How to Invest in Tokenized Equities: A Step-by-Step Guide for Blockchain Investors

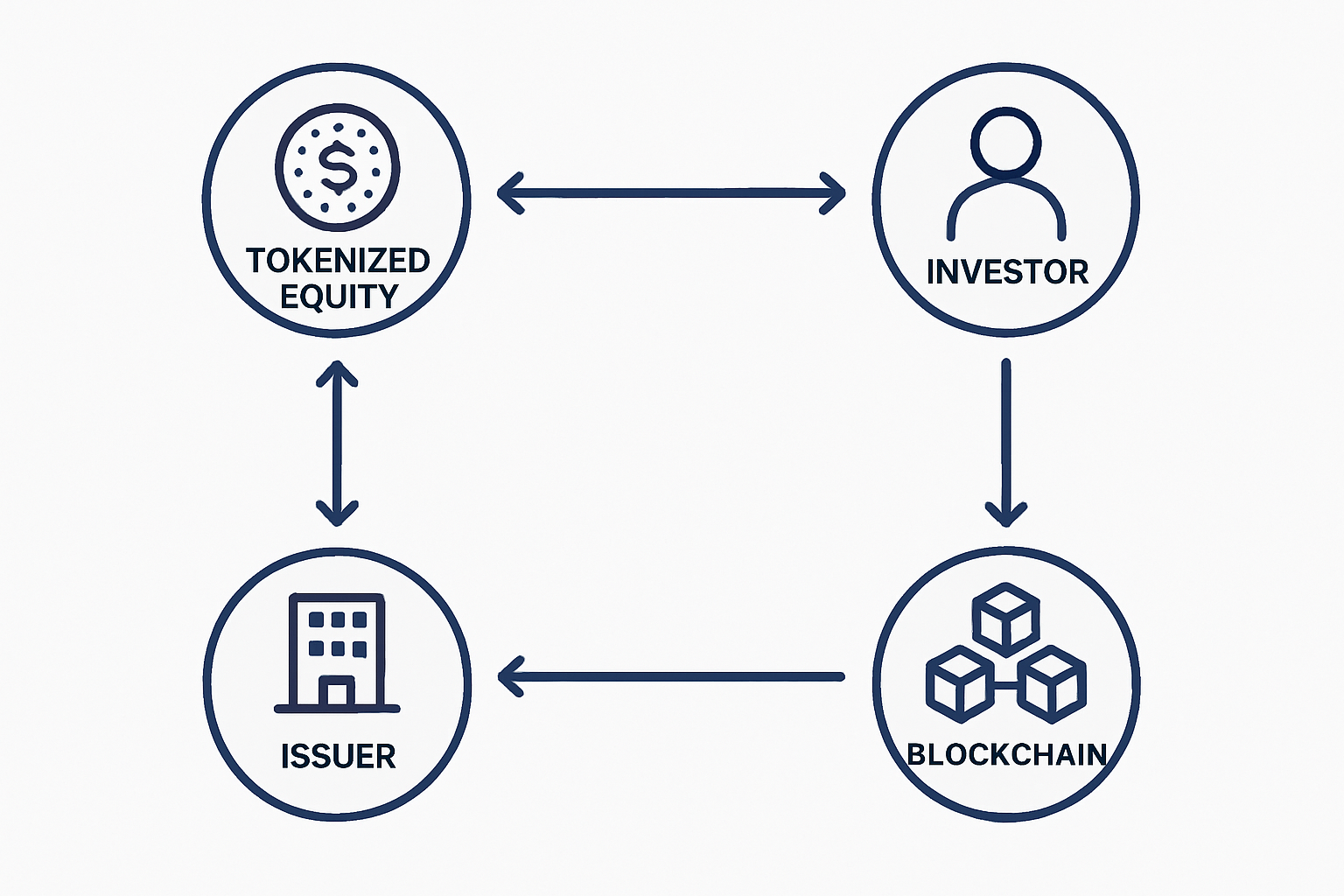

Tokenized equities are rapidly redefining how investors access and trade traditional stocks. By leveraging blockchain, these digital tokens represent ownership in real-world companies, offering unique advantages such as fractional shares, 24/7 access, and instant settlement. For blockchain investors aiming to diversify into on-chain equities or synthetic stocks, a methodical approach is essential. This data-driven, step-by-step guide breaks down the critical stages for investing in tokenized equities in today’s evolving market.

Step 1: Understand Tokenized Equities and Associated Risks

Before entering the market, it’s crucial to understand what tokenized equities are and the risks involved. These digital assets are blockchain-based representations of traditional stocks or synthetic derivatives. Benefits include:

- Fractional ownership: Buy small portions of high-value shares.

- Global access: Trade anywhere with an internet connection.

- 24/7 markets: No waiting for traditional exchange hours.

- Fast settlements: Blockchain enables near-instant clearing.

However, risks persist:

- Regulatory uncertainty: Jurisdictional rules can change quickly.

- Technology vulnerabilities: Smart contract bugs or wallet security issues may result in losses.

- Liquidity concerns: Some tokens may lack sufficient trading volume for easy entry and exit.

A robust understanding of these factors is foundational before deploying capital into any on-chain equity product.

Step 2: Select a Reputable Tokenization Platform or Exchange

The next step is to choose a regulated platform or exchange specializing in tokenized equities or synthetic stocks. Leading options include Securitize, Swarm Markets, tZERO, and Backed Finance. When evaluating platforms, prioritize:

- Securities compliance: Ensure the provider adheres to regional KYC/AML requirements and securities laws.

- User custody options: Platforms should support non-custodial wallets for maximum asset control.

- Diversity of offerings: Look for marketplaces listing both blue-chip stocks (like Apple via $bAAPL) and innovative synthetic equity products.

- Transparent backing: Verify that each token is fully collateralized by underlying shares or follows robust synthetic modeling standards.

This due diligence mitigates counterparty risk and ensures alignment with your investment objectives. For more on how decentralized platforms are expanding global market access, see our analysis at How Tokenized Equities Are Reshaping Global Market Access for Excluded Investors.

Step 3: Complete KYC/AML Verification and Fund Your Account

The majority of reputable exchanges require users to complete Know Your Customer (KYC) verification as part of Anti-Money Laundering (AML) compliance. Be prepared to submit government-issued identification and proof of address documents during onboarding. Once verified:

- Add funds via fiat or crypto: Most platforms accept bank transfers, stablecoins like USDC, or cryptocurrencies such as Ethereum (ETH).

- Review transaction fees: Each funding method comes with distinct fee structures, factor these into your cost basis calculations.

- Select supported currencies: Ensure your preferred funding currency is compatible with the platform’s requirements before initiating deposits.

This step lays the groundwork for seamless participation in tokenized equity markets while maintaining regulatory compliance, a key consideration given ongoing SEC oversight in this sector.

Step 4: Research and Evaluate Available Tokenized Equities or Synthetic Stocks

With your account funded, the next priority is thoroughly researching the available tokenized equities and synthetic stocks on your chosen platform. Not all on-chain equity products are created equal. Analyze the following:

- Underlying asset verification: Confirm that each token represents a legitimate share or follows a transparent synthetic model, with clear collateralization or price-tracking mechanisms.

- Liquidity metrics: Scrutinize daily trading volumes and order book depth to ensure you can enter and exit positions efficiently.

- Issuer reputation: Assess the credibility of the entity offering or backing the token. Look for audited smart contracts, transparent disclosures, and established operational history.

- Diversification potential: Evaluate whether the marketplace offers a mix of sectors, regions, and both traditional and synthetic stock exposures.

Dive into technical documentation, whitepapers, and on-chain analytics dashboards to validate claims. For investors seeking 24/7 global access to equities via crypto wallets, explore our deep dive at How Tokenized Stocks Are Enabling 24/7 Global Equity Trading via Crypto Wallets.

Step 5: Purchase, Monitor, and Manage Your On-Chain Equity Portfolio

Once you’ve selected your target assets, proceed to purchase tokenized equities directly through the platform’s trading interface. Orders can typically be placed at market price or with limit orders for more precise execution. After acquisition:

- Transfer tokens to a secure wallet: Move your holdings off-exchange into a non-custodial wallet such as MetaMask or Ledger for enhanced security.

- Track portfolio performance: Use real-time dashboards to monitor price movements, dividend distributions (where applicable), and portfolio allocation across different sectors or regions.

- Rebalance as needed: Adjust your holdings periodically in response to market shifts or changes in personal risk tolerance.

- Stay informed on regulatory changes: Regularly review updates from both platforms and regulators to anticipate impacts on liquidity or compliance requirements.

This ongoing management is essential for optimizing returns while mitigating risks associated with evolving blockchain equity markets.

Key Takeaways for Blockchain Investors

- Select only regulated platforms with robust compliance frameworks.

- Diversify across multiple tokenized equities and synthetic stocks for risk-adjusted exposure.

- Permanently secure assets in non-custodial wallets; prioritize self-custody over convenience where possible.

- KYC/AML compliance is not optional, expect it as standard practice in this sector.

The future of equity investing is increasingly digital-first. By following this step-by-step process, understand risks, select reputable platforms, complete onboarding checks, research assets rigorously, then actively manage your portfolio, blockchain investors can capture new opportunities in tokenized stocks while navigating regulatory complexity with confidence. Stay data-driven and agile as this market continues to evolve rapidly.

Best Practices for Managing Tokenized Equity Portfolios

-

Understand Tokenized Equities and Associated Risks: Gain a comprehensive understanding of how tokenized equities work, including benefits like fractional ownership and 24/7 trading. Assess risks such as regulatory uncertainty, liquidity constraints, and technology vulnerabilities before investing.

-

Select a Reputable Tokenization Platform or Exchange: Use established, regulated platforms such as Securitize, tZERO, Swarm Markets, or Backed Finance. Ensure the platform complies with securities laws and offers transparent asset backing for tokenized stocks.

-

Complete KYC/AML Verification and Fund Your Account: Follow strict KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures for compliance. Fund your account using fiat or cryptocurrencies (e.g., USDC, ETH), and verify all deposit channels for security.

-

Research and Evaluate Available Tokenized Equities or Synthetic Stocks: Analyze the underlying assets, market liquidity, and regulatory status of each tokenized equity. Prioritize equities with transparent backing and real-time price tracking from reputable companies such as Apple ($bAAPL) or Tesla ($bTSLA).

-

Purchase, Monitor, and Manage Your On-Chain Equity Portfolio: Execute trades through the platform, then transfer tokens to a non-custodial wallet like MetaMask or Ledger for enhanced security. Regularly monitor performance, track dividends, and stay updated on regulatory changes impacting your holdings.