How Real-World Assets Are Being Tokenized On-Chain: Examples Beyond Stocks

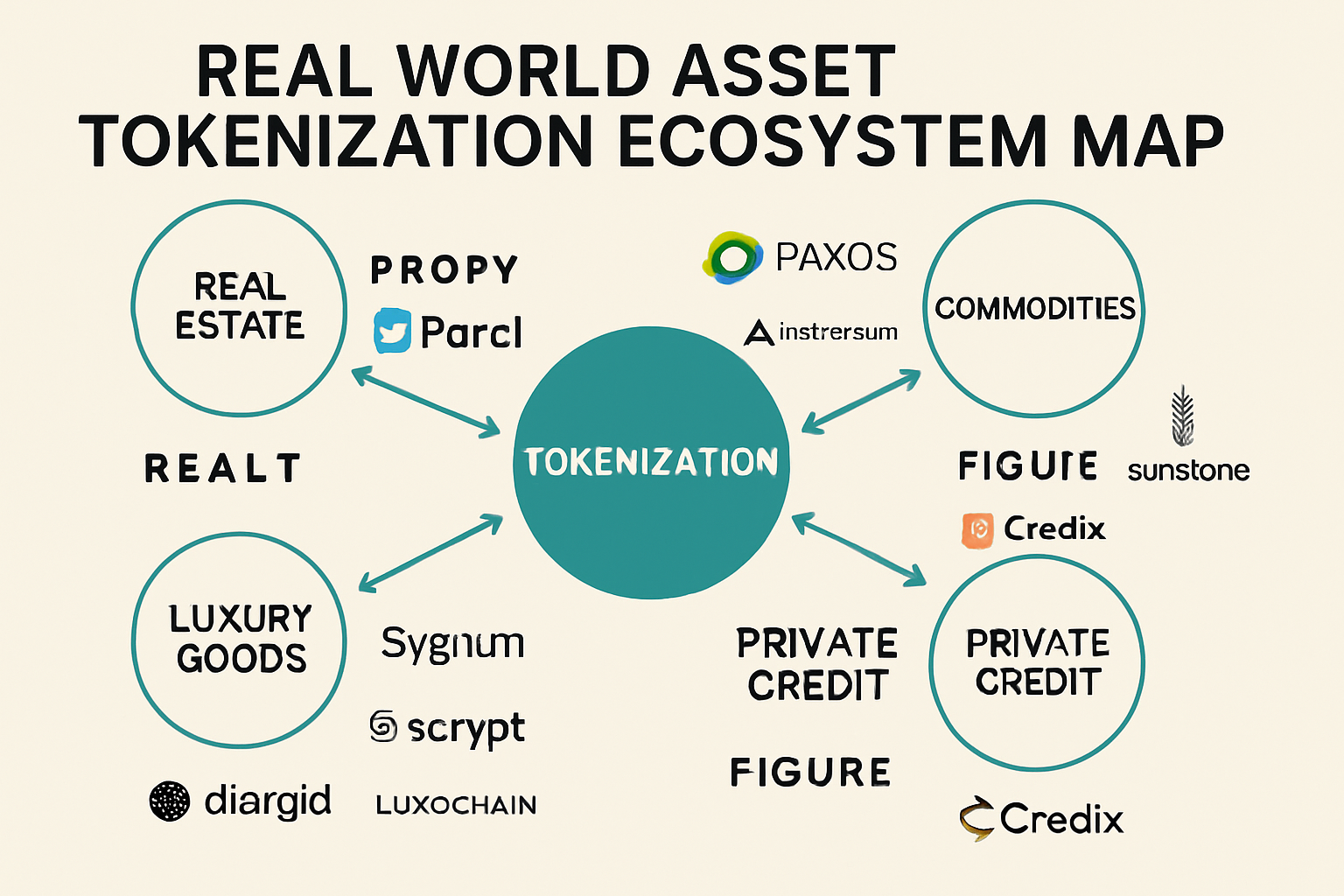

The tokenization of real-world assets (RWAs) is rapidly moving beyond the realm of traditional stocks, reshaping how investors interact with everything from real estate to luxury goods. As blockchain infrastructure matures and regulatory clarity improves, the on-chain asset tokenization market has ballooned to over $13.5 billion as of December 2024, according to Coinbase’s latest outlook. This surge is not just hype: it represents a fundamental shift in how value is stored, transferred, and accessed globally.

Tokenized Real Estate: Unlocking Global Property Markets

Real estate tokenization is leading the charge among tokenized real-world assets, with both commercial and residential properties now accessible on-chain. By converting property ownership into blockchain-based tokens, platforms enable fractional investment in assets that were once illiquid and reserved for institutional or ultra-high-net-worth investors. For example, a luxury hotel like the St. Regis Aspen Resort was tokenized through Aspen Coin, allowing investors to purchase fractional shares and participate in rental income streams. The process not only democratizes access but also enhances liquidity by making secondary market trading possible 24/7.

Tokenized real estate on the blockchain is also paving the way for new models of property management and governance, as smart contracts automate dividend payouts and voting rights. This sector is expected to see continued growth as more developers and asset managers recognize the efficiency gains and expanded investor base made possible by tokenization.

On-Chain Private Credit: The Rise of Tokenized Debt Instruments

Private credit, historically a domain of opaque bilateral deals, is being reimagined through on-chain private credit protocols. This involves tokenizing loans, promissory notes, and other debt instruments, allowing investors to gain exposure to yield-generating assets that were previously inaccessible or illiquid. On-chain platforms facilitate peer-to-peer lending, syndicated loans, and even structured credit products with full transparency and real-time settlement.

The benefits are twofold: borrowers gain access to a global pool of capital without traditional banking friction, while investors can diversify into private credit markets with lower minimums and enhanced liquidity. Smart contracts enforce repayment terms and automate coupon distributions, reducing counterparty risk. As DeFi matures, expect on-chain private credit to become a core part of blockchain yield strategies for both retail and institutional players.

Top 4 Tokenized Real-World Asset Types Beyond Stocks

-

Tokenized Real Estate: Blockchain enables fractional ownership of commercial and residential properties, making real estate investment more accessible. Notable projects include the St. Regis Aspen Resort, which issued Aspen Coins representing stakes in a luxury hotel.

-

Tokenized Private Credit: On-chain loans and debt instruments are transforming private credit markets. Platforms like Goldfinch and Maple Finance facilitate decentralized lending, allowing investors to access yields from real-world borrowers.

-

Tokenized Commodities: Physical assets such as gold, silver, and agricultural products are being digitized for easy trading. PAX Gold (PAXG) is a leading example, with each token backed by one fine troy ounce of gold stored in LBMA-accredited vaults.

Tokenized Commodities: Gold, Silver, and Agricultural Products on Blockchain

Commodities like gold, silver, and even agricultural products are now being tokenized for seamless trading on DeFi platforms. Projects such as PAX Gold (PAXG) have set the standard by issuing tokens backed 1: 1 by physical gold stored in LBMA-accredited vaults. Each PAXG token represents ownership of one fine troy ounce of gold, giving holders direct exposure to the underlying asset without the logistical headaches of physical delivery or custody.

This innovation is particularly attractive for investors seeking inflation hedges or portfolio diversification. Tokenized commodities can be traded 24/7 on global exchanges, integrated into DeFi protocols for collateralization or yield farming, and easily fractionalized for smaller investors. The same model is being extended to silver bullion and even agricultural goods like coffee or wheat, further broadening the scope of blockchain-based commodity markets.

Beyond precious metals, tokenized commodities are also transforming supply chains and settlement processes. By putting assets like wheat, coffee, or industrial metals on-chain, producers and buyers can settle trades instantly, verify provenance, and reduce reliance on intermediaries. This not only streamlines logistics but also opens new markets to participants who previously faced high entry barriers. As DeFi protocols integrate more real-world commodities, the sector is poised for deeper liquidity and increased cross-border participation.

Tokenized Luxury Goods: Fractional Ownership of High-Value Collectibles

Luxury goods, think rare watches, designer handbags, and collectible art, are joining the on-chain revolution through tokenization. Platforms now offer fractionalized ownership of high-value items, allowing a global audience to invest in assets that were once the preserve of elite collectors. For example, a $100,000 vintage watch can be divided into thousands of tokens, each representing a share of ownership. This not only enhances liquidity for sellers but also gives investors the ability to trade or leverage their positions in secondary markets.

Authentication is a critical component in this sector. Blockchain-based provenance records ensure that each token is backed by a genuine, securely stored asset, reducing fraud and boosting investor confidence. Tokenized luxury goods also introduce new possibilities for collateralization and DeFi integrations, as these tokens can be used to unlock on-chain loans or participate in yield-generating strategies. The result is a more efficient, transparent, and inclusive market for tangible collectibles.

Which type of tokenized real-world asset would you consider adding to your portfolio?

Tokenization is making it possible to invest in a wide range of real-world assets beyond traditional stocks. From real estate to luxury goods, blockchain technology is unlocking new opportunities for investors. Which of these emerging asset classes interests you most?

A New Era for Tokenized Real-World Assets

The momentum behind tokenized real-world assets is undeniable. As blockchain infrastructure matures, these innovations are not just speculative experiments, they are reshaping the foundations of global finance. Tokenized real estate, private credit, commodities, and luxury goods all demonstrate the power of on-chain asset tokenization to unlock liquidity, broaden access, and introduce radical transparency across markets.

For investors, this shift means new avenues for portfolio diversification, yield generation, and exposure to asset classes that were once out of reach. For asset owners and issuers, tokenization offers streamlined capital raising and a direct connection to a global investor base. While regulatory frameworks continue to evolve, the trajectory is clear: tokenized real-world assets are set to play a central role in the next wave of decentralized finance.

To explore how tokenized equities are traded on-chain, and how these innovations intersect with the broader RWA ecosystem, see our deep dive on how tokenized U. S. equities are traded on-chain.