Ondo Finance Onchain Stocks Expansion: Tokenized AI EV Tech Equities Now Live on Blockchain

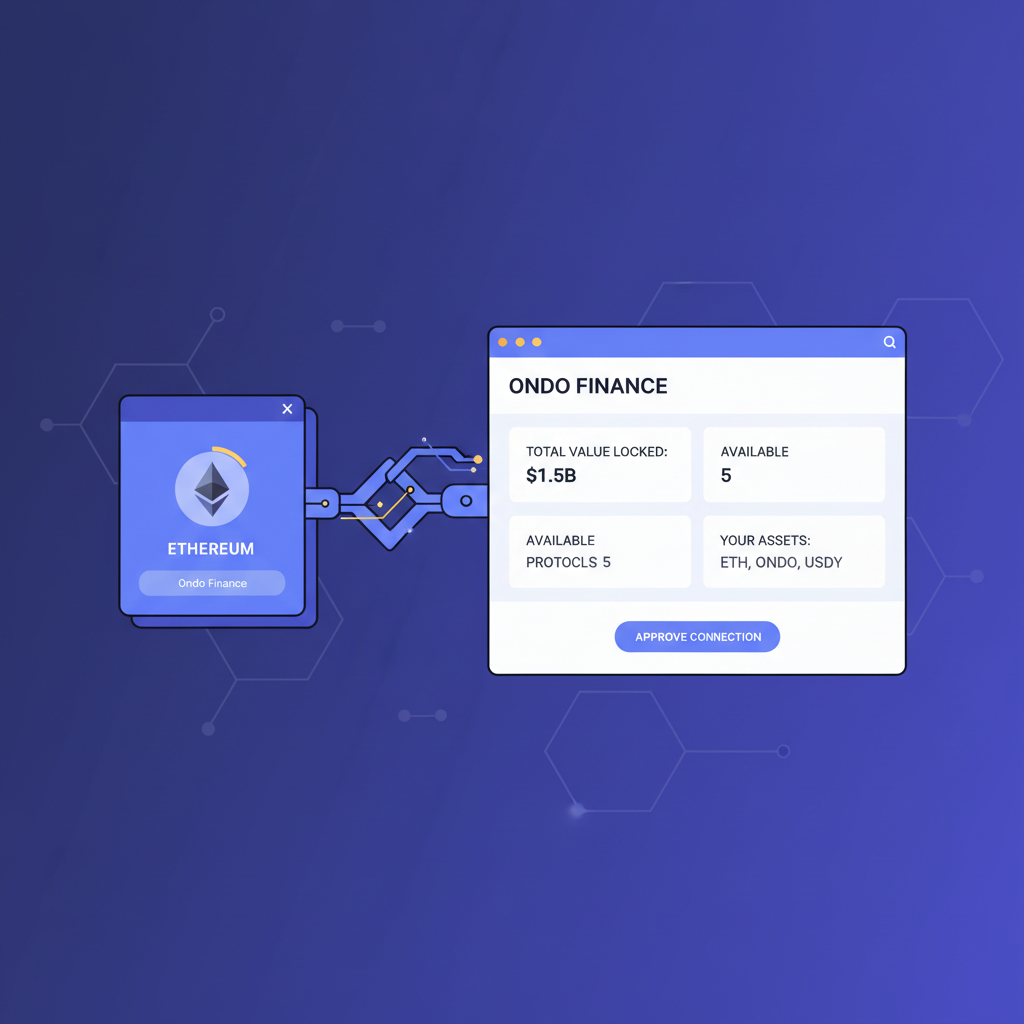

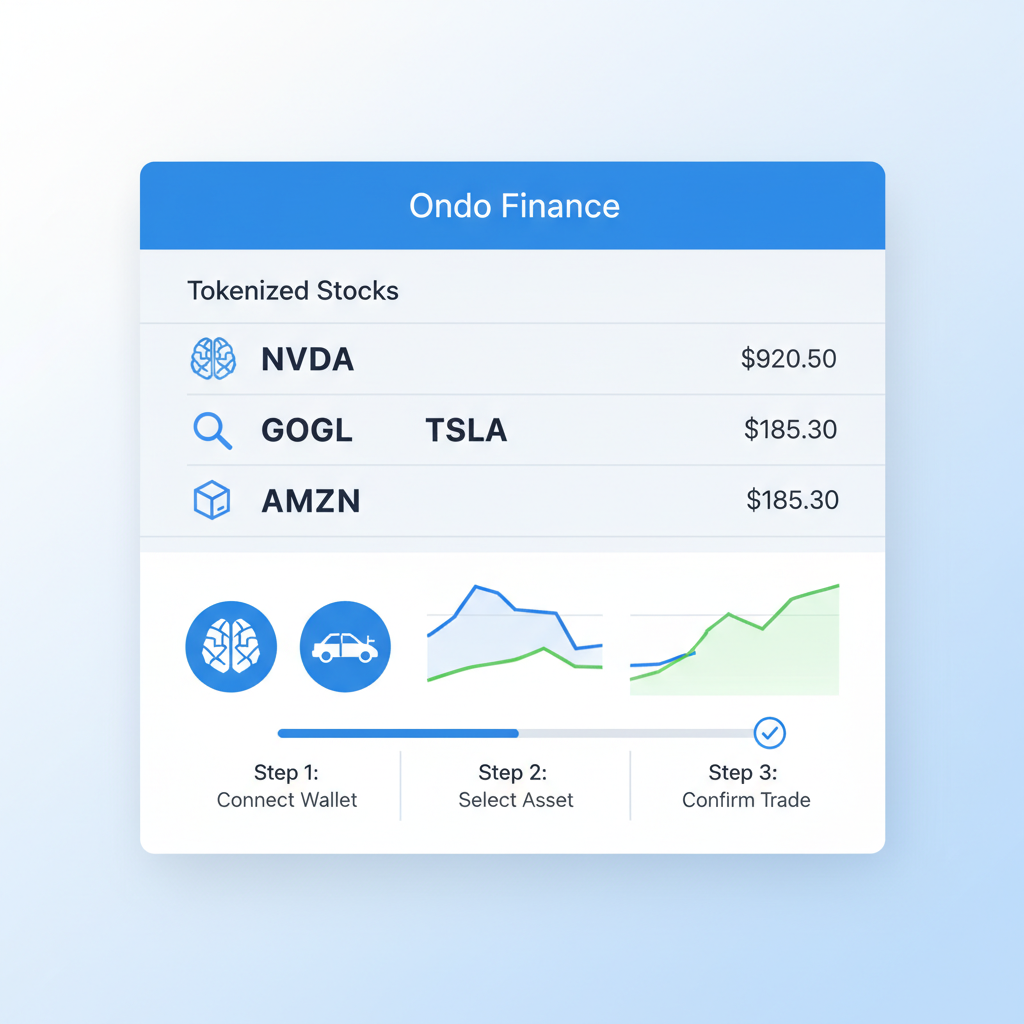

Ondo Finance has just supercharged its onchain equities platform with tokenized AI stocks, EV tech leaders, and other high-growth sectors, making them accessible directly on the blockchain. This expansion through Ondo Global Markets now brings over 100 U. S. stocks and ETFs live, including heavyweights like NVIDIA, Tesla, Apple, and Amazon. Non-U. S. investors, in particular, stand to gain from 24/7 trading without traditional brokerage hurdles, all backed by real U. S. securities held by registered broker-dealers.

At a current price of $0.2666, ONDO reflects measured stability amid this rollout, down just 0.1590% over the past 24 hours from a high of $0.2741 and low of $0.2659. This move isn’t mere hype; it’s a calculated step toward democratizing access to tokenized AI stocks and onchain EV equities, sectors dominating market narratives in 2026.

Ondo Global Markets Unlocks AI and EV Leaders Onchain

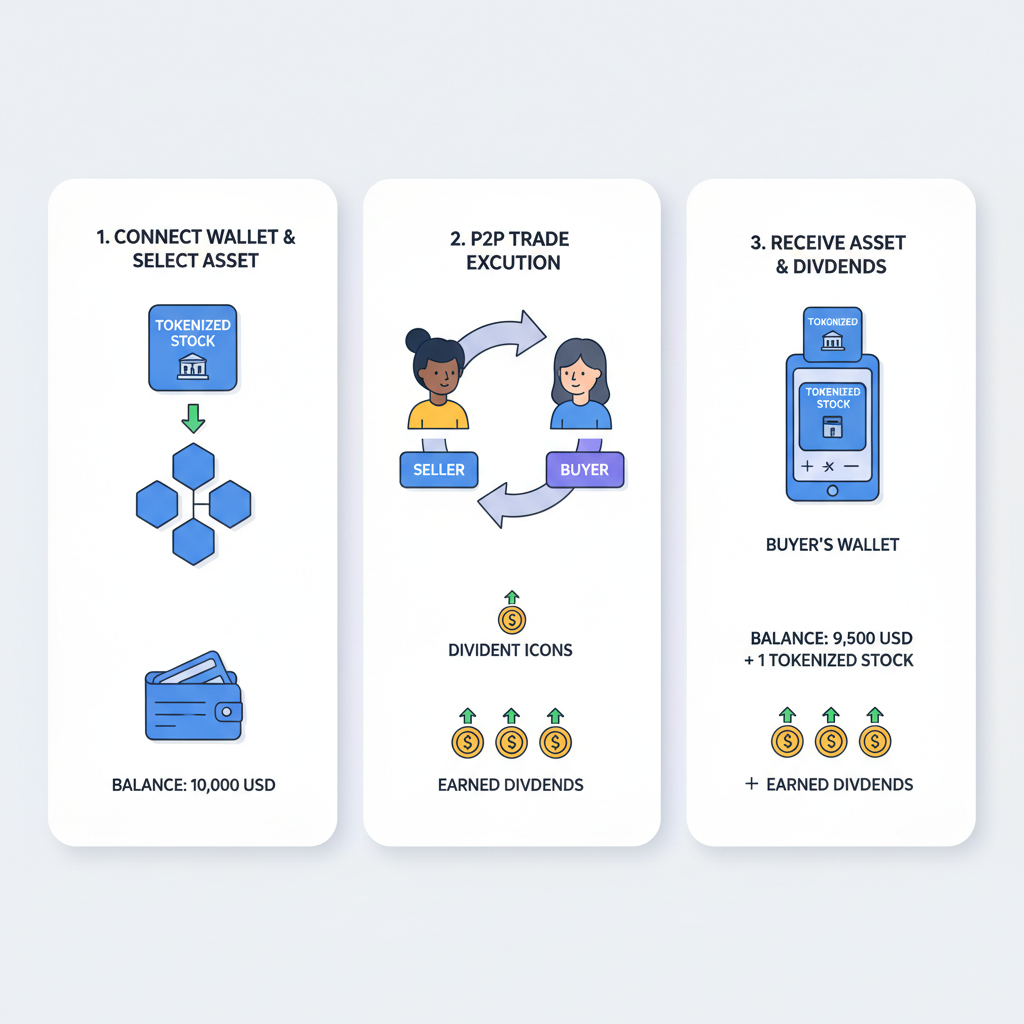

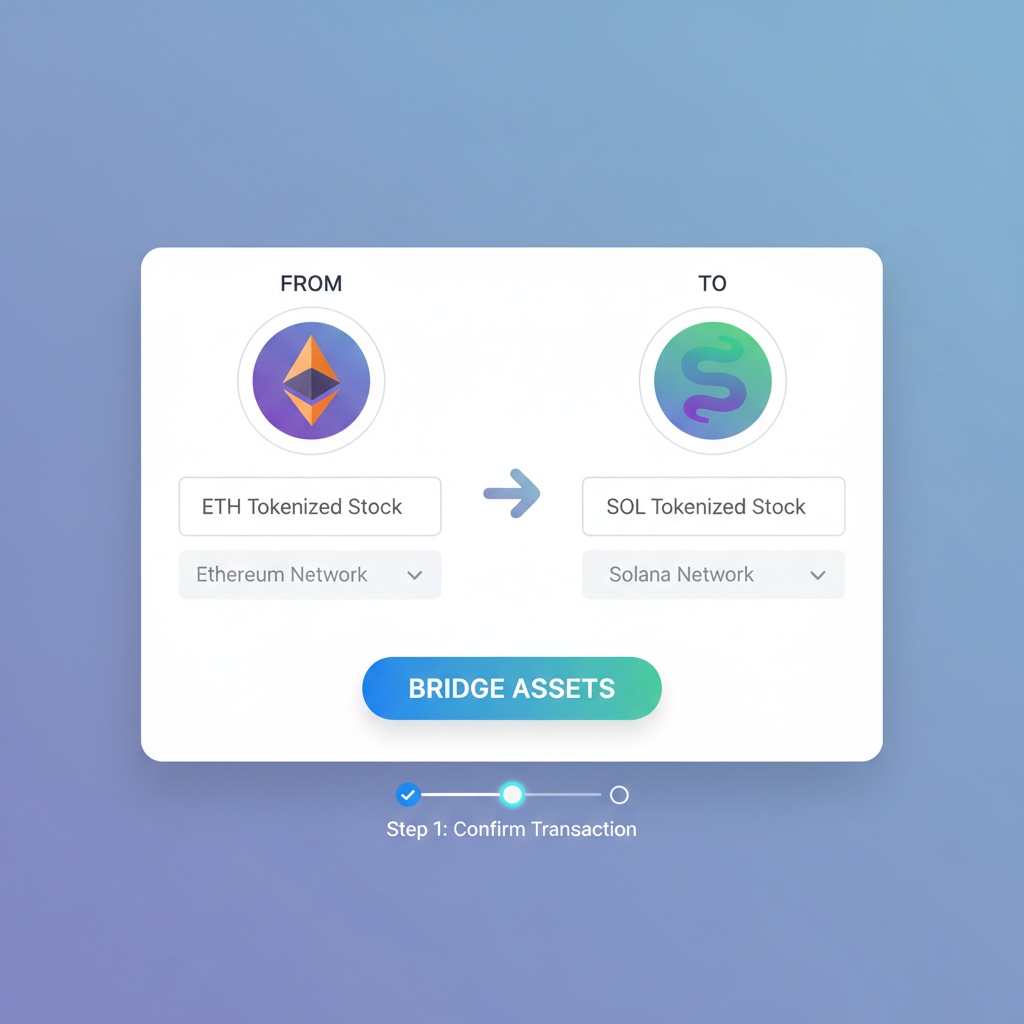

The platform’s Ethereum launch paves the way for expansions to Solana, BNB Chain, and Ondo Chain itself, a proof-of-stake Layer 1 tailored for institutional real-world assets. Token holders get precise economic exposure to underlying assets, capturing dividends net of fees, with full peer-to-peer transferability. Partnerships with custodians like BitGo and Ledger ensure compliance and security, while exchanges such as Phemex and MEXC broaden distribution.

Think about it: tokenized NVIDIA shares for AI exposure, Tesla for EV innovation, all tradable onchain with the liquidity of TradFi but the speed of DeFi. This bridges a persistent gap for global investors shut out of U. S. markets by regulations. Ondo’s approach feels refreshingly pragmatic, prioritizing substance over speculation.

Why Tokenized Tech Equities Matter in Today’s Market

Synthetic tech stocks on blockchain aren’t just a gimmick; they represent a structural shift. With Ondo Global Markets now boasting 200 and tokenized U. S. stocks and ETFs on Solana alone, reaching 3.2 million daily users, liquidity pools deepen daily. Precious metals ETFs like SLV join the fray alongside these tokenized blue chip equities, diversifying beyond pure tech plays.

From a value investor’s lens, this expansion spotlights undervalued opportunities in quantum computing and blue-chip staples amid volatile equities. ONDO’s price at $0.2666 underscores resilience, even as broader crypto markets test supports. The real edge lies in composability: use these tokens as collateral in DeFi protocols or pair with onchain commodities ETFs for hedged portfolios.

Details from the launch highlight full backing and dividend passthrough, critical for long-term holders. As expansions roll out, expect tighter spreads and higher volumes, especially for high-demand synthetic tech stocks blockchain assets.

Strategic Implications for Onchain Investors

Ondo’s institutional-grade infrastructure shines here, designed to mirror TradFi efficiencies onchain. Learn more about their tokenized U. S. stocks push in this deep dive. For those eyeing leveraged plays, while not yet emphasized, the peer-to-peer nature sets the stage for innovative derivatives.

Market data reinforces the timing: AI and EV sectors continue outperforming, with tokenized versions now amplifying that alpha onchain. ONDO’s steady $0.2666 price signals confidence from holders, positioning it as a gateway token for this ecosystem.

Ondo Finance (ONDO) Price Prediction 2027-2032

Forecast based on tokenized equities expansion, RWA adoption, and market cycles from current price of $0.2666

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | $0.25 | $0.35 | $0.50 |

| 2028 | $0.35 | $0.55 | $0.85 |

| 2029 | $0.50 | $0.80 | $1.25 |

| 2030 | $0.70 | $1.10 | $1.75 |

| 2031 | $0.95 | $1.50 | $2.40 |

| 2032 | $1.30 | $2.00 | $3.20 |

Price Prediction Summary

ONDO is poised for significant growth driven by Ondo Finance’s expansion into tokenized AI, EV, and tech equities on blockchain, targeting short-term $0.28-$0.50, medium-term $0.35-$1.10, and long-term up to $3.20 by 2032 in bullish scenarios. Predictions account for market cycles, with conservative mins reflecting potential bear markets and maxes assuming strong RWA adoption.

Key Factors Affecting Ondo Finance Price

- Tokenized U.S. stocks/ETFs expansion (NVIDIA, Tesla, etc.) boosting utility and TVL

- Partnerships with Solana, BNB Chain, Ondo Chain, Phemex, MEXC for wider access

- RWA sector growth amid institutional adoption and regulatory clarity

- Competition in tokenization but Ondo’s first-mover advantage in equities

- Crypto market cycles: bull runs post-2026 halving could amplify gains

- Technological upgrades like Ondo Chain enhancing scalability and security

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Investors can now compose sophisticated strategies, layering tokenized blue chip equities with onchain commodities ETFs for balanced exposure. This flexibility elevates Ondo beyond simple tokenization into a full-fledged onchain asset hub.

Navigating Tokenized AI Stocks and Onchain EV Equities

Accessing these assets starts with understanding the mechanics. Ondo Global Markets tokens mirror their TradFi counterparts economically, backed one-to-one by U. S. securities. For instance, holding tokenized NVIDIA provides AI sector upside, complete with dividend accrual, minus minimal fees. Tesla’s onchain EV equities offer similar purity of play, tradable around the clock.

Discover more on Ondo Finance powering 24/7 trading of tokenized U. S. stocks onchain. Such seamless integration appeals to my value investing roots, where timing and liquidity define alpha.

Yet, data tells a fuller story. ONDO at $0.2666 holds firm, its 24-hour range from $0.2659 to $0.2741 signaling low volatility ideal for accumulation. Expansions to Solana tap 3.2 million users, potentially spiking volumes for synthetic tech stocks blockchain.

Key Tokenized Stocks

| Stock | Ticker | Sector | 24h Perf. | Ondo Token Symbol |

|---|---|---|---|---|

| NVIDIA | NVDA | AI | 2.1% | oNVDA |

| Tesla | TSLA | EV | -0.8% | oTSLA |

| Apple | AAPL | Tech | 1.2% | oAAPL |

| Amazon | AMZN | Tech | 0.9% | oAMZN |

This table spotlights leaders now live, with performance tied to underlying assets. Diversify into quantum or value plays as Ondo lists grow, blending growth with stability.

Balancing Opportunities and Challenges

Tokenized equities shine for non-U. S. investors, bypassing KYC walls and time zones. Peer-to-peer transfers via BitGo and Ledger custody add trust layers. But smart money weighs risks: smart contract vulnerabilities, regulatory flux, and basis risk between token and stock prices. Ondo’s institutional design mitigates much, yet vigilance remains key.

From 15 years scanning markets, I see tokenized AI stocks as undervalued bridges to megatrends. EV tech follows suit, with Tesla’s tokenized shares capturing battery breakthroughs onchain. ONDO’s $0.2666 price, down a mere 0.1590% daily, reflects this maturation, not frenzy.

Partnerships with Phemex and MEXC accelerate adoption, funneling retail flows into these pools. Check Ondo’s push on transforming on-chain stocks and tokenized equities in 2025 for forward views.

Ondo Global Markets positions tokenized blue chip equities as everyday tools, not novelties. Pair leveraged tokenized stocks hypotheticals with onchain commodities ETFs for resilience. As chains multiply, liquidity surges, drawing institutions wary of pure crypto.

ONDO’s steady $0.2666 anchors this ecosystem, rewarding patient holders. Track expansions; the next wave in AI, EV, and beyond redefines value investing onchain.