks offer a flexible and modern solution.

The Leading Platforms for Investing in Tokenized Tech Stocks (2025)

Top Platforms for Tokenized U.S. Tech Stock Investing

-

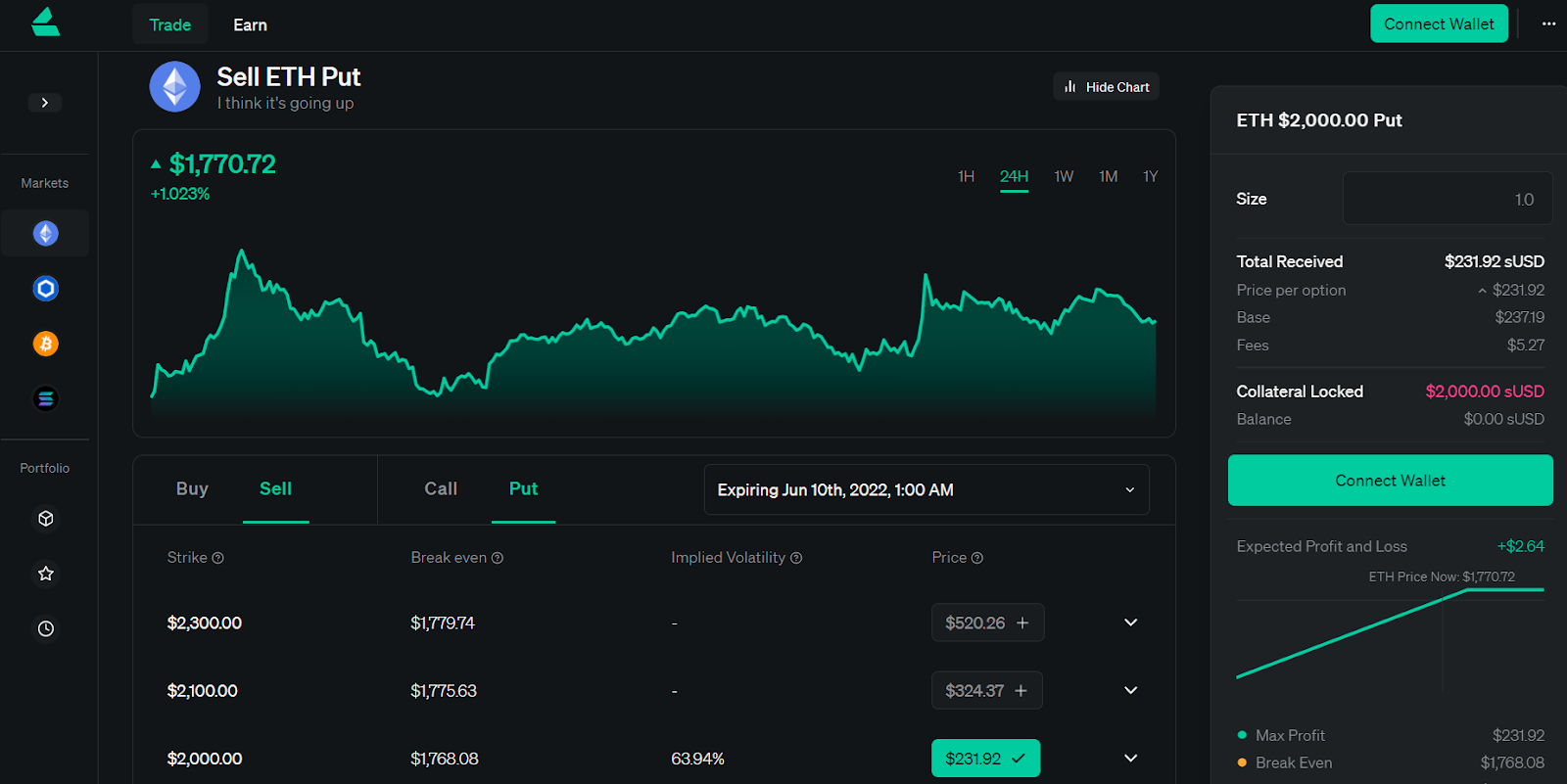

Synthetix (sX stocks): A leading DeFi protocol, Synthetix enables users to invest in synthetic U.S. tech stock tokens such as sAAPL and sTSLA. These tokens closely track the real prices of underlying equities and can be traded 24/7 on decentralized exchanges like Kwenta and Polynomial. Synthetix emphasizes transparency, permissionless access, and global availability, making it a popular choice for DeFi-savvy investors seeking exposure to U.S. tech stocks without intermediaries.

-

Kraken xStocks: As a regulated global crypto exchange, Kraken offers direct access to over 60 tokenized U.S. stocks—including Apple and NVIDIA—through its xStocks product. Kraken provides robust compliance, deep liquidity, and an intuitive user experience, making it suitable for both new and experienced investors. Its platform bridges traditional finance and crypto, allowing seamless trading of tokenized equities in select non-U.S. markets.

-

Backed Finance: Backed Finance specializes in issuing fully collateralized, real-world asset-backed tokens for major U.S. tech equities. The platform focuses on transparency, regulatory adherence, and on-chain proof of reserves, giving investors confidence in the 1:1 backing of each token. Backed Finance enables global, 24/7 access to fractionalized shares of leading tech companies, all verifiable on the blockchain.

If you’re considering investing in blockchain-based equities this year, there are three standout options:

- Synthetix (sX stocks): This DeFi protocol offers synthetic tokens like sAAPL and sTSLA that track the value of their underlying counterparts using decentralized oracles. These synthetic equities can be traded permissionlessly on decentralized exchanges such as Kwenta and Polynomial, no brokerage account required.

- Kraken xStocks: As one of the most established regulated exchanges in crypto, Kraken provides access to over 60 tokenized U. S. stocks including Apple and NVIDIA. Their xStocks product emphasizes regulatory compliance and deep liquidity for seamless trading experiences.

- Backed Finance: Focusing on full collateralization and transparency, Backed Finance issues real-world asset-backed tokens for major tech names. Each token is supported by actual shares held in regulated custody accounts, giving investors confidence that their tokens represent tangible value.

The rise of these platforms means investors can now diversify into high-growth sectors like technology without traditional barriers, whether you’re based in New York, Berlin, or Singapore.

Navigating Risks: What Every Investor Should Know

The innovation behind on-chain equities comes with notable risks you must weigh carefully before investing:

- Regulatory Uncertainty: The SEC has made it clear that tokenized securities must comply with existing rules (source). Platforms like Kraken xStocks lead by prioritizing compliance, but not every provider does.

- Lack of Traditional Rights: Many tokenized stocks do not grant voting rights or dividends; they simply track price movements. Synthetic tokens (like those from Synthetix) especially should be viewed as trading instruments rather than true equity ownership.

- Technical Vulnerabilities: Smart contracts power these assets but may contain bugs or security flaws that could result in loss of funds.

- Peg Risks and Market Volatility: Token prices may diverge from their underlying asset during periods of high volatility, especially outside regular market hours, leading to potential losses if not monitored closely (source).

The Current Market Landscape: Real-Time Prices and Opportunities

Tokenized U.S. Tech Stocks Price Prediction Table (2026-2031)

Forecast for AAPL, MSFT, GOOGL, AMZN, and TSLA based on current market, company fundamentals, and the evolving blockchain-tokenization landscape.

| Year | AAPL Min Price | AAPL Avg Price | AAPL Max Price | MSFT Min Price | MSFT Avg Price | MSFT Max Price | GOOGL Min Price | GOOGL Avg Price | GOOGL Max Price | AMZN Min Price | AMZN Avg Price | AMZN Max Price | TSLA Min Price | TSLA Avg Price | TSLA Max Price |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2026 | $225.00 | $262.00 | $285.00 | $470.00 | $535.00 | $575.00 | $215.00 | $250.00 | $280.00 | $200.00 | $232.00 | $260.00 | $370.00 | $440.00 | $490.00 |

| 2027 | $235.00 | $274.00 | $305.00 | $485.00 | $555.00 | $600.00 | $228.00 | $265.00 | $300.00 | $210.00 | $245.00 | $275.00 | $380.00 | $460.00 | $520.00 |

| 2028 | $245.00 | $288.00 | $330.00 | $505.00 | $580.00 | $630.00 | $240.00 | $280.00 | $325.00 | $225.00 | $260.00 | $295.00 | $400.00 | $485.00 | $555.00 |

| 2029 | $260.00 | $305.00 | $355.00 | $520.00 | $605.00 | $665.00 | $255.00 | $295.00 | $350.00 | $240.00 | $275.00 | $315.00 | $415.00 | $510.00 | $590.00 |

| 2030 | $275.00 | $325.00 | $380.00 | $540.00 | $635.00 | $700.00 | $270.00 | $315.00 | $375.00 | $255.00 | $295.00 | $340.00 | $435.00 | $540.00 | $630.00 |

| 2031 | $290.00 | $345.00 | $410.00 | $555.00 | $660.00 | $735.00 | $285.00 | $335.00 | $400.00 | $270.00 | $315.00 | $365.00 | $455.00 | $570.00 | $670.00 |

Price Prediction Summary

Over the next six years, tokenized U.S. tech stocks such as Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), and Tesla (TSLA) are expected to appreciate steadily, though with varying volatility and risk profiles. The integration of blockchain tokenization is anticipated to enhance liquidity and accessibility, supporting higher valuations, particularly for market leaders. However, regulatory uncertainties and broader market trends may introduce significant swings, especially in bearish scenarios. Microsoft and Tesla exhibit the widest potential ranges due to their respective growth opportunities and risk exposures. Investors should expect progressive but non-linear growth, with periodic corrections possible in response to macroeconomic or regulatory events.

Key Factors Affecting Apple Inc. Stock Price

- Regulatory clarity and adoption of tokenized equity platforms

- Company-specific fundamentals (earnings growth, innovation, competitive positioning)

- Overall tech sector growth and global economic trends

- Blockchain adoption and integration in capital markets

- Market volatility from macroeconomic shifts or policy changes

- Potential for increased institutional participation in tokenized assets

- Risks from technical vulnerabilities or market fragmentation

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

If you’re interested in learning more about how these platforms work under the hood or want a step-by-step guide to getting started with your first trade, continue reading below as we explore practical onboarding tips and future trends shaping this space.

How to Start: Onboarding to Tokenized Tech Stock Platforms

Getting started with investing in tokenized stocks is more accessible than ever, but the process and requirements differ depending on the platform. Here’s what you can expect when onboarding to each of the industry leaders:

Synthetix (sX stocks) appeals to DeFi enthusiasts comfortable with self-custody wallets and decentralized exchanges. To begin, you’ll need a compatible crypto wallet (such as MetaMask), some ETH for gas fees, and access to a DEX like Kwenta. After connecting your wallet, you can trade synthetic tokens like sAAPL or sTSLA directly against stablecoins or other assets. No centralized intermediaries are involved, but be aware that synthetic tokens reflect price exposure only, they do not represent actual share ownership.

Kraken xStocks offers a more traditional experience with a robust compliance framework. You’ll create an account, complete KYC/AML verification, fund your account with fiat or crypto, and then access over 60 tokenized U. S. equities, Apple ($245.27), NVIDIA, and more, through their secure trading interface. Kraken’s regulated environment provides additional peace of mind for those prioritizing investor protections.

Backed Finance bridges the gap between DeFi transparency and real-world asset backing. After onboarding with identity verification and funding your account (typically via USDC or fiat), you can purchase fully collateralized tokens representing shares like Apple or Tesla ($413.49). These tokens are transparently backed by actual securities held in regulated custody accounts, which can be especially reassuring during periods of market stress.

Best Practices for Blockchain Stock Investing

- Diversify across platforms: Consider holding both synthetic (Synthetix) and asset-backed (Backed Finance) tokens to spread risk.

- Monitor regulatory updates: Stay informed about evolving laws that may impact access or trading conditions on platforms like Kraken xStocks (source).

- Practice diligent security: Use hardware wallets for DeFi platforms and enable two-factor authentication on centralized exchanges.

- Understand liquidity risks: Tokenized markets can be less liquid than their traditional counterparts, especially outside U. S. hours.

![]()

Looking Forward: The Future of On-Chain Equities

The landscape for tokenized tech stocks continues to evolve rapidly as both institutional players and retail investors seek new ways to access global markets. With increasing integration between traditional finance and blockchain rails, platforms like Synthetix are experimenting with new forms of synthetic exposure while Backed Finance is setting benchmarks for transparency in real-world asset tokenization.

The next wave of growth will likely come from enhanced cross-platform interoperability and improved investor protections as regulators clarify expectations for blockchain-based securities. As these changes unfold, investors should balance curiosity with caution, leveraging the advantages of 24/7 trading, fractional ownership, and borderless access while remaining vigilant about platform-specific risks.

The ability to buy fractions of Apple at $245.27 or Tesla at $413.49 from anywhere in the world is no longer just theoretical; it’s here today thanks to these pioneering platforms. Whether you’re seeking exposure through decentralized protocols or prefer regulated venues backed by real assets, staying informed is your strongest ally as this market matures.