How Tokenized Stocks on Solana Are Attracting a New Wave of On-Chain Investors

The landscape of equity investment is undergoing a seismic shift, and at the heart of this transformation sits Solana. Once known primarily for its speed and efficiency in DeFi, Solana now commands attention as a leading platform for tokenized stocks and on-chain equities. With the latest price for Binance-Peg SOL (SOL) standing at $211.64, investors are flocking to Solana’s ecosystem, drawn by its unique blend of rapid settlement, low fees, and seamless DeFi integration. This new wave of on-chain investors is not only reshaping how we trade equities but also redefining access to global markets.

Why Solana? The Technical Edge in Tokenized Equities

Solana’s rise in the tokenized assets space is no accident. Its high-throughput architecture processes thousands of transactions per second with minimal latency and transaction costs – features that are critical when trading synthetic equities or tokenized versions of real-world stocks. Platforms like Kraken’s xStocks have chosen Solana as their foundation precisely because it enables instant settlement and 24/7 trading. This infrastructure advantage has allowed Solana to capture approximately 58% of the tokenized stock trading market within just six weeks of major launches.

But what truly sets Solana apart is its ability to facilitate fractional ownership and real-time liquidity. Investors can now hold fractions of high-value equities like Apple or Tesla without the friction typical of traditional brokerages. Every tokenized share on Solana is backed 1: 1 by real shares held with regulated custodians, ensuring both transparency and security.

A Surge in Adoption: $500 Million On-Chain Volume in Weeks

The numbers tell a compelling story. As of August 2025, cumulative on-chain volume for tokenized stocks on Solana reached nearly $500 million within six weeks of launch (source). This explosive growth highlights not just curiosity but genuine adoption by a global cohort of investors seeking alternatives to legacy financial rails.

Major players are taking notice. Galaxy Digital recently partnered with Superstate to tokenize its Class A Common Stock directly on the Solana blockchain – a move that signals increasing institutional confidence in on-chain equity infrastructure. Meanwhile, exchanges such as Robinhood, Kraken, and Coinbase are racing to offer their own tokenization solutions, further validating the sector’s momentum (read more here).

The New Investor Profile: Who’s Joining the On-Chain Revolution?

The appeal of Solana stock trading extends far beyond crypto natives. Traditional investors frustrated by after-hours limitations or opaque settlement processes are finding new freedom in tokenized markets. The ability to trade synthetic equities around the clock – often with tighter spreads and lower minimums – has democratized access in ways previously unimaginable.

Solana (SOL) Price Prediction Table: 2026-2031

Professional outlook based on Solana’s leading role in tokenized stocks and on-chain finance adoption. Assumes continued growth in tokenized assets, evolving regulatory clarity, and advances in Solana’s ecosystem.

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | % Change (Avg vs. Prev Year) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $185.00 | $245.00 | $315.00 | +16% | Sustained tokenized stock adoption; moderate market volatility |

| 2027 | $210.00 | $295.00 | $400.00 | +20% | Expansion of DeFi and tokenized assets; increased institutional adoption |

| 2028 | $250.00 | $360.00 | $495.00 | +22% | Regulatory clarity in major markets; Solana upgrades and scaling |

| 2029 | $290.00 | $430.00 | $595.00 | +19% | Mainstream integration of tokenized stocks; global investor participation |

| 2030 | $340.00 | $515.00 | $710.00 | +20% | Wider tokenization of real-world assets; cross-chain interoperability |

| 2031 | $390.00 | $610.00 | $850.00 | +18% | Mature tokenized markets; Solana solidifies position as top Layer 1 for financial assets |

Price Prediction Summary

Solana is projected to see steady price appreciation over the next six years, driven by its dominance in tokenized stocks, growing DeFi integration, and continued technological advancements. While short-term volatility is expected, the long-term outlook remains bullish, especially if regulatory frameworks support further institutional adoption and real-world asset tokenization.

Key Factors Affecting Solana Price

- Rapid growth of tokenized stocks and on-chain financial products on Solana

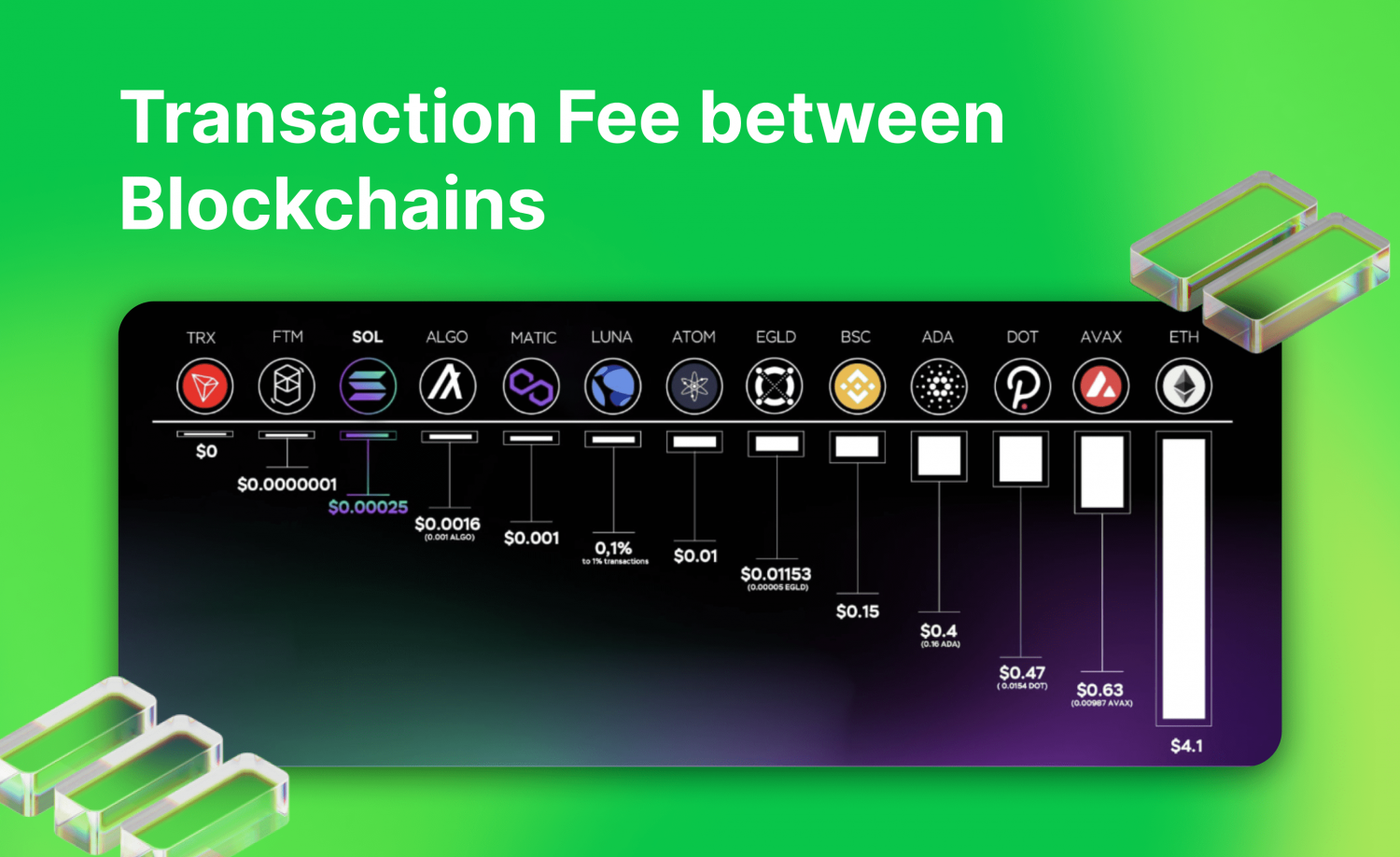

- Solana’s technical scalability and low transaction costs compared to competitors

- Regulatory developments impacting tokenized securities and DeFi

- Broader adoption of blockchain and tokenization by traditional finance institutions

- Potential network upgrades and ecosystem expansion

- Market cycles, macroeconomic factors, and competition from other Layer 1 blockchains

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Younger generations especially are embracing these innovations, attracted by transparent blockchain records and integration with DeFi protocols for yield opportunities. At the same time, seasoned institutional traders are leveraging on-chain assets for portfolio diversification and arbitrage strategies.

As the network effect grows, so does the ecosystem of tools and platforms supporting on-chain equities on Solana. Wallets, analytics dashboards, and liquidity pools are rapidly evolving to serve this new breed of investor. The result is a vibrant marketplace where retail and institutional participants can interact with tokenized assets in real time, with full transparency into order books and settlement flows. This level of accessibility is fundamentally changing expectations for what equity markets can offer.

Navigating Risks and Regulatory Hurdles

No innovation comes without its challenges. While enthusiasm for Solana blockchain tokenized assets is palpable, investors must remain mindful of evolving regulatory frameworks. Jurisdictional restrictions still apply, most platforms offering tokenized U. S. equities on Solana are limited to non-U. S. users due to securities laws. Additionally, questions around custody, compliance, and auditability are top of mind for both investors and regulators.

However, many leading projects are proactively addressing these concerns by partnering with regulated custodians and providing regular third-party audits. The use of smart contracts enhances transparency by automating compliance checks and settlement processes, an advantage over legacy systems that often rely on manual reconciliation.

Key Benefits and Risks of Tokenized Stocks on Solana

-

24/7 Trading Access: Tokenized stocks on Solana, available through platforms like Kraken xStocks, enable investors to trade U.S. equities and ETFs around the clock, breaking free from traditional market hours.

-

Fractional Ownership: Solana-based tokenized stocks allow investors to purchase fractions of high-value shares, such as Apple or Tesla, making blue-chip investments more accessible to a broader audience.

-

Fast, Low-Cost Transactions: With Solana’s high-speed blockchain and low transaction fees (Binance-Peg SOL price: $211.64 as of latest data), investors benefit from near-instant settlements and minimal costs compared to traditional brokers.

-

DeFi Integration: Tokenized stocks on Solana can be used within decentralized finance protocols, enabling features like lending, borrowing, and yield generation, as seen with integrations on platforms such as Jupiter Exchange.

-

Transparency and Security: Each tokenized stock is backed 1:1 by real shares held with regulated custodians, ensuring transparency and reducing counterparty risk for investors.

-

Liquidity Risks: While Solana-based tokenized stocks have reached nearly $500 million in on-chain volume, the market is still emerging, and liquidity can vary significantly between assets and platforms.

-

Regulatory Uncertainty: The evolving legal landscape for tokenized equities means investors face potential changes in regulations, which could impact access or trading of these assets on platforms like Kraken, Robinhood, or Coinbase.

-

Custodial and Technical Risks: Dependence on third-party custodians and smart contract code introduces risks related to custody failures or technical vulnerabilities, as highlighted by the nascent stage of tokenized stock technology.

What’s Next? The Path Forward for Solana Synthetic Equities

The trajectory for Solana synthetic equities points toward continued growth as both technology and regulation mature. With Binance-Peg SOL (SOL) currently trading at $211.64, the platform is well-positioned to attract even greater liquidity as more blue-chip stocks, ETFs, and pre-IPO shares become available in tokenized form.

In the coming year, expect further integration between tokenized stocks and DeFi protocols, enabling everything from instant collateralization to automated portfolio rebalancing directly on-chain. As interoperability standards improve, we may see seamless bridging between Solana-based assets and those issued on other leading blockchains like Ethereum or Polygon.

The next wave of financial innovation will be shaped not just by speed or cost but by transparency, inclusivity, and programmability, qualities that define Solana’s approach to on-chain equities.

How to Get Started with Tokenized Stocks on Solana

If you’re considering entering this space, begin with thorough research into reputable platforms such as Kraken’s xStocks or Galaxy Digital’s GLXY tokens. Always verify that your chosen provider works with regulated custodians who offer clear proof-of-reserves for underlying shares.

The rapid ascent of tokenized stocks Solana reflects a broader shift toward borderless finance, one where markets never sleep and opportunities abound for those willing to embrace change thoughtfully. Whether you’re a seasoned investor or just beginning your journey into digital equities, the tools now exist to invest for tomorrow, today.