How Tokenized Stocks Are Revolutionizing Equity Markets: On-Chain Settlement, Programmable Dividends, and 24/7 Access

Tokenized stocks are shaking up the investing world, and if you’re still waiting for your broker to clear trades or chasing dividend payments, you’re missing the action. The future of equity markets is on-chain: instant settlement, programmable dividends, and borderless 24/7 access. Let’s break down how these three features are not just buzzwords, but real-world innovations already changing how we invest in stocks.

Instant On-Chain Settlement: Goodbye to Waiting Games

Remember the old T and 2 settlement cycle? That’s history for on-chain equities. Tokenized stocks leverage blockchain technology to enable near-instantaneous trade settlement, meaning your trades clear in seconds instead of days. This isn’t just about speed – it’s about slashing counterparty risk and eliminating those nerve-wracking clearing delays that can cost you money and sleep.

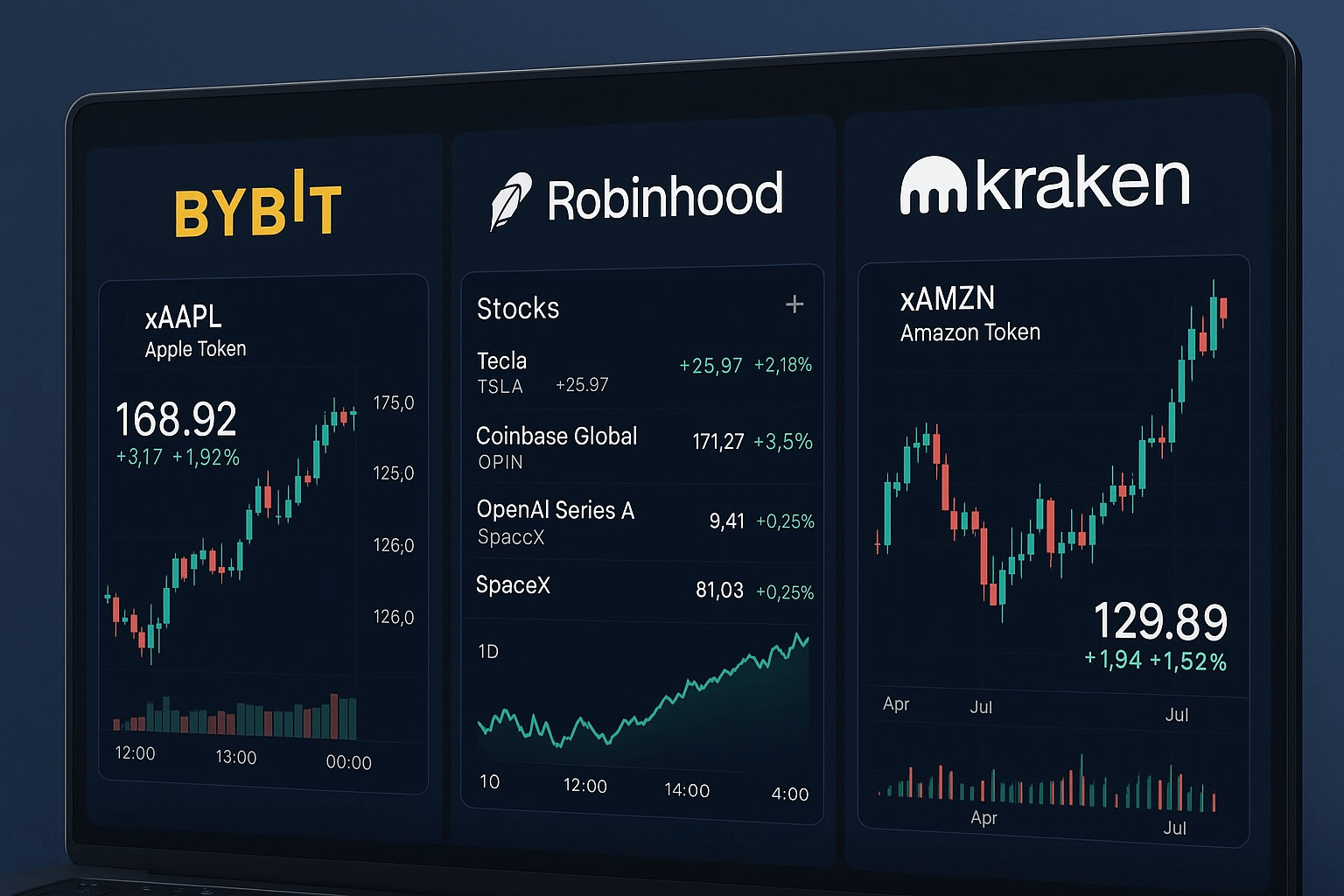

Platforms like xStocks on Solana are already offering tokenized versions of U. S. equities and ETFs, 1: 1 backed by real shares held with regulated custodians. When you buy or sell a tokenized equity, the transaction is verified and settled on-chain, so you know exactly where you stand – no middlemen, no after-hours uncertainty. This is particularly game-changing for non-U. S. traders who want instant exposure to American markets without the traditional banking roadblocks.

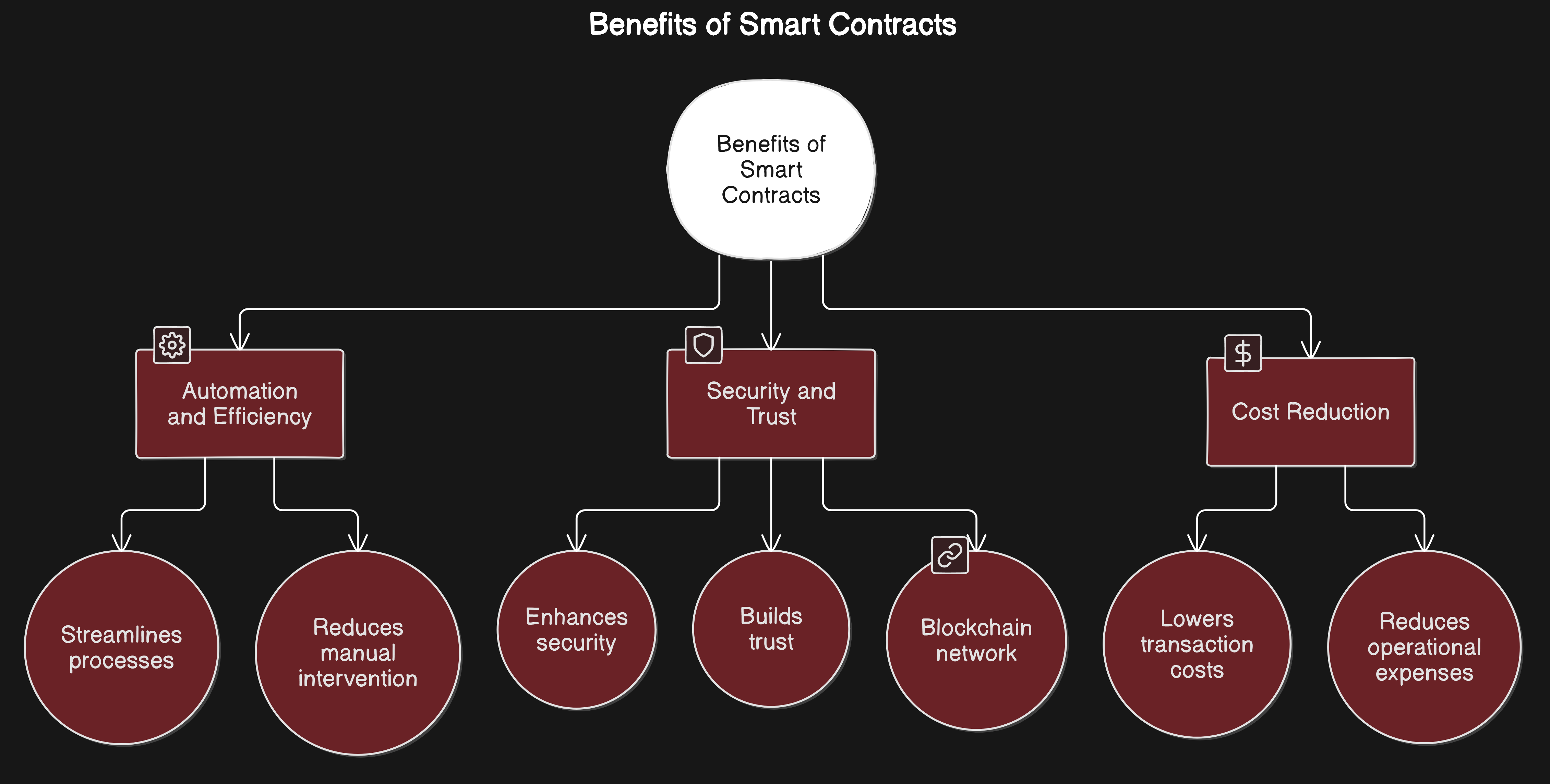

Programmable Dividends: Automation Meets Transparency

If you’ve ever waited weeks for a dividend payout or questioned whether your broker credited the right amount, programmable dividends will feel like magic. With tokenized stocks, smart contracts automate dividend distributions directly to holders’ wallets. No paperwork, no missed payments – just transparent, customizable payouts delivered exactly when they’re due.

This is more than just convenience; it’s efficiency and trust built into the code. Want monthly micro-dividends instead of quarterly lump sums? Smart contracts can handle that without breaking a sweat. And because everything happens on-chain, you can audit payouts in real time – no more hoping your broker got it right.

Top Benefits of Programmable Dividends for Investors

-

Instant On-Chain Settlement: Tokenized stocks leverage blockchain technology to enable near-instantaneous trade settlement, reducing counterparty risk and eliminating traditional clearing delays. Platforms like xStocks on Solana offer real-time settlement for U.S. equities, making trades faster and safer for investors.

-

Programmable Dividends: Smart contracts automate dividend distributions directly to token holders, allowing for transparent, customizable, and timely payouts without intermediaries. This means investors receive their earnings instantly and with full transparency, as seen on platforms like DCLEX and via Chainlink Data Streams.

-

24/7 Global Market Access: Unlike traditional equity markets with limited trading hours, tokenized stocks can be traded around the clock on compatible blockchain platforms, increasing liquidity and accessibility for investors worldwide. For example, xStocks on Solana and DCLEX enable continuous access to U.S. stocks and ETFs for global investors.

24/7 Global Market Access: Stocks That Never Sleep

The sun never sets on blockchain stocks. Unlike traditional exchanges that shut down at 4 p. m. , tokenized equities are available 24/7 on compatible platforms. Whether you’re an early riser in Singapore or a night owl in New York, you get seamless access to global equities any time you want.

This round-the-clock trading isn’t just about convenience; it’s a liquidity revolution. More hours mean more opportunities – especially for traders who thrive on volatility or want to react instantly to breaking news from anywhere in the world. It also opens doors for retail investors worldwide who were previously locked out by timezone mismatches and market restrictions.

If you want a deep dive into how this works (and why fractional ownership is such a big deal), check out our guide here: How Tokenized Stocks Enable 24/7 Trading and Fractional Ownership.

But let’s be real, 24/7 access isn’t just a flashy feature, it’s a seismic shift for market dynamics. When you can buy, sell, or rebalance your portfolio anytime, you’re no longer at the mercy of after-hours gaps or market opens that trigger wild price swings. Tokenized stocks empower you to act on your strategy exactly when opportunity strikes, no more waiting for the bell to ring.

Platforms like DCLEX have taken this concept even further by ensuring that these tokenized assets are fully backed and redeemable for actual shares of public companies. This means investors enjoy the flexibility of crypto with the security and compliance of traditional equities. And thanks to DeFi integrations, you can now put your tokenized stocks to work in liquidity pools or as collateral, earning yield while still holding exposure to blue-chip names.

Challenges and What Comes Next

Of course, no revolution comes without friction. The biggest hurdle right now? Liquidity. While the potential for 24/7 global markets sounds limitless, some tokenized stocks still suffer from thin order books and limited trading volumes. This is partly a function of early adoption, more participants and deeper pools will come as trust in on-chain equities grows.

Regulatory clarity is another frontier. Platforms are working hard to stay compliant, offering investor protections and transparent backing for every digital asset. Still, as jurisdictions catch up with technology, expect some turbulence (and opportunity) along the way. The good news: every major step forward brings us closer to an equity market that’s truly global, instant, and programmable.

For investors who crave both speed and transparency, and who aren’t afraid to embrace new tech, the upside is massive. You get instant on-chain settlement that eliminates delays and risk; programmable dividends that automate your income stream; and 24/7 access that puts you in control like never before.

The bottom line? Tokenized stocks aren’t just another blockchain experiment, they’re already unlocking new ways to trade, earn yield, and build portfolios without borders or downtime. Whether you’re looking to diversify into synthetic equities or maximize your capital efficiency with programmable payouts, this is one trend you don’t want to sleep on.