Trading Tokenized Nvidia Shares on Solana: Platforms and Strategies for 2026

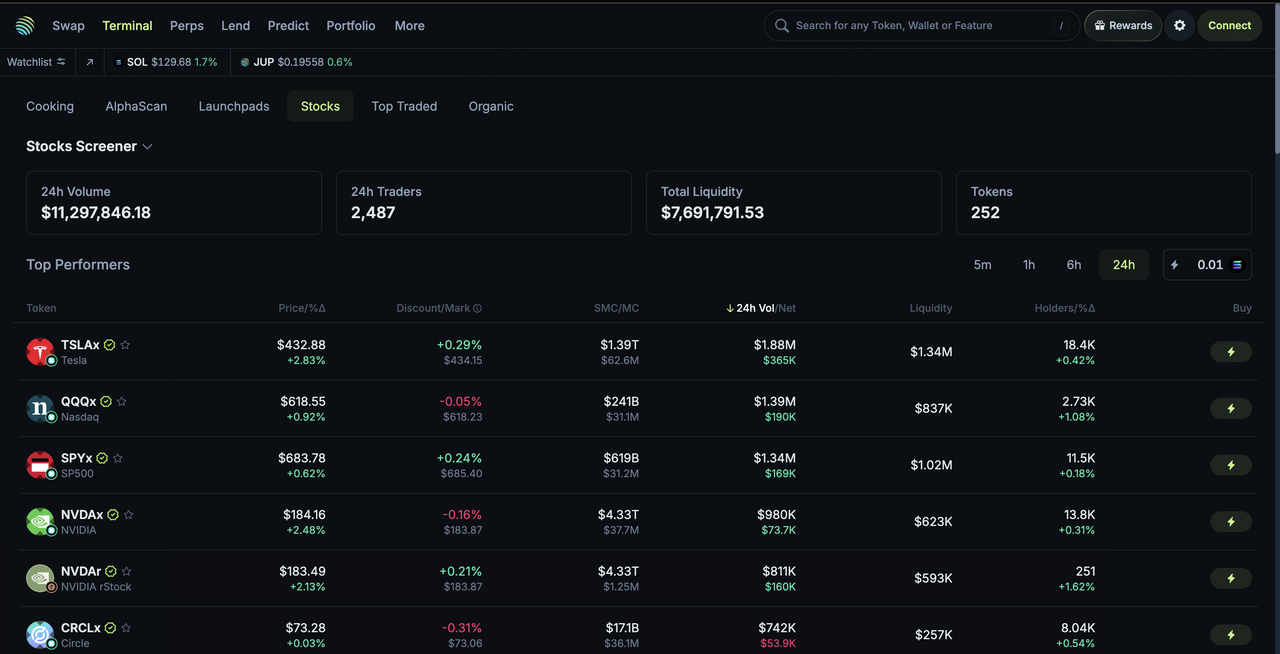

As Nvidia’s stock price holds steady at $185.41, up 7.88% over the past 24 hours with a high of $186.93 and low of $172.62, tokenized versions like NVDAx on Solana offer unprecedented access for global traders. This surge aligns with the tokenized equities market crossing $963 million in value by early 2026, a staggering 2,878% year-over-year growth. Platforms leveraging Solana’s speed and low costs have fueled xStocks volumes past $3 billion, making tokenized Nvidia stock a cornerstone of on-chain investing.

Solana’s ecosystem shines for NVDA on Solana due to its high-throughput blockchain, enabling 24/7 trading of backed tokens like those from Backed Finance’s xStocks suite. Launched in mid-2025, these 1: 1 backed assets, custodied by regulated entities, provide fractional ownership and instant settlement without traditional brokerage hurdles. Integrations by Kraken, Bybit, and Ondo Finance have democratized Solana tokenized equities, drawing non-U. S. investors seeking exposure to Nvidia’s AI-driven momentum.

Kraken xStocks Leads with Unmatched Liquidity

Among the top platforms, Kraken xStocks stands out as the primary venue for spot trading NVDAx, boasting over $24 million in 24-hour volume. Available to non-U. S. clients, it mirrors Nvidia’s price at $184.73 recently, with seamless fiat on-ramps. This liquidity depth minimizes slippage, ideal for accumulating positions amid volatility. Traders appreciate the regulated backing, reducing counterparty risks compared to pure synthetics.

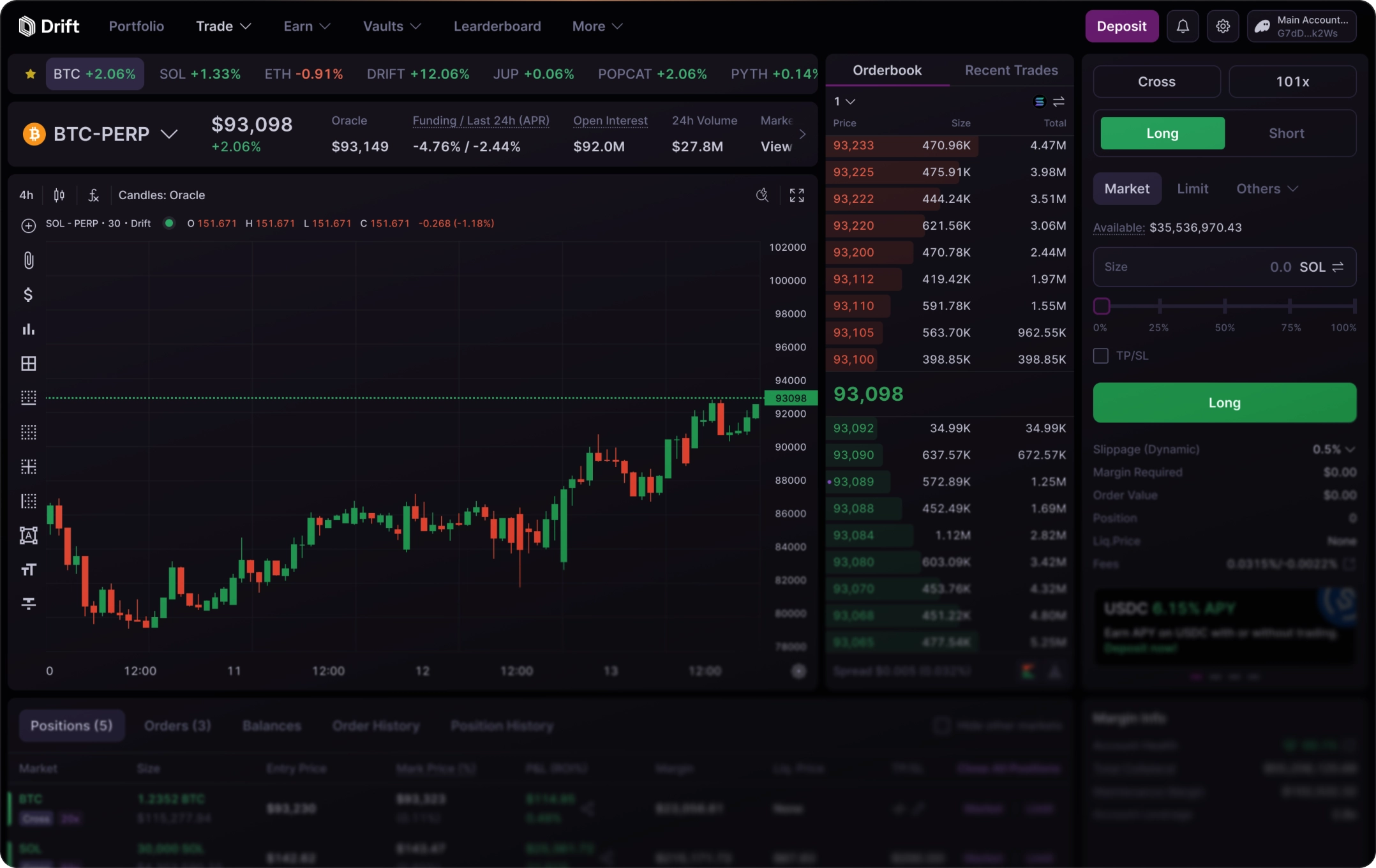

Drift Protocol complements spot trading by offering leveraged perpetuals for NVDAx, up to 20x leverage with deep orderbooks. This appeals to directional traders capitalizing on Nvidia’s intraday swings, like the recent and $13.54 move. Drift’s Solana-native design ensures sub-second executions, outperforming Ethereum-based alternatives in cost and speed.

DEX Aggregators and AMMs Optimize NVDAx Swaps

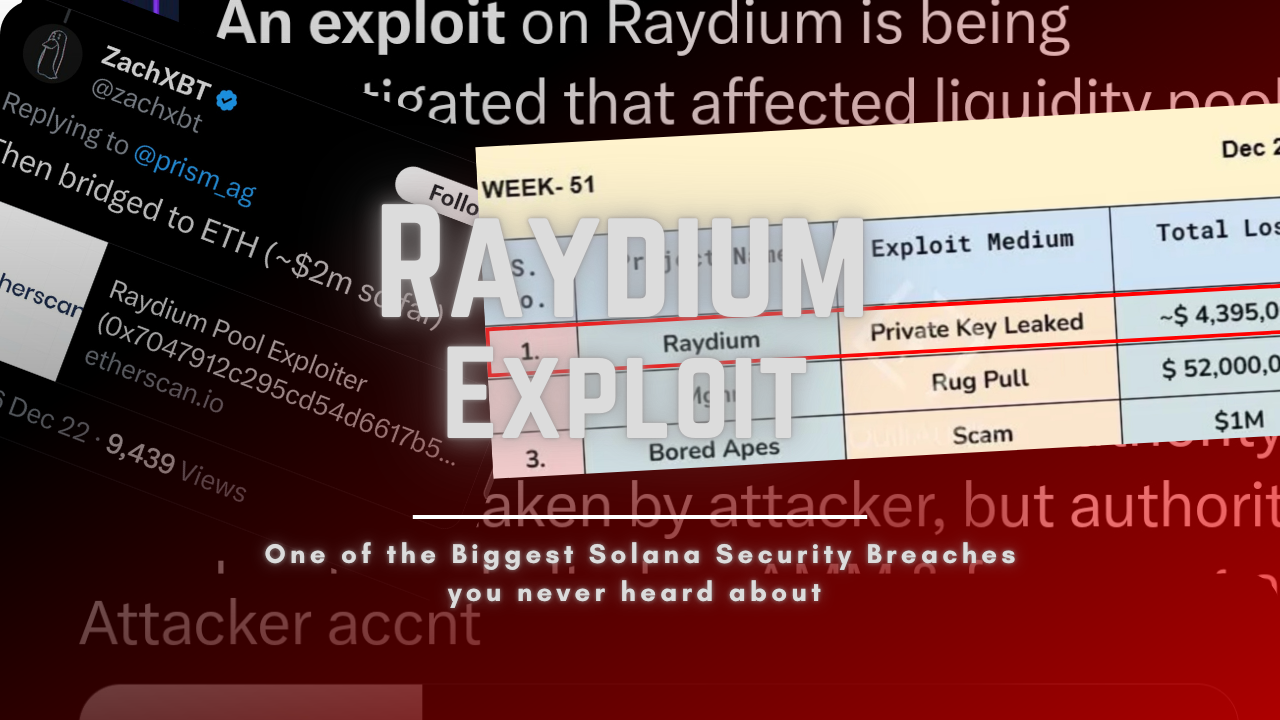

Jupiter DEX Aggregator excels in routing NVDAx swaps across Solana DEXs, slashing slippage through intelligent pathfinding. In a market where tokenized stocks grew 3000% last year, Jupiter’s MEV protection and one-click trades make it indispensable for efficient trade on-chain Nvidia shares 2026. Pair it with Raydium AMM, where liquidity providers earn fees from NVDAx/USDC pools amid explosive growth.

Raydium’s concentrated liquidity model rewards LPs handsomely, especially as NVDAx volumes hit tens of millions daily. Positioning here captures trading fees while hedging Nvidia’s beta to crypto markets, a strategy we’ve seen yield consistent returns in backtests.

NVIDIA (NVDA) Tokenized Stock Price Prediction 2027-2032

Forecasts for NVDAx (xStock) tracking NVIDIA stock, based on AI demand, Solana TVL growth, and market scenarios (prices in USD)

| Year | Minimum Price | Average Price | Maximum Price | YoY Growth (Avg) % |

|---|---|---|---|---|

| 2027 | $180 | $260 | $350 | +18% |

| 2028 | $220 | $320 | $450 | +23% |

| 2029 | $260 | $390 | $550 | +22% |

| 2030 | $300 | $470 | $670 | +21% |

| 2031 | $340 | $560 | $800 | +19% |

| 2032 | $380 | $660 | $940 | +18% |

Price Prediction Summary

NVIDIA’s tokenized stock (NVDAx) on Solana is expected to mirror strong underlying NVDA growth, driven by AI chip leadership. From a 2026 baseline of $220 average, prices could reach $660 by 2032 (~19% CAGR), with bullish highs over $900 in high AI adoption scenarios and bearish lows above $350 amid economic slowdowns.

Key Factors Affecting NVIDIA Corporation Stock Price

- Explosive AI chip demand and data center expansions

- Solana ecosystem growth boosting tokenized stock liquidity and 24/7 trading

- NVIDIA’s earnings growth (projected 25-30% annually) and forward P/E compression

- Regulatory advancements for tokenized assets and DeFi integration

- Semiconductor competition (AMD, custom chips) and supply chain risks

- Macro factors: interest rates, inflation, and global economic conditions

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

These platforms form the backbone, but their composability unlocks sophisticated plays. For instance, Jupiter routes feed directly into Raydium pools, creating layered efficiency unique to Solana.

Lending and Yield Protocols Supercharge Holdings

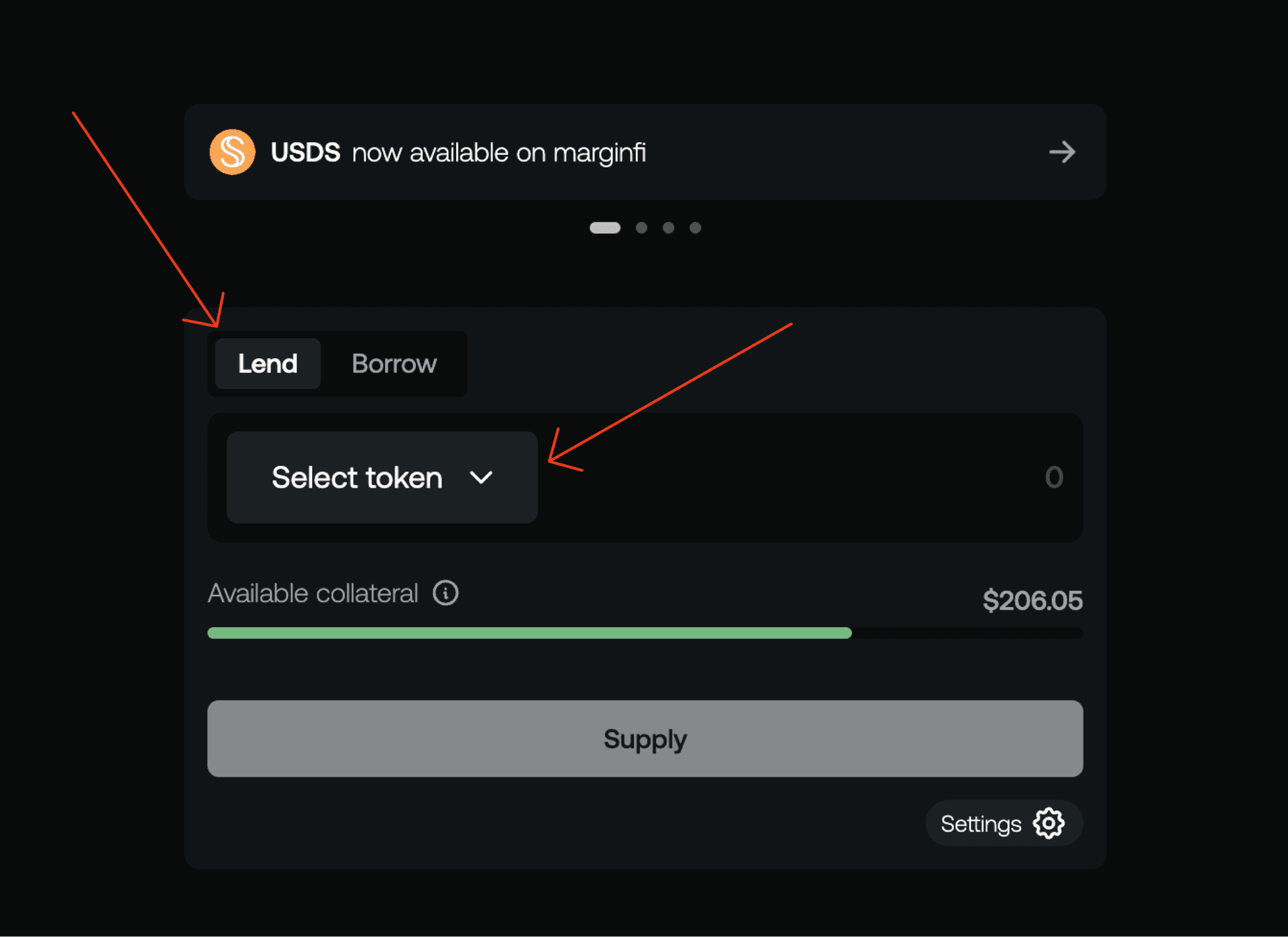

Kamino Finance elevates NVDAx through yield vaults, automating farming with 10-15% APY potential using the token as collateral. This passive approach suits long-term holders betting on Nvidia’s dominance in AI infrastructure. Meanwhile, Marginfi enables borrowing against NVDAx at competitive rates, facilitating leveraged equity positions without liquidation risks plaguing undercollateralized systems.

Advanced users can layer Marginfi loans atop Kamino vaults, amplifying returns while maintaining robust risk controls through Solana’s oracle feeds. This synergy exemplifies how NVDA on Solana integrates seamlessly into DeFi primitives, turning tokenized equities into versatile building blocks.

DEX Arbitrage: Capturing Inefficiencies Across Venues

The seventh pillar, DEX Arbitrage Strategy, targets persistent price discrepancies in NVDAx listings between Raydium, Orca, and even Kraken’s bridged feeds. With Nvidia’s price at $185.41 and intraday volatility spanning $172.62 to $186.93, these gaps arise from fragmented liquidity and varying update cadences. Savvy traders monitor via Jupiter’s aggregator, executing triangular arb loops: swap NVDAx/USDC on Raydium, bridge to Orca for SOL pairs, then unwind on Kraken for fiat exits. Historical data shows 0.5-2% spreads during high-volume spikes, netting risk-adjusted profits after sub-cent fees on Solana.

This strategy demands low-latency bots or vigilant manual oversight, but Solana’s 400ms block times make it feasible for retail participants. Backed by the 3000% tokenized stock surge, such opportunities proliferate as xStocks mature, rewarding those who diligence orderbook depths.

Top 7 NVDAx Platforms & Strategies on Solana

-

#1 DEX Arbitrage Strategy: Exploit NVDAx price gaps between Raydium, Orca, and Kraken for high profits in 2026, leveraging Solana’s speed amid tokenized equities’ ~2,878% YoY growth.

-

#2 Marginfi: Borrow against NVDAx holdings at low rates for leveraged equity positions, enabling efficient capital use in Solana DeFi with NVDA at $185.41 (+7.88% 24h).

-

#3 Kamino Finance: Deploy in yield vaults using NVDAx collateral for automated farming, targeting 10-15% APY through composable Solana strategies.

-

#4 Raydium AMM: Provide liquidity in NVDAx/USDC pools to earn fees, capitalizing on 3000% tokenized stock growth and Solana’s high-performance trading.

-

#5 Jupiter DEX Aggregator: Achieve optimal routing for NVDAx swaps across Solana DEXs, minimizing slippage for precise trade execution.

-

#6 Drift Protocol: Trade leveraged perpetuals for NVDAx with up to 20x leverage and deep orderbooks, ideal for advanced Solana derivatives.

-

#7 Kraken xStocks: Primary spot trading for NVDAx with high liquidity and $24,719,220 24h volume (NVDAx at $185.06 USD), available to non-U.S. clients 24/7.

Ranking these by relevance, liquidity, and yield potential reveals a maturing ecosystem. Kraken anchors with institutional-grade volume, while Drift caters to leverage hunters. Jupiter and Raydium handle swaps and provision, Kamino/Marginfi optimize yields, and arbitrage closes the loop for alpha extraction. Together, they position trade on-chain Nvidia shares 2026 as a high-conviction play, blending Nvidia’s AI tailwinds with Solana’s infrastructural edge.

Navigating risks remains paramount: oracle divergences, custodian solvency, and regulatory shifts warrant vigilant monitoring. Yet, with NVDAx’s $24 million and daily volumes and 1: 1 backing, the risk-reward skews favorably for diversified allocations. As tokenized equities eclipse $1 billion in market value, Solana platforms like these redefine equity access, empowering global portfolios with precision and speed.