How Tokenized Stocks Are Enabling 24/7 Global Trading: Wallets vs. Traditional Brokers

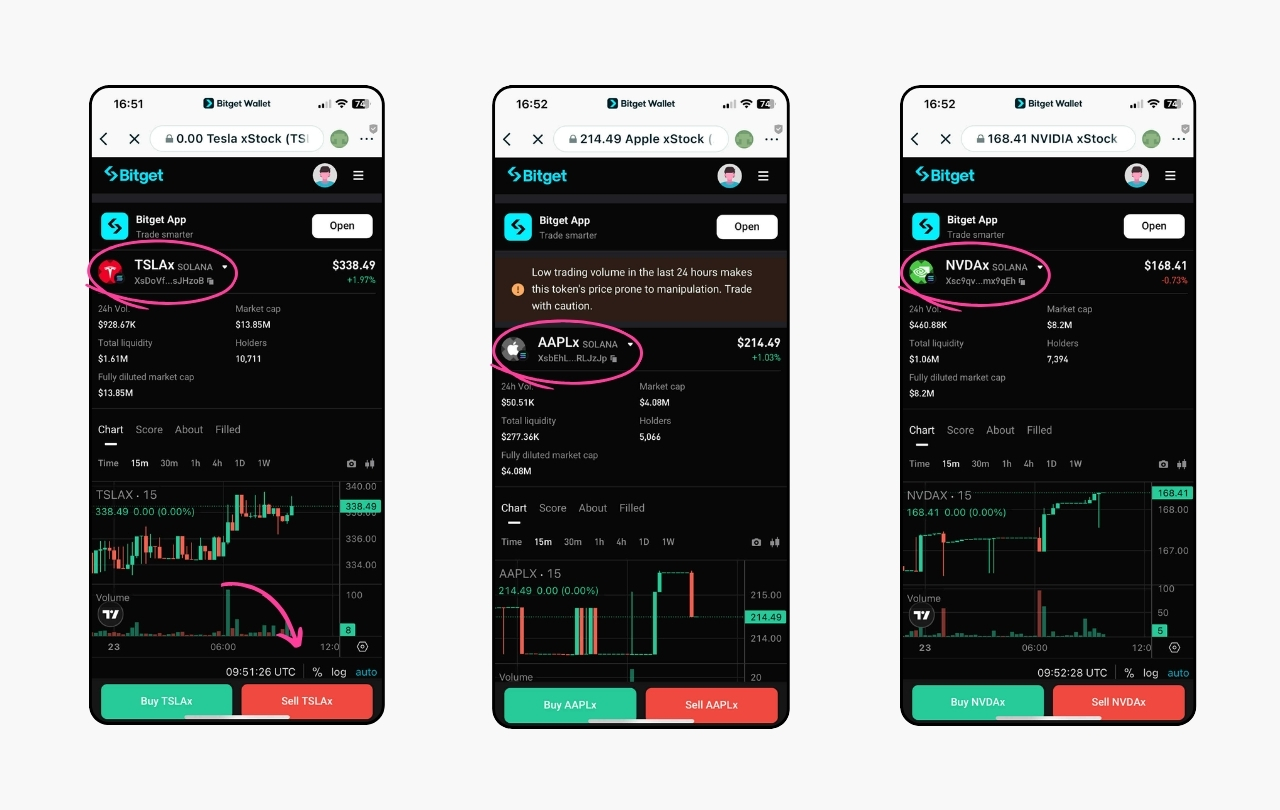

Tokenized stocks are rapidly transforming the global equity landscape, unlocking 24/7 trading and direct wallet-based access that sidesteps the limitations of legacy brokers. As of October 2025, the market for tokenized stocks has surged to $412 million, a dramatic leap from just a year ago. Major platforms like Ondo Global Markets and Bitget Wallet now offer non-U. S. investors seamless exposure to over 100 tokenized U. S. stocks and ETFs, including blue chips like Tesla, Apple, Amazon, Alphabet, and Microsoft. This evolution is not just about convenience; it is fundamentally reshaping how, when, and where global investors interact with equities.

Tokenized Stocks: From Wall Street Hours to 24/7 On-Chain Liquidity

Traditional stock trading is constrained by exchange hours, typically 9: 30 AM to 4: 00 PM EST for U. S. equities. In contrast, tokenized stocks operate on blockchain rails, enabling continuous trading with no market closures or geographic barriers. This shift empowers investors in Asia-Pacific, Europe, Africa, and Latin America to react instantly to global news cycles, earnings releases, or macro events, without waiting for Wall Street to open.

The latest data highlights this new paradigm: as of October 18,2025, Tesla Inc (TSLA) trades at $439.31, Apple Inc (AAPL) at $252.29, Amazon. com Inc. (AMZN) at $213.04, Alphabet Inc (GOOGL) at $253.30, and Microsoft Corporation (MSFT) at $513.58. These exact prices are mirrored on leading tokenized stock platforms, delivering real-time economic exposure around the clock.

Wallets vs. Brokers: The Self-Custody Revolution in Equities

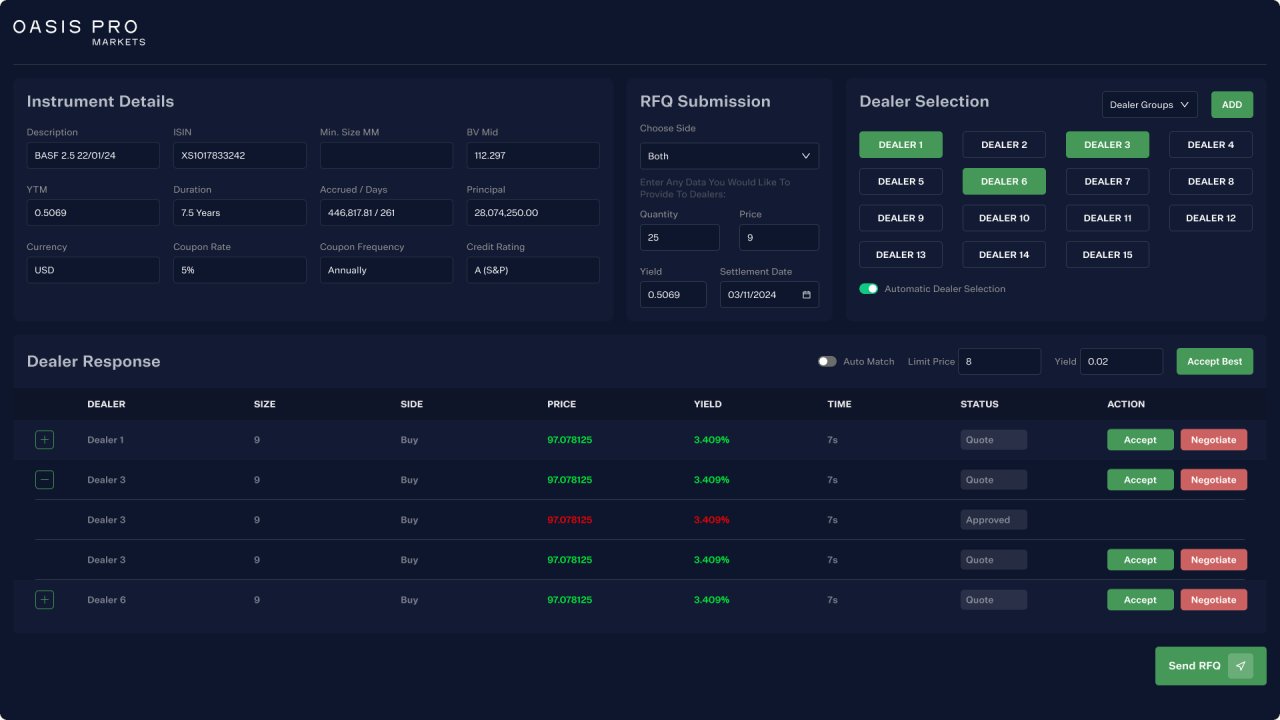

The core innovation lies in how investors interact with these assets. Instead of opening brokerage accounts, often gated by KYC, banking restrictions, or regional limitations, users simply connect a self-custody crypto wallet such as Bitget Wallet. This wallet-first approach enables direct on-chain settlement, instant trade execution, and full control over assets without intermediaries.

This is a stark departure from legacy brokers, which require lengthy onboarding and only operate within regulated jurisdictions. Tokenized stocks democratize access: anyone with a supported wallet can buy fractional shares with as little as $1, regardless of their location or banking status. For emerging markets and excluded populations, this is a seismic shift in financial inclusion and capital mobility.

Key Differences: Tokenized Stocks in Wallets vs. Traditional Brokers

-

Trading Hours: Tokenized stocks on platforms like Ondo Global Markets and Bitget Wallet can be traded 24/7, while traditional brokers restrict trading to exchange hours (e.g., 9:30 AM – 4:00 PM EST).

-

Ownership and Rights: Traditional brokerage accounts grant legal ownership, voting rights, and dividends. Tokenized stocks typically provide economic exposure only, without conferring actual ownership, voting power, or dividend rights.

-

Settlement Speed: Blockchain-based tokenized stocks settle almost instantly, compared to the T+2 days settlement cycle for traditional stock trades.

-

Accessibility: Tokenized stocks are accessible globally through wallets like Bitget Wallet, allowing users from regions such as Asia-Pacific, Europe, Africa, and Latin America to participate without traditional brokerage accounts or banking relationships.

-

Minimum Investment: Platforms like Bitget allow trading tokenized stocks with as little as $1, whereas traditional brokers often require higher minimum deposits or share purchases.

-

Regulatory Protections: Traditional brokers operate under strict regulatory oversight, providing investor protections such as insurance and dispute resolution. Tokenized stock platforms may offer fewer regulatory safeguards, with ongoing evaluation by authorities.

Structural Shifts: Settlement, Rights, and Regulatory Frontiers

Beyond trading hours and accessibility, tokenized stocks introduce several structural differences:

- Settlement Speed: Traditional equities settle in T and 2 days; tokenized stocks settle almost instantly on-chain.

- Ownership Structure: Most tokenized stocks provide economic exposure but not legal ownership, voting rights, or dividends, unlike their traditional counterparts.

- Global Liquidity: On-chain equities aggregate buyers and sellers worldwide, creating deeper liquidity pools outside traditional exchanges.

- Regulatory Ambiguity: With rapid growth come questions about investor protection, compliance, and the legal status of synthetic equities, a key area regulators are now scrutinizing.

For more on the mechanics and risks of trading tokenized U. S. equities on-chain, see this detailed guide.

Do you prefer trading equities via self-custody wallets or traditional brokers? Why?

Tokenized stocks now enable 24/7 global trading through self-custody wallets, while traditional brokers still offer legal ownership and investor protections. With platforms like Ondo Global Markets and Bitget Wallet making tokenized stocks more accessible, would you rather trade via a wallet or stick with a broker?

The rise of tokenized stocks is not just a technical upgrade, it’s a reimagining of global equity access, liquidity, and investor empowerment. In the next section, we’ll dive deeper into the mechanics of on-chain settlement, explore the latest innovations from Ondo and Bitget, and analyze the evolving regulatory landscape shaping the future of decentralized investing.

Instant Settlement and Global Reach: How On-Chain Equities Are Changing Market Dynamics

Instant settlement is more than a technical curiosity, it’s a game-changer for market participants. By leveraging blockchain, tokenized stocks eliminate T and 2 delays, allowing users to enter and exit positions with near-zero latency. This responsiveness is critical for traders managing risk during volatile events, as well as for long-term investors who value transparency and real-time asset verification. With platforms like Ondo Global Markets and Bitget Wallet now supporting over 100 tokenized U. S. stocks and ETFs, global liquidity is no longer siloed within national borders, but aggregated on-chain, accessible to anyone, anytime.

However, the economic exposure provided by tokenized stocks is not synonymous with full equity rights. While users can benefit from price movements, such as Tesla at $439.31 or Apple at $252.29: they typically do not receive dividends or voting power. This distinction is crucial for investors to understand, especially as tokenized equities gain mainstream traction. The lack of direct ownership rights means that tokenized stocks function more like synthetic derivatives, tracking underlying assets but not conferring shareholder privileges. For a deeper comparison, see this analysis of on-chain equity trading.

Risks and Regulatory Considerations: The Next Phase for Tokenized Equities

As the market cap for tokenized stocks climbs to $412 million (October 2025), regulators are stepping up scrutiny. The primary concerns center on investor protection, transparency of underlying custodians, and the enforceability of economic rights. Without clear jurisdictional frameworks, some platforms may expose users to counterparty risk or operational failures. Investors must conduct due diligence, assessing how assets are collateralized, what legal recourse exists, and whether platforms comply with emerging standards for synthetic equities.

Another important consideration is price discovery. While tokenized stocks mirror real-world prices, such as Amazon at $213.04, Alphabet at $253.30, and Microsoft at $513.58: liquidity and spreads can differ from traditional exchanges, particularly during periods of high volatility or low on-chain activity. Monitoring these discrepancies is essential for active traders and institutions transitioning to on-chain markets.

The Road Ahead: Tokenized Stocks and the Future of Decentralized Investing

The rapid adoption of self-custody wallets for equity trading is a signal that investor preferences are shifting toward autonomy, transparency, and global access. With minimum investments as low as $1, platforms like Bitget are lowering the entry barrier and bringing capital markets to populations historically excluded by traditional finance. As regulatory clarity improves and infrastructure matures, expect further integration of real-world assets (RWA) into DeFi protocols, deeper liquidity, and more sophisticated synthetic equity products.

Ultimately, the ability to buy, sell, and transfer economic exposure to blue-chip stocks like Tesla, Apple, and Microsoft, at any time, from anywhere, marks a fundamental shift in how capital markets operate. Investors who understand both the opportunities and limitations of tokenized stocks will be best positioned to capitalize on this new era of 24/7 global trading.

For further insights into strategies, risks, and the best platforms for trading tokenized stocks 24/7, explore this comprehensive resource.