How to Track Real-Time Data for Tokenized Equities on the Blockchain

Tracking real-time data for tokenized equities on the blockchain is no longer a futuristic dream – it’s a necessity for anyone serious about on-chain investing. The market for tokenized stocks and synthetic equities is exploding, and the difference between making a sharp move or missing out often comes down to how quickly you can access actionable data. With the rise of decentralized oracle networks like Chainlink (now streaming live equity prices across 37 blockchains), we’re witnessing an entirely new level of transparency and speed in market data delivery.

Why Real-Time Data Matters for Tokenized Equities

Tokenized equities are digital representations of real-world stocks, living on public blockchains. This means every trade, price update, and volume spike is recorded transparently and (crucially) can be accessed in real time by anyone with the right tools. Whether you’re arbitraging synthetic Apple shares (AAPL), monitoring SPY ETF flows, or hunting volatility in Solana’s DeFi markets, real-time blockchain stocks data is your edge.

The era of waiting for delayed quotes or trusting centralized feeds is over. Now, with decentralized oracles like Chainlink feeding fresh equity prices directly to smart contracts, you get immediate access to up-to-the-second information – including timestamped price points so you know exactly how fresh your data is.

The Top 5 Tools and Platforms to Track Tokenized Equities in Real Time

Let’s get tactical. Here are the five essential tools every trader and investor should know about when it comes to tokenized stocks monitoring tools:

Top Tools for Tracking Tokenized Equities On-Chain

-

Moralis Tokenized Stock APIs: Instantly access real-time blockchain data, historical price feeds, and event monitoring for tokenized stocks. Moralis powers fintech and custody platforms with robust APIs for tracking tokenized equities across multiple chains.

-

RWA.xyz Analytics Platform: Dive deep into tokenized real-world assets with RWA.xyz. This analytics hub visualizes on-chain data, tracks issuers and investors, and offers actionable insights for tokenized equities and other RWAs.

-

Securitize Markets Dashboard: Monitor live tokenized equity offerings, secondary market trades, and compliance status. Securitize’s dashboard is a trusted platform for both institutional and retail investors seeking regulated tokenized securities.

-

xStocks (Solana-based Synthetic Stocks): Trade and track synthetic versions of popular equities directly on Solana. xStocks delivers on-chain price feeds, live charts, and DeFi integration for seamless synthetic stock trading.

-

Polymath Tokenization Explorer: Explore tokenized assets and compliance workflows on the Polymath blockchain. The explorer provides transparency into tokenized equities, issuance data, and on-chain activity.

Moralis Tokenized Stock APIs: The Developer’s Secret Weapon

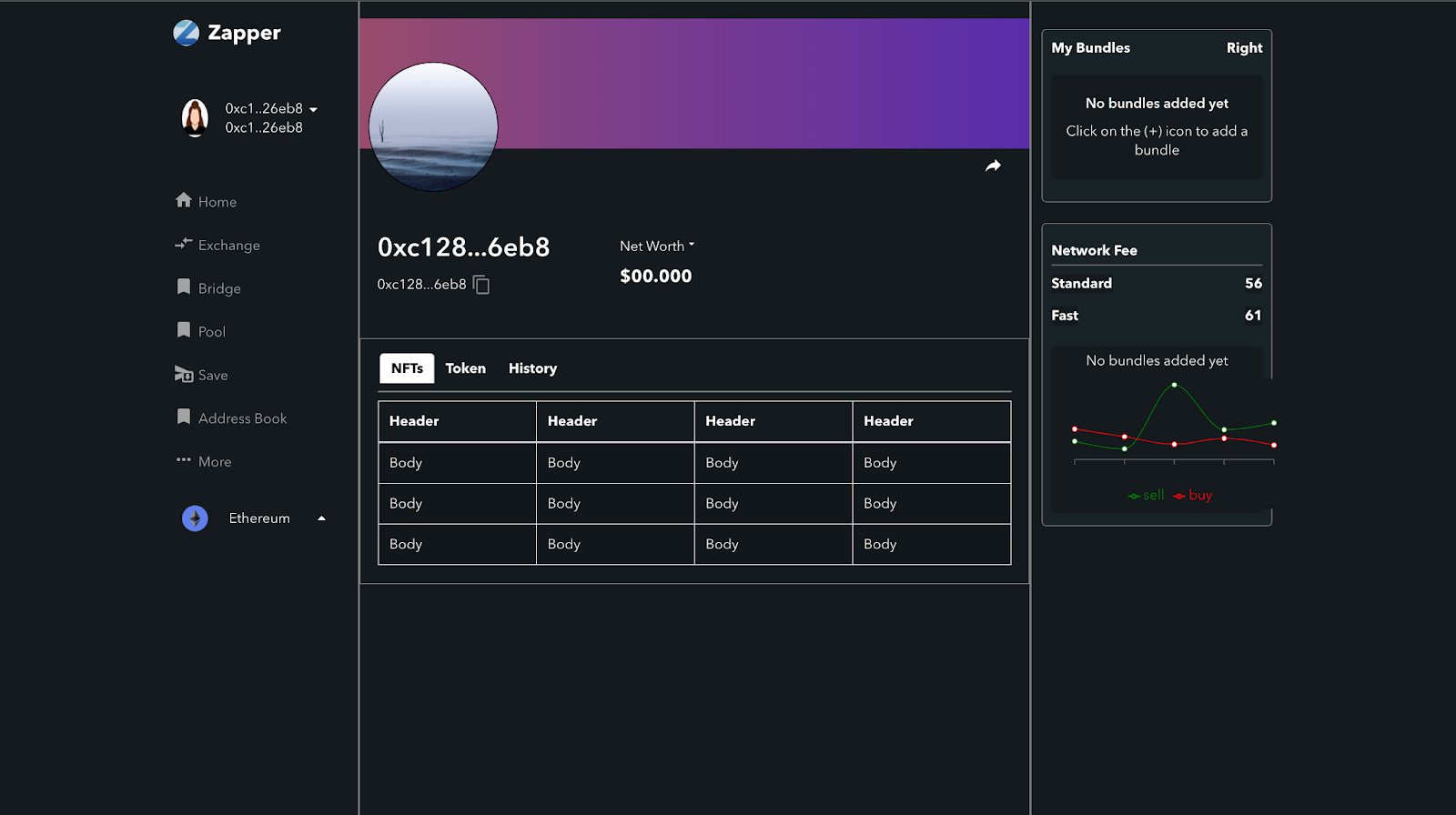

If you want to build custom dashboards or automate your trading strategies for on-chain equities analytics, Moralis Tokenized Stock APIs are a game changer. Moralis provides plug-and-play access to live blockchain data feeds for tokenized stocks across multiple chains. Think event monitoring, historical datasets, and instant price pulls – all via robust APIs that fintech builders love.

This means you can create your own alert systems for price swings in synthetic equities or even power entire trading bots that react instantly as new data hits the chain. For devs who want ultimate flexibility and speed, Moralis is hard to beat.

RWA. xyz Analytics Platform: Visualize the On-Chain Equities Universe

RWA. xyz stands out as one of the most comprehensive analytics platforms dedicated to tokenized real-world assets (RWAs). Its dashboard lets you track top issuers, investors, service providers – and most importantly – real-time price movements across a growing universe of tokenized stocks.

The platform’s interactive charts give you immediate insight into liquidity pools, trading volume surges, and cross-chain activity. If your goal is macro-level analysis or sector rotation within on-chain equities markets, RWA. xyz delivers clarity where others overwhelm with noise.

Securitize Markets Dashboard: Institutional-Grade Monitoring

Securitize has earned its reputation as a leader in asset tokenization by delivering compliance-first infrastructure trusted by both retail traders and institutions. The Securitize Markets Dashboard brings together real-time pricing info, order book depth, corporate actions (like dividends), and regulatory status updates – all under one hood.

This dashboard isn’t just about numbers; it’s about context. Want to see how a particular security token reacts after an earnings announcement? Or compare synthetic equity spreads before/after key macro events? Securitize makes it possible with intuitive visualizations tailored for serious decision-makers.

xStocks: Synthetic Stocks Trading on Solana’s Fast Lane

If speed is your thing (and let’s be honest – fortune favors the fast), xStocks brings synthetic stock trading to Solana’s ultra-low latency ecosystem. With DeFi integration at its core, xStocks lets users track live prices of top U. S. equities like NVDA or MSFT directly on-chain – then trade them instantly using decentralized protocols without ever leaving Web3.

The platform offers transparent order books and up-to-the-millisecond price feeds thanks to integrations with decentralized oracle networks like Chainlink Data Streams. For traders looking to exploit micro-movements or execute arbitrage between CEXs/DEXs and synthetic markets on Solana, xStocks is an indispensable tool.

Polymath Tokenization Explorer: Transparency and Discovery for Tokenized Equities

Polymath is a veteran in the asset tokenization space, and its Tokenization Explorer is purpose-built for those who crave transparency. This tool lets you drill down into the lifecycle of any tokenized equity: from issuance and regulatory compliance to live price tracking and historical performance. If you want to know how many tokens are circulating, who the major holders are, or how a specific synthetic stock has performed over time, Polymath’s explorer gives you that granular edge.

Its open-access ethos means you’re never left guessing whether a price movement was organic or orchestrated. For due diligence, portfolio research, or simply keeping tabs on your favorite on-chain equities, Polymath’s explorer is a must-have in your arsenal.

How to Choose the Right Tool for Your On-Chain Equity Strategy

The best platform depends on your goals:

- Developers and Quant Traders: Moralis Tokenized Stock APIs let you build custom solutions and automate trading strategies with direct blockchain data access.

- Macro Analysts and Asset Allocators: RWA. xyz’s analytics dashboard shines for big-picture market trends and cross-platform tracking.

- Institutional or Compliance-Focused Investors: Securitize Markets Dashboard provides regulatory clarity plus actionable pricing and order book data.

- DeFi-Native Traders: xStocks offers lightning-fast synthetic equity trading within Solana’s DeFi ecosystem, perfect for those chasing volatility and arbitrage opportunities.

- Diligence-Driven Investors: Polymath Tokenization Explorer is your go-to for transparency, lifecycle analysis, and network-wide discovery of tokenized stocks.

Feature Comparison of Top Platforms for Tracking Real-Time Tokenized Equities Data (2025)

| Platform | Real-Time Data Access | Supported Asset Types | Blockchain Integration | Analytics & Insights | User Interface | Unique Features |

|---|---|---|---|---|---|---|

| Moralis Tokenized Stock APIs | ✅ Yes | Tokenized stocks, synthetic equities | Multi-chain (EVM, Solana, more) | Advanced (real-time, historical, event monitoring) | API-first, developer-focused | Plug-and-play APIs for rapid fintech development |

| RWA.xyz Analytics Platform | ✅ Yes | Tokenized real-world assets (RWAs), equities | Ethereum, Polygon, and others | Comprehensive dashboards, investor/issuer analytics | Web dashboard | Deep analytics on issuers, investors, and service providers |

| Securitize Markets Dashboard | ✅ Yes | Tokenized equities, bonds, funds | Ethereum, Avalanche, others | Basic to moderate (portfolio, compliance) | User-friendly web dashboard | Regulatory compliance and investor onboarding tools |

| xStocks (Solana-based Synthetic Stocks) | ✅ Yes | Synthetic stocks (mirrored equities) | Solana | Price tracking, portfolio management | Web & mobile app | DeFi integration, fast settlement, low fees |

| Polymath Tokenization Explorer | ❌ Limited (block explorer data) | Security tokens, tokenized equities | Polymesh (native), Ethereum (legacy) | Basic (on-chain activity, issuance tracking) | Explorer-style web interface | Focus on compliance and security token issuance |

Pro Tips: Getting the Most Out of Real-Time Blockchain Stocks Data

- Automate Alerts: Use API endpoints (like those from Moralis) to set up real-time price alerts on your favorite synthetic equities so you never miss a move.

- Diversify Your Tracking: Don’t rely on just one platform. Cross-reference RWA. xyz analytics with Securitize’s institutional dashboards to spot discrepancies or arbitrage windows.

- Dive Into Order Books: Platforms like xStocks provide transparent order books, use them to analyze liquidity depth before executing large trades.

- Audit Smart Contracts: Use Polymath’s explorer to check contract details before investing in new tokenized equities. Transparency is protection!

The landscape for tracking real-time data in tokenized equities keeps evolving. With decentralized oracles like Chainlink pushing ultra-fresh feeds directly onto blockchains, and platforms like these five making that data actionable, there’s never been a better time to get hands-on with on-chain stocks. Whether you’re building tools, trading fast markets, or researching long-term trends, these solutions put actionable insights at your fingertips.