How Ondo Finance is Powering 24/7 Trading of Tokenized U.S. Stocks On-Chain

Tokenized equities have long been a promise of blockchain, but with the launch of Ondo Global Markets, that vision is rapidly becoming a reality. Ondo Finance has introduced a platform where over 100 tokenized U. S. stocks and ETFs are now available for 24/7 trading on-chain, creating an unprecedented level of accessibility and flexibility for global investors. For those outside the U. S. and U. K. , this marks a pivotal moment: you can now gain exposure to household names like Apple and Tesla, as well as a suite of popular ETFs, directly from your crypto wallet.

Ondo Finance: Unlocking 24/7 On-Chain Equities Trading

Traditional equity markets are bound by the clock, typically operating Monday through Friday during set trading hours. This structure can be limiting for global investors, especially those in regions where market hours clash with local time zones. Ondo Finance tokenized stocks are breaking this mold, leveraging the Ethereum blockchain to offer continuous, peer-to-peer trading access five days a week, no matter where you are in the world.

What sets Ondo apart is the platform’s commitment to asset backing and regulatory compliance. Each token is fully collateralized by the underlying security, held at U. S. -registered broker-dealers. This ensures that the digital asset you trade on-chain is always 1: 1 matched with its real-world counterpart, providing both transparency and peace of mind for investors.

How Ondo’s Tokenized U. S. Stocks Work

The process is elegantly simple but technologically robust. When you purchase a tokenized stock or ETF on Ondo Global Markets, you are acquiring a blockchain-based representation of a real share or fund. These tokens are backed by actual securities, with all holdings managed by trusted custodians. The result is a seamless bridge between traditional finance and DeFi, allowing investors to hold and trade U. S. equities alongside their crypto assets.

Ondo’s offering is not limited to just big tech stocks. The platform includes a diverse array of assets: from blue-chip companies to sector-specific ETFs and even precious metals ETFs, all accessible on-chain. This breadth is crucial for investors seeking diversification and exposure to different market sectors without the friction of legacy brokerage systems.

Global Reach, Local Compliance

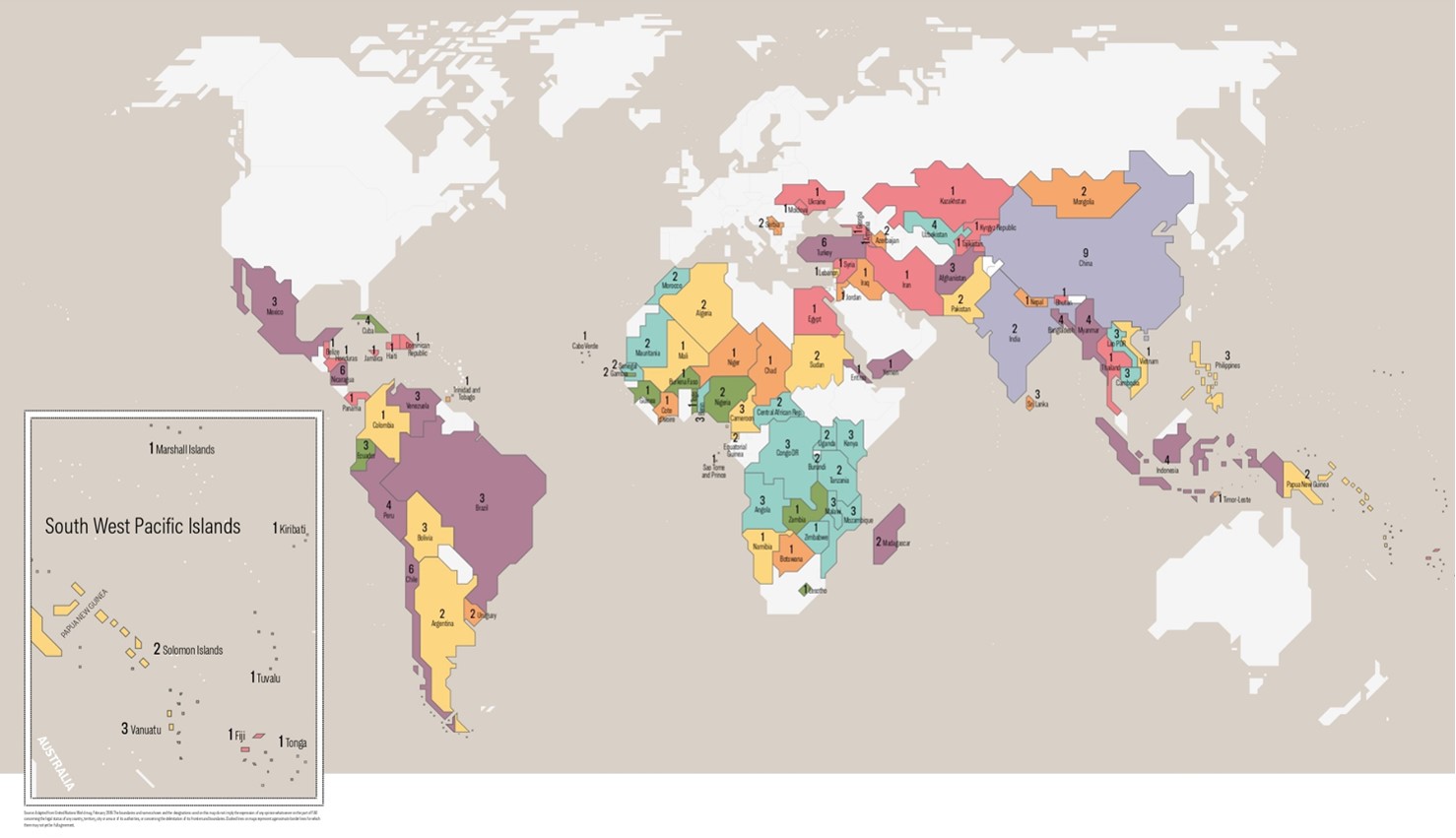

Accessibility is at the heart of Ondo’s mission, but so is regulatory responsibility. To comply with current regulations, Ondo Global Markets is available to investors in Asia-Pacific, Europe, Africa, and Latin America, while U. S. and U. K. residents remain excluded for now. This focus ensures that the platform operates within legal frameworks while maximizing its potential impact across underserved markets.

Recent integrations, such as the partnership with Blockchain. com’s DeFi Wallet in Nigeria, are already expanding access to tokenized U. S. stocks for users who previously faced significant barriers to entry. Ondo’s approach is setting a new standard for how global investors can participate in the U. S. equities market without the need for intermediaries or traditional brokerage accounts.

For a deeper dive into how Ondo is bridging global equity markets and DeFi, see How Tokenized Stocks Are Enabling 24/7 Global Equity Markets On-Chain.

The ONDO token itself is also gaining traction as Ondo’s ecosystem expands. As of October 22,2025, the live price of ONDO is $0.7156, with a 24-hour trading volume of $154,228,146 and a daily range between $0.7156 and $0.7801, demonstrating robust liquidity and growing investor interest.

Ondo Finance (ONDO) Price Prediction 2026-2031

Comprehensive ONDO price outlook based on adoption trends, DeFi integration, and global expansion of tokenized assets.

| Year | Minimum Price | Average Price | Maximum Price | Year-Over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.65 | $0.95 | $1.30 | +33% | Steady adoption of tokenized stocks in emerging markets; regulatory clarity in Asia/Africa boosts confidence. |

| 2027 | $0.82 | $1.18 | $1.70 | +24% | Expansion to 1,000+ assets and integration with BNB/Solana increases DeFi activity; volatility from global market cycles. |

| 2028 | $1.05 | $1.45 | $2.10 | +23% | Mainstream institutional interest and interoperability with major chains; some regulatory headwinds in Europe. |

| 2029 | $1.20 | $1.75 | $2.60 | +21% | Continued growth in tokenized asset volume; potential entry into U.S./U.K. if regulations relax. |

| 2030 | $1.15 | $2.10 | $3.20 | +20% | DeFi and TradFi merge further; ONDO becomes a leading platform for on-chain real-world assets. |

| 2031 | $1.30 | $2.50 | $3.80 | +19% | Global on-chain finance matures; ONDO faces competition but retains strong market share with innovation. |

Price Prediction Summary

Ondo Finance (ONDO) is positioned for significant growth as it capitalizes on the tokenization of traditional assets and DeFi integration. The average price is projected to more than triple from current levels by 2031, assuming favorable adoption and regulatory environments. Investors should expect volatility, but long-term prospects remain strong given Ondo’s first-mover advantage in on-chain tokenized equities.

Key Factors Affecting Ondo Finance Price

- Expansion of tokenized assets (from 100+ to 1,000+) and cross-chain support (Ethereum, BNB, Solana)

- Broader DeFi adoption and use cases for tokenized stocks/ETFs

- Global regulatory developments, especially in U.S. and Europe

- Competition from other tokenization platforms and Layer 1 blockchains

- Market cycles in both crypto and traditional equities

- Institutional adoption and TradFi partnerships

- Liquidity improvements and adoption in emerging markets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Integration With DeFi: Beyond Simple Trading

Perhaps most exciting is the composability Ondo brings to on-chain assets. Tokenized stocks and ETFs on Ondo Global Markets are not just tradable, they are transferable peer-to-peer and can be integrated into DeFi protocols for lending, borrowing, or yield strategies. This opens up entirely new possibilities for portfolio management and capital efficiency within the blockchain ecosystem.

Ondo’s roadmap is ambitious: plans are underway to expand the asset selection to over 1,000 tokenized securities by year-end and to support additional blockchains like BNB Chain and Solana. As these developments unfold, the boundaries between traditional finance and decentralized markets will continue to blur, empowering investors worldwide to build more resilient, diversified portfolios on their own terms.

For investors, the practical benefits of 24/7 on-chain equities trading are already materializing. Markets never sleep, and neither do opportunities, especially in volatile periods when after-hours news can move prices sharply. With Ondo, you’re no longer at the mercy of market open and close bells. Instead, you can respond to global events, rebalance your portfolio, or access liquidity at any time that suits your strategy.

This always-on access is especially meaningful for participants in emerging markets, where time zones and local financial infrastructure have historically limited access to U. S. equities. By tokenizing stocks and ETFs, Ondo Finance is removing these barriers and democratizing the world’s largest equity markets. For many, it’s the first time they can directly own and trade U. S. stocks without intermediaries, high fees, or paperwork.

Risks and Considerations for On-Chain Stock Investors

While the advantages are substantial, it’s important to approach Ondo tokenized ETFs and stocks with a balanced perspective. The tokens are fully backed and regulated where offered, but investors should be aware of jurisdictional restrictions, smart contract risks, and the evolving nature of securities law in DeFi. Additionally, price discovery and liquidity may differ from those found on traditional exchanges, especially during periods of high volatility or rapid market news cycles.

Ondo’s ongoing commitment to transparency is a reassuring factor. Asset backing is regularly audited, and all tokenized equities are managed by U. S. -registered broker-dealers. Still, prudent investors should perform their own due diligence and stay informed about regulatory updates in their region. For more on what this means for DeFi investors specifically, see How Ondo Finance Is Bringing 100 Tokenized U. S. Stocks And ETFs On-Chain: What It Means For DeFi Investors.

Key Benefits of Ondo’s 24/7 On-Chain Equities Trading

-

Round-the-Clock Trading Access: Ondo Global Markets enables investors to buy and sell tokenized U.S. stocks and ETFs 24/7, providing continuous access beyond traditional market hours.

-

Global Reach for Non-U.S. Investors: The platform is designed for users in Asia-Pacific, Europe, Africa, and Latin America, allowing global participation while complying with regulatory restrictions.

-

Extensive Asset Selection: Investors can access over 100 tokenized U.S. stocks and ETFs, including major companies like Apple and Tesla, all backed by real securities held at U.S.-registered broker-dealers.

-

Seamless Integration with DeFi: Tokenized equities can be transferred peer-to-peer and used in decentralized finance applications, expanding their utility within the crypto ecosystem.

-

Enhanced Liquidity and Flexibility: By operating on the Ethereum blockchain, Ondo facilitates greater liquidity and flexibility, enabling instant settlement and reducing reliance on traditional intermediaries.

What’s Next for Ondo Finance?

Looking ahead, Ondo Finance’s roadmap is poised to accelerate the adoption of blockchain synthetic equities worldwide. The planned expansion to over 1,000 tokenized assets will give investors access to an even broader swath of global markets, all tradable directly from a self-custody wallet. Integration with other leading blockchains like BNB Chain and Solana will further boost interoperability and user choice.

This evolution aligns with a broader shift in capital markets: traditional boundaries are dissolving as blockchain technology enables new forms of asset ownership, transferability, and composability. As more institutional-grade platforms like Ondo emerge, expect increased competition, innovation, and ultimately better outcomes for everyday investors seeking diversification beyond their local markets.

“Tokenization is not just about putting stocks on-chain, it’s about reimagining what access, liquidity, and transparency can look like in the next era of investing. ”

For those eager to explore further or get started with tokenized U. S. stocks on-chain, our resources at On-Chain Stocks/Equities offer guides on account setup, regulatory FAQs, and comparisons between leading platforms. As always, remember that innovation brings both opportunity and risk, so invest thoughtfully, stay informed, and invest for tomorrow, today.