How Tokenized U.S. Treasuries and Stocks Are Transforming On-Chain Investment Opportunities

Tokenization is rewriting the rules of capital markets, moving real-world assets like U. S. Treasuries and equities onto public blockchains. What was once a vision for the distant future has become today’s headline: tokenized U. S. Treasuries reached $7.4 billion in assets under management by mid-2025, while tokenized stocks have surged to $412 million. These numbers aren’t just statistics, they represent a seismic shift in how investors access, trade, and collateralize traditional assets in a digital-first world.

The New Frontier: Tokenized U. S. Treasuries Hit $7.4 Billion

Let’s start with the juggernaut: U. S. Treasury securities. Once confined to legacy custodians and business-hour trading desks, these bedrocks of global finance now flow freely on-chain, and at scale.

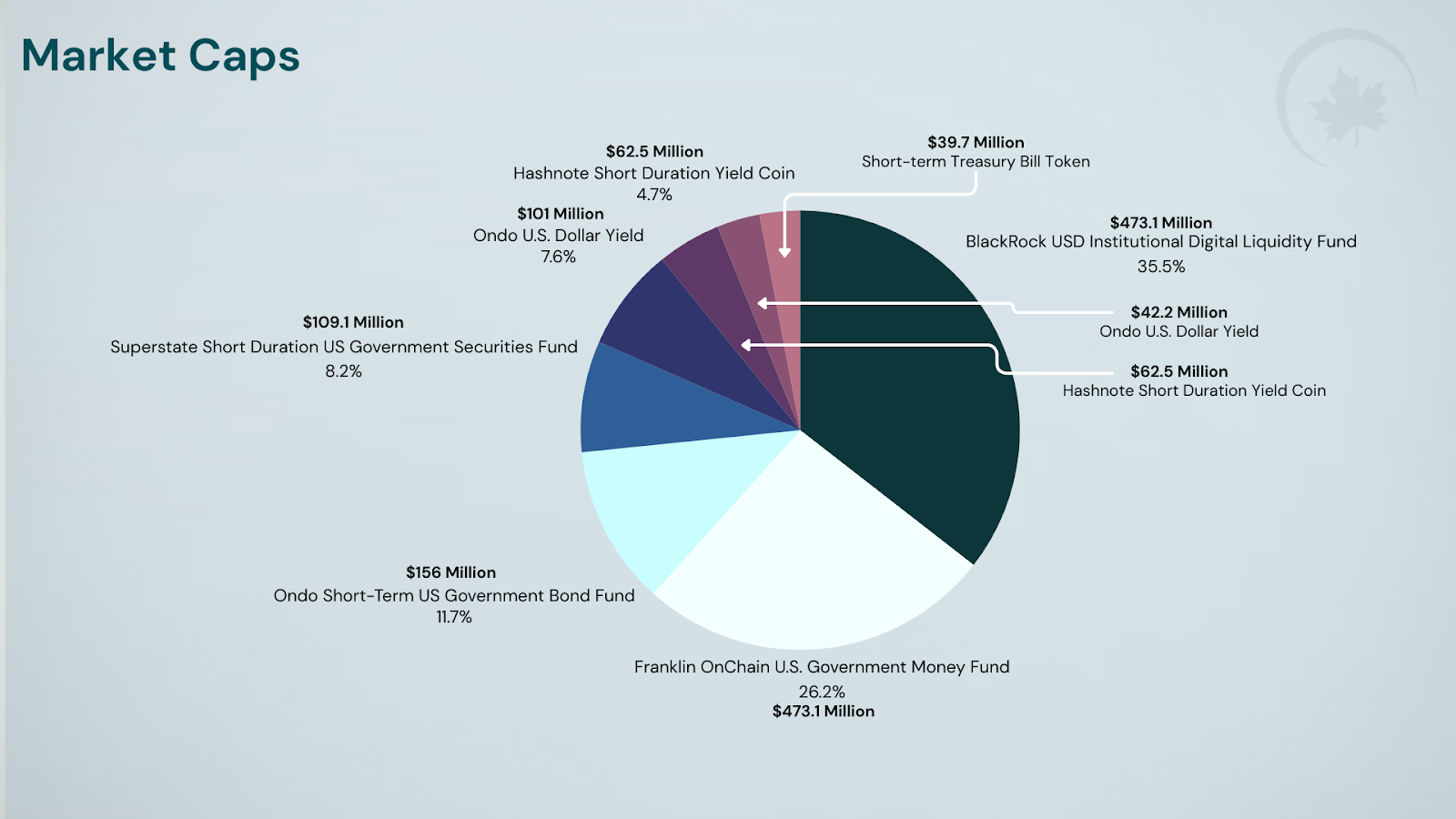

Three key players are leading this transformation:

- BlackRock’s BUIDL Fund: Launched in March 2024, it amassed $2.9 billion by September 2025, offering stable yields and on-chain collateral utility for DeFi protocols.

- Franklin Templeton’s BENJI Fund: With $753.8 million AUM by mid-2025, BENJI provides direct exposure to U. S. government securities via programmable tokens.

- Ondo Finance’s OUSG Token: Designed for stablecoin holders seeking yield, OUSG bridges crypto-native liquidity with off-chain fixed income markets.

This explosive growth, up more than 500% since early 2024, has institutional investors taking notice. According to recent data, tokenized Treasury products now command nearly 88% of the market share among tokenized fixed-income assets. The appeal? Around-the-clock trading, instant settlement, fractional ownership, and seamless integration with DeFi platforms.

Key Benefits of Tokenized U.S. Treasuries for On-Chain Investors

-

24/7 Trading and Enhanced Liquidity: Tokenized U.S. Treasuries can be traded at any time, providing continuous market access and significantly improving liquidity compared to traditional markets. This round-the-clock trading is especially valuable for global investors and DeFi participants.

-

Fractional Ownership and Lower Barriers to Entry: Investors can purchase small fractions of Treasury securities, making these high-quality assets accessible to a wider audience. This democratizes investment opportunities and allows for more diversified portfolios.

-

Seamless Integration with DeFi Platforms: Tokenized Treasuries, such as BlackRock’s BUIDL Fund and Ondo Finance’s OUSG Token, can be used as on-chain collateral or within decentralized finance protocols, enabling innovative yield strategies and lending products.

-

Programmable and Automated Asset Management: Through smart contracts, tokenized Treasuries can be managed automatically, enabling features like instant settlement, automated interest distribution, and compliance checks, streamlining the investment process.

-

Global Accessibility and Cross-Border Investment: On-chain Treasuries can be accessed by investors worldwide without the need for traditional intermediaries, reducing friction and opening U.S. government securities to a truly global market.

The real kicker is accessibility: anyone with an internet connection can hold a slice of the most trusted asset class on earth, no Wall Street gatekeepers required. As adoption widens, expect new yield strategies and cross-border investment flows that simply weren’t possible before tokenization (see how tokenized treasuries unlock cross-border investment opportunities).

Tokenized Stocks: From Niche to $412 Million Market

If Treasuries are the safe harbor, tokenized stocks are the high seas, volatile but full of promise for those willing to navigate regulatory waters.

The market for tokenized equities has exploded from just a few million dollars last year to $412 million by September 2025. Major crypto platforms like Robinhood, Gemini, Kraken, and Coinbase have all launched digital stock offerings that mimic blue-chip shares such as Apple or Tesla, except these tokens trade globally, 24/7.

This new breed of synthetic equity enables fractional ownership down to the cent and instant settlement across borders. For retail investors locked out by minimum lot sizes or regional restrictions in traditional finance, it’s nothing short of revolutionary.

The catch? Many current offerings operate more like derivatives than true shares, they lack voting rights or dividend entitlements and raise thorny questions around custody and investor protections (learn how institutional investors use tokenized Treasuries as a digital safe haven). Regulatory clarity remains elusive as authorities struggle to keep pace with innovation.

Bigger Than Hype: The Expanding Tokenized Assets Market

The numbers speak volumes about momentum, and potential:

- $7.4 billion: Tokenized U. S. Treasuries (mid-2025)

- $412 million: Tokenized stocks (September 2025)

- $30 and billion: Total value of all blockchain-tokenized real-world assets (2025)

This represents only a small fraction of global asset markets but signals an exponential growth curve ahead; some forecasts see U. S. tokenized assets reaching nearly $688 billion by 2034 if current trajectories hold steady.

The implications are profound: programmable logic allows for automated compliance checks and instant settlement; composability means these assets can be used as collateral or building blocks within DeFi protocols; borderless access democratizes wealth creation like never before (explore how tokenization enables global dollar access and yield around-the-clock). The forest is vast, but if you know where to look, the trees are ripe for picking.

Yet, the path forward isn’t without obstacles. The regulatory landscape is fragmented and evolving unevenly across jurisdictions. For tokenized U. S. Treasuries, institutional players have largely embraced compliance-first frameworks, but tokenized stocks often occupy a gray area, caught between securities law and the realities of decentralized trading. This tension creates both risk and opportunity for early adopters.

Liquidity is the lifeblood of any market, and here tokenization delivers in spades. With round-the-clock trading and global access, on-chain assets are eroding the traditional boundaries of time zones and settlement cycles. We’re already seeing DeFi protocols leverage tokenized Treasuries as pristine collateral for lending, stablecoin minting, or even as yield-bearing instruments in composable strategies.

What’s Next? Tokenization’s Unstoppable Momentum

As more asset classes migrate on-chain, from real estate to private credit, the lines between traditional finance and crypto-native innovation will continue to blur. Tokenized U. S. Treasuries are already serving as a digital safe haven during periods of crypto volatility, while synthetic equities offer exposure to global growth stories without legacy frictions.

For investors, this means new portfolio construction tools that combine the stability of sovereign debt with the upside potential of equities, all programmable and instantly accessible from a wallet or dApp interface. The next wave could see pension funds, insurers, and sovereign wealth managers allocating directly into on-chain vehicles as regulatory clarity improves.

Five Ways Tokenized Assets Are Changing Investment Strategies in 2025

-

1. 24/7 Trading and Enhanced LiquidityTokenized U.S. Treasuries and stocks are available for trading around the clock, unlike traditional markets with limited hours. This continuous access boosts market liquidity, allowing investors to respond instantly to global events and manage risk more dynamically.

-

2. Fractional Ownership Lowers BarriersTokenization enables investors to buy fractions of high-value assets, such as U.S. Treasuries or blue-chip stocks. This democratizes access, letting individuals participate in markets previously reserved for large institutions or wealthy investors.

-

3. Seamless Integration with DeFi PlatformsTokenized assets like BlackRock’s BUIDL Fund and Ondo Finance’s OUSG Token can be used as collateral or traded within decentralized finance (DeFi) protocols. This unlocks new yield opportunities and innovative financial products beyond traditional finance.

-

4. Institutional Adoption Drives Market GrowthMajor asset managers—including BlackRock and Franklin Templeton—are launching tokenized Treasury funds, fueling rapid market expansion. By mid-2025, tokenized U.S. Treasury assets under management reached approximately $7.4 billion, reflecting growing institutional confidence and participation.

-

5. Regulatory Evolution and Investor Protection ChallengesThe surge in tokenized stocks—reaching $412 million by September 2025—has prompted calls for clearer regulations. As these assets often lack traditional shareholder rights, evolving oversight is essential to safeguard investors and ensure market integrity.

But it’s not just about speculation or yield-chasing; programmable assets enable entirely new forms of financial engineering, think automated dividend payouts, dynamic risk management via smart contracts, or global syndication of capital for infrastructure projects at unprecedented speed (see how Ethereum-based Treasuries are reshaping institutional yield strategies).

The numbers provides $7.4 billion in tokenized U. S. Treasuries and $412 million in tokenized stocks, are just the tip of the iceberg if current growth rates persist. With an anticipated market size approaching $688 billion by 2034 for U. S. tokenized assets alone, we’re witnessing a generational shift in capital markets architecture.

See the forest, spot the trees: The winners will be those who understand both macro trends and micro opportunities, bridging old-world finance with tomorrow’s programmable economy.