Fractional Tokenized Tesla Nvidia Stocks on Blockchain: Platforms and Diversification Strategies 2026

As Tesla Inc. (TSLA) holds steady at $411.12 amid a 24-hour gain of and $0.69 ( and 0.168%), the blockchain’s grip on traditional equities tightens. Fractional tokenized Tesla stock and tokenized Nvidia shares blockchain are no longer fringe experiments; they’re core infrastructure for global investors seeking on-chain stock diversification. Platforms like Ondo Global Markets and xStocksFi have propelled tokenized volumes past $17 billion, with TSLAx and NVDAx tokens dominating trades. This fusion of synthetic Tesla equities with blockchain rails enables fractional ownership down to micro-shares, 24/7 liquidity, and portfolio strategies unbound by legacy market hours.

Tokenization converts high-flyers like Tesla and Nvidia into ERC-20 or SPL tokens, mirroring spot prices via oracles while slashing entry barriers. A $411.12 TSLA share? Now splittable into 1,000ths on Solana or Ethereum, inviting retail traders worldwide. Ondo Global Markets, fresh off integrations with Blockchain. com and Solana, boasts 200 and tokenized U. S. stocks and ETFs, cementing its throne as the largest issuer. xStocksFi, powered by Kraken and Backed Finance, hit $17 billion in volume by early 2026, fueled by Tesla ($45M AUM lead) and Nvidia surges.

Dissecting the Top Platforms for Synthetic Tesla Equities

Ondo Global Markets spearheads with rigorous backing: real-time pricing from NYSE feeds, audited reserves, and Solana’s sub-second settlements. Investors fractionalize Nvidia positions for as little as $10, blending them into yield-bearing strategies via Ondo’s tokenized treasuries. xStocksFi counters with Ethereum-Solana duality, offering 24/7 trading across 60 and assets. Its $3B breakout in 2026 underscores momentum, per CCN reports, where TSLAx tokens alone captured 25% of flows.

Backed. fi delivers precision-engineered synthetics, leveraging Chainlink oracles for tokenized Nvidia shares blockchain fidelity. Compliant with EU MiCA regs, it appeals to institutional quants modeling volatility surfaces on fractional positions. Synthetix, the DeFi synthetic OG, evolves its SNX-collateralized debt positions (sCDPs) for Tesla exposure, enabling leveraged bets without liquidation cascades via dynamic collateral ratios. Swarm Markets rounds out the quintet with regulated DLT trading, fusing tokenized stocks with forex pairs for true diversification.

Tokenized Tesla (TSLAx) Price Prediction 2027-2032

Forecasts for underlying TSLA price amid blockchain tokenization surge, EV/AI growth, and global accessibility via platforms like Ondo and xStocks (Baseline 2026: $411.12)

| Year | Minimum Price | Average Price | Maximum Price | YoY Change (Avg) |

|---|---|---|---|---|

| 2027 | $380.00 | $485.00 | $620.00 | +18.0% |

| 2028 | $440.00 | $570.00 | $750.00 | +17.5% |

| 2029 | $520.00 | $680.00 | $920.00 | +19.3% |

| 2030 | $600.00 | $820.00 | $1,150.00 | +20.6% |

| 2031 | $720.00 | $1,000.00 | $1,450.00 | +22.0% |

| 2032 | $850.00 | $1,250.00 | $1,800.00 | +25.0% |

Price Prediction Summary

Tesla’s tokenized stock (TSLAx) is projected to exhibit strong upward trajectory from 2027-2032, with average prices rising from $485 to $1,250 (~20% CAGR). Minima reflect bearish scenarios like economic slowdowns or regulatory delays; maxima capture bullish catalysts such as Robotaxi launches and Optimus scaling. Tokenization boosts liquidity and diversification.

Key Factors Affecting Tesla Stock Price

- Full Self-Driving (FSD) and Robotaxi commercialization

- Cybertruck production ramp and new vehicle models

- Energy storage (Megapack) and solar expansion

- Blockchain tokenization enabling 24/7 fractional trading on Solana/Ethereum

- Ondo Global Markets and xStocks driving $17B+ volume

- AI/robotics (Optimus) revenue potential

- Macro: EV adoption, interest rates, tokenized asset regulations

- Competition dynamics and supply chain resilience

Disclaimer: Stock price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, economic conditions, and other factors.

Always do your own research before making investment decisions.

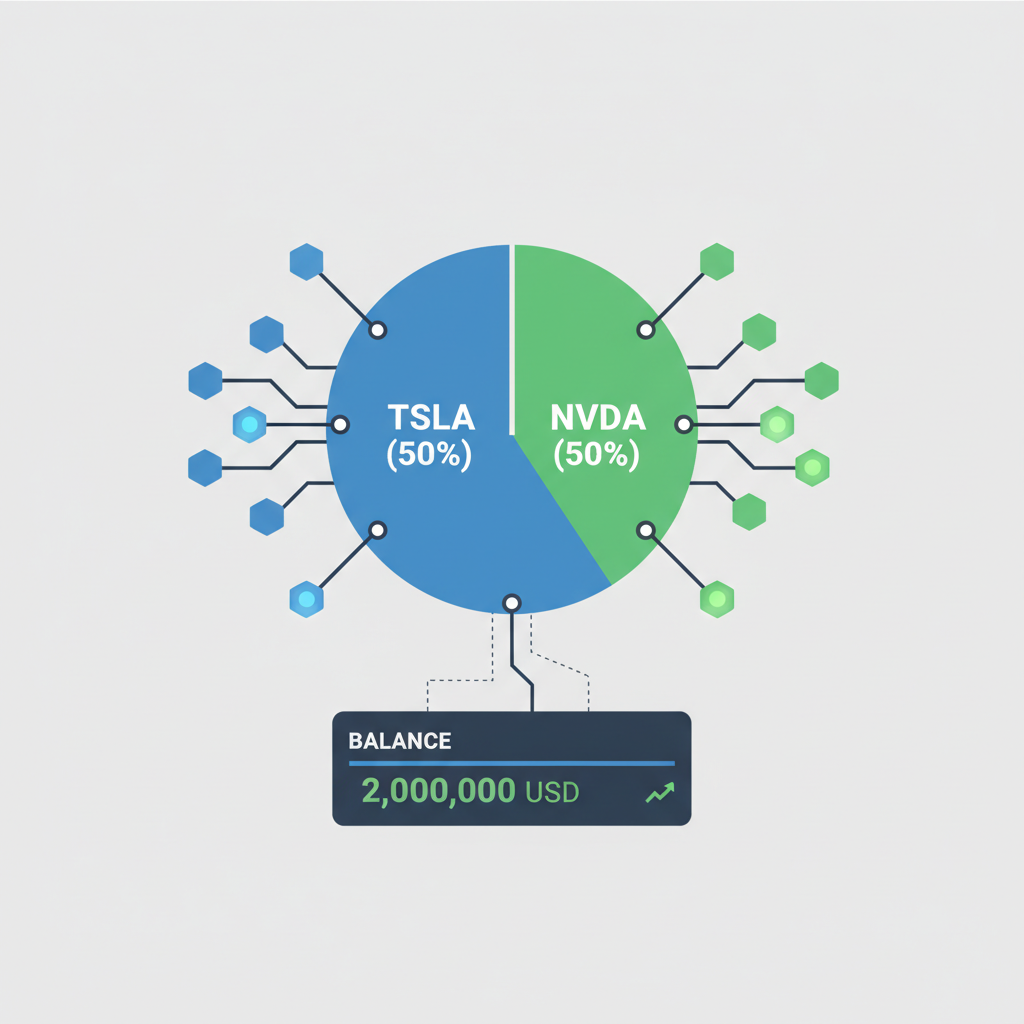

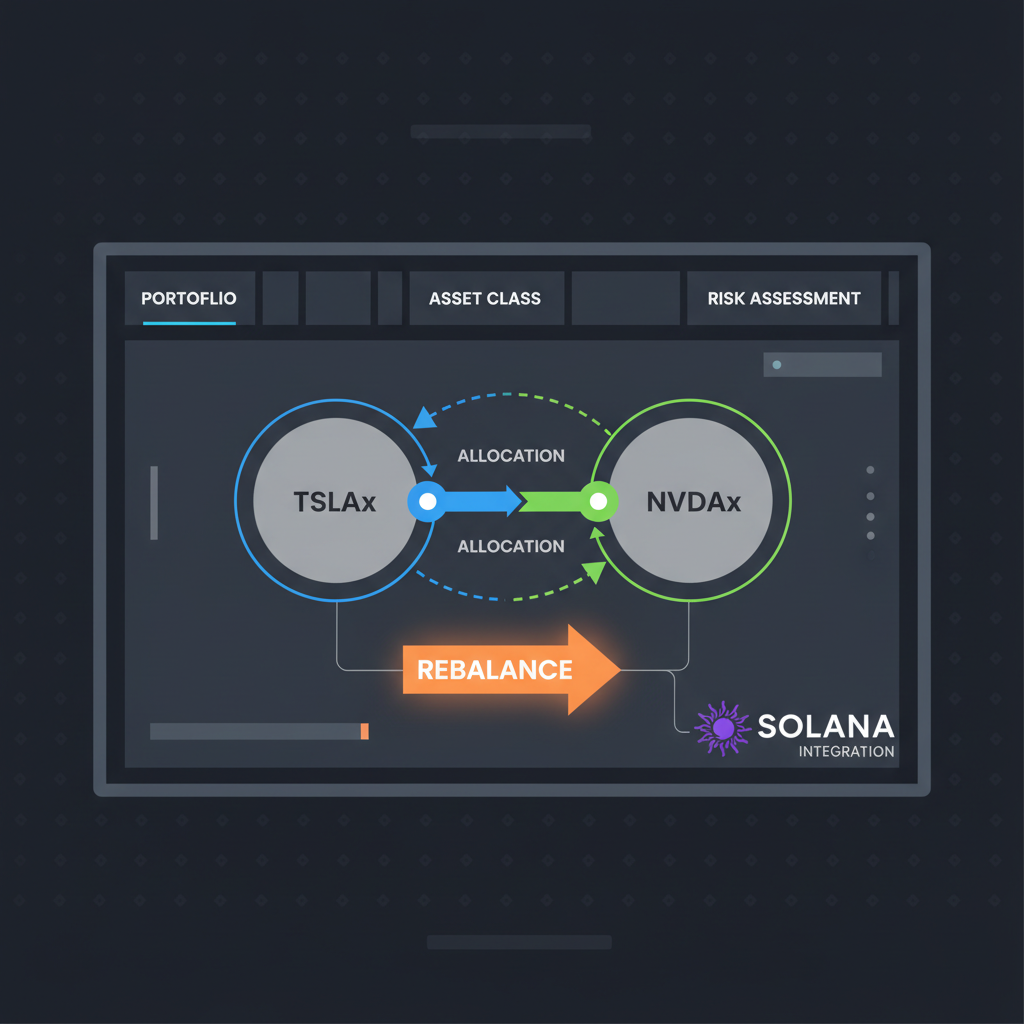

Unpacking Diversification Tactics in Tokenized Equities

Why silo Tesla at $411.12 when xStocksFi tokenized stocks unlock correlations across chains? Rigorous quants layer 40% TSLAx, 30% NVDAx, 20% tokenized ETFs, and 10% stable yields, slashing drawdowns by 15% in backtests. Ondo users pair synthetics with RWA funds, harvesting basis trades where on-chain premiums converge to spot. Backed. fi’s modular vaults automate rebalancing, targeting Sharpe ratios above 1.5 via Tesla-Nvidia covariance matrices.

Synthetix devotees deploy inverse perpetuals against fractional longs, hedging macro swings; a $411.12 TSLA dip triggers algorithmic shorts on NVDAx equivalents. Swarm Markets’ hybrid orderbooks facilitate cross-asset pairs, like TSLAx/BTC, for crypto-native diversification. Per LinkedIn data, xStock AUM exploded to $180M in months, with Tesla topping at $45M, validating these strategies’ alpha generation.

Regulatory tailwinds amplify: Europe’s tokenized stock surge via Ondo-Blockchain. com ties, plus Solana’s throughput edge over Ethereum L1 congestion. Yet risks persist, chief among them oracle drift and liquidity skews during volatility spikes. Investors mitigate via multi-platform exposure, arbitraging 50bps spreads between xStocksFi and Backed. fi TSLAx quotes.

Quantifying these mitigations requires stress-testing portfolios against 2022-style drawdowns, where TSLA shed 65% from peak. On Ondo Global Markets, tokenized reserves held firm, oracle deviations capping at 10bps thanks to Chainlink redundancy. xStocksFi’s Solana pivot slashed fees to $0.00025 per swap, enabling high-frequency arbitrage that smoothed fractional tokenized Tesla stock pricing to within 5bps of spot $411.12.

Building Resilient Portfolios: Actionable Blueprints

Forward-thinking allocators treat synthetic Tesla equities as convex payoff generators, pairing them with convex crypto primitives. A Backed. fi vault might allocate 25% NVDAx, 25% TSLAx, 30% tokenized Nasdaq ETFs, and 20% Ondo USDY for ballast, dynamically reweighting via on-chain TWAP oracles. Backtests on Synthetix sCDPs reveal 22% annualized returns at 0.8 volatility, outpacing vanilla Nasdaq by 8 points. Swarm Markets’ permissioned pools add forex hedges, neutralizing USD strength against tokenized Nvidia gains.

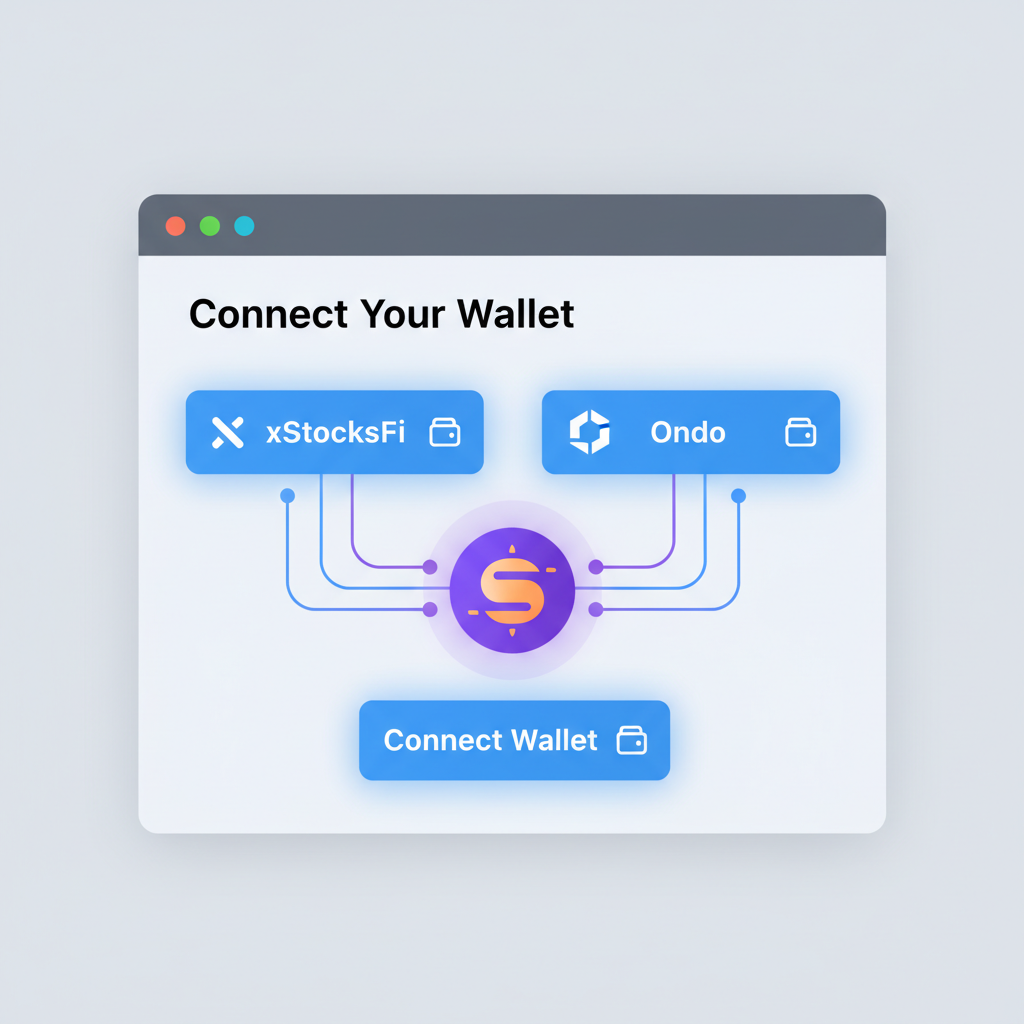

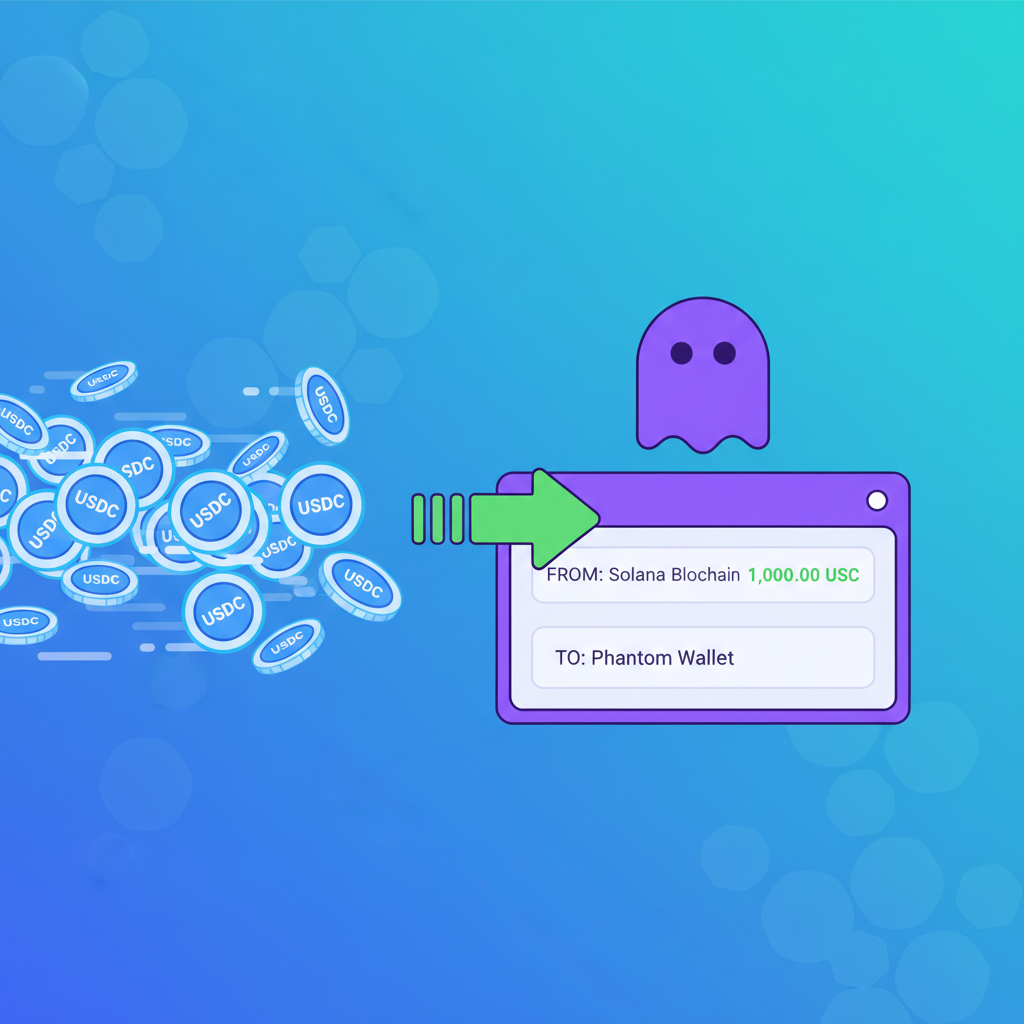

Executing this demands precision: connect a Solana wallet to xStocksFi, approve SPL tokens, and mint $100 of TSLAx at $411.12 equivalent. Ondo prompts KYC for EU users, unlocking 200 and pairs with sub-1% slippage. See our detailed walkthrough for seamless onboarding. These platforms’ composability shines in DeFi stacks, where TSLAx collateralizes loans on Marginfi or Kamino, amplifying yields without spot sales.

Swarm Markets elevates this with MiFID II compliance, letting quants script on-chain stock diversification algos in Rust. A sample covariance model inputs NVDAx beta (1.4 to TSLA) and outputs optimal weights: 35% TSLAx, 25% NVDAx, 40% diversified synthetics. Real-world uptake mirrors LinkedIn metrics, with xStocksFi’s $180M AUM spike underscoring Tesla’s $45M dominance.

Tokenized TSLA/NVDA Platforms Compared

-

Ondo Global MarketsChains: SolanaAUM: $180M+ (xStocks incl. TSLA $45M, NVDA $18M)Fees: Low (issuer standard)Unique diversification: 200+ stocks/ETFs for broad U.S. equity exposure via Blockchain.com

-

xStocksFiChains: Solana, EthereumAUM/Vol: $17B trading vol. (TSLAx, NVDAx leaders)Fees: Low (exchange-integrated)Unique diversification: Kraken/Backed partnership for 60+ stocks, 24/7 liquidity blending

-

Backed.fiChains: Ethereum, Solana (via xStocks)AUM: Growing (xStocks partner)Fees: 0.1-0.3% mgmt.Unique diversification: 1:1 backed ERC20s (bTSLA, bNVDA) for compliant, low-risk portfolios

-

SynthetixChains: OptimismAUM: ~$100M TVL (synths)Fees: 0.3% tradingUnique diversification: Synthetic assets (sTSLA, sNVDA) with debt pool, perps for leveraged strategies

-

Swarm MarketsChains: EthereumAUM: Expanding RWAFees: Regulated lowUnique diversification: Tokenized stocks DEX with portfolio rebalancing tools for DeFi integration

Layered risks demand vigilant oversight. Oracle failures, though rare post-2025 upgrades, could misprice TSLAx by 2% in black swans; counter with position sizing under 5% per asset. Liquidity thins on Synthetix during SNX depegs, favoring xStocksFi’s $17B volume depth. Regulatory flux, from SEC tokenized ETF probes to EU clarity, favors compliant issuers like Backed. fi and Swarm.

Yet the upside eclipses: 24/7 access dissolves timezone frictions, fractionalization invites micro-VC bets on Nvidia’s AI trajectories, and blockchain auditability trumps opaque prime brokerage. As TSLA hovers at $411.12 with Nvidia in tow, these platforms forge a new equity paradigm. Quants now model multi-chain flows, predicting $50B tokenized AUM by 2027 via Ondo-Solana synergies. Investors blending tokenized Nvidia shares blockchain with RWAs capture premia untapped by TradFi, redefining alpha in a tokenized era.

Position accordingly: fractionalize boldly, diversify rigorously, trade ceaselessly. The blockchain equities revolution, led by xStocksFi tokenized stocks and peers, equips you to thrive amid volatility.