How to Track Tokenized Equities in Real-Time on the Blockchain

Tokenized equities are rapidly transforming how investors access, trade, and monitor traditional stocks by bridging them onto the blockchain. With 24/7 markets and on-chain transparency, tracking these digital representations of real-world equities in real time is both empowering and essential for anyone serious about modern portfolio management. But how do you actually track tokenized equities as they move on-chain, minute by minute?

Why Real-Time Tracking Matters for Tokenized Equities

Unlike legacy equity markets that close overnight and on weekends, tokenized stocks trade around the clock. This non-stop activity means opportunities (and risks) can emerge at any hour. Real-time tracking ensures you’re never caught off guard by price swings or liquidity events. Moreover, the transparent nature of blockchain means every token transfer, trade, or balance update is instantly visible, if you know where to look.

Recent advances like Chainlink’s Data Streams for U. S. equities and ETFs have raised the bar by delivering sub-second pricing across dozens of blockchains. Now, assets like SPY, QQQ, NVDA, AAPL, and MSFT can be tracked with institutional-grade accuracy directly on-chain. These innovations are driving a new era of sophisticated synthetic ETFs and perpetual futures built atop real-time data feeds.

Key Tools to Track Tokenized Equities in Real Time

To effectively monitor on-chain stocks, you’ll need a toolkit that combines reliability with depth. Here are some foundational tools every investor should consider:

- Blockchain Oracles: Services like Chainlink’s Data Streams connect off-chain equity prices to blockchain networks in real time. Features such as market hours enforcement and circuit-breaker readiness add layers of trust for traders and builders alike.

- Tokenized Stock APIs: Platforms like Moralis provide robust APIs that let developers (and savvy investors) pull live price data, monitor token balances, fetch metadata, and analyze trading volumes across multiple chains.

- DeFi Protocol Dashboards: Decentralized finance platforms such as GMX or Kamino have integrated direct data feeds for tokenized equities, enabling users to view up-to-the-second prices before trading or lending assets.

- Analytics Aggregators: Sites like RWA. xyz visualize the entire landscape of tokenized real-world assets, including historical performance charts and current investor activity across public blockchains.

If you want a step-by-step walkthrough on setting up your own monitoring tools or dashboards for real-time tokenized stock prices, check out our dedicated guide: How to Track Real-Time Prices of Tokenized Stocks on the Blockchain.

The Role of Transparency and Auditability in Blockchain Equity Tracking

The biggest advantage of tracking tokenized equities via blockchain is radical transparency. Every transaction, from issuance to trading to settlement, is recorded immutably on a public ledger. This allows for instantaneous auditability: anyone can verify circulating supply, ownership changes, or historic pricing without waiting for end-of-day reconciliations common in traditional finance.

This level of openness not only bolsters investor confidence but also reduces settlement risk, a key pain point in conventional equity markets. As noted by Chainlink and other leading providers, public blockchains make it possible to track token transfers and balances in real time without relying solely on centralized intermediaries.

Navigating Challenges: Price Accuracy and Regulatory Considerations

A word of caution: while blockchain-based tracking offers unprecedented speed and visibility, not all platforms guarantee perfect price accuracy at all times. Some exchanges may experience latency or rely on less robust oracle solutions, meaning there could be brief discrepancies between actual stock market prices and their tokenized counterparts. To mitigate this risk, many leading platforms now implement advanced safeguards like staleness detection and circuit breakers (as seen with Chainlink’s latest rollout).

Additionally, regulatory clarity around tokenized securities continues to evolve globally. Investors should stay informed about jurisdictional requirements, especially since some tokens may not confer traditional shareholder rights or protections found in legacy markets.

For those new to the space, these nuances can be daunting. However, as the ecosystem matures, both data quality and regulatory frameworks are becoming more robust. It’s important to choose platforms and protocols that prioritize compliance and transparency, and always verify whether the tokenized equities you’re tracking are backed by real assets or function as synthetic derivatives.

Top 5 Platforms for Real-Time Tokenized Equity Tracking

-

Chainlink Data Streams – Leading on-chain real-time equity dataPros: Delivers sub-second, high-throughput price feeds for U.S. equities and ETFs across 37 blockchains, with features like market hours enforcement, staleness checks, and circuit-breaker readiness.Cons: Primarily focused on data provision for developers and platforms, not a direct retail dashboard.

-

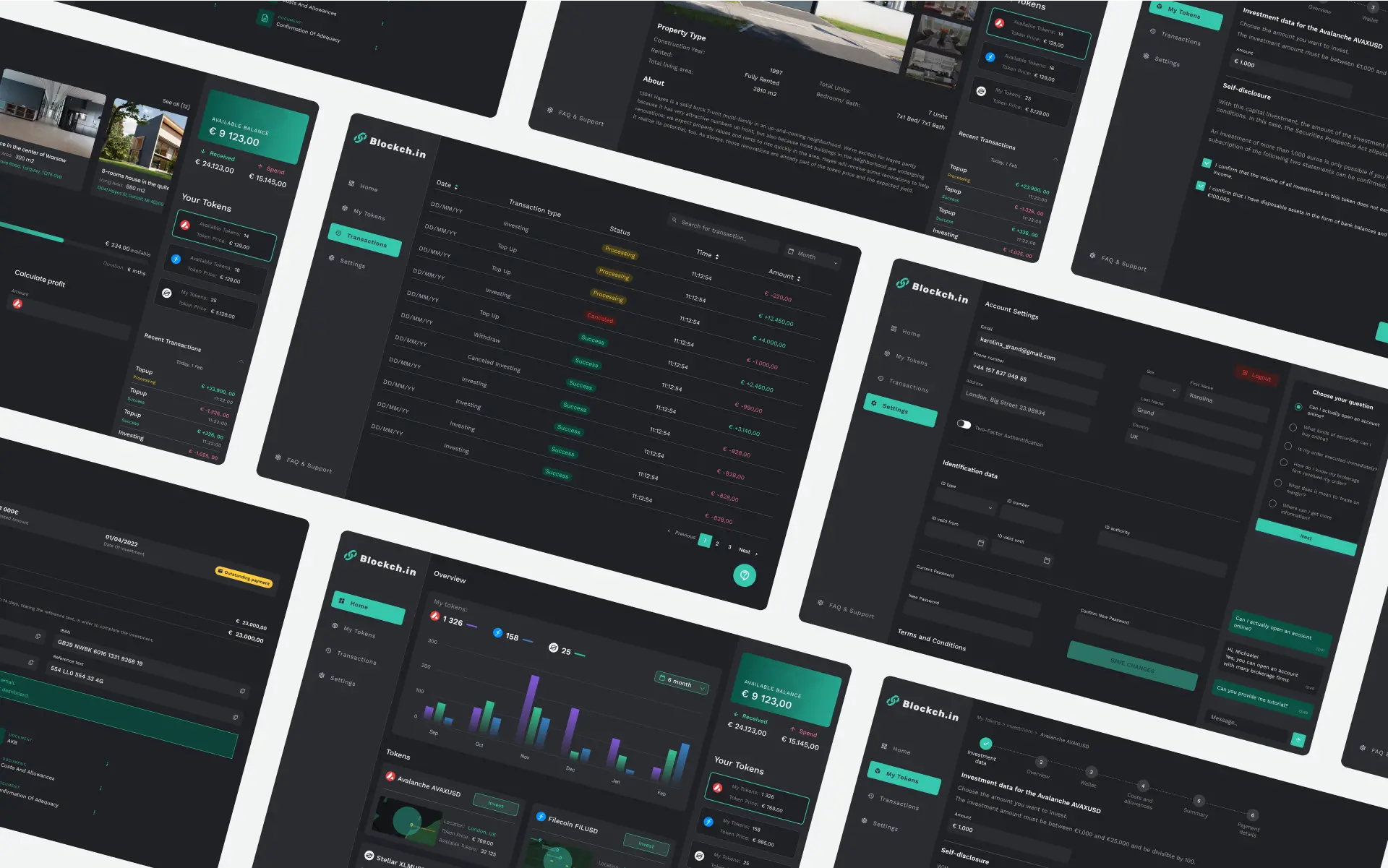

Moralis Tokenized Stock APIs – Comprehensive APIs for real-time trackingPros: Offers real-time blockchain data, event monitoring, and historical datasets for tokenized stocks, enabling integration into custom dashboards and fintech apps.Cons: Requires technical integration; not a plug-and-play solution for casual investors.

-

RWA.xyz – Analytics and discovery for tokenized real-world assetsPros: User-friendly platform to explore tokenized equities, issuers, and service providers, with visual analytics and transparency on public blockchains.Cons: Primarily focuses on analytics and discovery, with less emphasis on live trading or price feeds.

-

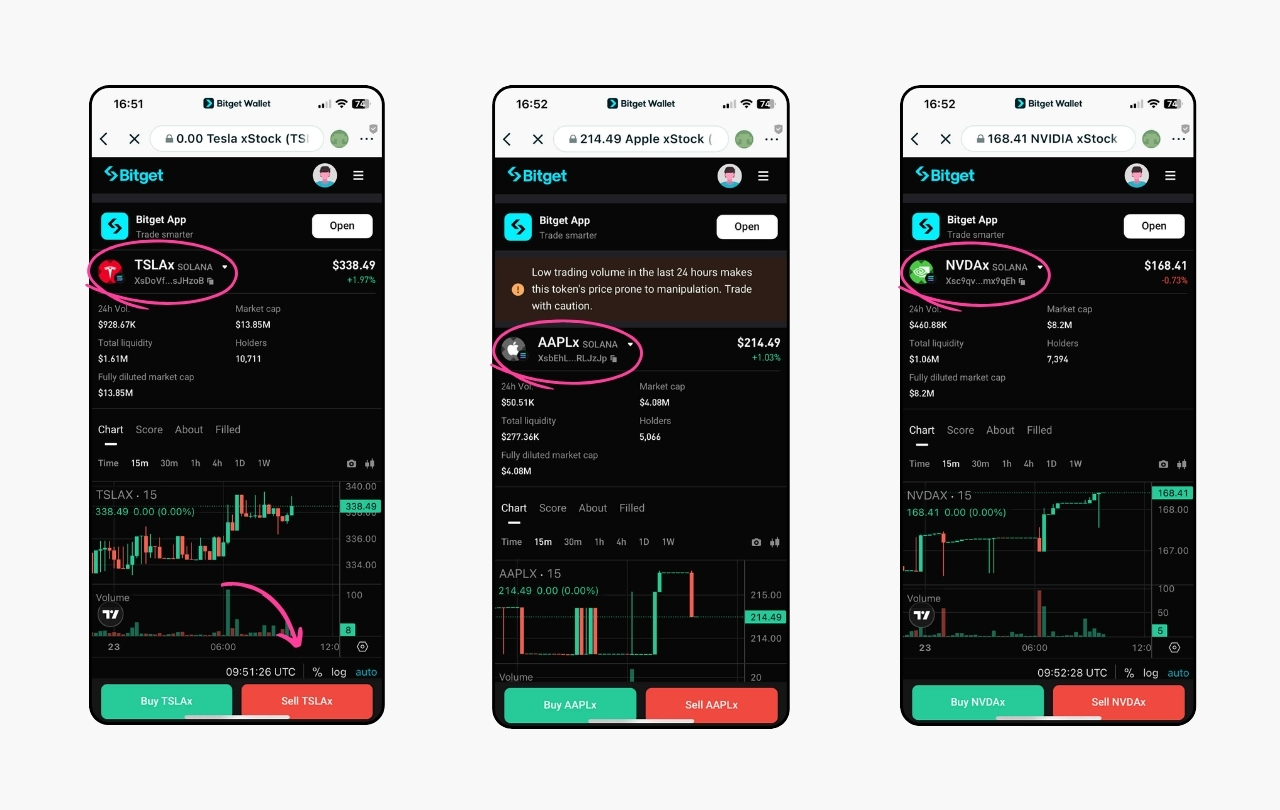

Bitget – Crypto exchange with real-time stock tracking featuresPros: Integrates real-time tracking for tokenized stocks alongside crypto markets, offering a unified trading and monitoring experience.Cons: Availability of tokenized equities may vary by region and regulatory status; not all equities are supported.

-

GMX – DeFi protocol with tokenized equity tradingPros: Supports real-time trading of synthetic and tokenized equities using on-chain data feeds (including Chainlink Data Streams), with decentralized access.Cons: Focused on DeFi users; may require familiarity with decentralized wallets and protocols.

Community sentiment is increasingly positive as real-time blockchain equity tracking tools become more accessible. Investors now expect not just speed but also reliability and clarity regarding how prices are sourced and how tokens relate to their underlying assets. This shift is fueling a wave of innovation in both user interfaces and backend infrastructure.

Best Practices for On-Chain Stocks Monitoring

To optimize your experience when tracking tokenized equities in real time, consider these best practices:

- Verify Data Sources: Always check that your data provider uses reputable oracles like Chainlink’s Data Streams for sub-second accuracy.

- Diversify Your Tools: Use a combination of DeFi dashboards, analytics aggregators, and direct API integrations to cross-reference price feeds and trading activity.

- Monitor Market Conditions: Stay updated on liquidity events and circuit breaker triggers, especially during periods of high volatility or after-hours trading.

- Stay Informed on Regulations: Regularly review regulatory updates regarding tokenized securities within your jurisdiction to ensure compliance and avoid unexpected risks.

If you’re curious about how tokenization enables continuous trading and fractional ownership beyond traditional stock hours, our guide provides a deeper dive into the mechanics: How Tokenized Stocks Enable 24/7 Trading and Fractional Ownership on the Blockchain.

Looking Ahead: The Future of Tokenized Asset Tools

The landscape for blockchain equity tracking is evolving at breakneck speed. As more traditional financial products migrate onto public blockchains, expect further improvements in data granularity, user experience, and regulatory harmonization. In the near future, we’ll likely see even tighter integration between legacy exchanges and decentralized protocols, potentially blurring the line between on-chain stocks monitoring and classic brokerage platforms.

The bottom line? Real-time blockchain monitoring is no longer just a novelty; it’s an essential skillset for any forward-thinking investor navigating this new era of digital assets. By leveraging the right mix of tools, and staying vigilant about accuracy, transparency, and compliance, you can harness the full potential of tokenized equities while minimizing surprises along the way.