How Tokenized Stocks Enable 24/7 Trading: The Rise of On-Chain Equities in Crypto Wallets

Imagine checking your crypto wallet at midnight and seeing the price of Tesla Inc (TSLA) at $435.15, up $5.99 ( and 0.0140%) in the past 24 hours. Now, instead of waiting for Wall Street to open, you can buy, sell, or even use tokenized TSLA as collateral in DeFi protocols, directly from your phone. This is not a futuristic vision; it’s the new reality for global investors as tokenized stocks bring 24/7 trading and on-chain equities to crypto wallets.

Tokenized Stocks: The Gateway to 24/7 Equity Trading

Traditional stock markets have always been bound by rigid trading hours, leaving investors in different time zones at a disadvantage. With the rise of real asset-backed tokenized equities, this paradigm is shifting. Platforms like Bitget, Ondo Finance, and Kraken are pioneering the integration of tokenized stocks, digital representations of traditional shares, into blockchain ecosystems. These tokens are typically backed 1: 1 by real shares held with regulated custodians, ensuring their value closely tracks the underlying asset.

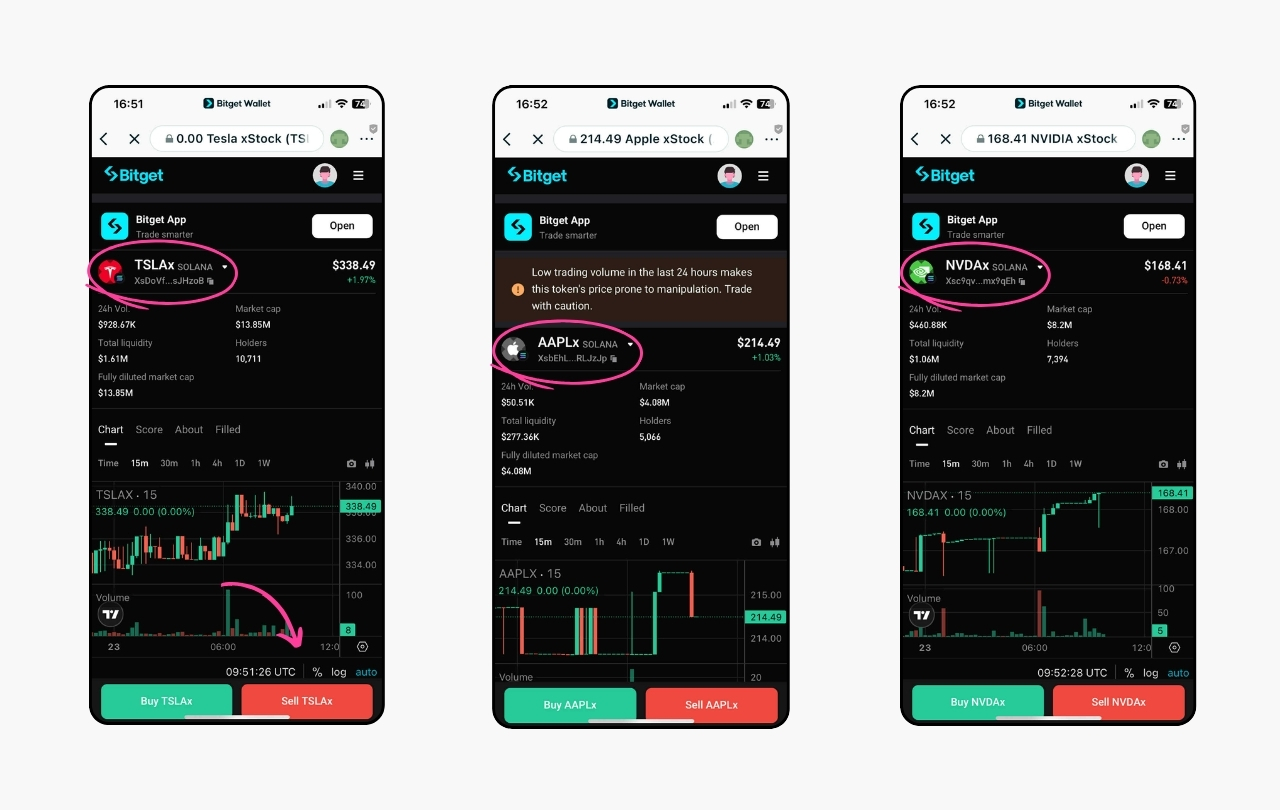

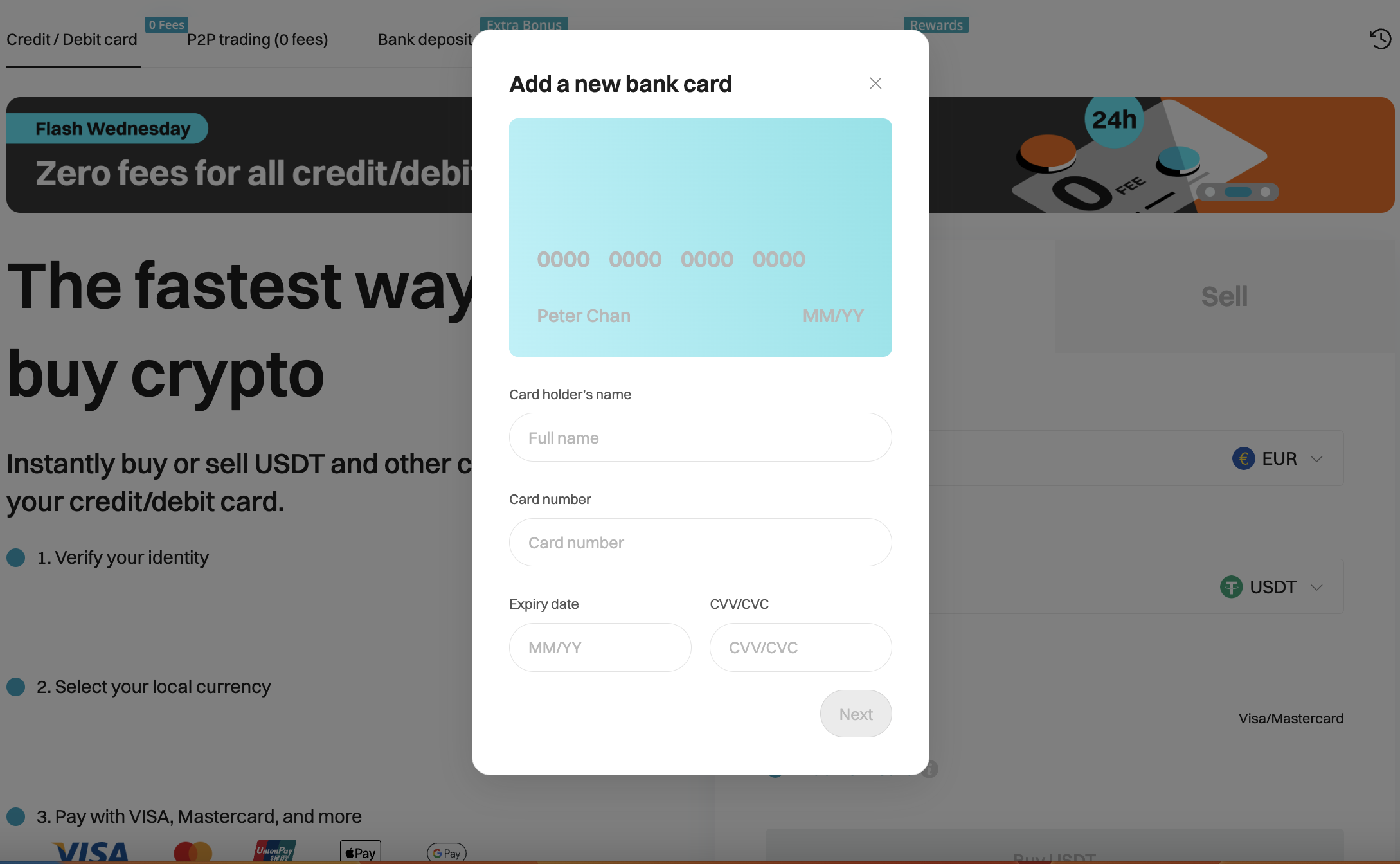

The impact? Investors can now trade leading U. S. equities such as Tesla (currently $435.15), Apple, and Nvidia on a near-continuous basis. For example, Bitget and Bitget Wallet, through their partnership with Ondo Finance, offer over 100 tokenized stocks and ETFs to users outside the U. S. , with trading accessible for as little as $1. While some platforms offer true 24/7 trading, others align with U. S. market hours but still provide significant flexibility compared to traditional brokers.

How On-Chain Equities in Wallets Reshape Market Access

One of the most transformative aspects of tokenized stocks is the shift from broker-centric access to self-custody. Instead of relying on intermediaries, investors can now hold and trade tokenized equities directly within their crypto wallets. This model not only democratizes access but also enhances transparency and control. For instance, Trust Wallet’s integration of tokenized U. S. stocks allows over 200 million users worldwide to discover, hold, and swap equities on-chain, no broker required.

This wallet-native approach unlocks a suite of DeFi possibilities: tokenized stocks can serve as collateral for loans, be pooled in automated market makers (AMMs), or even staked for yield. As a result, the boundaries between traditional finance and decentralized finance are dissolving, creating a more fluid, global market for equities.

Top Platforms for Tokenized Stocks with Wallet Integration

-

Bitget & Bitget Wallet: Bitget, in partnership with Ondo Finance, offers trading of over 100 tokenized stocks and ETFs. Users outside the U.S. can access these assets 24/7 (with some limitations during U.S. market closures) directly from the Bitget Wallet, enabling seamless integration with DeFi and self-custody options.

-

Ondo Finance: As a leading issuer of tokenized stocks and ETFs, Ondo Finance allows users to mint and redeem tokens backed 1:1 by real shares. Ondo’s platform supports wallet connectivity, letting investors manage and trade tokenized equities on-chain with stablecoin settlements.

-

Kraken: The global crypto exchange has launched tokenized versions of more than 50 U.S. stocks and ETFs—including Tesla Inc (TSLA) at $435.15. Kraken enables non-U.S. customers to trade these tokens around the clock, with wallet integration for secure storage and transfers.

-

Robinhood: Robinhood’s EU platform now supports commission-free trading of over 200 tokenized U.S. stocks and ETFs. These digital assets are available 24 hours a day, five days a week, and can be managed through integrated crypto wallets for flexible access and transfer.

-

Trust Wallet: This popular self-custody Web3 wallet has added support for tokenized stocks and ETFs, allowing users to discover, hold, and swap these assets directly within the app. Trust Wallet’s integration brings real-world equities on-chain for over 200 million users worldwide.

Fractional Ownership and New Investment Strategies

Perhaps one of the most empowering features for retail investors is fractional ownership. High-priced stocks like Tesla at $435.15 are now accessible in smaller denominations, lowering barriers for entry and diversification. This means that with just a few dollars, anyone can gain exposure to blue-chip equities, an impossibility in traditional markets where full shares are often required for direct ownership.

The flexibility extends beyond simple buying and selling. Tokenized stocks can be integrated into DeFi protocols for lending, liquidity provision, or even algorithmic trading strategies. For example, Ondo Global Markets enables users to mint or redeem tokens for stablecoins at the prevailing value of the underlying asset during trading hours, ensuring liquidity and price alignment.

Key Advantages at a Glance

- Continuous Trading: Trade equities across all time zones without waiting for market open or close.

- Fractional Access: Buy fractions of high-value stocks like TSLA ($435.15), making markets more inclusive.

- DeFi Integration: Use tokenized stocks as collateral or in liquidity pools, expanding investment possibilities.

- Self-Custody: Hold equities directly in your crypto wallet for maximum control and transparency.

As tokenized stocks mature, the distinction between synthetic and real asset-backed equities becomes increasingly important. Synthetic stocks are designed to mirror the price action of real-world equities but are not directly backed by underlying shares. In contrast, platforms like Ondo Finance and Kraken emphasize true 1: 1 backing, with regulated custodians holding actual shares that correspond to each token. This difference has major implications for investor trust, regulatory scrutiny, and the ability to redeem tokens for real assets or stablecoins.

For investors, understanding whether a tokenized stock is synthetic or asset-backed is crucial. Asset-backed tokens tend to offer greater alignment with traditional market prices and redemption guarantees, while synthetics may be more flexible but carry additional counterparty risks. Always check the platform’s disclosures and custody arrangements before committing capital.

Navigating Regulatory Waters

The rapid adoption of tokenized stocks has not gone unnoticed by global regulators. The World Federation of Exchanges has called for tighter oversight to ensure market integrity and protect investors from potential risks associated with blockchain-based equities. As regulatory frameworks evolve, platforms offering tokenized stocks will need to maintain robust compliance standards, particularly regarding custody, investor protection, and cross-border trading.

For now, most major offerings are restricted to non-U. S. users due to regulatory uncertainty in American markets. However, jurisdictions in Europe and Asia are moving faster to embrace these innovations, making them accessible to a growing international audience.

Real-Time Price Action: A New Era for Retail Investors

The ability to monitor and act on price movements at any hour is a game-changer for retail traders. For example, if Tesla Inc (TSLA) surges or dips outside traditional U. S. trading hours, currently priced at $435.15, with a 24-hour change of and $5.99 ( and 0.0140%): investors can immediately respond rather than waiting for the next session. This round-the-clock access reduces information asymmetry and levels the playing field between institutional and retail participants.

Platforms like Bitget have pioneered this model by allowing trades starting from just $1, all denominated in USD for familiar pricing. This inclusivity means more people can participate in the equity markets without large upfront investments or reliance on legacy brokers.

What Comes Next?

The momentum behind on-chain equities in wallets shows no signs of slowing down. As infrastructure matures and regulatory clarity improves, expect even broader access, additional asset classes (like global stocks and bonds), and deeper DeFi integrations, from lending protocols to algorithmic portfolio management.

If you’re considering exploring this space further or want step-by-step guidance on getting started with tokenized equities and 24/7 trading strategies, our comprehensive guide can help: How Tokenized Stocks Enable 24/7 Trading and Fractional Ownership on the Blockchain.