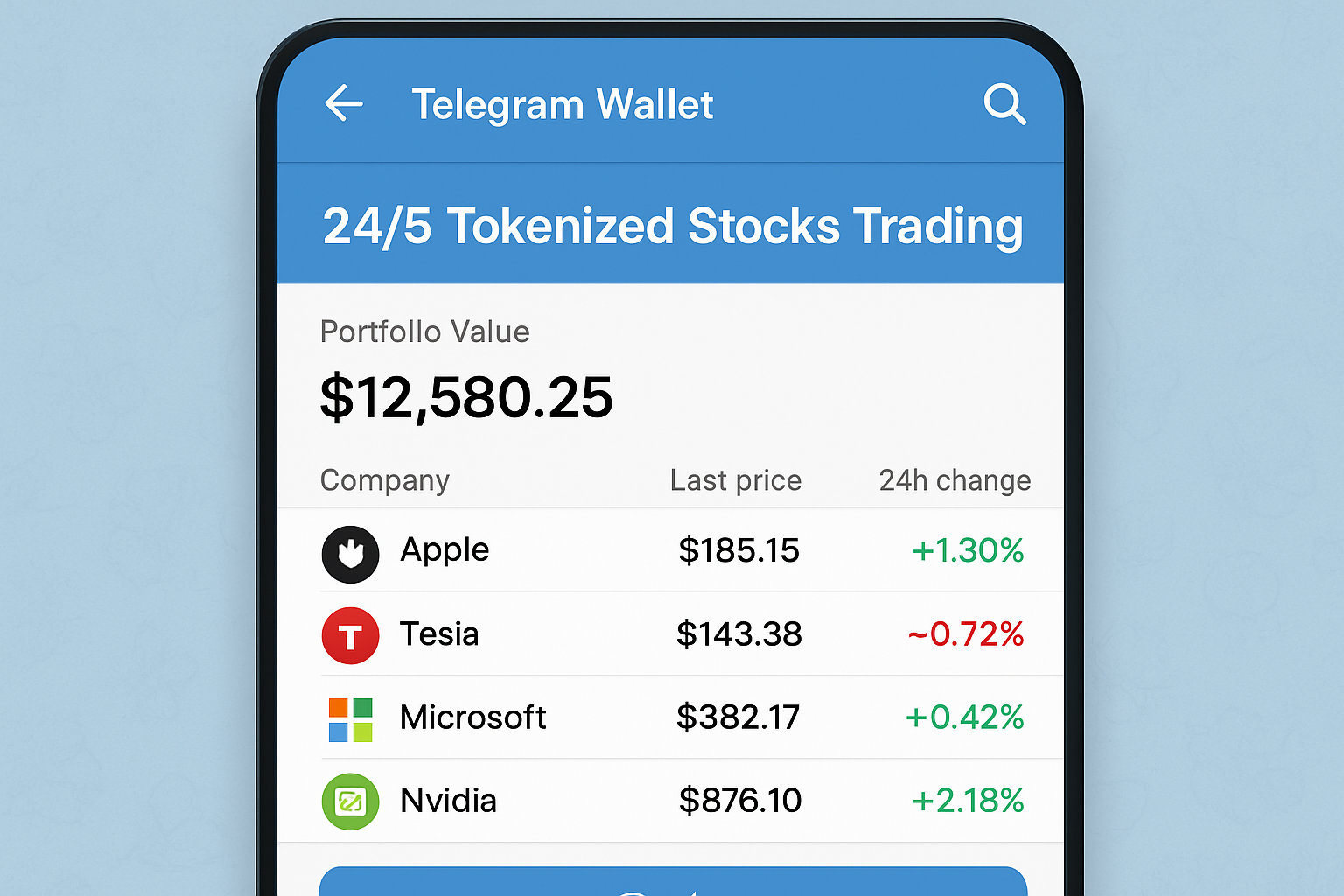

Trading Tokenized AAPL TSLA NVDA Stocks 24/5 On-Chain via Telegram Wallet

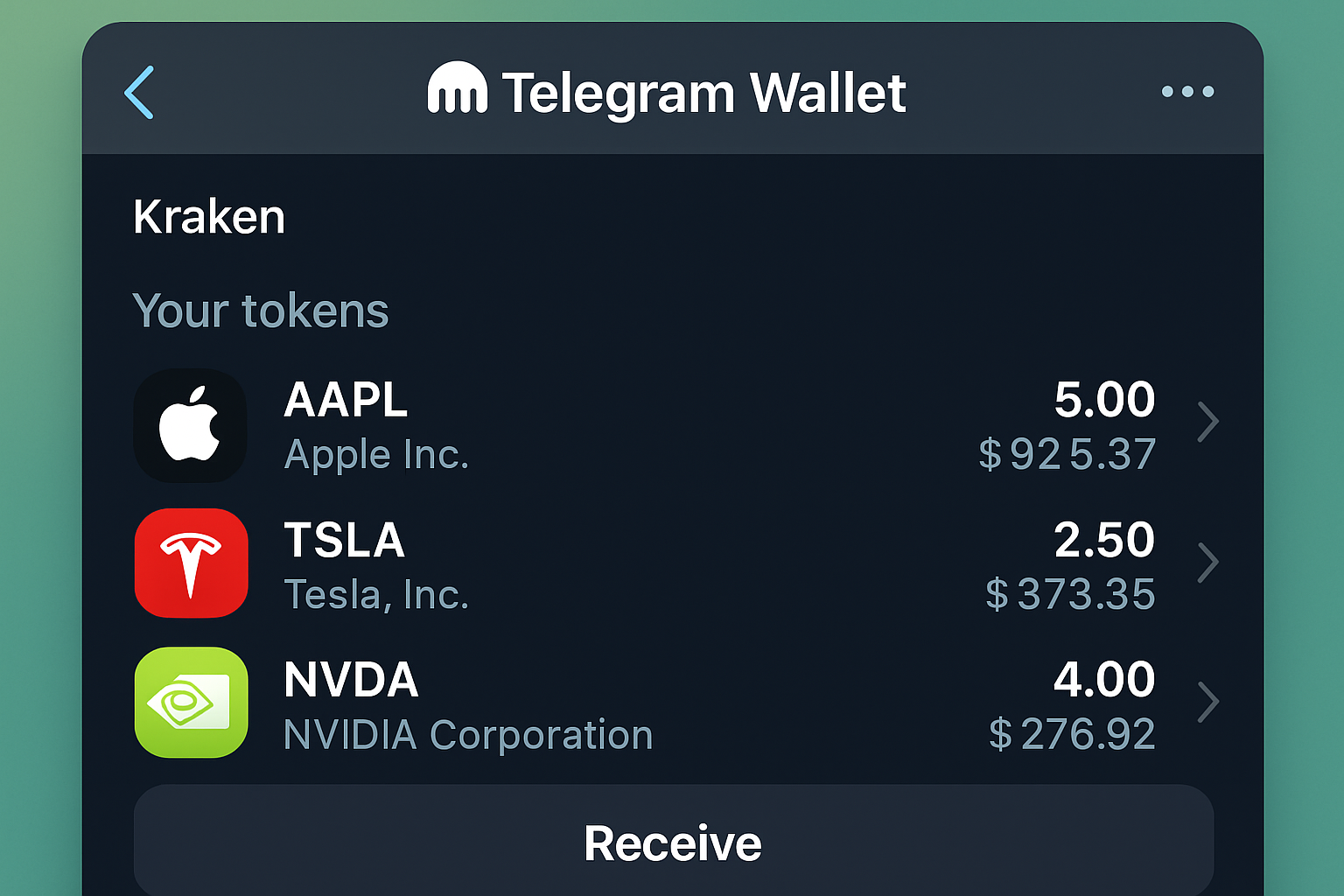

In a move that’s reshaping access to U. S. equities for the global investor, Telegram’s Wallet has teamed up with Kraken and Backed to bring tokenized versions of powerhouse stocks like Apple (AAPL), Tesla (TSLA), and Nvidia (NVDA) directly into the app. Imagine trading tokenized AAPL at its current price of $278.78, with 24h change of $-1.90 (-0.68%), right from your Telegram chat, 24/5 on-chain. This partnership isn’t just convenient; it’s a strategic pivot toward democratizing markets for non-U. S. traders, blending the familiarity of Telegram’s 1 billion users with blockchain’s borderless efficiency.

Apple sits at $278.78 today, dipping slightly from its 24h high of $281.28, yet underscoring the stability that makes tokenized AAPL telegram a prime pick for diversified portfolios. Tesla and Nvidia, synonymous with innovation in EVs and AI, now trade as xStocks on Kraken’s platform, withdrawable to self-hosted wallets for true 24/7 on-chain action via Solana. Backed Finance powers the tokenization, ensuring these assets track their underlying equities with precision while unlocking fractional ownership and instant settlement.

Global Traders Gain 24/5 Edge with Kraken xStocks

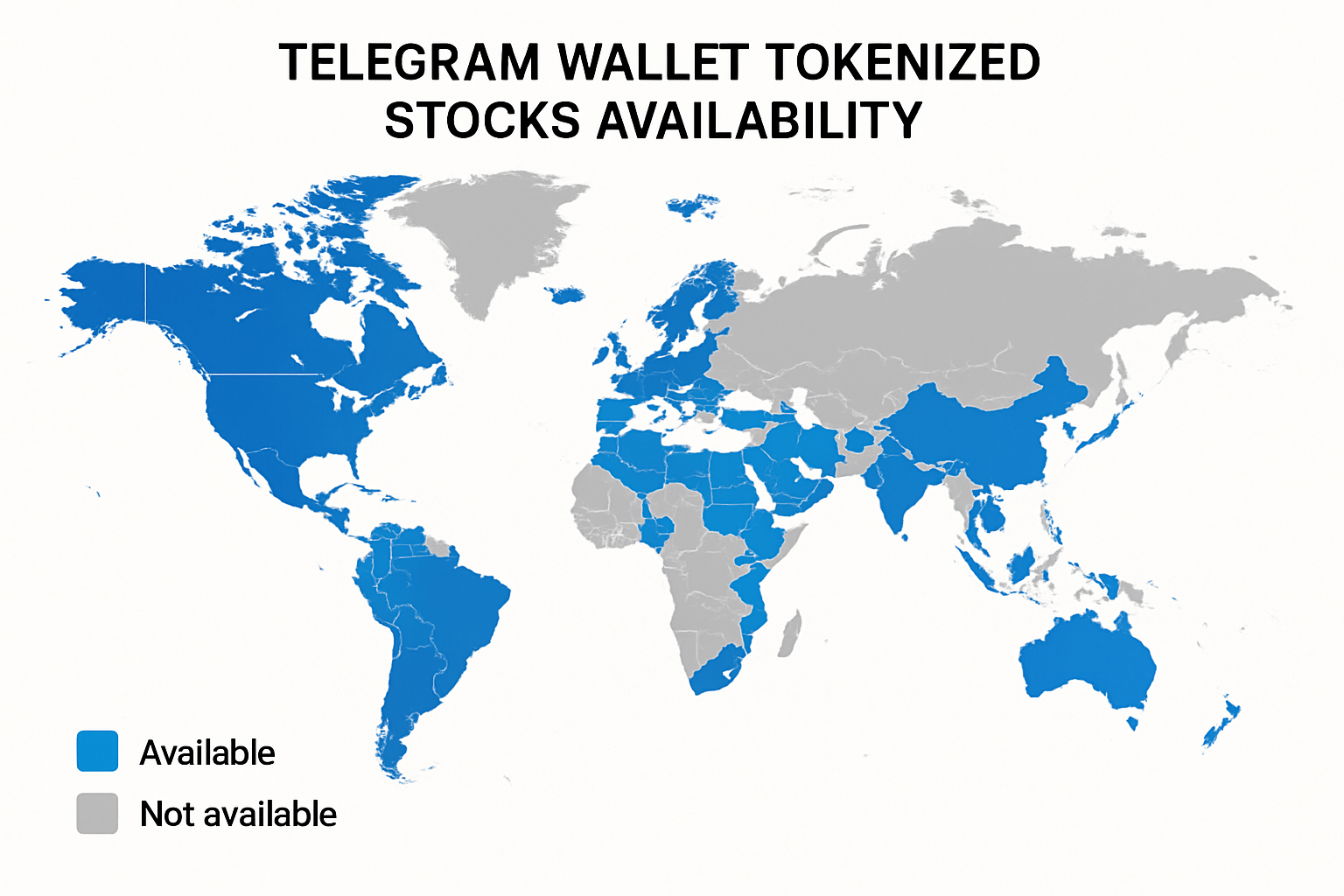

Kraken’s xStocks lineup spans 60 U. S. stock tokens, from NVDA tokenized stock to S and amp;P 500 trackers, available commission-free in Telegram Wallet until January 1,2026. Non-U. S. customers, long sidelined by traditional market hours, can now execute TSLA on-chain trading without intermediaries. The rollout kicked off in select regions this October 2025, with expansion on the horizon, complete with a giveaway: buy $100 in xStocks, hold 14 days, and vie for up to $100 in bonus tokens.

This setup leverages Solana’s speed for low-cost trades, a boon in volatile sessions when AAPL tests $278.78 lows like today’s $278.06. Think globally, invest locally – that’s the mantra as emerging markets in Asia and Latin America tap U. S. growth stories without forex hurdles or time zone woes.

Why Telegram Wallet Equities Change the Game

Seamless integration means no app-switching: spot a TSLA surge in your group chat, buy tokenized shares instantly. Kraken handles custody and compliance, Backed ensures 1: 1 backing, and Telegram provides the frictionless UI. For pros eyeing 24/5 tokenized stocks, this beats DEXs with better liquidity from Kraken’s 200 and asset depth.

Strategic insight: in a world where NVDA dominates AI narratives, tokenized access lets you position ahead of earnings without T and 1 delays. AAPL’s steady $278.78 reflects ecosystem lock-in, ideal for hedging crypto volatility. Global adoption could swell tokenized volumes, pressuring TradFi to adapt.

Early movers snag the giveaway edge, but the real win is portfolio agility. Pair tokenized NVDA with Solana ecosystem plays for correlated upside, all trackable on-chain.

Apple Inc. (AAPL) Tokenized Stock Price Prediction 2026-2031

Annual price forecasts for tokenized AAPL shares considering 24/7 on-chain trading liquidity, AI-driven growth, and macroeconomic factors (baseline: $278.78 end-2025)

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $265.00 | $305.00 | $355.00 |

| 2027 | $280.00 | $335.00 (+9.8%) | $395.00 |

| 2028 | $300.00 | $368.00 (+9.9%) | $440.00 |

| 2029 | $325.00 | $405.00 (+10.0%) | $485.00 |

| 2030 | $350.00 | $445.00 (+10.0%) | $535.00 |

| 2031 | $380.00 | $490.00 (+10.1%) | $590.00 |

Price Prediction Summary

AAPL tokenized stock is forecasted to grow steadily from $278.78, reaching an average of $490 by 2031 (10% CAGR), fueled by services revenue, AI innovations, and enhanced 24/7 trading accessibility via Telegram Wallet and Kraken. Min reflects bearish recession risks; max captures bullish AI/expansion scenarios.

Key Factors Affecting Apple Inc. Stock Price

- Services segment growth (40%+ of revenue, high margins)

- AI integration in devices (Apple Intelligence boosting ecosystem lock-in)

- Tokenized assets enabling 24/7 global liquidity and retail adoption

- Macro factors: interest rates, US-China trade tensions, consumer spending

- Earnings growth: 10-12% EPS CAGR; forward P/E ~28x

- Regulatory risks (antitrust) and competition from Samsung/Google in hardware

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

Navigating Risks and Rewards in On-Chain Equities[/h2>

While 24/5 access thrills, savvy investors weigh smart contract risks and regulatory flux. Kraken’s track record mitigates much, yet oracle dependencies tie tokenized prices to TradFi feeds. At AAPL’s $278.78, downside protection via stops is straightforward in Telegram.

Opinion: this fusion accelerates RWA adoption, positioning Telegram Wallet equities as a gateway for the next 500 million blockchain users. TSLA bulls, take note – on-chain trading amplifies Elon-driven pumps without legacy broker friction.

Real-world assets like these tokenized stocks bridge TradFi and DeFi, offering yields and liquidity previously siloed. With AAPL holding steady at $278.78 amid a 24h dip of $-1.90 (-0.68%), positioning now captures any rebound toward the recent high of $281.28.

How to Trade Tokenized AAPL, TSLA, and NVDA in Telegram Wallet

Getting started is straightforward, tailored for users in eligible regions. Open Telegram, access Wallet, and fund via crypto or fiat ramps. Kraken’s integration surfaces xStocks like AAPLx, TSLAx, and NVDAx, mirroring spot prices with minimal spread. Execute buys or sells 24/5, withdraw to Solana wallets for full on-chain flexibility, or hold in-app for simplicity.

This telegram wallet equities flow suits day traders chasing NVDA’s AI momentum or long-term holders betting on TSLA’s autonomy pivot. Solana’s sub-second finality ensures trades settle before markets twitch, a edge over centralized brokers.

Strategic Advantages of 24/5 Tokenized Stocks

Key Advantages of 24/5 Tokenized Trading

-

24/5 Trading Access: Trade tokenized AAPL ($278.78), TSLA, and NVDA shares instantly within Telegram Wallet, extending beyond traditional market hours for strategic global positioning.

-

Commission-Free Period: Enjoy zero trading fees on xStocks until January 1, 2026, maximizing returns during the promotional window.

-

Global Reach: Non-US users in select regions gain immediate access via Kraken and Backed partnership, with expansion planned for broader worldwide adoption.

-

On-Chain 24/7 Potential: Withdraw xStocks to self-hosted wallets for continuous 24/7 trading on the Solana blockchain, enabling round-the-clock strategies.

-

Seamless Telegram Integration: Buy and sell 60+ US stocks and ETFs directly in-app, leveraging Telegram’s massive user base for effortless on-chain exposure.

-

Exclusive Giveaway: Purchase $100 in xStocks, hold for 14 days, and enter to win up to $100 bonus tokenized stocks, boosting early adopter gains.

Beyond convenience, these assets enable S and P 500 blockchain fractional ownership, letting smaller accounts slice into megacaps. Kraken’s liquidity depth, paired with Backed’s audited reserves, minimizes slippage even during NVDA earnings volatility. For global players in time zones far from NYSE open, 24/5 windows align with local rhythms – trade AAPL at $278.78 during Asian dawn without proxies.

Layer in the promo: scoop $100 in xStocks, hold 14 days, enter the bonus draw. It’s a low-risk entry to test 24/5 tokenized stocks, building conviction as volumes ramp.

Risk Management in Telegram’s On-Chain Equities Arena

Counterparty trust hinges on Kraken and Backed, both battle-tested. Yet, watch for Solana congestion or oracle lags during black swan events. Set limit orders at key levels – say, defending AAPL’s $278.06 low – and diversify across tokenized ETFs for ballast. Regulatory clarity grows, but non-U. S. focus sidesteps SEC glare for now.

Insight: pair these with on-chain analytics for alpha. Track whale flows in TSLAx to front-run sentiment shifts, blending macro views with blockchain transparency.

Future Outlook for On-Chain Equities Boom

As Telegram’s 1 billion users eye finance, tokenized U. S. stocks could hit billions in AUM swiftly. NVDA’s lead in AI chips positions its token for outsized gains; TSLA rides robotaxi hype. AAPL at $278.78 embodies resilience, a anchor for hybrid portfolios mixing crypto and equities.

Think globally, invest locally: this infrastructure empowers emerging market investors to own U. S. growth without capital controls. Expansion beyond select regions will turbocharge adoption, pressuring incumbents to tokenize or fade.

Position early in this shift. With commission-free trades through 2025’s end, the barrier to TSLA on-chain trading vanishes. Monitor AAPL’s $278.78 base for entries, NVDA for breakouts, and let Telegram Wallet redefine your equity playbook.