How Synthetic Stocks Work: Risks, Rewards, and What On-Chain Investors Must Know

Synthetic stocks on blockchain platforms are rapidly reshaping how investors access and trade equity exposure. These digital instruments, engineered through smart contracts, mirror the price movements of real-world equities like Tesla (TSLA) or Apple (AAPL) without conferring actual share ownership. As the SEC signals openness to blockchain-based stock trading and major exchanges like Nasdaq propose rule changes for tokenized securities, the landscape is evolving fast. Yet, this innovation comes with unique risks and rewards that every on-chain investor must understand.

Mechanics of Synthetic Stocks: How On-Chain Exposure Works

At their core, synthetic stocks are on-chain synthetic assets created by decentralized finance (DeFi) protocols. These protocols deploy smart contracts that define each asset’s parameters, including its underlying reference (e. g. , TSLA), leverage options, and expiry terms. Price tracking relies on decentralized oracles to feed real-time data into the contract, ensuring the synthetic asset’s value closely follows its real-world counterpart.

To trade a synthetic stock, users deposit collateral, often Ethereum (ETH) or stablecoins such as USDC, into liquidity pools. The platform’s smart contracts automatically manage positions, profits, and liquidations based on live price feeds. For example, if a leveraged position falls below margin requirements due to price movement, the contract will liquidate it to protect the protocol’s solvency.

This architecture allows for seamless global trading without intermediaries or traditional brokerage accounts. The result is a 24/7 market where anyone can gain exposure to U. S. equities or international stocks regardless of geographic restrictions or local regulatory barriers.

Key Rewards: Why Investors Are Flocking to Synthetic Equities

Key Advantages of Synthetic Stocks for On-Chain Investors

-

Global Accessibility: Synthetic stocks enable investors worldwide to gain exposure to equities like Tesla (TSLA) without the need for traditional brokerage accounts or regional compliance barriers. This democratizes access to major stock markets. Source

-

Blockchain Transparency: All synthetic stock transactions are recorded on public blockchains, allowing for real-time auditing and increased investor confidence through verifiable, tamper-resistant records. Source

-

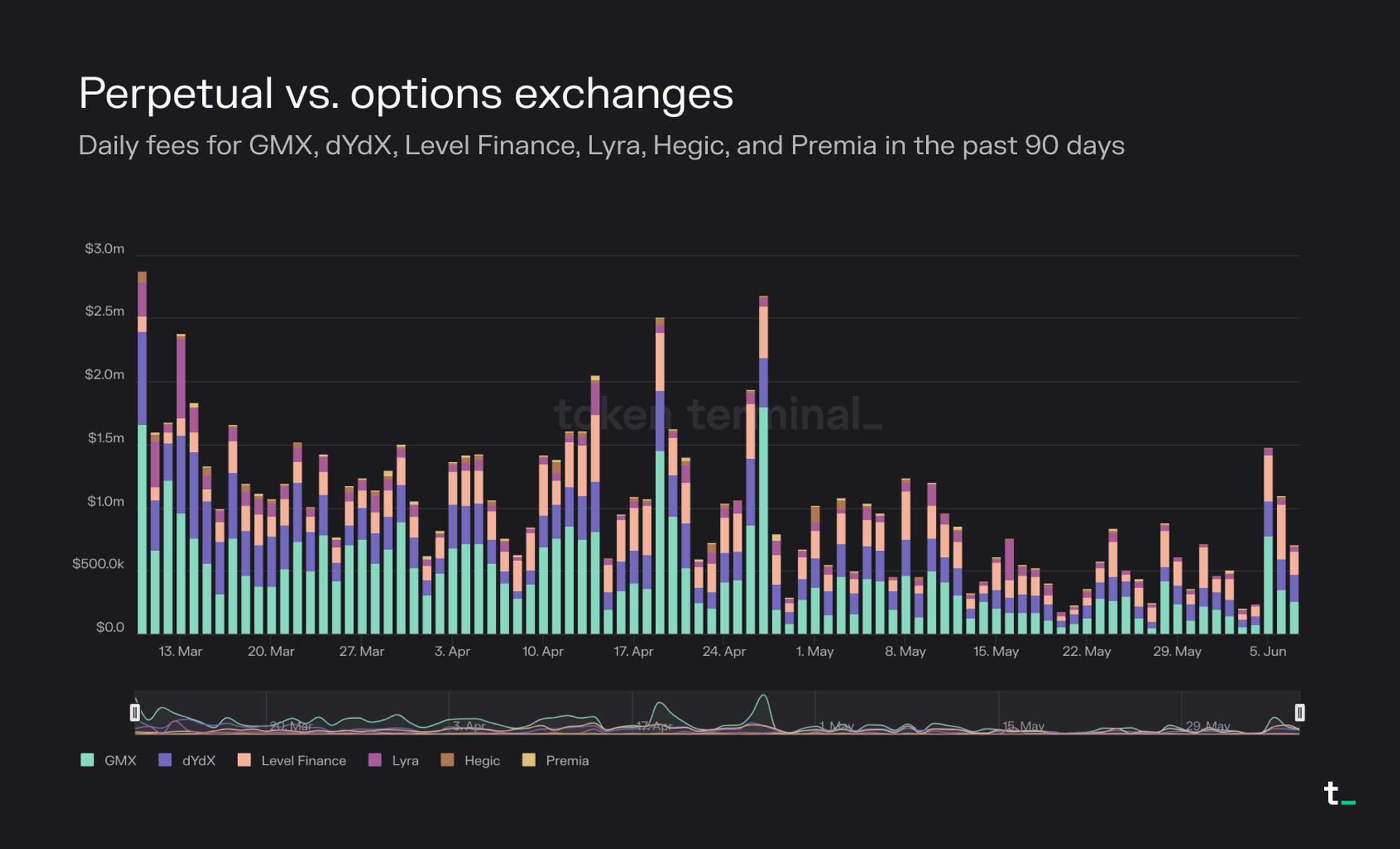

Cost Efficiency: By utilizing decentralized exchanges (DEXs) and eliminating intermediaries, synthetic stocks often feature lower trading fees. For example, GMX charges approximately 0.1% per trade, undercutting many centralized platforms. Source

-

Deep Liquidity: DeFi protocols like dYdX and Synthetix aggregate liquidity from global users, facilitating efficient entry and exit from positions even at high volumes. dYdX, for instance, regularly reports significant daily trading volumes. Source

-

Innovative Investment Strategies: Synthetic assets allow exposure to a wide range of stocks and indices without direct ownership, supporting portfolio diversification and the creation of advanced strategies such as leveraged or inverse positions. Source

The surge in adoption of synthetic stocks on blockchain platforms is driven by several compelling benefits:

- Accessibility: Global investors can participate without conventional brokerage hurdles, democratizing access to major equities markets.

- Transparency: Every transaction is recorded on-chain for real-time auditing, investors can verify trades and holdings directly.

- Cost Efficiency: DeFi platforms typically offer lower fees than centralized brokers; for instance, GMX charges about 0.1% per trade (source).

- Liquidity: Deep liquidity pools enable easy entry and exit from positions, even during volatile periods, with DEXs like dYdX reporting robust daily volumes (source).

- Innovation: Synthetic equities unlock new strategies such as cross-market hedging and asset diversification without direct ownership constraints.

This combination of features makes synthetic stocks especially attractive for sophisticated traders seeking efficiency and flexibility in their portfolios.

The Risk Landscape: What On-Chain Investors Must Watch

No discussion about synthetic equities risks is complete without addressing their vulnerabilities. While smart contracts automate many functions, they are not immune to critical bugs or exploits, as seen in the $49.5 million Infini protocol hack in early 2025 (source). High leverage offerings (sometimes up to 100x) can amplify both gains and losses, exposing traders to rapid liquidations during volatile swings.

Synthetic assets also depend heavily on decentralized oracles for price feeds. Manipulated or faulty data can lead to unfair liquidations or mispricing events, undermining trust in the protocol. Liquidity fragmentation across competing DeFi derivatives platforms further increases slippage risks for large trades.

Perhaps most critically, regulatory uncertainty looms large in 2025. Some jurisdictions treat these products as unregulated derivatives lacking traditional investor rights such as dividends or voting power (source). This can create confusion about legal protections and recourse in the event of disputes or platform failures.

Another fundamental distinction for on-chain investors is understanding what synthetic stocks do not provide. Unlike tokenized equities, which may represent actual shares held in a custodian structure, most synthetic stocks grant no legal ownership, voting rights, or direct dividend entitlement. Instead, they offer price exposure only. This means that while your portfolio may track the performance of Apple or Tesla, you are not entitled to participate in shareholder meetings or receive official dividend distributions.

“Synthetic stock platforms often advertise global access and low fees, but investors must recognize that these products are derivatives, not shares. The absence of traditional rights is a key regulatory and risk consideration. ”

As global regulators intensify scrutiny, the difference between synthetic vs tokenized stocks is becoming more relevant. For example, the SEC’s evolving stance and Nasdaq’s proposed rule changes indicate a future where tokenized securities could offer a regulated path for digital equities. However, most current synthetic assets remain outside these frameworks, operating in a legal gray zone that can change rapidly.

Navigating the Market: Best Practices for On-Chain Synthetic Asset Investors

Given these complexities, prudent investors should adopt a disciplined approach. Here’s a concise checklist to help manage exposure and risk:

- Vet Smart Contract Audits: Only use platforms with recent, reputable third-party audits and a track record of responding to vulnerabilities.

- Understand Collateralization: Review the platform’s collateral requirements and liquidation mechanisms, especially if using leverage.

- Monitor Oracle Design: Favor protocols with decentralized, multi-source oracles and robust fallback mechanisms to reduce manipulation risk.

- Stay Informed on Regulation: Track developments from bodies like the SEC or ESMA that could impact platform legality or investor protections.

- Diversify Exposure: Avoid concentrating capital in a single protocol or asset; allocate across multiple platforms and asset classes.

For those seeking a summary of the most common risks and rewards, see the quick-reference table below:

Synthetic Stocks: Key Benefits vs. Core Risks

| Aspect | Key Benefits | Core Risks |

|---|---|---|

| Accessibility | Global participation without traditional brokerage accounts or regional restrictions; democratizes access to U.S. and global equities. | Regulatory uncertainty—classification varies by jurisdiction, potential for sudden legal changes or delistings. |

| Transparency | All transactions are recorded on-chain, enabling real-time auditing and reducing manipulation risk. | Smart contract vulnerabilities—bugs or exploits (e.g., Infini protocol’s $49.5M hack in Feb 2025) can lead to significant losses. |

| Cost Efficiency | Lower trading fees by eliminating intermediaries (e.g., ~0.1% per trade on platforms like GMX). | Liquidity fragmentation—multiple DeFi protocols can split liquidity, increasing slippage and complicating large trades. |

| Liquidity | Deep liquidity pools on DeFi platforms facilitate easy entry and exit (e.g., high daily volumes on dYdX). | Oracle manipulation—reliance on external data feeds can result in mispricing or unfair liquidations if oracles are compromised. |

| Innovation | Exposure to diverse assets and strategies without direct ownership; enables portfolio diversification and novel investment approaches. | High leverage risks—platforms offering up to 100x leverage (e.g., Hyperliquid) can amplify losses, especially during volatility. |

| — | — | Market volatility—synthetic assets mirror underlying stock swings, leading to potential rapid losses, especially with leverage. |

Synthetic Stock Regulation 2025: The Road Ahead

The next phase for synthetic stock regulation 2025 will likely be defined by greater regulatory clarity and technical innovation. As major exchanges and regulators experiment with blockchain-based securities, we may see hybrid models emerge that combine the efficiency of DeFi infrastructure with traditional investor protections, such as pass-through voting rights or automated dividend distribution (source).

Until then, on-chain investors must balance the upside of borderless equity exposure against unresolved questions around legal status and platform security. The market is moving rapidly, but fundamentals remain: rigorous due diligence, risk management, and staying informed are essential for anyone engaging with on-chain synthetic assets.