How Ondo Finance is Bringing 100+ Tokenized U.S. Stocks and ETFs On-Chain: What It Means for DeFi Investors

Ondo Finance is rapidly reshaping the DeFi landscape by bridging Wall Street’s most coveted assets with on-chain accessibility. In September 2025, Ondo Global Markets went live, enabling non-U. S. investors to trade over 100 tokenized U. S. stocks and ETFs directly on Ethereum. This move is more than a technical milestone, it’s a structural reimagining of global capital markets that could fundamentally alter how investors access, trade, and utilize traditional equities in decentralized finance.

Ondo Finance Token ($ONDO) Surges as Tokenization Hype Peaks

The market has responded decisively to this innovation. Ondo Finance’s native token ($ONDO) is up nearly 10% on the day to $1.10, following a weekly rally that saw gains exceed 21%, according to CoinGecko data. This surge reflects both speculative excitement and genuine confidence in the protocol’s ability to deliver real-world assets (RWAs) on-chain at scale.

Within just two days of launch, Ondo Global Markets became the largest tokenized stock and ETF platform by total value locked (TVL), surpassing $240 million. The protocol’s rapid ascent signals robust demand for tokenized U. S. equities among global investors, especially those previously excluded from Wall Street due to geographic or regulatory barriers.

How Ondo Global Markets Works: On-Chain Stocks With Real-World Backing

The core innovation lies in how Ondo bridges traditional securities with blockchain infrastructure:

Key Features of Ondo Global Markets for DeFi Investors

-

Access to 100+ Tokenized U.S. Stocks and ETFs: Non-U.S. investors can trade tokenized versions of major U.S. equities and ETFs directly on Ethereum, with plans to expand to over 1,000 assets by year-end.

-

24/7 Trading on Ethereum: Investors benefit from continuous market access, allowing minting and redemption of tokenized assets 24 hours a day, five days a week.

-

Full Asset Backing and Regulatory Compliance: Each tokenized asset is fully backed by underlying securities held at U.S.-registered broker-dealers, ensuring transparency and security for investors.

-

DeFi Integration and Automation: Ondo assets are designed to behave like stablecoins, enabling seamless use in DeFi protocols for lending, borrowing, and automated strategies.

-

Global Accessibility and Lower Barriers: The platform democratizes access to U.S. financial markets by reducing fees and eliminating geographic restrictions for non-U.S. users.

-

Rapid Growth and Market Leadership: Ondo Global Markets became the world’s largest tokenized stock and ETF platform by total value locked (TVL), surpassing $240 million within 48 hours of launch.

-

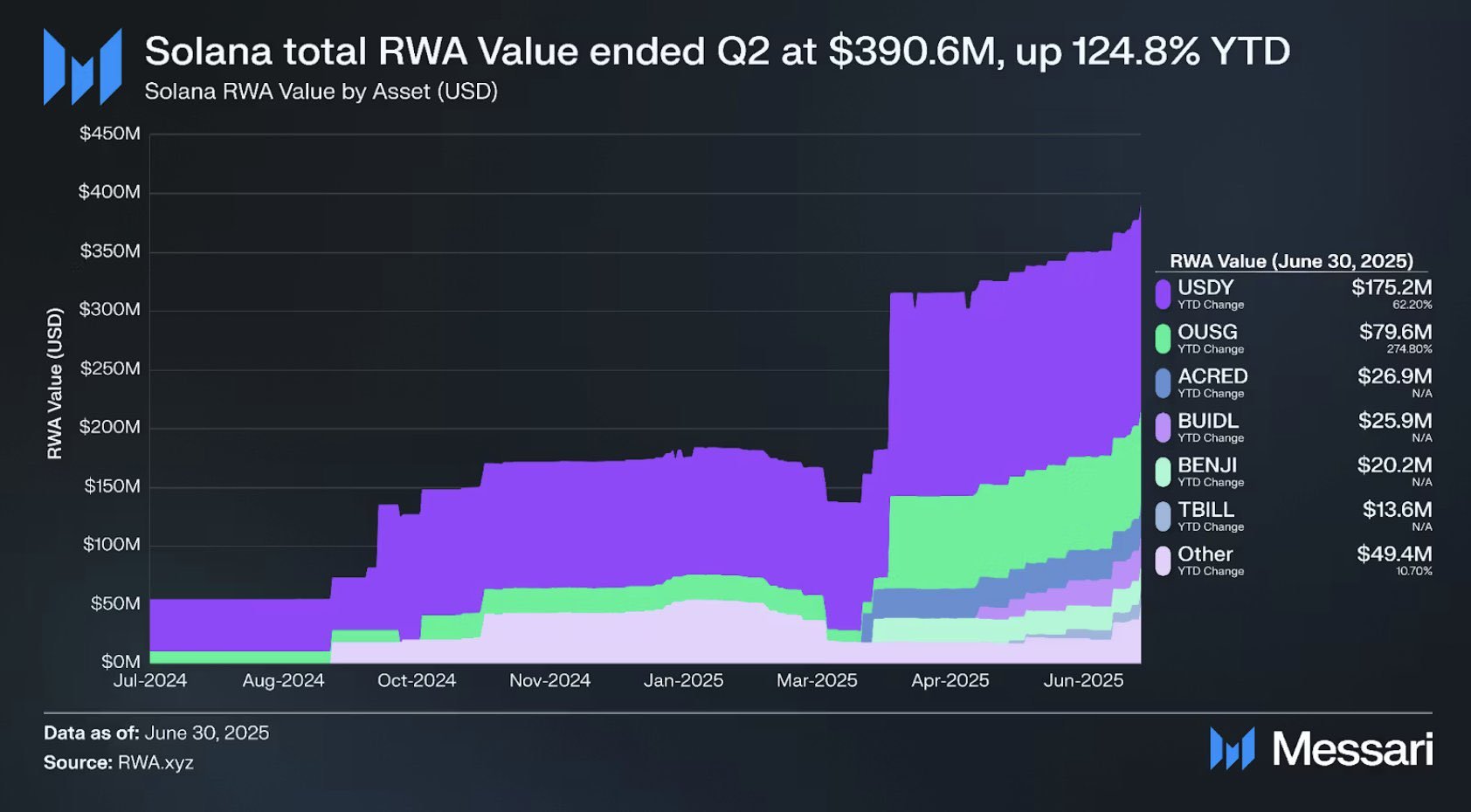

Future Multi-Chain Expansion: Ondo plans to introduce support for Solana and BNB Chain, broadening access and interoperability for DeFi investors.

Each tokenized asset is fully backed by underlying stocks or ETFs, held at U. S. -registered broker-dealers for maximum transparency and security. Investors can mint and redeem tokens representing these equities 24/7 (five days per week), sidestepping legacy market hours and intermediaries.

This model offers several critical advantages:

- Fractional Ownership: Investors can own fractions of high-priced stocks, democratizing access.

- Global Liquidity: Non-U. S. participants gain exposure without complex cross-border arrangements.

- DeFi Integration: Tokenized stocks behave like stablecoins within DeFi protocols, enabling lending, borrowing, and automated strategies using blue-chip equities as collateral.

The result is an ecosystem where on-chain U. S. equities are not just passive investments but programmable assets that can power new financial primitives, from synthetic indices to yield-generating vaults.

The Significance for DeFi Investors: Beyond Speculation

The arrival of over 100 Ethereum tokenized stocks and ETFs via Ondo unlocks unprecedented opportunities for portfolio diversification, risk management, and yield generation within DeFi. For years, crypto-native investors have been limited to volatile digital assets; now they can blend exposure to Apple, Tesla, or S and P 500 ETFs with their on-chain portfolios, without leaving the blockchain environment.

This also introduces new forms of composability: imagine using a tokenized S and P 500 ETF as collateral in a lending protocol or earning on-chain dividends seamlessly distributed via smart contracts. Such possibilities were unthinkable with legacy rails but are now becoming reality thanks to platforms like Ondo Global Markets.

The implications reach beyond individual traders; institutional allocators seeking compliant access to U. S. equity exposure in emerging markets now have a transparent, auditable alternative that operates around the clock, no wire transfers or settlement delays required.

Ondo’s model also addresses a persistent challenge in DeFi: counterparty and settlement risk. By anchoring every tokenized share or ETF to underlying real-world assets held with regulated U. S. broker-dealers, Ondo provides a strong layer of trust and legal clarity that most synthetic equity protocols lack. This makes it possible for institutional DeFi, DAOs, and even fintech neobanks to confidently integrate on-chain U. S. equities into their product stacks.

Another major differentiator is continuous market access: investors can mint or redeem tokenized stocks 24/7, five days a week, far beyond traditional Wall Street trading hours. This feature enables real-time portfolio rebalancing, instant liquidity, and seamless arbitrage between global markets. As Ondo expands to support Solana and BNB Chain by year-end, cross-chain composability will further accelerate adoption and capital efficiency.

Risks, Regulatory Considerations, and What’s Next

Despite the momentum, DeFi investors must remain cognizant of regulatory nuances. Currently, Ondo Global Markets is only available to non-U. S. investors, reflecting ongoing legal uncertainty around tokenized securities in the United States. While the protocol’s asset-backing structure reduces some risk, users should still assess custodial arrangements, smart contract security audits, and evolving jurisdictional guidance before allocating significant capital.

This rapid growth has already attracted industry attention, and speculation about what comes next for on-chain U. S. equities:

- Will other major DeFi protocols follow suit by listing Ondo-backed equities as collateral?

- Could on-chain ETFs become the preferred vehicle for yield farming or structured products?

- Might regulators accelerate clarity as tokenized RWAs reach mainstream scale?

Regardless of how these questions resolve, one fact is clear: the $ONDO price surge to $1.10 reflects not just speculative fervor but an emerging consensus that tokenized real-world assets are here to stay, and set to transform both DeFi and TradFi infrastructure.

Key Takeaways for Investors Exploring Ondo Finance Tokenized Stocks

Steps to Add On-Chain U.S. Equities via Ondo Global Markets

-

Confirm Eligibility as a Non-U.S. Investor: Ondo Global Markets is currently available only to non-U.S. investors due to regulatory requirements. Ensure you meet the eligibility criteria before proceeding.

-

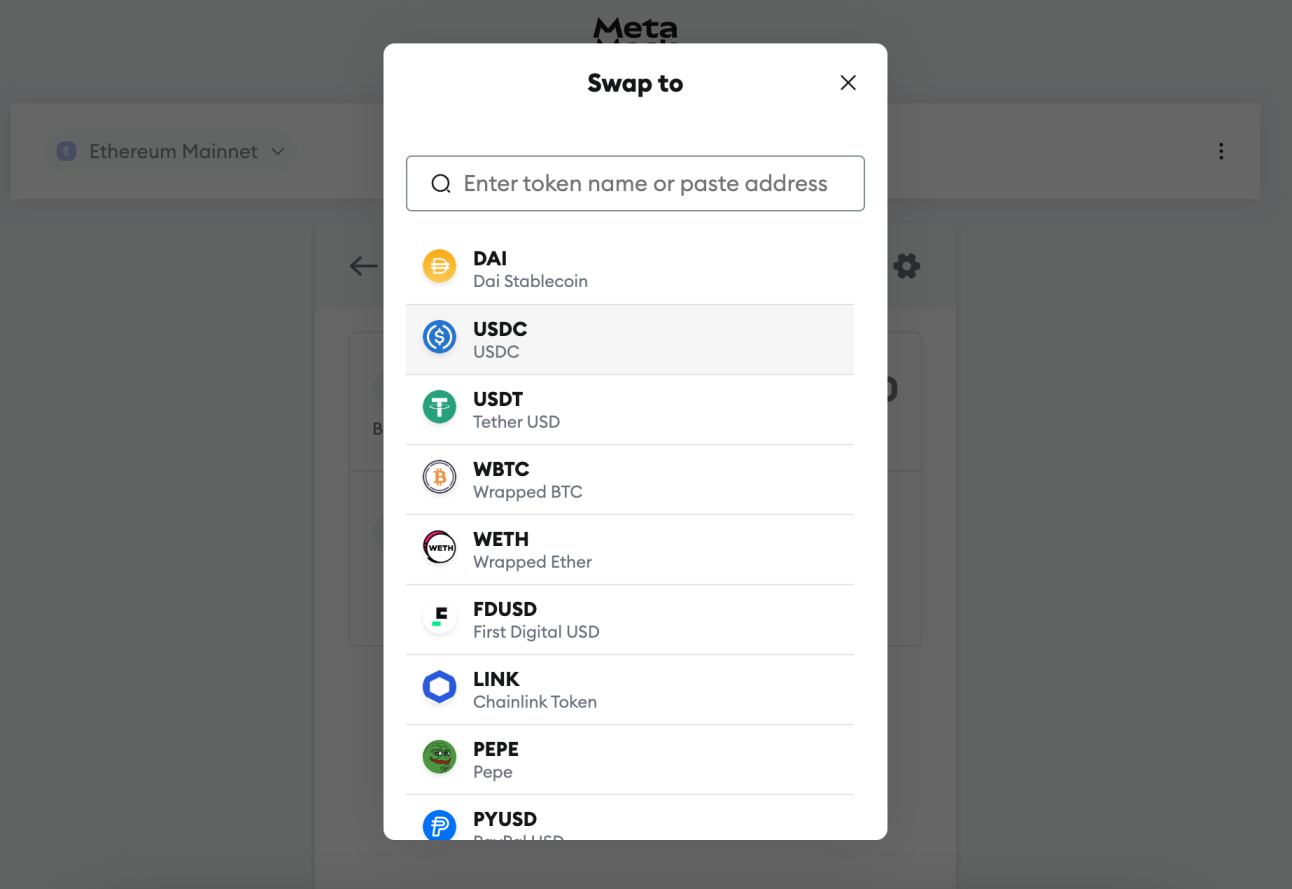

Set Up a Compatible Ethereum Wallet: Prepare a non-custodial Ethereum wallet (such as MetaMask or Coinbase Wallet) to interact with the Ondo platform and manage tokenized assets.

-

Complete KYC Verification on Ondo Global Markets: Register on the Ondo Global Markets platform and complete the required Know Your Customer (KYC) process to access tokenized U.S. equities.

-

Fund Your Wallet with USDC or Supported Stablecoins: Deposit USDC or other supported stablecoins into your Ethereum wallet to facilitate purchases of tokenized stocks and ETFs on the platform.

-

Browse and Select Tokenized U.S. Stocks or ETFs: Explore the list of over 100 available tokenized U.S. equities and ETFs on Ondo Global Markets, with plans to expand to 1,000+ by year-end.

-

Mint or Purchase Tokenized Equities: Use your stablecoins to mint new tokens or purchase existing tokenized stocks and ETFs directly on the platform. Transactions are available 24/7, five days a week.

-

Integrate with DeFi Protocols for Yield or Collateral: Leverage your tokenized equities within supported DeFi protocols for additional use cases, such as providing liquidity or using them as collateral, as Ondo assets are designed for DeFi compatibility.

-

Monitor Asset Performance and Redeem as Needed: Track your portfolio’s performance in real-time and redeem tokenized equities for underlying assets or stablecoins through the platform as desired.

If you’re considering exposure to Ethereum tokenized stocks or ETFs through Ondo Global Markets, focus on security diligence (custody and smart contracts), liquidity depth (TVL metrics), regulatory access (non-U. S. -only), and integration with your existing DeFi strategies.

The opportunity set will only grow as Ondo targets 1,000 and listed assets by year-end 2025, potentially spanning everything from blue-chip tech giants to thematic ETFs, all programmable within your wallet or dApp interface.

For a technical deep dive into how platforms like Ondo Finance leverage Chainlink for secure price feeds and proof-of-reserve attestations in their on-chain U. S. equities offering, see this resource: How Ondo Finance and Chainlink are Leading the Way.