Trading Tokenized AAPL TSLA NVDA Stocks 24/7 on Telegram Wallet via Kraken BackedFi

In the ever-accelerating fusion of traditional finance and blockchain, Telegram’s Wallet now unlocks 24/7 trading of tokenized AAPL, TSLA, and NVDA stocks directly within the app. This isn’t just another crypto gimmick; it’s a strategic pivot that democratizes access to U. S. equities for millions of users worldwide, bypassing traditional market hours and broker hurdles. Partnering with Kraken and Backed, Telegram delivers fully collateralized synthetic stocks, blending the liquidity of crypto with the stability of blue-chip names.

Imagine checking Elon Musk’s latest X post on Tesla and instantly positioning your portfolio via a Telegram bot, all while sipping coffee in Tokyo at 3 a. m. That’s the reality for Telegram wallet tokenized equities users. Over 60 assets, including the S and amp;P 500, rolled out initially in emerging markets this October 2025, with self-custodial TON Wallet expansion slated by year-end. Each token mirrors its underlying asset 1: 1, backed by real shares held in custody, ensuring transparency that rivals TradFi custodians.

Strategic Edge of Kraken and BackedFi’s xStocks Alliance

Kraken’s institutional-grade infrastructure meets Backed’s tokenized asset expertise in what could redefine on-chain equities. This Kraken BackedFi tokenized stocks synergy isn’t mere hype; it’s a calculated move into the $1 trillion tokenized equities race. Telegram’s 900 million-plus users gain frictionless entry, fueling adoption in regions where stock trading feels like a distant dream. From my vantage as a macro strategist tracking cross-market flows, this setup amplifies correlations between crypto volatility and equity momentum, offering savvy investors alpha through perpetual access.

The custodial Wallet integration prioritizes ease, letting users swap TON or USDT for tokenized AAPL on Telegram in seconds. Compliance is baked in, with reserves audited and verifiable on-chain. Critics might decry centralization risks, but the 1: 1 backing and Kraken’s regulatory footprint mitigate that, positioning this as a bridge rather than a break from legacy systems.

Why Tokenized TSLA and NVDA Reshape Portfolio Strategies

TSLA synthetic stock blockchain trading via Telegram flips the script on time-zone tyranny. Tesla’s narrative-driven surges often hit after-hours; now, capture them instantly without premium futures contracts. Nvidia’s AI-fueled ascent demands similar agility, and NVDA on-chain trading delivers it. These aren’t diluted proxies; they’re precision instruments for global portfolios, enabling fractional ownership down to micro-shares. In a world of fragmented markets, this unifies exposure, letting emerging market traders hedge U. S. tech dominance alongside their crypto holdings.

Consider the ripple effects: retail investors in Latin America or Southeast Asia, long sidelined by capital controls, now ride NVDA’s coattails 24/7. This influx could juice liquidity, narrowing spreads and drawing institutional overlays. Yet, strategic caution prevails; volatility in tokenized wrappers demands rigorous risk sizing, especially with crypto’s leverage temptations lurking nearby.

Unpacking the 24/7 Trading Infrastructure

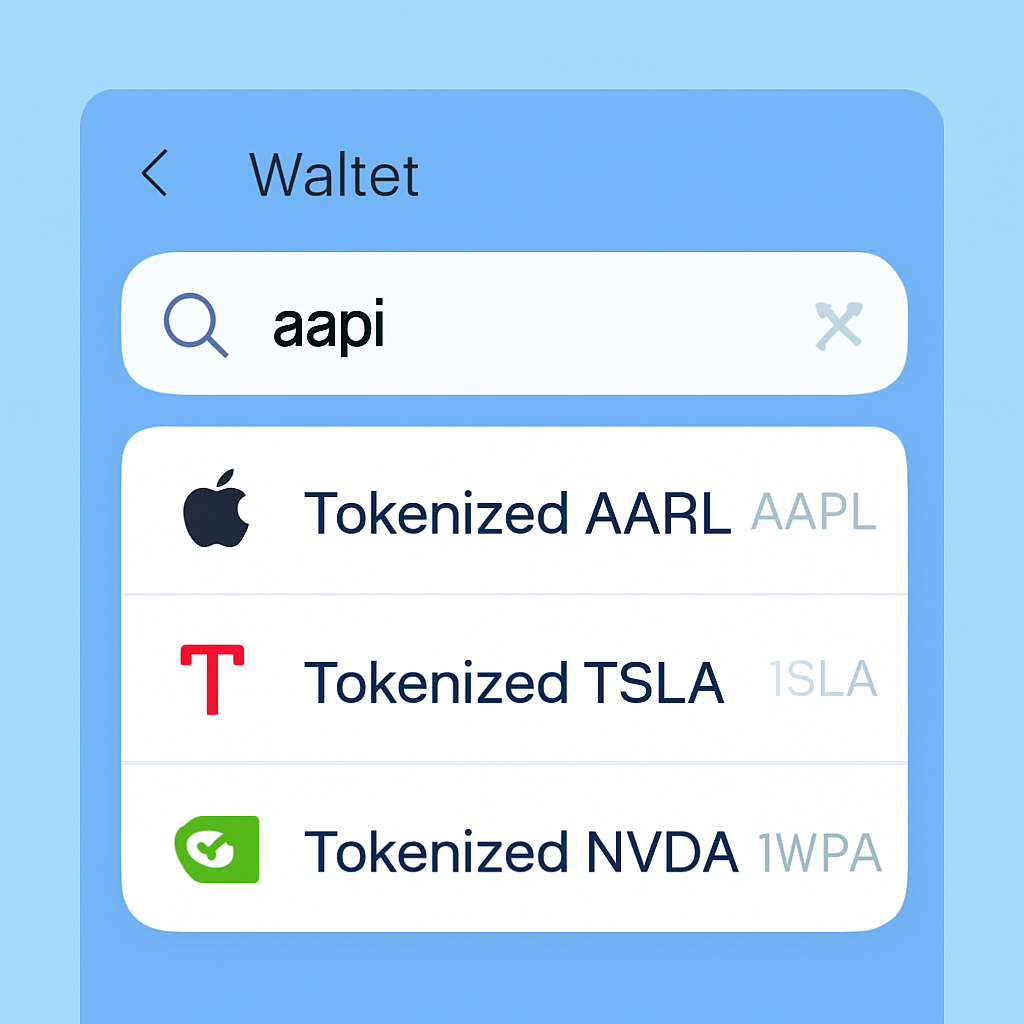

At its core, 24/7 fractional US stocks crypto thrives on blockchain’s relentless uptime. Kraken handles order routing and custody, Backed issues ERC-20 tokens on Ethereum-compatible chains, and Telegram’s bot layer abstracts complexity. Users fund via on-ramps, trade peer-to-pool, and settle instantly. No KYC walls for small trades in select regions, scaling to full verification for larger positions.

This stack empowers S and amp;P 500 tokenized Telegram plays too, diversifying beyond singles like AAPL. As correlations tighten between blockchain yields and equity betas, portfolios blending these gain resilience. I’ve long advocated viewing tokenized assets through a macro lens; here, they illuminate how DeFi wallets evolve into full-spectrum trading hubs. The initial phase targets high-growth Telegram demographics, priming for explosive volume as self-custody unlocks broader participation.

Diving deeper, the transparency edge shines: on-chain proofs let you verify collateral anytime, a luxury absent in opaque offshore brokers. For commodities analysts like myself, this opens nuanced hedges, pairing NVDA’s chip demand with gold or energy proxies in perpetual motion.

Layering in these tokenized instruments sharpens the macro toolkit, revealing how U. S. tech giants like AAPL influence global commodity cycles through supply chain ripples. As supply constraints in semiconductors echo into rare earths and energy, traders can now arbitrage those links without market close interruptions.

Navigating Risks in the Tokenized Equities Arena

Strategic deployment demands vigilance. While 1: 1 collateralization fortifies trust, smart contract vulnerabilities and chain congestion pose tail risks. Kraken’s oversight tempers this, but oracle dependencies for pricing could amplify flash crashes if feeds falter. From a cross-market lens, I’ve observed tokenized wrappers magnify beta during equity drawdowns, especially when crypto deleverages coincide. Position accordingly: allocate no more than 10-15% of risk capital here initially, favoring diversified baskets like S and P 500 tokens over single-name bets on TSLA synthetic stock blockchain volatility.

Regulatory horizons add another vector. Emerging market rollouts skirt stringent U. S. rules, but as self-custodial TON integration hits by December 2025, expect SEC scrutiny to intensify. This isn’t a deterrent; it’s an evolution signal. Institutions eyeing on-chain pilots will test waters here, potentially catalyzing yield-bearing wrappers or lending markets atop these tokens.

Geopolitical flows underscore the appeal. In regions battered by currency debasement, 24/7 fractional US stocks crypto offers a dollar-linked haven, tradable sans forex friction. Pair this with Telegram’s viral network effects, and you have a liquidity flywheel that traditional brokers envy.

Getting Started with Telegram Wallet Tokenized Equities

Frictionless onboarding defines the edge. New users tap into the Wallet bot, fund via fiat ramps or crypto swaps, and execute trades mirroring spot prices with minimal slippage. For NVDA on-chain trading, select the asset, review collateral proofs, and go long or short via integrated pools. Advanced users script bots for automated strategies, capitalizing on news-driven spikes outside NYSE hours. Read more on the mechanics in our deep dive: How Tokenized Stocks Enable 24/7 Trading.

Key Features of Telegram xStocks

| Feature | Benefit |

|---|---|

| 24/7 Access | Beat market hours ⏰ |

| 1:1 Backing | Full collateral transparency 💎 |

| Fractional Shares | Micro-invest from $1 💰 |

| Multi-Chain | Ethereum/Base support 🌉 |

| Over 60 Assets | AAPL, TSLA, NVDA, ETFs & more 📈 |

| Kraken & Backed Partnership | Fully collateralized 1:1 with compliance 🔒 |

This infrastructure doesn’t just replicate TradFi; it augments it. Correlations I’ve tracked show tokenized tech stocks leading crypto rotations, signaling risk-on phases early. As a CAIA charterholder, I see this accelerating the ‘big picture’ convergence, where blockchain dissolves silos between assets.

Future Horizons for On-Chain Equities

Expansion beckons. Post-TON self-custody, anticipate tokenized commodities and forex, forging true universal portfolios. Volume surges could compress premiums to near-zero, rivaling CEX spot markets. For forward-thinkers, this Telegram gateway heralds a decentralized equity universe, where Telegram wallet tokenized equities become the default for borderless alpha. Monitor Kraken’s xStocks updates; they’re plotting the next leap.

Blending these tools equips investors to thrive amid flux. In a decentralized world, perpetual access to blue-chips like NVDA isn’t optional; it’s the new baseline for strategic edge.