How Tokenized Stocks are Enabling 24/7 Global Equity Trading via Crypto Wallets

The landscape of equity trading is undergoing a profound transformation, driven by the emergence of tokenized stocks and on-chain equities. For decades, global investors have been constrained by traditional market hours, geographic barriers, and the friction of legacy brokerage systems. Now, blockchain technology and decentralized finance (DeFi) protocols are unlocking 24/7 trading access to some of the world’s most coveted equities, directly from crypto wallets, without the need for intermediaries.

From Wall Street to Wallet: The Shift to On-Chain Equities

The core innovation behind tokenized stocks is simple yet revolutionary: digital representations of real company shares are issued and traded on blockchain networks, such as Ethereum or Solana. These tokenized assets mirror the price movements of their underlying equities, think Apple, Tesla, or Nvidia, but can be bought, sold, and held in a crypto wallet 24/7. This eliminates the need for a traditional brokerage account and sidesteps regional restrictions that have historically excluded many investors from U. S. markets.

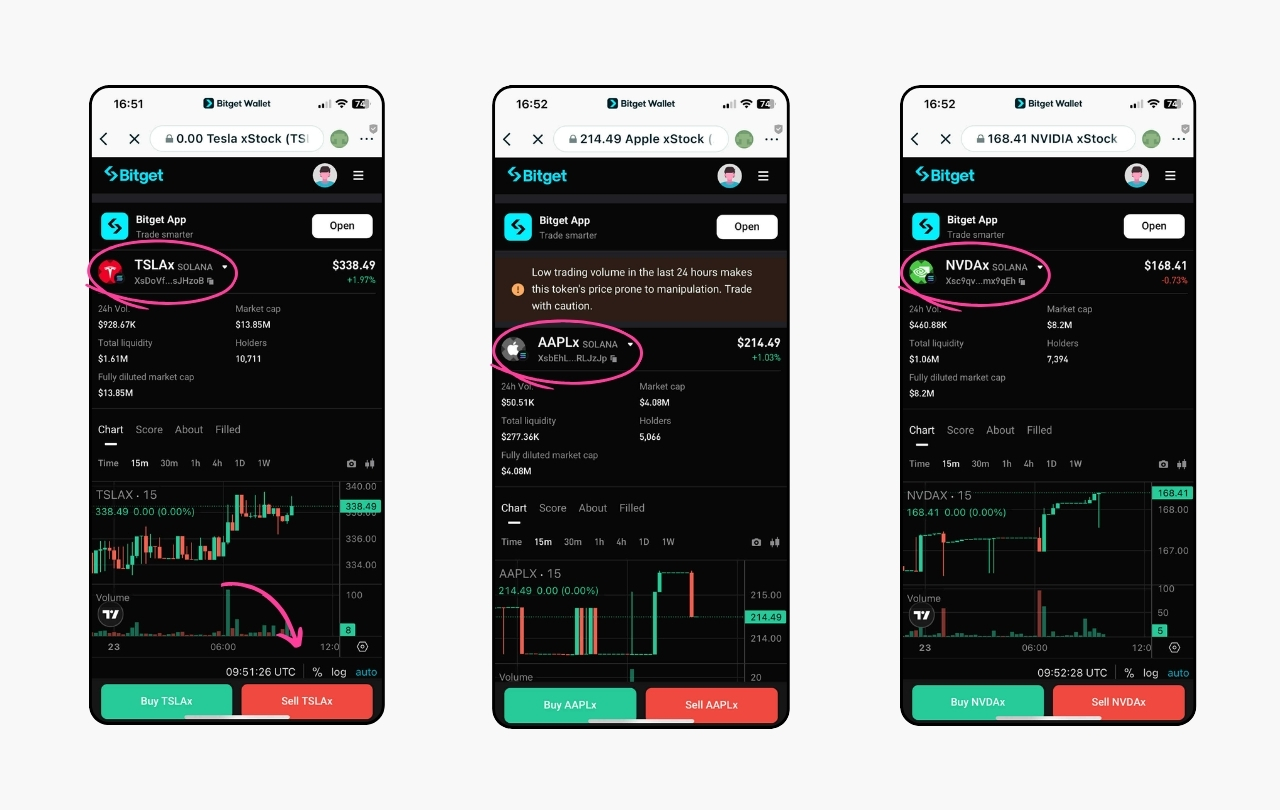

Recent launches by major platforms highlight this trend. In May 2025, Kraken unveiled its “xStocks” suite, over 50 U. S. stocks and ETFs tokenized on Solana, enabling non-U. S. users to trade around the clock. By July, eToro introduced 100 tokenized U. S. stocks as ERC-20 tokens on Ethereum with 24/5 trading access. Ondo Finance’s September 2025 expansion brought 100 and U. S. stocks and ETFs onto Ethereum for non-U. S. investors, with plans to scale to more than 1,000 assets by year-end. This rapid expansion signals a new era where crypto wallet stock trading is not just possible but increasingly mainstream.

The Mechanics: How Tokenized Stocks Work in Crypto Wallets

At its core, a tokenized stock is a blockchain-based asset that tracks the price of a corresponding traditional equity. These tokens can be purchased using cryptocurrencies, such as USDC, USDT, or ETH, and are stored in decentralized wallets like MetaMask or Phantom. Investors gain exposure to price movements without directly holding the underlying share; platforms may back tokens with actual shares held in custody or use synthetic models that rely on derivatives.

This structure delivers several key advantages:

Key Benefits of Tokenized Stocks for Global Investors

-

24/7 Trading Access: Tokenized stocks enable investors to trade equities around the clock, including weekends and holidays, removing the limitations of traditional market hours. This flexibility is offered by platforms like Kraken xStocks and Ondo Finance.

-

Global Accessibility via Crypto Wallets: Investors worldwide can buy and sell tokenized stocks directly through crypto wallets, bypassing the need for traditional brokerage accounts. This lowers entry barriers, especially for non-U.S. investors, as seen with Ondo Finance and Bitget.

-

Fractional Ownership: Tokenized stocks allow users to purchase fractions of shares, making high-value equities like Apple or Tesla more accessible to retail investors. This feature is available on platforms such as eToro and Kraken xStocks.

-

Faster Settlement and Lower Fees: Blockchain-based trading reduces settlement times and can lower transaction costs compared to traditional equity markets. Platforms like eToro and Ondo Finance leverage these efficiencies for investors.

-

Diversification and Choice: Major platforms now offer a wide selection of tokenized U.S. stocks and ETFs, enabling investors to diversify portfolios with assets that were previously hard to access internationally. Kraken xStocks and Ondo Finance have each listed over 50-100 U.S. equities, with plans to expand further.

The most transformative feature is continuous trading. Unlike traditional exchanges that close on evenings and weekends, blockchains operate without interruption. This means investors can buy or sell tokenized equities at any time, responding instantly to global news cycles or market-moving events.

Fractional Shares and Global Access: Leveling the Playing Field

Tokenization also enables fractional ownership, allowing users to purchase a fraction of a share, such as 0.01 TSLA or AAPL, making blue-chip stocks accessible to smaller investors worldwide. This is particularly impactful for those in emerging markets or underbanked regions who might otherwise face high minimums or regulatory hurdles.

The shift from brokers to wallets is not merely about convenience, it’s about democratizing access. Platforms like Ondo Global Markets and Bitget are reshaping financial inclusion by allowing anyone with an internet connection and a crypto wallet to participate in global equity markets without waiting for the opening bell.

This paradigm shift also introduces new considerations around custody, regulation, and investor protections. As highlighted by the World Federation of Exchanges and SEC Commissioner Hester Peirce in 2025, tokenized securities must still comply with existing laws, and investors should remain vigilant about platform transparency and rights associated with these digital assets.

For all the promise of tokenized stocks 24/7 trading, there are uncertainties that every investor must weigh. While the technology enables borderless, round-the-clock access, the regulatory landscape is still evolving. In August 2025, the World Federation of Exchanges called for stricter oversight, emphasizing the importance of market integrity and investor protection. SEC Commissioner Hester Peirce reiterated that “tokenized securities are still securities, ” meaning that platforms must navigate both blockchain innovation and the rigors of securities law. This duality creates a dynamic environment where compliance, transparency, and user education are paramount.

Another key consideration is the nature of ownership. Most tokenized stocks do not currently confer traditional shareholder rights, such as voting at annual meetings or receiving dividends directly. Instead, investors are exposed to price movements and, in some cases, synthetic derivatives rather than actual equity. This is a critical distinction for those accustomed to the rights and protections of conventional equity ownership. As platforms mature, we may see new models emerge that blend on-chain efficiency with greater alignment to legacy shareholder privileges.

The Road Ahead: What’s Next for On-Chain Equities?

The pace of innovation shows no signs of slowing. Kraken’s xStocks, eToro’s ERC-20 equities, and Ondo Finance’s rapid asset expansion highlight fierce competition to capture global demand for on-chain equities global access. As more platforms race to scale their offerings, expect to see:

Key Trends Shaping Tokenized Stock Trading in 2026

-

Kraken xStocks: Expanding 24/7 Global Access — In May 2025, Kraken launched xStocks, offering tokenized versions of over 50 major U.S. stocks and ETFs on the Solana blockchain. This enables non-U.S. investors to trade equities like Apple and Tesla around the clock, bypassing traditional brokerages.

-

eToro’s ERC-20 Tokenized Stocks: 24/5 Trading on Ethereum — By July 2025, eToro introduced tokenized versions of 100 top U.S. stocks as ERC-20 tokens on Ethereum, allowing users to trade outside standard market hours and increasing accessibility for global retail investors.

-

Ondo Finance: Scaling Tokenized Equity Offerings — In September 2025, Ondo Finance launched its tokenized equity platform on Ethereum, providing access to over 100 U.S. stocks and ETFs, with plans to expand to 1,000 assets by year-end. This marks a significant step toward comprehensive, blockchain-based equity markets.

-

Regulatory Scrutiny and Investor Protection — The rapid growth of tokenized stocks has prompted calls for stricter oversight. In August 2025, the World Federation of Exchanges and SEC Commissioner Hester Peirce emphasized that tokenized securities must comply with existing regulations, highlighting the importance of investor safeguards and market integrity.

-

Fractional Ownership and Continuous Trading — Tokenized stocks enable fractional ownership and 24/7 trading via crypto wallets, providing unprecedented flexibility and access for investors worldwide. However, users must be mindful of risks like regulatory uncertainty and limited shareholder rights.

We’re also witnessing a blurring of lines between centralized platforms and DeFi protocols. Some providers custody real shares, while others use synthetic models or derivatives to mimic equity exposure. For investors, due diligence is non-negotiable: understanding whether a token is backed by actual shares or operates as a synthetic is vital for risk management.

The future of fractional shares blockchain ecosystems is likely to hinge on three pillars: robust regulatory frameworks, trusted infrastructure partners (such as Chainlink for price oracles), and seamless wallet integrations. As these elements converge, tokenized equities are poised to become a core pillar of diversified portfolios – not just for crypto natives, but for traditional investors seeking global exposure without the friction of legacy systems.

Strategic Takeaways:

- Continuous access: Tokenized stocks enable investors to respond instantly to global news, earnings releases, or macro events, regardless of time zone.

- Democratization: Fractionalization and wallet-based trading are lowering barriers for emerging market participants and those previously excluded from U. S. equities.

- Regulatory vigilance: The sector’s growth will depend on clear rules and investor protections without stifling innovation.

For those ready to explore this new frontier, staying informed is non-negotiable. Track platform updates, regulatory shifts, and the evolving features that distinguish one provider from another. As the market matures, expect more sophisticated products – including tokenized ETFs, real-time settlement, and even hybrid models that bridge DeFi and traditional brokerage systems.

For a deeper dive into the mechanics and opportunities of on-chain equities, see our guide on how tokenized stocks enable 24/7 trading and fractional ownership on the blockchain.