How to Access and Trade Tokenized US Stocks On-Chain: Platforms, Benefits, and Risks

Imagine trading Apple, Nvidia, or Tesla on your phone at midnight, no matter where you are in the world. That’s not a fantasy anymore – it’s the new reality of tokenized U. S. stocks. These digital representations of real-world equities are now live on-chain, offering 24/7 access and fractional ownership to anyone with a crypto wallet. The landscape is moving fast, and if you want to stay ahead of the curve, it’s time to get familiar with how these platforms work – and what you need to watch out for.

The Tokenization Revolution: How U. S. Stocks Go On-Chain

Tokenization is shaking up the old guard of stock trading by converting traditional equities into blockchain-based tokens. Each token typically represents a share (or fraction) of a real company like Microsoft or Amazon, held in custody by a regulated entity. The result? You can buy, sell, or transfer exposure to your favorite U. S. stocks directly from your DeFi wallet – sometimes with lower fees and always with more flexibility than legacy brokers.

Why is this such a big deal? For starters:

- Global Access: Investors outside the U. S. can gain exposure without jumping through hoops.

- Fractional Shares: Buy $10 worth of Tesla instead of entire shares.

- No Market Hours: Trade whenever you want – not just 9: 30am to 4pm EST.

- Reduced Settlement Times: Blockchain rails mean near-instant settlement vs traditional T and 2 delays.

If you want the nitty-gritty on how this works under the hood and why it matters for investors like you, check out our deep dive on how tokenized stocks enable 24/7 trading and fractional ownership on the blockchain.

The Leading Platforms for Trading Tokenized US Stocks in 2025

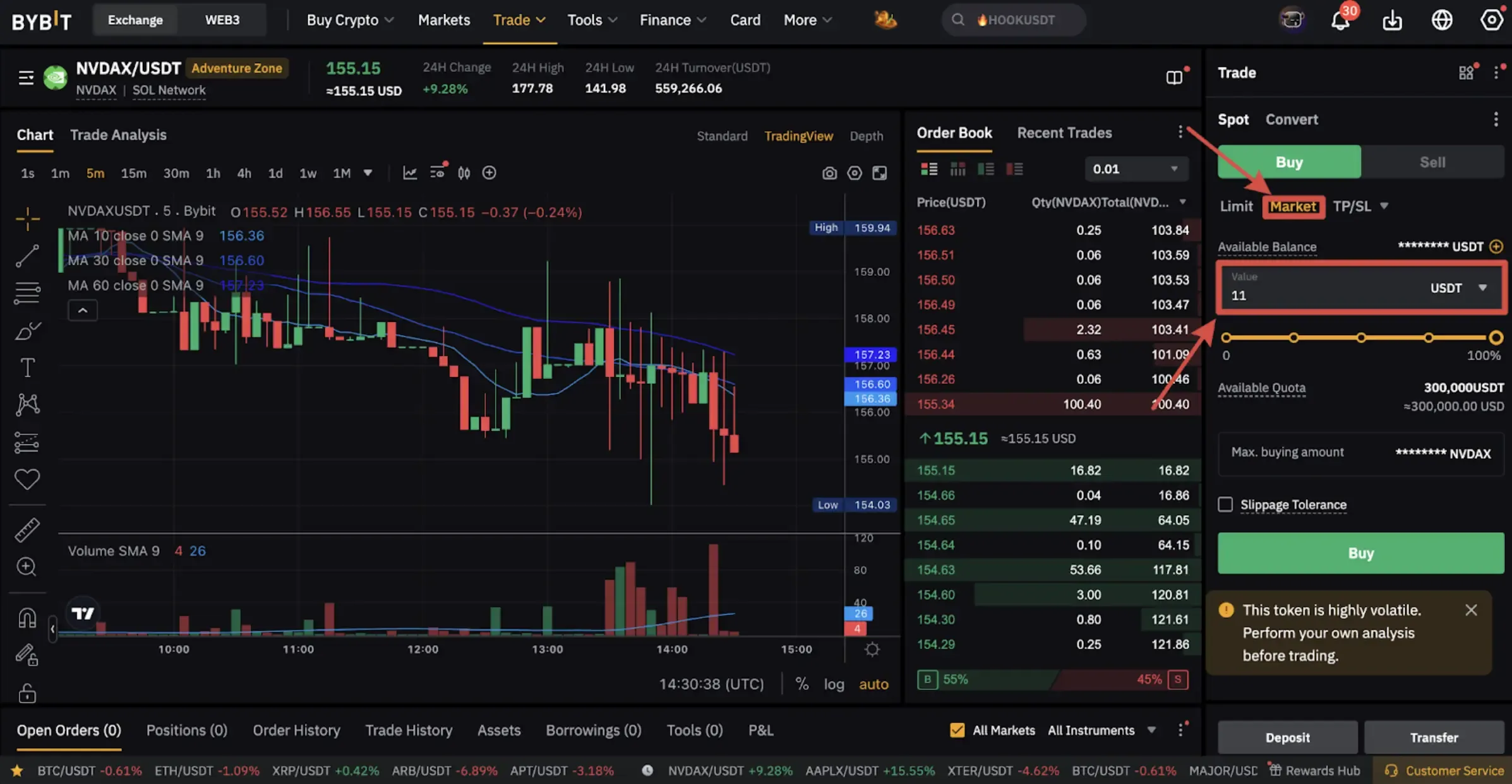

The market has exploded with options for accessing on-chain equities. Here’s a quick tour of some top contenders making headlines right now:

- Gemini dShares™: Backed 1: 1 by real U. S. equities via Dinari Inc. , available across select European countries.

- Blockchain. com x Ondo Global Markets: Over 100 tokenized stocks and ETFs tradable directly on Ethereum – non-U. S. users only (for now).

- Kraken: Commission-free trading for over 11,000 tokenized stocks and ETFs; currently rolling out state-by-state in the U. S.

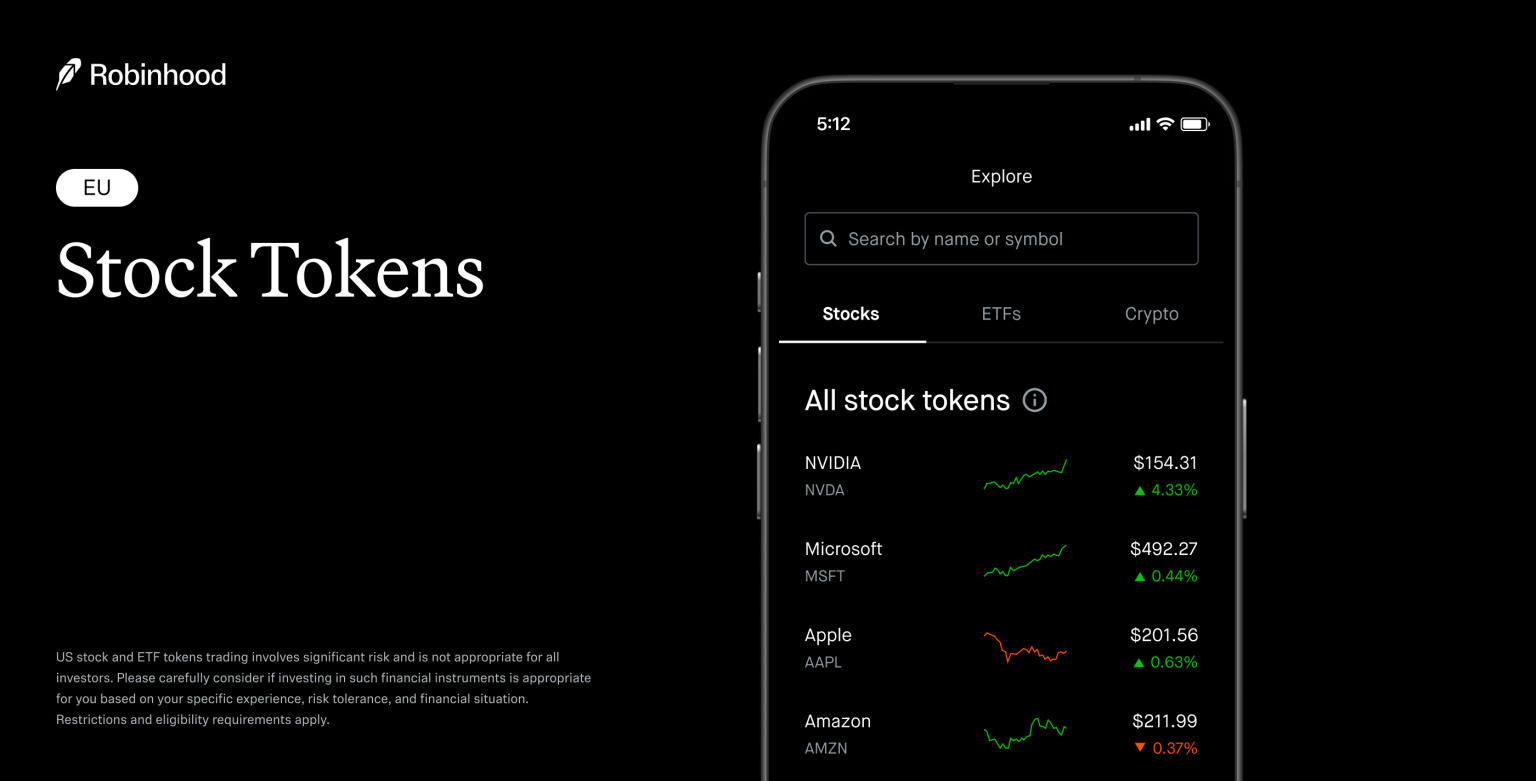

- Robinhood (EU): Commission-free access to over 200 U. S. stocks as tokens for EU residents; trade five days a week, any hour.

- MyStonks (Base chain): Fully decentralized platform minting tokenized shares at a 1: 1 ratio; pricing via ChainLink oracles; low fees (0.3%).

- Backed (Switzerland): Swiss-regulated issuer with tokens tradable across DEXes like CoW swap and 1inch.

- Swarm dOTC: DeFi-native exchange offering AAPL, NVDA, MSFT, COIN and TSLA tokens against USDC on Ethereum/Polygon/Base; transparent fees (0.25%).

- Bitget Wallet x Ondo Finance: Trade over 100 fully backed stock tokens using USDC; features include fractional shares and seamless wallet integration.

This isn’t just hype – these platforms are already handling millions in daily volume as investors look beyond traditional brokerages for speed and flexibility.

The Benefits That Matter Most: Why Go On-Chain?

If you’re wondering whether it’s worth switching from your old-school broker or CEX to an on-chain solution, here’s what stands out:

- Around-the-clock trading: Never miss news-driven moves again because markets are closed – volatility is opportunity!

- Simplified global access: No need for complicated paperwork or local residency requirements just to own U. S. blue chips.

- Tiny minimums: Start with $5 if that’s all you have – perfect for new traders or those looking to diversify without heavy capital outlay.

- No intermediaries: Settle trades instantly via smart contracts rather than waiting days for clearinghouses to catch up.

The verdict? If agility matters to your strategy or if you’re outside traditional financial hubs, tokenization levels the playing field dramatically.

Navigating Key Risks and Considerations Before You Dive In

No innovation comes without caveats! Before jumping in headfirst, be aware of these crucial risks unique to on-chain equities:

- Regulatory uncertainty: Jurisdictions are still racing to catch up. Your rights and protections may not be crystal clear, and platforms can change access or delist assets if laws shift.

- Shareholder rights: Most tokenized stocks don’t grant you voting power or direct dividend payouts like holding real shares. You’re getting economic exposure, not a seat at the table.

- Tech risks: Smart contract bugs, wallet hacks, and oracle failures can all put your assets at risk. If you lose your private keys, there’s no helpline to call.

- Liquidity: While volumes are growing fast, some tokens can still be thinly traded, especially outside top names like AAPL or TSLA. Sudden price swings or wide spreads aren’t uncommon.

If you want a detailed breakdown of these pitfalls, and how to manage them, our guide to on-chain equities risks is a must-read for any serious trader.

How to Get Started: Action Steps for First-Time On-Chain Stock Traders

This new frontier is open to anyone with a crypto wallet, but moving fast without a plan is risky. Here’s how to get started safely and smartly:

Essential Steps to Trade Tokenized US Stocks On-Chain

-

1. Choose a Compliant PlatformStart by selecting a reputable and compliant platform that offers tokenized US stocks. Leading options include Gemini, Blockchain.com, Kraken, Robinhood (EU), MyStonks, Backed, Swarm, and Bitget Wallet. Always check regional availability and regulatory status before signing up.

-

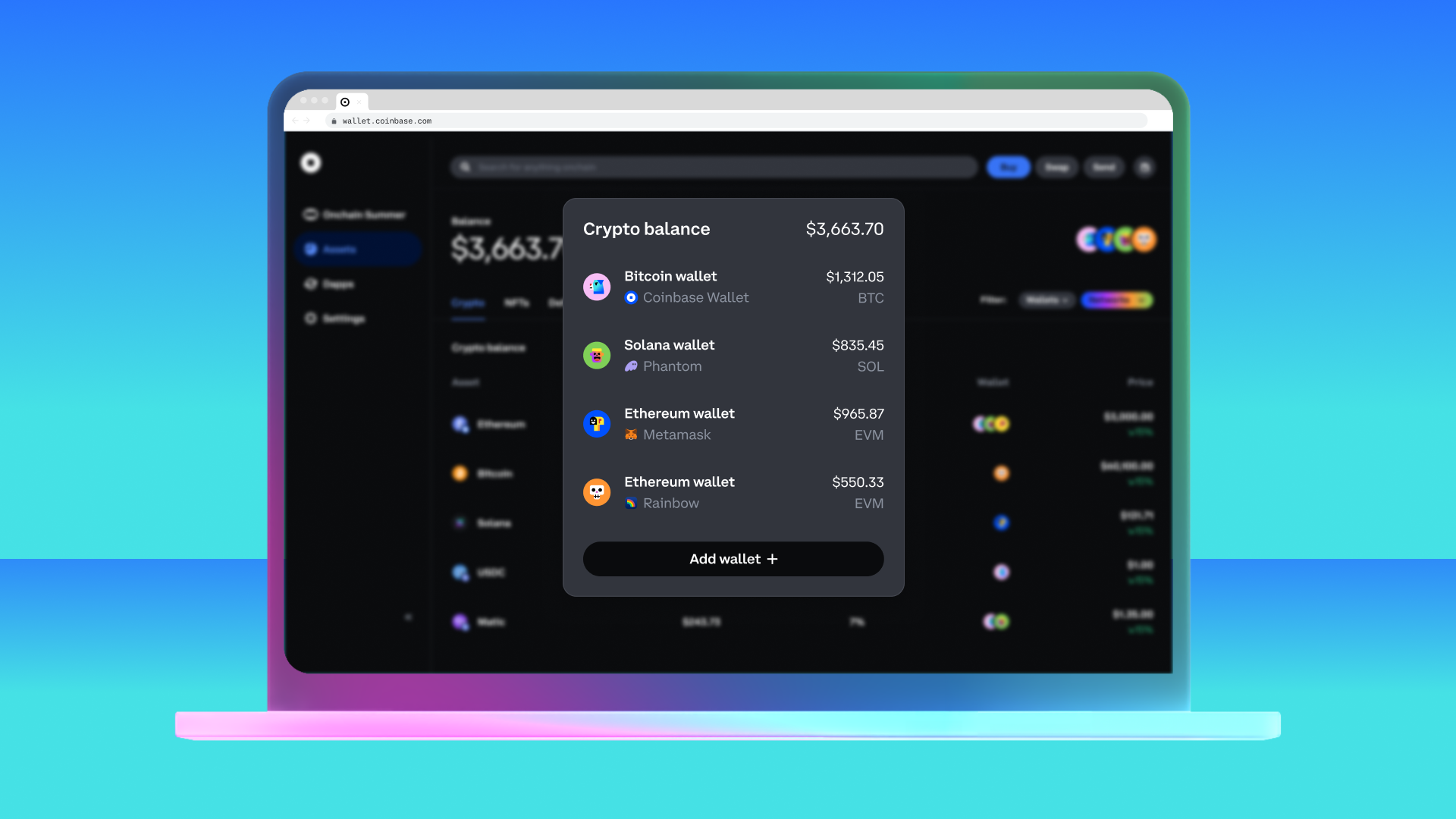

2. Set Up a Compatible Crypto WalletYou’ll need a secure crypto wallet that supports the blockchain network used by your chosen platform (such as Ethereum, Polygon, or Base). Popular options include MetaMask, Coinbase Wallet, and Bitget Wallet. Ensure your wallet is properly secured with strong passwords and backup phrases.

-

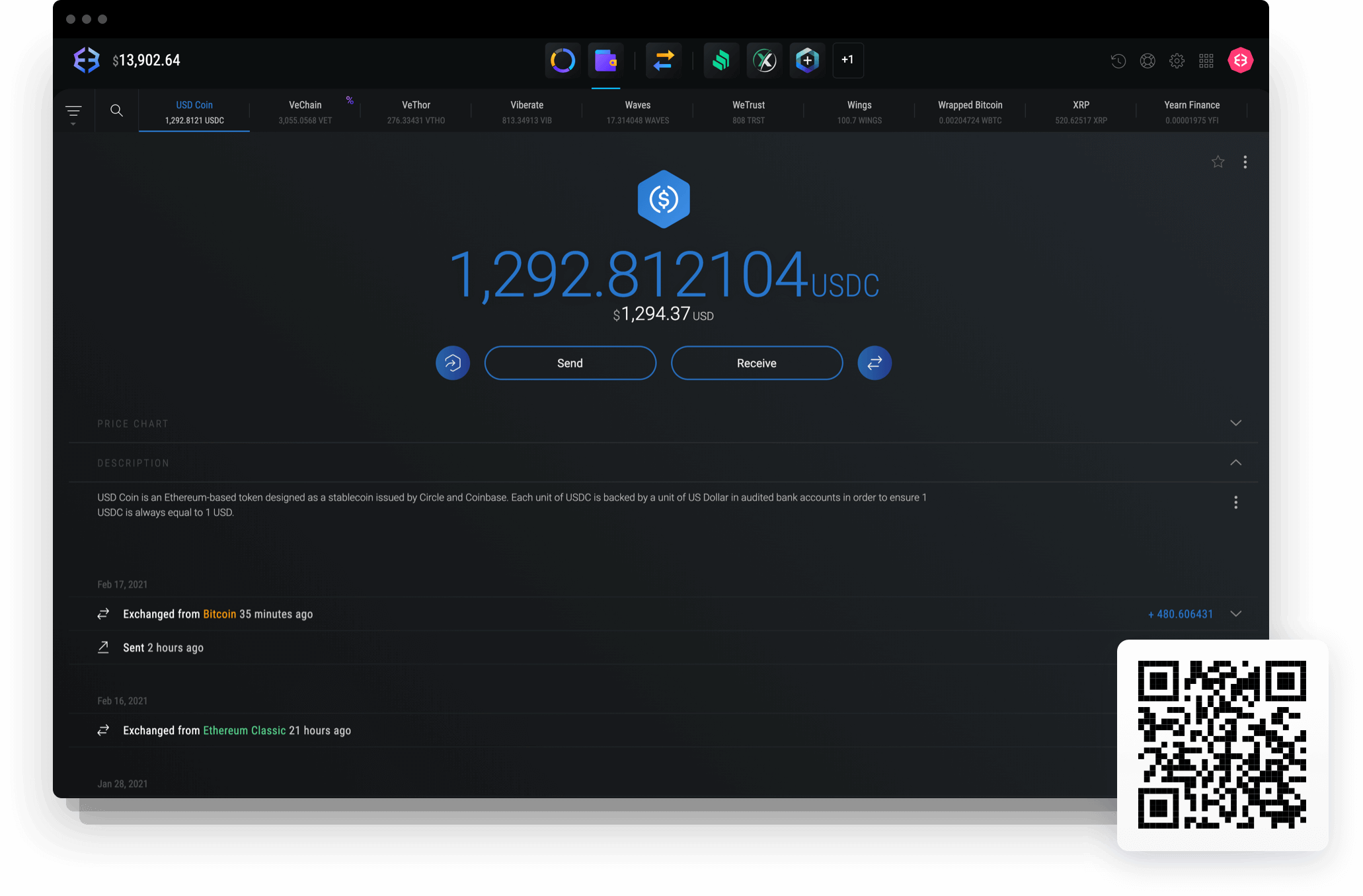

3. Fund Your Wallet with StablecoinsMost platforms require you to deposit stablecoins like USDC to purchase tokenized stocks. Buy or transfer USDC from a trusted exchange and send it to your wallet address. Double-check network compatibility to avoid lost funds.

-

4. Review Platform Fees and LiquidityBefore trading, check the platform’s fee structure and available liquidity for your desired stocks. For example, MyStonks charges a 0.3% transaction fee, while Swarm charges 0.25%. Higher liquidity ensures smoother trades and better pricing.

-

5. Understand Withdrawal and Redemption LimitsEach platform sets its own rules for withdrawing or redeeming tokenized stocks back into fiat or underlying shares. Review these limits and timelines—some platforms may only allow redemptions under certain conditions or within specific jurisdictions.

Pro tip: Always double-check that the platform you choose is compliant in your country and that tokens are truly backed 1: 1 by underlying equities (not just synthetic assets). Scams do exist in this space; if an offer seems too good to be true, it probably is.

If you’re ready for hands-on guidance, from setting up your first DeFi wallet to executing your first trade, bookmark our step-by-step on-chain investing guide.

Looking Ahead: The Future of Tokenized Equities Is Now

The cat’s out of the bag: tokenized U. S. stocks are here and already redrawing the lines between Wall Street and Web3. As more platforms race to onboard users worldwide, often with no minimums and 24/7 access, the power dynamic in equity markets is shifting faster than most realize.

The long-term winners? Those who adapt early, stay nimble, and keep learning as this space evolves. Whether you’re hunting after-hours volatility or building a globally diversified portfolio from your phone, on-chain stocks are rewriting what’s possible for retail investors everywhere.

The only question left: Will you watch from the sidelines, or seize the opportunity while it’s still early?