How Tokenized Stocks Enable 24/7 Trading and Fractional Ownership on the Blockchain

Traditional equity markets are defined by their rigid opening hours, high barriers to entry, and legacy settlement infrastructure. Tokenized stocks, however, are rewriting these rules by leveraging blockchain technology to enable 24/7 trading and fractional ownership. This shift is not just about convenience – it fundamentally alters how investors access and interact with equities, creating new opportunities and raising important questions about market structure and regulation.

What Are Tokenized Stocks?

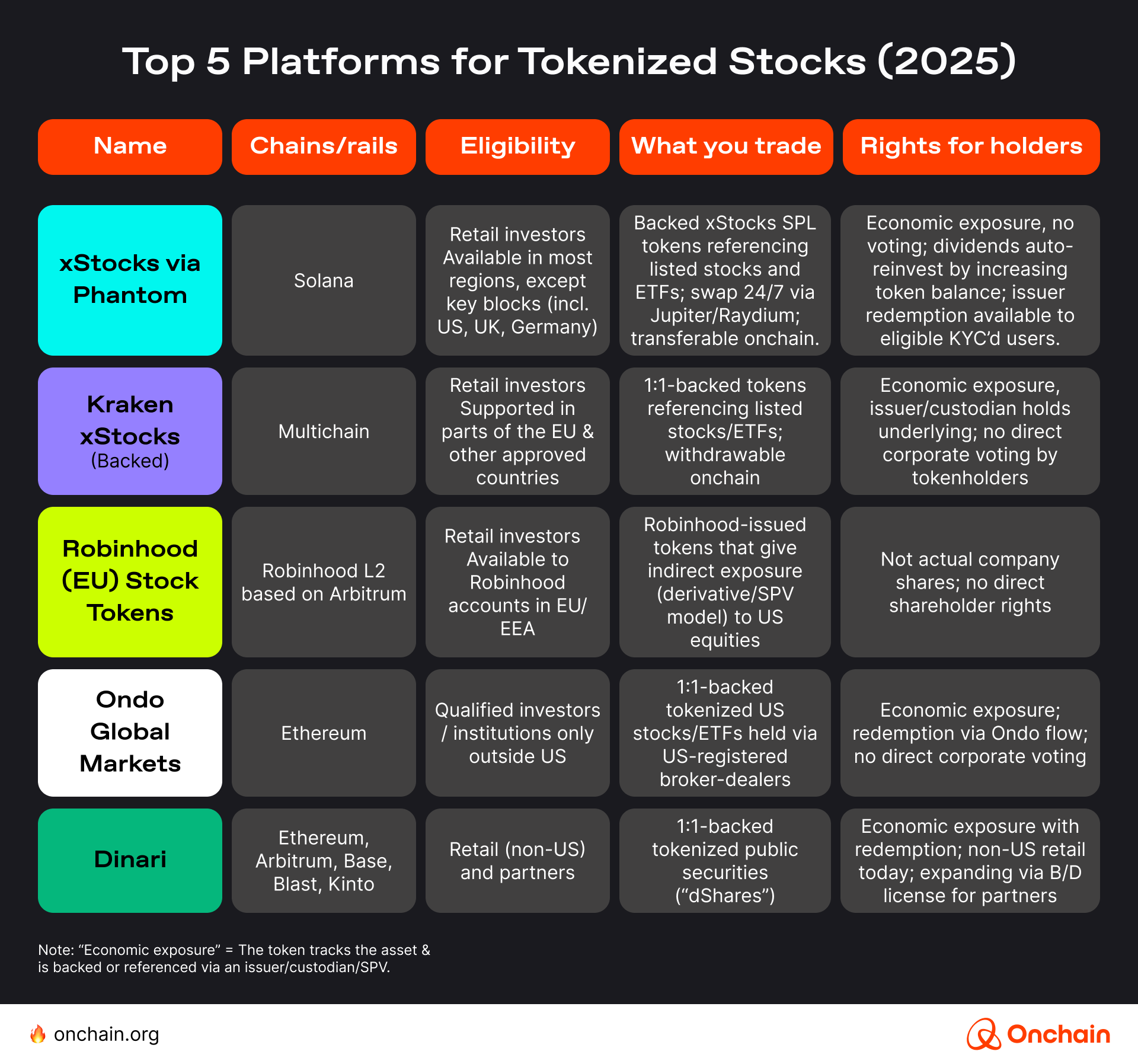

Tokenized stocks are digital representations of traditional equities issued and traded on blockchain platforms. Each token mirrors the price of its underlying asset, such as shares of Apple or Nvidia, but exists as a blockchain-based asset. These tokens can be bought, sold, and transferred globally at any time, bypassing the constraints of traditional exchanges. Platforms like Gemini and Robinhood have recently made headlines by offering tokenized versions of over 200 U. S. stocks and ETFs to European users, including major names like Nvidia, Apple, and Microsoft (source).

This innovation is powered by smart contracts and decentralized ledgers that automate settlement and ensure transparency. The result: instantaneous transfers, reduced counterparty risk, and a democratized pathway to equity markets.

24/7 Trading: Always-On Access for Investors

Unlike legacy stock exchanges that close for weekends and holidays, blockchain-based platforms never sleep. Tokenized stocks can be traded around the clock, providing unmatched flexibility for investors in any time zone. Whether it’s responding to after-hours earnings news or managing risk during global macro events, traders are no longer limited by the bell.

Key Advantages of Tokenized Stocks

-

24/7 Trading Availability: Tokenized stocks can be traded at any time, including nights, weekends, and holidays, unlike traditional equities restricted to exchange hours.

-

Fractional Ownership: Investors can purchase small portions of high-value stocks, making assets like Apple or Nvidia more accessible to a broader audience.

-

Global Market Access: Platforms such as Robinhood and Gemini enable users worldwide to invest in U.S. stocks and ETFs via blockchain, bypassing traditional geographic barriers.

-

Faster Settlement Times: Blockchain-based tokenized stocks often settle transactions instantly or within minutes, compared to the multi-day settlement cycles of traditional equities.

-

Enhanced Liquidity: The ability to trade tokenized stocks on digital platforms around the clock can increase market liquidity compared to traditional stocks limited by exchange hours.

This always-on model has significant implications for liquidity and market efficiency. By enabling continuous price discovery, tokenized stocks can theoretically reduce volatility spikes associated with market open/close cycles. However, this also introduces new challenges around liquidity fragmentation and price synchronization with underlying assets.

Fractional Ownership: Lowering Barriers to Entry

Fractional ownership is another core advantage of tokenized equities. Instead of buying a full share – which can cost hundreds or thousands of dollars – investors can purchase fractions of a stock for as little as a few dollars or even cents. This unlocks access to high-value companies like Nvidia or Apple for retail investors worldwide.

The ability to own micro-shares aligns with broader trends in DeFi and on-chain finance that prioritize accessibility and inclusivity. As noted by regulators, this also requires clear communication around what rights these tokens confer – especially since most tokenized stocks do not grant voting power or dividends.

How Fractionalization Works on Blockchain

Smart contracts underpin fractional ownership by dividing each equity-backed token into many decimal units. This allows seamless trading of micro-shares across decentralized platforms without manual intervention or complex back-office processes.

Fractionalization also amplifies portfolio diversification, as investors can spread capital across a broader set of assets without being constrained by high share prices or minimum lot sizes. For example, instead of committing $500 to a single stock, a user can allocate $50 each to ten different equities, optimizing risk-adjusted returns. This is a marked departure from traditional brokerages where such granularity is often unavailable or cost-prohibitive.

Moreover, the instant settlement characteristic of blockchain-based trading eliminates multi-day waiting periods common in legacy systems. Token transfers are executed and finalized on-chain within seconds or minutes, reducing counterparty risk and freeing up capital for immediate redeployment. This operational efficiency is particularly valuable for algorithmic traders and DeFi protocols seeking to automate strategies around on-chain equities.

Regulatory Landscape: Balancing Innovation and Protection

The rapid growth of tokenized stocks has not gone unnoticed by global regulators. While platforms like Robinhood and Gemini are pushing boundaries by offering commission-free trading of major U. S. stocks as tokens in the EU (source), authorities such as ESMA have raised concerns about potential investor misunderstandings, especially regarding shareholder rights and asset backing. The World Federation of Exchanges has called for stricter oversight, emphasizing the need for transparency and market integrity (source).

Most tokenized stocks today are synthetic representations rather than actual legal claims on the underlying shares. This distinction is critical: while prices track real equities, token holders typically lack voting rights and may not receive dividends. Clear disclosures and robust user education are essential to prevent confusion as adoption accelerates.

Key Regulatory Risks in Tokenized Stock Platforms

-

Regulatory Uncertainty: The European Securities and Markets Authority (ESMA) has highlighted unclear regulatory frameworks for tokenized stocks, increasing legal and compliance risks for both platforms and users.

-

Market Integrity Concerns: The World Federation of Exchanges has called for stricter oversight of tokenized stock trading to prevent market manipulation and ensure fair pricing mechanisms.

-

Investor Protection Gaps: Regulatory bodies warn that insufficient disclosures and a lack of clear communication on tokenized stock platforms can expose investors to misunderstandings and potential losses.

-

Jurisdictional Compliance Challenges: Platforms operating across borders, such as Robinhood’s EU tokenized stock offering, must navigate complex regulatory requirements in multiple regions, increasing operational risk.

Market Access and Global Participation

Perhaps the most transformative aspect of tokenized stocks is their ability to level the playing field for global investors. By removing geographic restrictions, intermediaries, and high entry thresholds, these assets make it possible for anyone with an internet connection to access U. S. equities and other markets 24/7. This democratization could reshape capital flows, improve liquidity in traditionally illiquid regions, and foster new financial products built atop on-chain equity primitives.

However, this new paradigm also introduces challenges around liquidity fragmentation, price discovery outside primary market hours, and maintaining fair access in a rapidly evolving regulatory environment. As with any disruptive technology, risks must be weighed against rewards, and ongoing dialogue between innovators, regulators, and end users will be crucial.

The Road Ahead: Integration with DeFi Ecosystems

Looking forward, integration with decentralized finance (DeFi) protocols will likely accelerate the evolution of on-chain equities. Already, synthetic stocks are being used as collateral in lending protocols or paired with stablecoins in liquidity pools, enabling new yield opportunities that simply don’t exist in legacy finance. As smart contract standards mature and interoperability improves across chains, expect even more sophisticated products, such as automated index funds or on-chain options, to emerge.

The next frontier will be bridging these innovations with robust investor protections, ensuring that accessibility does not come at the expense of transparency or security. As tokenized stocks continue to gain traction globally, they stand poised to redefine what it means to invest in equities in a digital-first world.