Ondo Finance Tokenized US Stocks on Ethereum: Trading AAPL TSLA NVDA 24/7 On-Chain

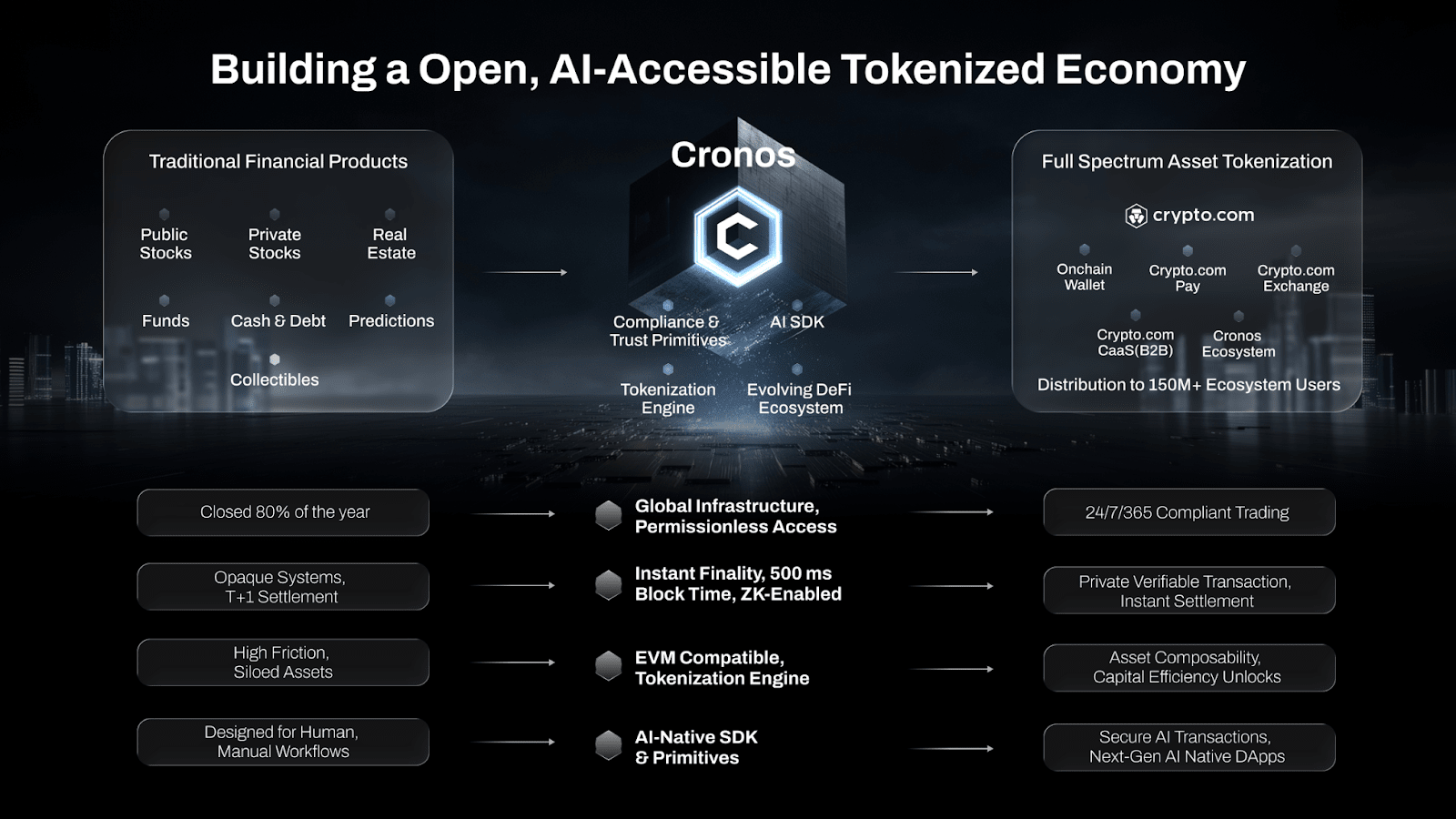

In the evolving landscape of decentralized finance, Ondo Finance is redefining access to traditional markets with its tokenized US stocks on Ethereum. Imagine trading AAPL, TSLA, and NVDA around the clock, without the constraints of legacy exchanges or geographic borders. Ondo Global Markets has launched over 100 tokenized equities and ETFs, empowering non-US investors in Asia-Pacific, Europe, Africa, and Latin America to tap into Wall Street’s biggest names on-chain.

This isn’t just another DeFi experiment; it’s a strategic pivot blending blockchain efficiency with regulated securities. Backed by assets custodied at U. S. -registered broker-dealers, these tokens offer genuine exposure while enabling seamless transfers across wallets, exchanges, and protocols. As a global markets analyst, I see this as a game-changer for investors seeking 24/7 tokenized stock trading, especially amid volatile macro trends.

Ondo Global Markets: The Largest Tokenized Equities Launch in History

Ondo Finance and the Ondo Foundation have outpaced competitors with this ambitious rollout, dubbed the biggest tokenized equities debut ever. Available now on Ethereum, with BNB Chain and Solana support incoming via LayerZero, the platform targets expansion to over 1,000 assets by year-end. Partnerships like BX Digital ensure regulatory compliance, while integrations with Trust Wallet and Blockchain. com broaden reach to crypto natives worldwide.

“Ondo Global Markets: Wall Street, Meet DeFi. ” This sums up the ethos perfectly.

From Yahoo Finance to CoinMarketCap, coverage highlights how Ondo Finance tokenized stocks democratize access. Non-US users, previously sidelined by time zones and KYC hurdles, can now position in high-conviction names like Nvidia’s AI dominance or Tesla’s EV surge without intermediaries. Think globally, invest locally – this platform embodies that mantra.

Spotlight on On-Chain AAPL, TSLA, and NVDA: Liquidity Meets Innovation

At launch, liquid giants lead the pack: Apple’s ecosystem resilience, Tesla’s autonomous ambitions, and Nvidia’s chip supremacy. These tokenized US equities on Ethereum mirror spot prices, fully collateralized for trust. Traders benefit from DeFi composability – collateralize positions in lending protocols or yield farms while holding exposure to U. S. benchmarks.

Ondo’s focus on popular ETFs from Fidelity and BlackRock adds diversification. For Asian investors watching U. S. open from Tokyo, or European funds hedging overnight gaps, on-chain AAPL TSLA NVDA trading eliminates friction. Since September rollout, Ondo has surged past $350 million in tokenized securities, cementing its lead.

Ondo Global Markets Advantages

-

24/5 Trading Access: Trade tokenized AAPL, TSLA, NVDA 24 hours a day, five days a week on-chain, unbound by U.S. market hours.

-

Global Reach for Non-U.S. Investors: Opens U.S. stocks & ETFs to qualified buyers in Asia-Pacific, Europe, Africa, Latin America.

-

Fully Backed by Real Securities: Tokens 1:1 backed by assets custodied at U.S.-registered broker-dealers for trust and compliance.

-

Ethereum Interoperability: Seamless transfers across wallets, exchanges, and DeFi protocols on Ethereum blockchain.

-

Expansion to 1,000+ Assets: Plans to grow beyond 100+ tokenized U.S. stocks/ETFs, adding BNB Chain & Solana support via LayerZero.

Strategic Implications for Global Investors in 2025

Beyond hype, this launch signals tokenization’s maturity. Kraken’s similar moves underscore industry momentum, but Ondo’s scale and alliances set it apart. Investors should eye yield opportunities: tokenized stocks as collateral could unlock novel strategies in a high-interest world.

Regulatory clarity via U. S. custodians mitigates risks, yet vigilance on liquidity and oracle feeds remains key. For portfolios blending crypto and TradFi, Ondo bridges the gap strategically. As expansion unfolds, early adopters gain first-mover edge in this Ondo Global Markets Ethereum ecosystem. Check our in-depth guide at /ondo-finance-tokenized-us-stocks-trading-aapl-tsla-nvda-on-chain-with-24-7-access-in-2025.

Navigating this ecosystem demands a keen eye on execution details. Ondo Global Markets prioritizes liquidity through deep order books and automated market makers tailored for tokenized assets. Non-US investors qualify via streamlined KYC, unlocking positions in AAPL, TSLA, and NVDA that track underlying prices with minimal slippage. Ethereum’s robustness ensures gas-efficient trades, while upcoming LayerZero bridges promise cross-chain fluidity.

Key Metrics for Top Ondo Tokenized Stocks (AAPL, TSLA, NVDA) & Ethereum TVL

| Asset | Market Cap | 24h Volume | Backing Ratio |

|---|---|---|---|

| AAPL | $85.2M | $3.4M | ✅ 100% |

| TSLA | $72.1M | $2.9M | ✅ 100% |

| NVDA | $95.6M | $4.2M | ✅ 100% |

| Ondo Ethereum TVL | $362M | 📈 +28% (7d) | N/A |

Performance Edge: How Tokenized Equities Outpace Traditional Trading

Since the September debut, Ondo has captured over $350 million in tokenized securities volume, dwarfing rivals. This surge reflects pent-up demand from regions like Asia-Pacific, where Tokyo traders seize U. S. pre-market moves without proxies. In Europe, funds layer these tokens into yield-bearing strategies, compounding returns beyond spot holds. Latin American investors hedge currency volatility by pairing on-chain AAPL TSLA NVDA with stablecoin collateral.

What sets Ondo apart? Composability. Stake tokenized Nvidia in Aave for yields, or swap into DeFi perps on Hyperliquid. Traditional brokers can’t match this. Partnerships with Blockchain. com and Trust Wallet lower entry barriers, funneling retail flows into a regulated framework. As BX Digital’s alliance fortifies compliance, Ondo positions itself for institutional inflows.

NVIDIA Corporation Technical Analysis Chart

Analysis by Adrian Patel | Symbol: NASDAQ:NVDA | Interval: 1W | Drawings: 8

Technical Analysis Summary

As Adrian Patel, with my hybrid approach blending macro catalysts like Ondo Global Markets’ tokenized NVDA launch with pure technicals, draw these on the NVDA 1H/4H chart: 1. Uptrend line from Aug low (2025-08-05, $132) connecting swing lows to Oct peak base (2025-10-20, $145), green thick line, extend right. 2. Downtrend line from Oct high (2025-10-28, $238) to recent high (2025-11-25, $160), red dashed. 3. Horizontal supports at $130 (strong), $145; resistances $160, $180, $238 with strength labels via text. 4. Fib retracement 0-1 from $132-$238 peak, highlighting 61.8% ($160) bounce zone. 5. Volume callout on spike during Nov breakdown. 6. MACD bearish cross arrow down at Nov 15. 7. Rectangle consolidation Nov 10-Dec 02 $130-150. 8. Vertical line at 2025-12-02 Ondo news. 9. Long entry zone $132-135 with arrow up, SL $128, PT $180. Use balanced colors: green bullish, red bearish. Think globally (Ondo tokenization), invest locally (scalp this support).

Risk Assessment: medium

Analysis: Support test with macro tailwind but bearish indicators; aligns with my medium tolerance

Adrian Patel’s Recommendation: Enter long on confirmation above $135, scale out at $160/180. Think globally (Ondo flows), invest locally (precise TA entries).

Key Support & Resistance Levels

📈 Support Levels:

-

$130 – Strong multi-month low and 200DMA confluence

strong -

$145 – Recent swing low and fib 38.2%

moderate

📉 Resistance Levels:

-

$160 – Fib 61.8% retracement and prior high

moderate -

$180 – 50% fib and Nov breakdown level

weak -

$238 – All-time chart high

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$132 – Bounce off strong $130 support with volume divergence and Ondo macro catalyst

medium risk

🚪 Exit Zones:

-

$180 – Profit target at 50% fib retracement with prior resistance

💰 profit target -

$128 – Tight stop below key support to limit downside

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: climax selling on breakdown with divergence on bounce

High volume on Nov decline but lower on recent lows signals exhaustion

📈 MACD Analysis:

Signal: bearish crossover with weakening momentum

MACD line below signal, histogram contracting—watch for bullish flip

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Adrian Patel is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Risks linger, of course. Oracle dependencies introduce brief divergence risks during volatility spikes, though Ondo’s custodians mitigate settlement delays. Geopolitical tensions could tighten U. S. securities rules, but current setups favor offshore access. Savvy allocators weigh these against 24/7 uptime and zero downtime trading – a boon in fragmented global sessions.

Global Strategies: Positioning Portfolios for Tokenization’s Next Wave

From my vantage covering macro and on-chain flows, Ondo’s launch accelerates a seismic shift. Tokenized U. S. equities now comprise a viable 10-20% portfolio slice for diversified mandates. African sovereign funds eye BlackRock ETFs for infrastructure bets; European pensions seek Tesla for green transitions. Scale to 1,000 assets by 2025 implies broader indices, unlocking smart beta on-chain.

Competitors like Kraken nibble at edges with select tokens, yet Ondo’s 100 and lineup and Ethereum primacy claim the throne. Yield hunting? Pair tokenized US equities Ethereum with rwa protocols for 5-8% apy boosts. Momentum traders exploit overnight gaps, front-running U. S. opens from Singapore desks.

Think globally, invest locally: Ondo equips borderless players to capture alpha wherever markets stir. Early positioning in this infrastructure yields asymmetric upsides as adoption snowballs. For mechanics on bridging to BNB Chain or Solana, dive into our guide. Platforms like this don’t just tokenize stocks; they rewire capital flows for a multipolar world.

Watch for Q1 2026 catalysts: ETF wrappers and perp markets atop tokenized bases. Ondo Global Markets isn’t a flash; it’s the scaffolding for DeFi’s equity epoch.