How Exodus Tokenized SEC-Registered Shares on Algorand: A New Era for On-Chain Equities

In 2021, Exodus Movement, Inc. made headlines as the first U. S. public company to tokenize its SEC-registered Class A common stock on the Algorand blockchain. This move was more than a technological milestone – it marked a paradigm shift in how investors can access and manage real on-chain stocks, blending the regulatory rigor of traditional equities with the flexibility and transparency of blockchain.

The digital transformation of equity markets has long been discussed, but Exodus’s implementation set a new benchmark for compliance and innovation. By issuing tokenized shares that represent actual legal ownership, Exodus enabled investors to hold EXOD stock directly in their self-custodial wallets. This approach not only enhances accessibility but also lays the groundwork for secondary liquidity in tokenized equities, all while maintaining full SEC compliance.

Why Algorand? Technical and Regulatory Foundations

Exodus’s decision to utilize Algorand was driven by both technical and regulatory considerations. Algorand’s high throughput – boasting over 6,000 transactions per second – ensures seamless settlement for digital securities without compromising speed or security. More critically, Algorand’s infrastructure supports features essential for regulatory compliance, such as programmable controls over transfer restrictions and whitelisting mechanisms.

The result is an environment where SEC-registered on-chain equities can be issued and managed transparently. Each EXOD token on Algorand functions as a digital twin of a registered share, viewable within the Exodus wallet alongside other digital assets. This interoperability is vital for mainstream adoption of blockchain equities.

The Role of Superstate: Expanding On-Chain Accessibility

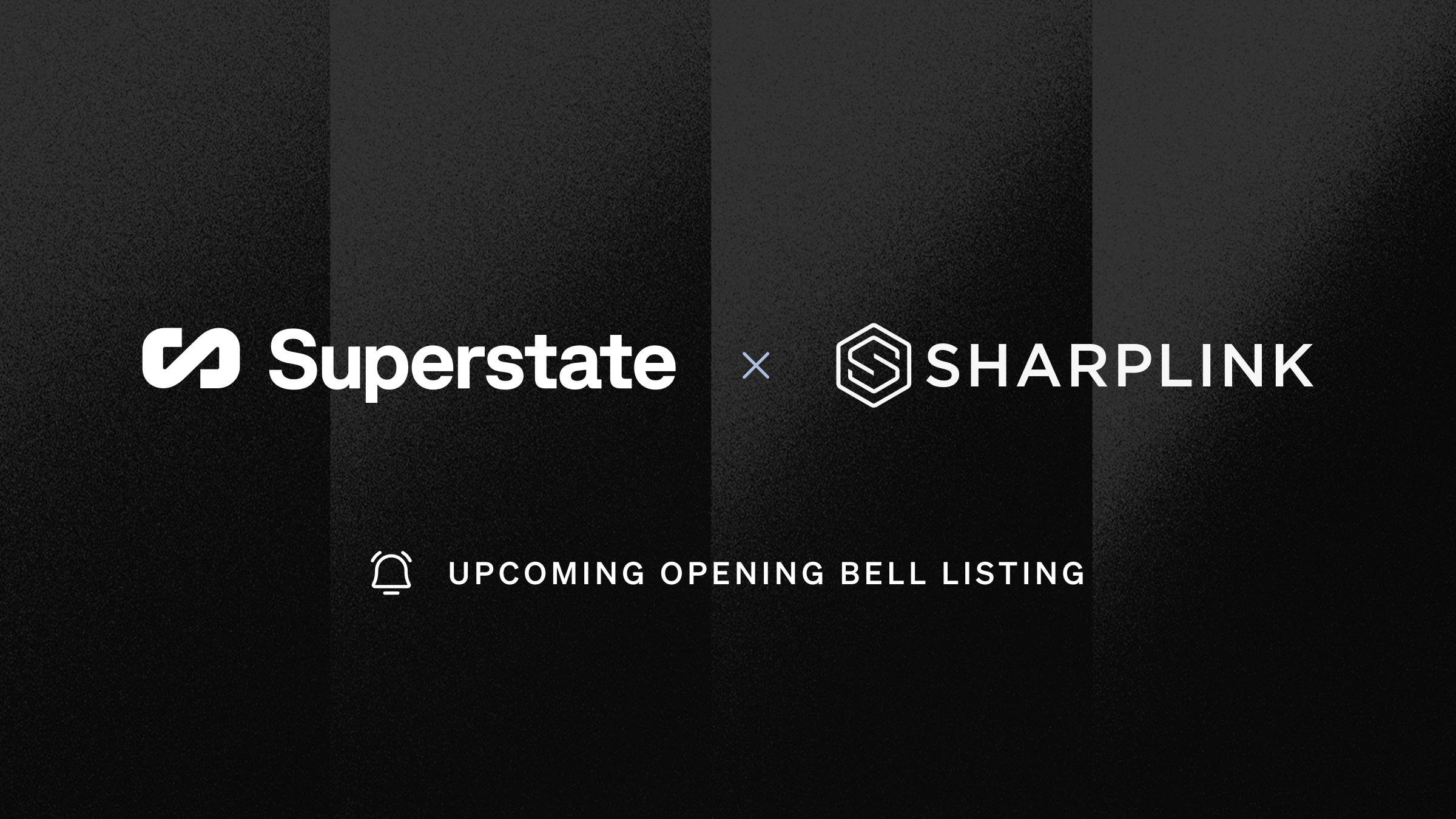

By August 2025, Exodus signaled its intent to further democratize access to its stock tokens by partnering with Superstate – a regulated on-chain equity platform. Superstate’s Opening Bell platform acts as an SEC-registered transfer agent, ensuring that every transaction involving EXOD tokens is recorded on-chain with full legal clarity.

This partnership enables Exodus to expand beyond Algorand, bringing its tokenized shares to Solana and Ethereum blockchains as well. The multi-chain approach aligns with broader trends in decentralized finance (DeFi), where interoperability is crucial for unlocking liquidity across protocols and investor bases.

Key Benefits of Holding SEC-Registered Tokenized Equities Like EXOD

-

Regulatory Compliance and Investor Protection: EXOD tokens represent SEC-registered shares issued via Superstate, an SEC-registered transfer agent. This ensures legal ownership is recognized and investor rights are protected under U.S. securities law.

-

Direct Ownership and On-Chain Transparency: Investors hold digital representations of Exodus shares directly in their wallets, with ownership recorded on-chain. This provides real-time, immutable records and increased transparency compared to traditional share registries.

-

Enhanced Accessibility and Liquidity: Tokenized EXOD shares are available on multiple blockchains (Algorand, Solana, Ethereum), making them more accessible to global investors and potentially increasing liquidity through 24/7 trading and interoperability with DeFi protocols.

-

Seamless Integration with DeFi Ecosystems: By expanding to major blockchains, EXOD tokens can interact with decentralized finance (DeFi) protocols, opening up new opportunities for lending, borrowing, and other financial services.

-

Faster Settlement and Reduced Costs: Blockchain-based share transfers can settle instantly or within minutes, minimizing counterparty risk and reducing administrative costs compared to traditional stock settlement processes.

Compliance at the Core: How Regulation Shapes Tokenized Equities

Unlike synthetic stocks or unregulated equity tokens circulating in DeFi markets, Exodus’s model prioritizes regulatory compliance from issuance through settlement. With Superstate serving as transfer agent, every movement of EXOD tokens reflects an actual change in share ownership under U. S. securities law.

This framework provides critical safeguards for investors seeking exposure to Algorand tokenized stocks. It also positions Exodus at the forefront of bridging traditional capital markets with next-generation financial infrastructure.

As the regulatory environment for digital assets matures, market participants are increasingly scrutinizing the distinction between compliant, SEC-registered on-chain equities and the more speculative, non-compliant offerings prevalent in some corners of DeFi. Exodus’s approach stands out not only for its technological sophistication but for the legal certainty it provides investors. With every EXOD token mapped to a legally registered share and all ownership changes immutably recorded on-chain, the risks associated with ambiguous asset status are dramatically reduced.

The impact of this compliance-centric model is already evident: institutional interest in tokenized equities is rising, and platforms like Superstate’s Opening Bell are setting new standards for transparency and investor protection. As more issuers follow Exodus’s lead, the market for real on-chain stocks is poised for robust growth, especially as interoperability across blockchains becomes the norm rather than the exception.

A Glimpse into the Future: Multi-Chain Tokenized Equities

The recent expansion of EXOD tokens to Solana and Ethereum is more than a technical upgrade, it is a signal that the future of equity markets will be multi-chain by default. This evolution allows investors to choose their preferred blockchain ecosystem, tap into diverse DeFi protocols, and enjoy lower transaction costs or greater network effects depending on their needs.

For forward-thinking investors, this means enhanced liquidity opportunities and access to a new class of regulated digital assets that can be integrated into both traditional and crypto-native portfolios. The ability to custody EXOD tokens alongside digital currencies in a self-custodial wallet underscores the convergence of legacy finance and blockchain innovation.

How Multi-Chain Expansion Benefits EXOD Token Holders

-

Increased Liquidity Across Major Blockchains: By expanding EXOD tokens to Ethereum and Solana, in addition to Algorand, holders benefit from access to deeper pools of liquidity and more active trading venues, making it easier to buy, sell, or transfer EXOD shares.

-

Broader Access to DeFi Protocols: Multi-chain support enables EXOD token holders to interact with a wider range of decentralized finance (DeFi) platforms, unlocking new opportunities for lending, borrowing, and yield generation using their tokenized shares.

-

Enhanced Interoperability and Flexibility: Holding EXOD tokens on several blockchains allows investors to choose their preferred network based on speed, fees, and ecosystem compatibility, improving user experience and flexibility.

-

Reduced Counterparty and Custodial Risks: With Superstate’s SEC-registered Opening Bell platform ensuring on-chain legal ownership and compliance, token holders gain increased transparency and security compared to traditional custodial models.

-

Future-Proofing Through Ecosystem Growth: As the Ethereum, Solana, and Algorand ecosystems evolve, EXOD token holders stand to benefit from ongoing innovations, integrations, and network effects across multiple leading blockchain platforms.

The expansion also paves the way for secondary trading venues and the emergence of decentralized exchanges tailored to compliant equity tokens. As regulatory clarity increases, expect to see more public companies exploring tokenization, not just as a novelty but as a strategic imperative to attract global capital and foster deeper shareholder engagement.

Investor Takeaways: What Makes Exodus Different?

For those evaluating the landscape of tokenized equities regulation, Exodus offers a compelling case study in how to balance innovation with regulatory rigor. Key differentiators include:

- SEC-compliant issuance: Every EXOD token represents a legally registered share, tracked by a regulated transfer agent.

- On-chain transparency: Investors can verify ownership and transaction history directly via Algorand, Solana, or Ethereum explorers.

- Self-custody: Holders maintain direct control over their assets within the Exodus wallet environment.

- Interoperability: Integration with multiple blockchains broadens access and liquidity potential.

In a market where regulatory headlines often dominate, Exodus demonstrates that blockchain equities compliance can be a catalyst for growth, not a barrier. As tokenized shares gain traction, expect continued momentum from both issuers and investors seeking transparency, efficiency, and legal clarity in their digital asset portfolios.