Tokenized NVDAx on xStocksFi: 24/7 NVIDIA Stock Exposure for Blockchain Investors

Picture this: NVIDIA’s AI chips are powering the next tech revolution, but traditional markets shut down just when the real action heats up overnight. Enter tokenized NVDAx on xStocksFi, your ticket to 24/7 exposure without the Wall Street gatekeepers. As of February 3,2026, NVDAx sits at $185.61, down 2.85% from the prior close, yet the volume screams opportunity for blockchain traders who move fast.

This isn’t just another synthetic asset; NVDAx delivers 1: 1 backing by real NVIDIA shares custodied securely, minting as Solana SPL and ERC-20 tokens. Trade fractions, leverage in DeFi, all while tracking NVDA’s price beat-for-beat. No voting rights or dividends, sure, but who needs them when you can flip positions around the clock on xStocksFi?

6-Month Price Performance: Tokenized NVDAx vs. Native NVDA, Tokenized Peers, and Major Cryptos

Comparing stability of tokenized stocks to crypto gains as of 2026-02-03, highlighting 24/7 exposure benefits for blockchain investors

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Tokenized NVIDIA (NVDAx) | $185.61 | $186.66 | -0.6% |

| NVIDIA Corporation (NVDA) | $185.61 | $186.66 | -0.6% |

| Tokenized Tesla (TSLAx) | $421.81 | $431.31 | -2.2% |

| Tokenized Apple (AAPLx) | $270.01 | $270.01 | +0.0% |

| Tokenized Microsoft (MSFTx) | $423.37 | $423.37 | +0.0% |

| Tokenized Amazon (AMZNx) | $242.96 | $242.96 | +0.0% |

| Tokenized Alphabet (Google) (GOOGLx) | $343.69 | $343.69 | +0.0% |

| Bitcoin (BTC) | $78,062.00 | $65,000.00 | +20.1% |

| Ethereum (ETH) | $2,283.72 | $2,000.00 | +14.2% |

Analysis Summary

Tokenized NVDAx mirrors native NVDA stock with a stable -0.6% 6-month change, while peers like TSLAx show slight declines and others remain flat. In contrast, BTC and ETH have surged +20.1% and +14.2%, underscoring tokenized stocks’ role in providing 24/7, low-volatility equity exposure amid crypto bull trends. NVDAx saw a -2.85% 24h change with strong volume.

Key Insights

- NVDAx perfectly tracks NVDA at -0.6% over 6 months, enabling 24/7 blockchain access without shareholder rights.

- Tokenized peers (TSLAx, AAPLx, etc.) exhibit minimal volatility (0% to -2.2%), ideal for DeFi integration.

- BTC and ETH deliver strong +20.1% and +14.2% gains, highlighting crypto market outperformance vs. tokenized equities.

Real-time data from Investing.com, CryptoNews, and others as provided (6 months ago: 2025-08-07). Prices and changes used exactly as listed; tokenized assets track underlying stocks 1:1 via custodied shares.

Data Sources:

- Main Asset: https://www.investing.com/crypto/nvidia-tokenized-stock-xstock/nvdax-usd-historical-data

- NVIDIA Corporation: https://www.investing.com/crypto/nvidia-tokenized-stock-xstock/nvdax-usd-historical-data

- Tokenized Tesla: https://cryptonews.net/news/market/32320755/

- Tokenized Apple: https://www.investing.com/crypto/nvidia-tokenized-stock-xstock/nvdax-usd-historical-data

- Tokenized Microsoft: https://www.investing.com/crypto/nvidia-tokenized-stock-xstock/nvdax-usd-historical-data

- Tokenized Amazon: https://www.investing.com/crypto/nvidia-tokenized-stock-xstock/nvdax-usd-historical-data

- Tokenized Alphabet (Google): https://www.investing.com/crypto/nvidia-tokenized-stock-xstock/nvdax-usd-historical-data

- Bitcoin: https://www.investing.com/crypto/nvidia-tokenized-stock-xstock/nvdax-usd-historical-data

- Ethereum: https://www.investing.com/crypto/nvidia-tokenized-stock-xstock/nvdax-usd-historical-data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

NVDAx at $185.61: Spotting the Entry in a Pullback

Let’s cut through the noise. NVDAx’s dip to $185.61 mirrors broader market jitters, but NVIDIA’s fundamentals scream rebound. Data centers are gobbling GPUs like candy, and with AI hype unrelenting, this tokenized version lets crypto natives pile in without KYC headaches or 9-to-5 limits. On xStocksFi, liquidity pools ensure tight spreads, even at odd hours.

I’ve day-traded NVDA swings for years, and blockchain versions like NVDAx amplify the edge. Why wait for NYSE open when you can ape into a pre-market pump via Solana speed? Current sentiment: bearish short-term, but my conviction says $200 and incoming if earnings deliver.

Why xStocksFi Dominates On-Chain NVIDIA Trading

xStocksFi isn’t chasing hype; it’s built for speed demons like us. Their NVDAx integration means seamless swaps, yield farming with stock exposure, and composability across chains. Forget clunky CEXs; here, you collateralize NVDAx for loans or perps, stacking yields while riding equity waves.

Key perks: 24/7 tokenized stocks trading, sub-second settlements on Solana, and audited custodians keeping that 1: 1 peg rock-solid. Volume’s surging, with recent 24-hour figures hitting millions across trackers. If you’re into synthetic NVDA blockchain plays, xStocksFi’s dashboard gives real-time charts, order books, and one-click positions.

Trading NVDAx: Actionable Strategies for Crypto Degens

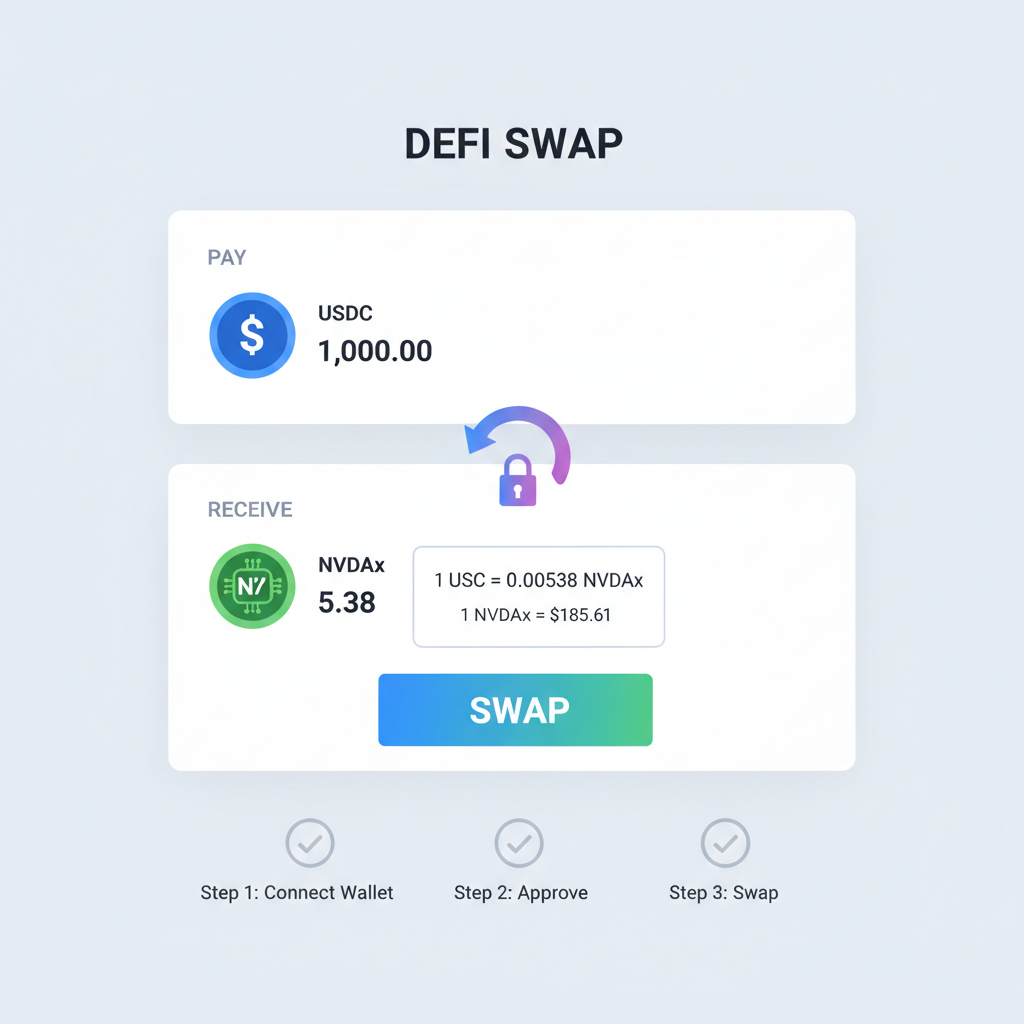

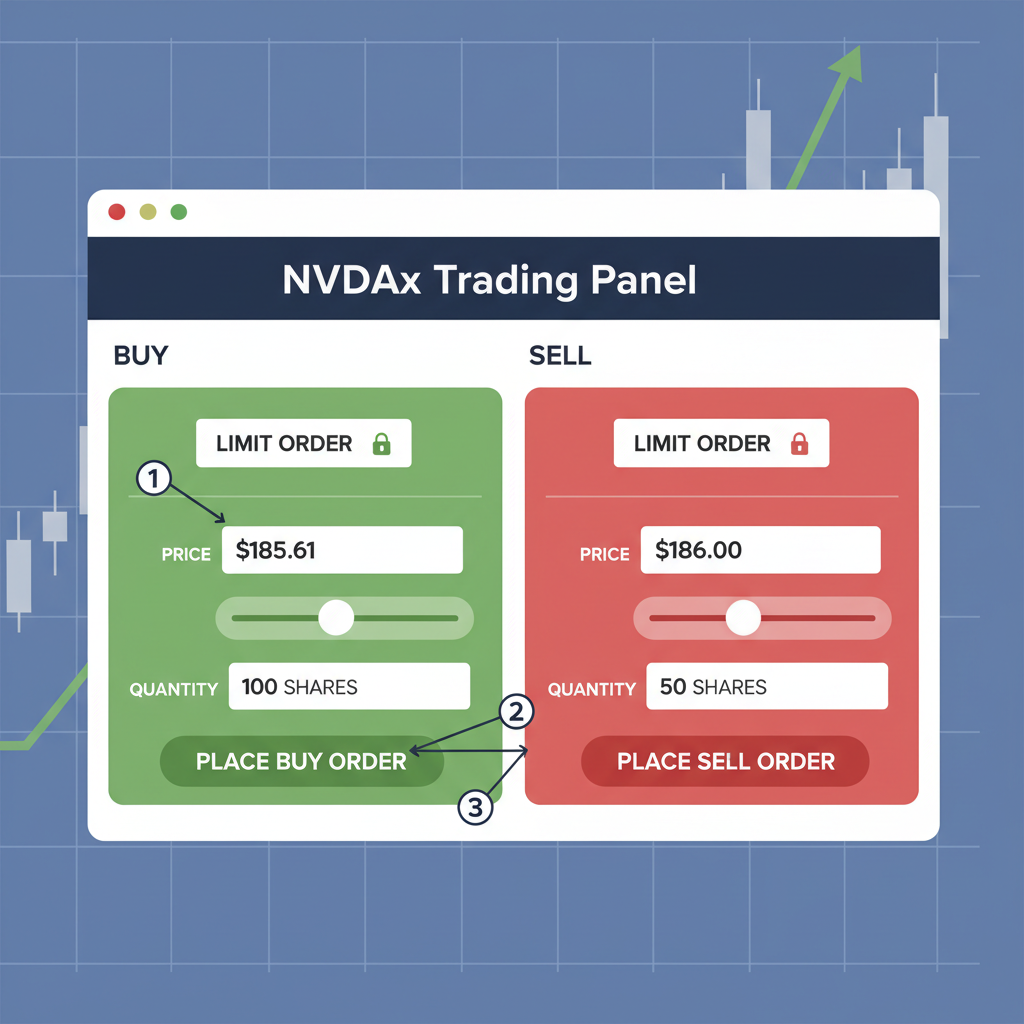

Ready to act? Start small: swap USDC for NVDAx at $185.61 on xStocksFi, set a trailing stop above $190 for the bounce. Or go leveraged; pair with perps for 5x upside on NVIDIA catalysts like new Blackwell chip reveals. Watch resistance at $192, support holding $180.

Pro tip: Layer in options-like strategies via xStocksFi’s vaults. I’ve netted quick 10% flips by scalping volatility gaps traditional traders miss. Risk management first, though; size positions at 2-5% of portfolio, and trail profits ruthlessly. Fortune favors the fast, especially with on-chain NVIDIA stock this accessible.

Diving deeper, NVDAx unlocks DeFi alphas invisible to stock bros. Bridge to Ethereum for more liquidity, or stake on Solana for extra APY. The pullback to $185.61? That’s your green light.

But don’t just take my word for it, let’s zoom in on the charts. NVDAx’s 24/7 tokenized stocks action reveals classic support patterns forming right now at $185.61. RSI dipping into oversold territory signals exhausted sellers, perfect for a swift counterpunch.

NVIDIA Corporation Technical Analysis Chart

Analysis by Lila Penrose | Symbol: NASDAQ:NVDA | Interval: 1h | Drawings: 7

Technical Analysis Summary

Aggressively mark this NVDAx chart with a bold red downtrend line from the Jan 29 peak at $189.50 straight to the Feb 4 hammer low at $184.80 – that’s our bearish highway! Slap horizontal lines at key S/R: support at 184.80 (strong), 186 (moderate); resistance 187.50 (moderate), 189 (strong). Rectangle the consolidation zone Jan 31-Feb 2 between 186-188. Short position marker at 186.50 entry, profit target 184, stop 188. Red arrow down on the Feb 3 breakdown candle with volume spike callout: ‘Volume confirms dump!’ Fib retracement 0-1 from peak to low for pullback traps. Vertical line on Feb 4 for potential bounce watch. Text: ‘Short NVDAx NOW – fast money awaits!’

Risk Assessment: high

Analysis: Volatile tokenized stock in downtrend with volume confirmation, aligns with aggressive style but whipsaw risk on news

Lila Penrose’s Recommendation: Short aggressively now – scale in on pullbacks, target 184 fast! Fortune favors the fast.

Key Support & Resistance Levels

📈 Support Levels:

-

$184.8 – Recent swing low with volume spike, strong test point

strong -

$186 – Prior candle lows clustering here

moderate

📉 Resistance Levels:

-

$187.5 – Multiple rejections in consolidation

moderate -

$189 – Breakdown from this prior high

strong

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$186.5 – Aggressive short on pullback to minor resistance amid downtrend

high risk -

$187.2 – Secondary short if breaks higher, but momentum favors downside

high risk

🚪 Exit Zones:

-

$184 – Profit target at strong support

💰 profit target -

$183.5 – Trail stop below low

🛡️ stop loss -

$188 – Tight stop above resistance

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Increasing on downside, confirming bearish momentum

Spike on Feb 3 red candle shows conviction selling

📈 MACD Analysis:

Signal: Bearish crossover with histogram expanding negative

Momentum diverging lower, no bullish reversal

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Lila Penrose is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

Risks in the NVDAx Arena: Play Smart, Not Sorry

Listen up, speed demons: tokenized assets like NVDAx pack punch, but they’re not risk-free. Peg deviations can happen during extreme volatility, though xStocksFi’s custodians keep it tight with daily attestations. No dividends means you’re pure price play, so time your exits around NVIDIA earnings blackouts. Regulatory wildcards loom too, watch SEC chatter on synthetics, but for now, Solana’s speed outruns the bureaucrats.

I’ve burned fingers ignoring macro cues, like Fed rate surprises tanking tech. Mitigate by diversifying: pair NVDAx longs with stablecoin farms or short perps on correlated alts. At $185.61, implied vol screams opportunity, but cap leverage at 3x unless you’re feeling bulletproof.

xStocksFi NVDAx: Your Launchpad to On-Chain Equities

Why grind traditional brokers when xStocksFi hands you the keys? Fund your wallet with SOL or ETH, hit the NVDAx pool, and execute in milliseconds. Their UI screams pro-trader: live order books, slippage previews, and one-tap bridges. I’ve flipped NVDAx trading crypto positions here faster than NYSE lunch breaks, netting edges on Asia-session pumps.

Deeper still, composability shines. Collateralize NVDAx in lending protocols for 15% APY boosts, or zap into liquidity pools for fees. With tokenized NVDAx volume spiking, liquidity’s no issue, recent 24h averages ~$20M keep spreads razor-thin. Native NVDA lags behind closed doors; here, you dictate the tempo.

Zoom out: NVIDIA’s GPU moat widens with AI sovereignty pushes globally. China alternatives falter; NVDA owns the stack. Tokenized versions like NVDAx on xStocksFi democratize that alpha for blockchain crews. Current dip? Fuel for the fire. I’ve got calls stacking at $190; watch catalysts like Q1 guidance or Blackwell ramps.

Fortune favors the fast, and with NVDAx at $185.61, the runway’s clear. Dive into xStocksFi NVDA, scalp the bounce, and stack those sats. Your edge awaits, grab it before the herd wakes up.