How Ondo Finance Is Bringing 100+ Tokenized US Stocks and ETFs On-Chain: What Investors Need to Know

Ondo Finance has just made a seismic move in the world of decentralized finance by launching Ondo Global Markets, a platform that brings over 100 tokenized U. S. stocks and ETFs directly onto the Ethereum blockchain. For non-U. S. investors, this is more than just another trading venue – it’s a new way to access blue-chip American equities like Apple (AAPL), Microsoft (MSFT), and Tesla (TSLA), as well as leading ETFs such as SPDR S and P 500 ETF Trust (SPY) and Invesco QQQ Trust (QQQ). Each digital token is fully backed by underlying securities held at U. S. -registered broker-dealers, ensuring regulatory compliance and transparency rarely seen in the on-chain asset space.

Tokenized Wall Street: What’s Actually Available?

The curated list of assets available via Ondo Finance reads like the who’s who of global finance. Investors can now own fractions of industry titans such as Alphabet Inc. Class A (GOOGL), Amazon. com Inc. (AMZN), NVIDIA Corporation (NVDA), Meta Platforms Inc. (META), Berkshire Hathaway Inc. Class B (BRK. B), JPMorgan Chase and Co. (JPM), Visa Inc. Class A (V), Johnson and Johnson (JNJ), UnitedHealth Group Incorporated (UNH), and Exxon Mobil Corporation (XOM). This isn’t just about tech giants – healthcare leaders like Eli Lilly and Company (LLY) and Procter and Gamble Company (PG) are also represented, alongside financial powerhouses including Mastercard Incorporated Class A (MA) and Goldman Sachs Group, Inc. (GS).

“We’re witnessing a fundamental shift: blue-chip stocks and major ETFs are now accessible on-chain, 24/7, for anyone outside the U. S. ”

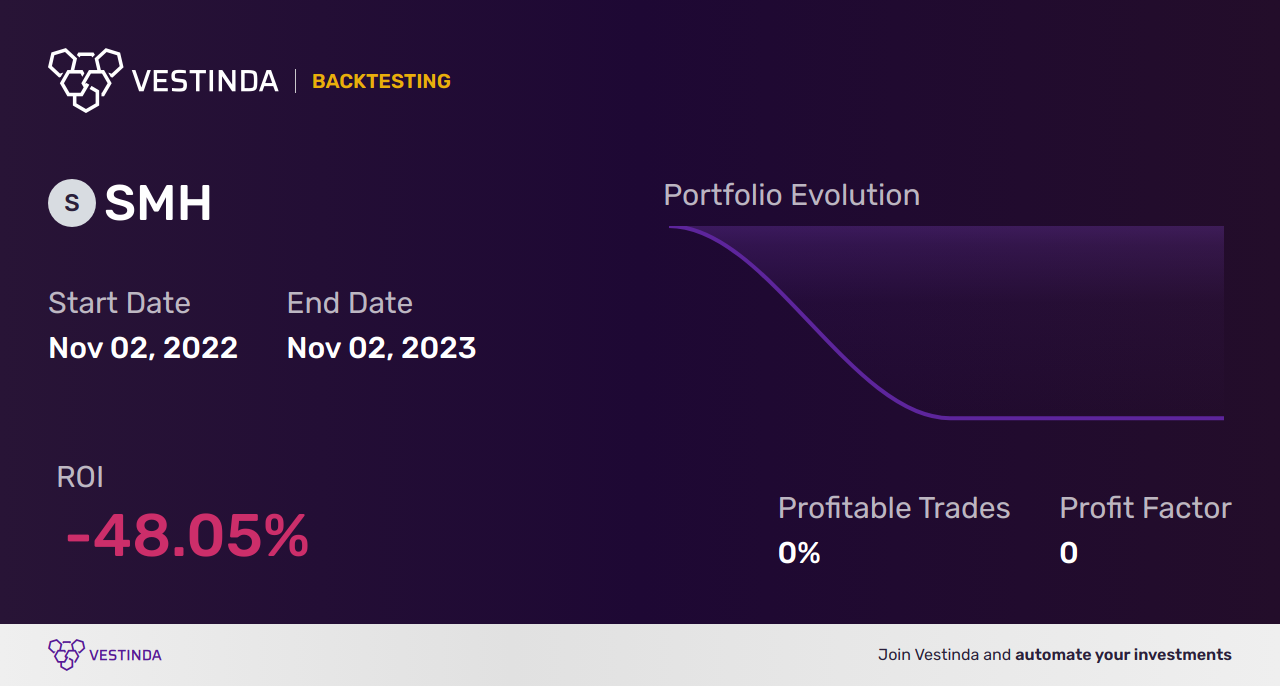

This breadth extends to popular sector ETFs such as Technology Select Sector SPDR Fund (XLK) and Energy Select Sector SPDR Fund (XLE). For those seeking diversification, options include Vanguard S and P 500 ETF (VOO), iShares Russell 2000 ETF (IWM), ARK Innovation ETF (ARKK), iShares Core S and P Mid-Cap ETF (IJH), or even thematic funds like Global X Robotics and Artificial Intelligence ETF (BOTZ) and VanEck Semiconductor ETF (SMH).

Top 20 Tokenized US Stocks & ETFs on Ondo Finance

-

Apple Inc. (AAPL): The world’s most valuable company, Apple leads in consumer electronics and innovation. Tokenized AAPL gives global investors seamless, on-chain exposure to this tech giant.

-

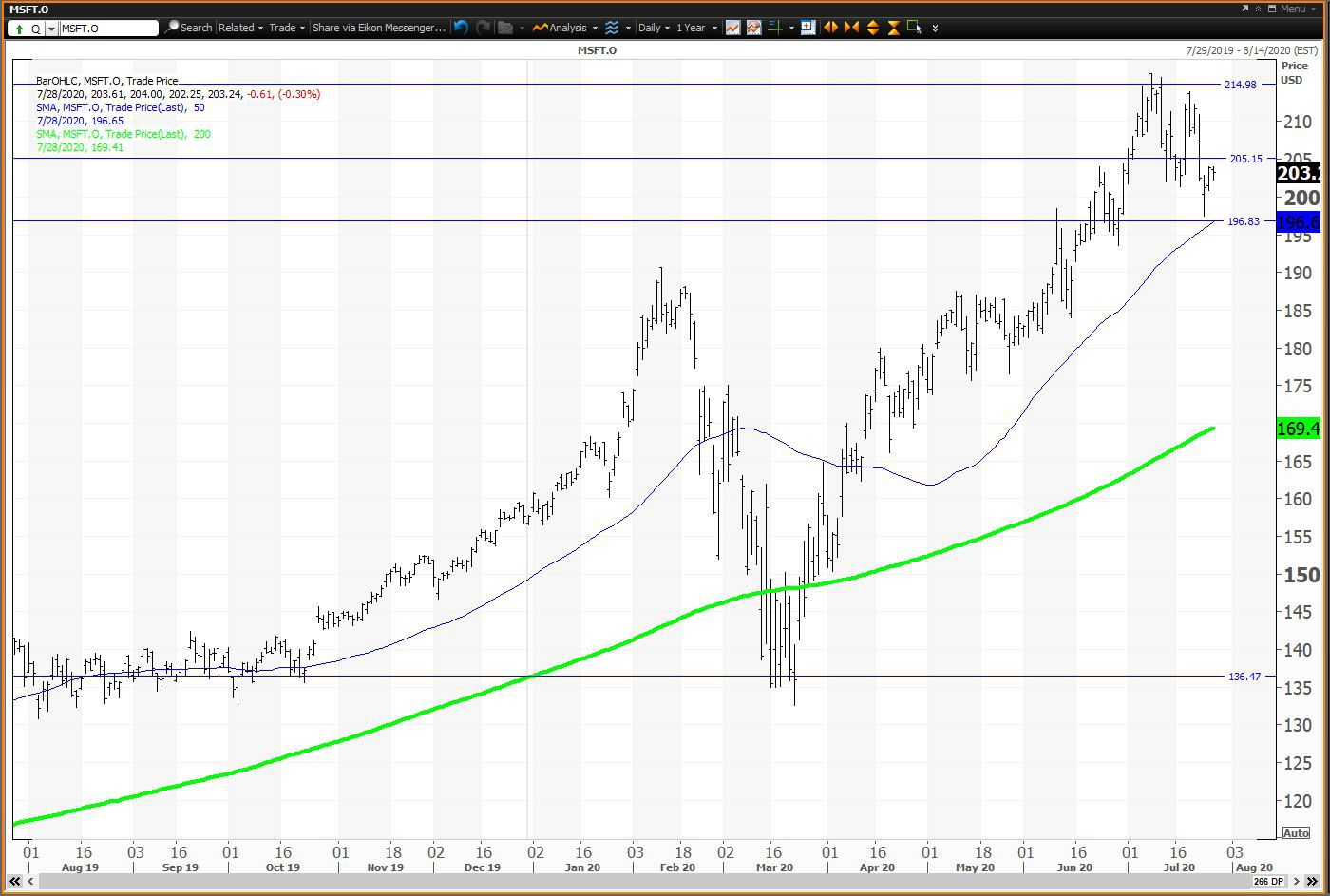

Microsoft Corporation (MSFT): A software and cloud powerhouse, Microsoft is central to enterprise and consumer tech. Tokenized MSFT offers blockchain-based access to its growth.

-

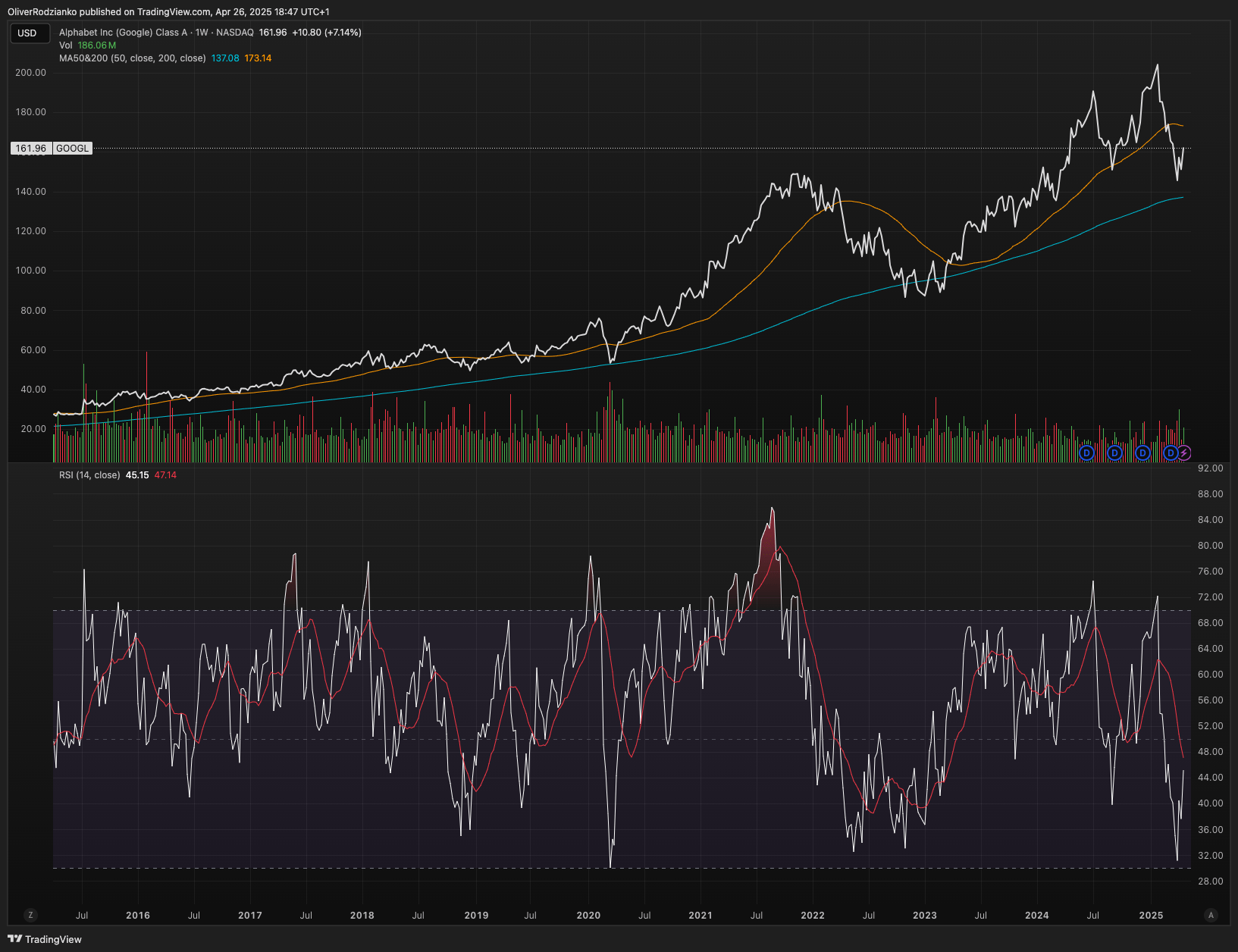

Alphabet Inc. Class A (GOOGL): As Google’s parent, Alphabet dominates digital advertising and search. Tokenized GOOGL brings this market leader to the blockchain era.

-

Amazon.com Inc. (AMZN): The e-commerce and cloud computing titan, Amazon is a staple of global portfolios. Tokenized AMZN enables 24/7 access for non-U.S. investors.

-

NVIDIA Corporation (NVDA): The leader in AI and graphics chips, NVIDIA is at the heart of tech innovation. Tokenized NVDA allows investors to tap into this explosive sector.

-

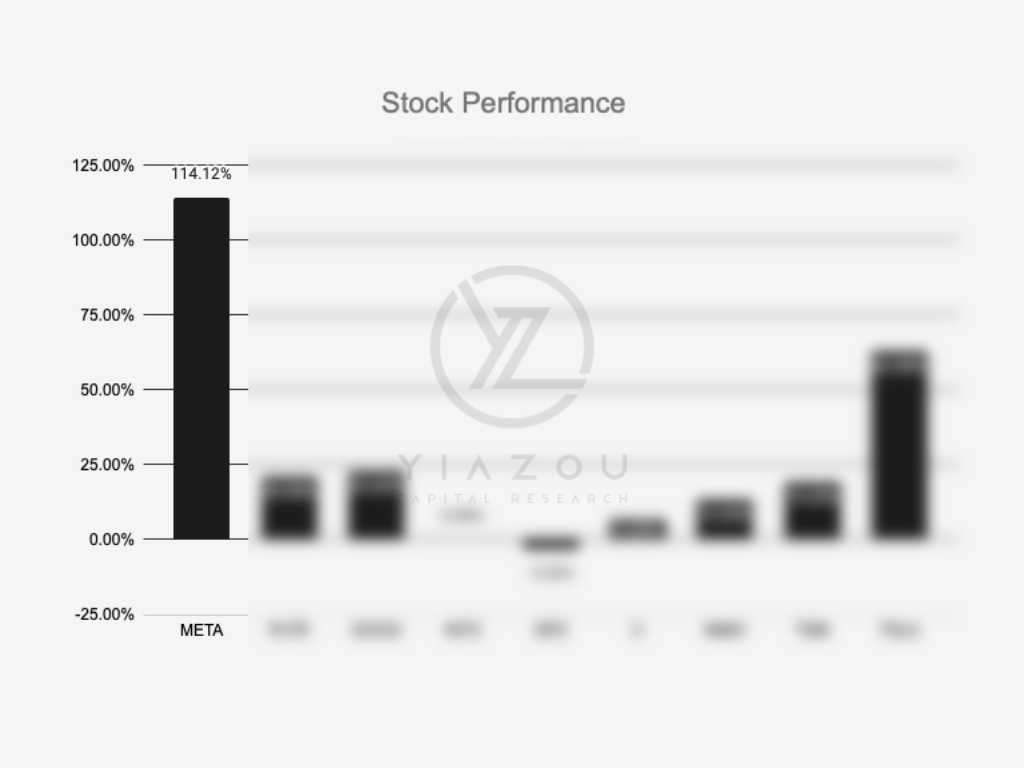

Meta Platforms Inc. (META): Formerly Facebook, Meta is a social media and metaverse pioneer. Tokenized META provides exposure to its digital ecosystem.

-

Tesla Inc. (TSLA): The electric vehicle and clean energy disruptor, Tesla is a favorite among growth investors. Tokenized TSLA brings its volatility and upside to DeFi.

-

Berkshire Hathaway Inc. Class B (BRK.B): Warren Buffett’s conglomerate spans insurance, railroads, and more. Tokenized BRK.B offers diversified exposure to the U.S. economy.

-

JPMorgan Chase & Co. (JPM): America’s largest bank, JPMorgan is a financial sector bellwether. Tokenized JPM gives on-chain access to traditional banking strength.

-

Visa Inc. Class A (V): A global payments leader, Visa powers commerce worldwide. Tokenized V provides blockchain-based exposure to the digital payments revolution.

-

Johnson & Johnson (JNJ): A healthcare giant, J&J is known for pharmaceuticals and consumer health products. Tokenized JNJ offers defensive exposure on-chain.

-

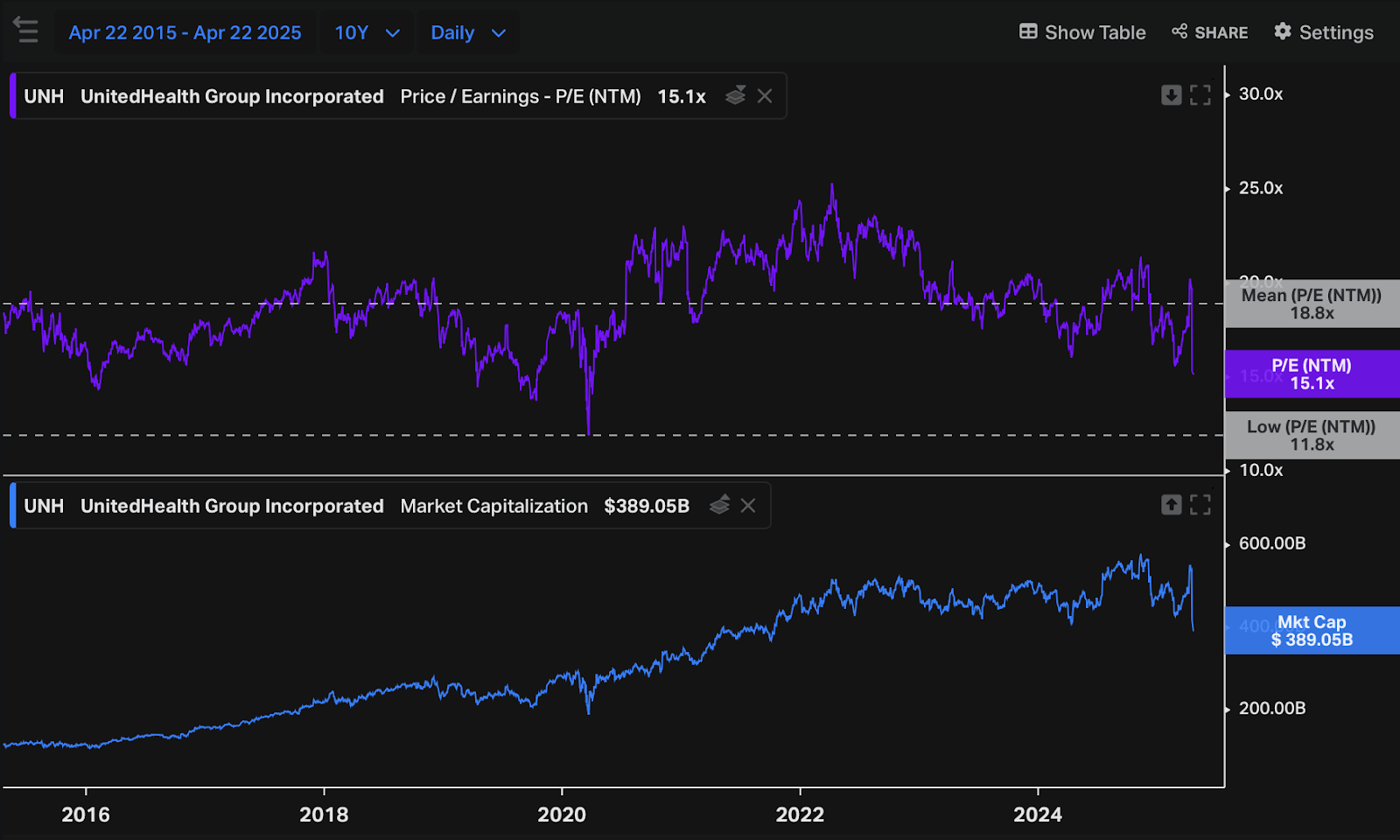

UnitedHealth Group Incorporated (UNH): The largest U.S. health insurer, UnitedHealth is a key player in healthcare services. Tokenized UNH brings this sector to blockchain investors.

-

Exxon Mobil Corporation (XOM): As a top oil and gas company, Exxon Mobil is central to global energy markets. Tokenized XOM provides exposure to energy sector dynamics.

-

Eli Lilly and Company (LLY): A pharmaceutical leader, Eli Lilly is renowned for innovation in medicine. Tokenized LLY offers access to healthcare breakthroughs.

-

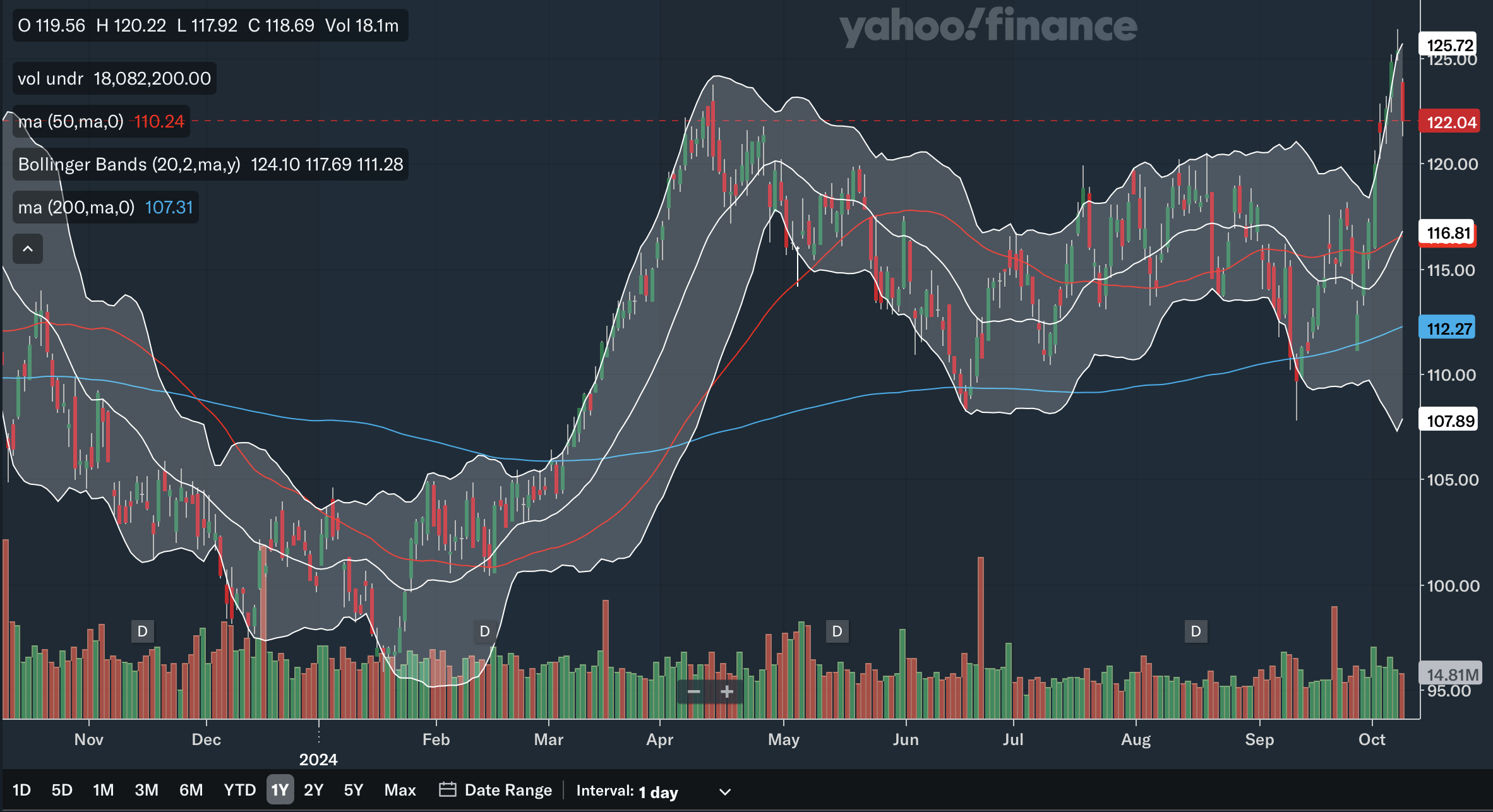

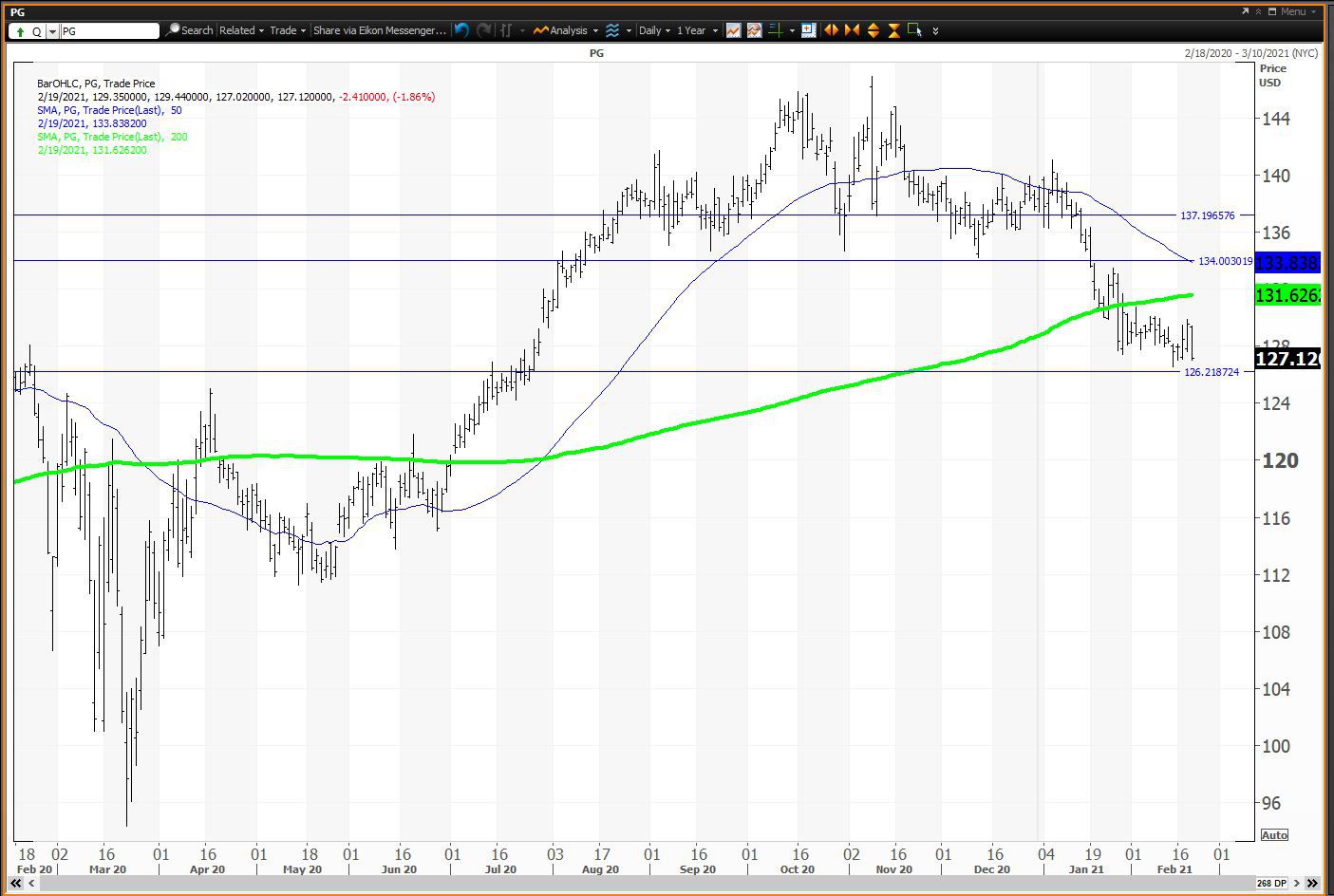

Procter & Gamble Company (PG): P&G is a consumer staples powerhouse behind many household brands. Tokenized PG brings defensive, blue-chip exposure to DeFi portfolios.

-

Mastercard Incorporated Class A (MA): Another payments giant, Mastercard is at the forefront of global transactions. Tokenized MA enables blockchain investors to join the digital payments trend.

-

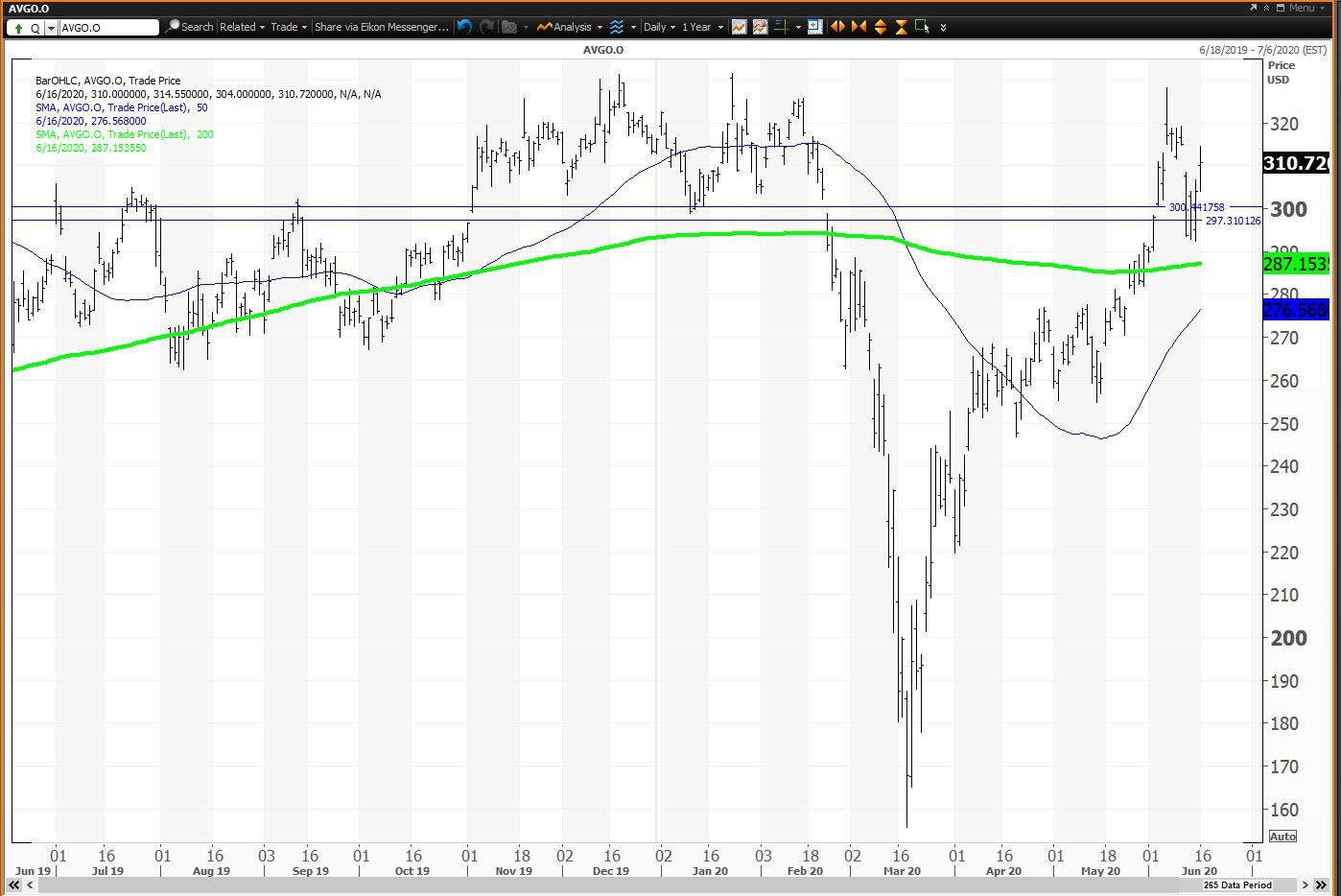

Broadcom Inc. (AVGO): A leader in semiconductor and infrastructure software, Broadcom is essential to tech supply chains. Tokenized AVGO brings this exposure on-chain.

-

Home Depot Inc. (HD): The largest home improvement retailer, Home Depot is a bellwether for U.S. consumer spending. Tokenized HD offers real estate and retail sector exposure.

-

Chevron Corporation (CVX): Chevron is a major integrated energy company. Tokenized CVX brings oil and gas sector access to blockchain-based portfolios.

-

Coca-Cola Company (KO): An iconic beverage brand, Coca-Cola is a global consumer staple. Tokenized KO offers defensive, steady exposure to a world-famous company.

How Does Ondo’s Tokenization Actually Work?

At its core, each Ondo equity or ETF token represents a fully-backed claim on real-world securities held with U. S. -registered broker-dealers. This means when you hold an Apple or Nvidia token on Ethereum, there’s an actual share in custody backing your position – not just synthetic exposure or leveraged contracts.

Ondo leverages robust infrastructure partners like BitGo for secure custody, Ledger Live for wallet compatibility, LayerZero for interoperability across chains, and Chainlink for official price feeds to ensure transparency. This architecture enables near-instant settlement, peer-to-peer transfers 24/7, fractional ownership down to tiny increments, and integration with DeFi protocols for lending or collateralization.

The New Investor Experience: 24/7 Access Meets Blockchain Transparency

The days of waiting for Wall Street’s opening bell are over for global investors using Ondo’s platform. Trading is available 24 hours a day during market weekdays, with tokens transferable peer-to-peer at any time – even outside traditional market hours.

Imagine buying into Costco Wholesale Corporation (COST) or Walt Disney Company (DIS) from anywhere in the world via your crypto wallet – no intermediaries required beyond initial KYC onboarding for compliance purposes. Fractional ownership means you don’t need thousands of dollars to get exposure to high-priced shares like Berkshire Hathaway Inc. Class B or Broadcom Inc. Instead, you can start small while still accessing on-chain dividends when supported by issuers.

This isn’t limited to single-name stocks either; major ETFs covering every corner of the market are included: SPDR Gold Shares (GLD) for commodities exposure, Vanguard Total Stock Market ETF (VTI) for broad diversification, iShares MSCI Emerging Markets ETF (EEM) for global reach, ARK Next Generation Internet ETF (ARKW) for disruptive tech themes, and many more.

Ondo’s approach is fundamentally changing the accessibility of U. S. equities and ETFs for non-U. S. investors. By tokenizing a curated basket of more than 100 assets, Ondo Global Markets now lets users access everything from blue-chip tech stocks like Apple (AAPL), Microsoft (MSFT), and NVIDIA (NVDA) to sector-spanning ETFs such as the SPDR S and amp;P 500 ETF Trust (SPY), Invesco QQQ Trust (QQQ), and Vanguard S and amp;P 500 ETF (VOO). The platform isn’t just about technology, it’s about breadth and depth, offering exposure to financials like JPMorgan Chase and amp; Co. (JPM), healthcare leaders such as Johnson and amp; Johnson (JNJ) and UnitedHealth Group Incorporated (UNH), consumer titans like Walmart Inc. (WMT) and McDonald’s Corporation (MCD), as well as energy names including Exxon Mobil Corporation (XOM) and Chevron Corporation (CVX).

Why This Matters: Real Ownership and On-Chain Utility

Unlike synthetic derivatives or CFDs, each Ondo token is fully backed by real-world shares or ETF units. This means your on-chain holding in Tesla Inc. (TSLA) or the ARK Innovation ETF (ARKK) is not just a bet, it’s a digital reflection of actual ownership, with all the associated rights, including eligibility for on-chain dividends where supported.

This model unlocks several key advantages:

- Fractional Ownership: Buy increments as small as you want in Amazon. com Inc. (AMZN) or Berkshire Hathaway Inc. Class B (BRK. B), making high-value stocks accessible to all.

- P2P Transfers: Move your tokens representing Meta Platforms Inc. (META), Visa Inc. Class A (V), or any other asset instantly between wallets, no need for legacy clearinghouses.

- Integration with DeFi: Use your tokenized equities as collateral in lending protocols, or provide liquidity using major ETFs like iShares Core S and P Mid-Cap ETF (IJH) or Vanguard Real Estate ETF (VNQ).

- Diversification: Access thematic ETFs such as Global X Robotics and Artificial Intelligence ETF (BOTZ), VanEck Semiconductor ETF (SMH), Invesco Solar ETF (TAN), and more, all on-chain.

The Full Spectrum: From Tech Giants to Thematic ETFs

The diversity available through Ondo Finance is striking. Investors can assemble a portfolio spanning every major sector, technology via Advanced Micro Devices, Inc. (AMD) and Qualcomm Incorporated (QCOM); financials via Goldman Sachs Group, Inc. (GS) and Bank of America Corporation (BAC); industrials like Boeing Company, The (BA) and Honeywell International Inc. (HON); consumer staples via Coca-Cola Company (KO) and PepsiCo, Inc. (PEP); plus real estate with iShares U. S. Real Estate ETF (IYR). For those seeking growth opportunities beyond U. S. borders, international exposure comes from iShares MSCI Emerging Markets ETF (EEM), iShares MSCI EAFE ETF (EFA), SPDR Portfolio Developed World ex-US ETF (SPDW), and more.

Top Sector ETFs Available on Ondo Finance

-

SPDR S&P 500 ETF Trust (SPY): The most traded ETF tracking the S&P 500, offering broad exposure to leading U.S. large-cap companies.

-

Invesco QQQ Trust (QQQ): Tracks the Nasdaq-100 Index, focusing on top technology and growth companies like Apple, Microsoft, and Nvidia.

-

iShares Russell 2000 ETF (IWM): Provides access to small-cap U.S. stocks, ideal for investors seeking diversified growth.

-

Vanguard S&P 500 ETF (VOO): A low-cost ETF mirroring the S&P 500, popular for its broad market exposure and strong liquidity.

-

iShares MSCI Emerging Markets ETF (EEM): Invests in leading companies from emerging markets, diversifying beyond the U.S.

-

Vanguard Total Stock Market ETF (VTI): Offers comprehensive exposure to the entire U.S. equity market, from small to large caps.

-

ARK Innovation ETF (ARKK): Focuses on disruptive innovation, holding high-growth tech companies and industry disruptors.

-

iShares MSCI EAFE ETF (EFA): Tracks developed markets outside the U.S. and Canada, including Europe, Australia, and Asia.

-

Schwab U.S. Broad Market ETF (SCHB): Covers the entire U.S. stock market, offering a diversified and cost-effective option.

-

SPDR Dow Jones Industrial Average ETF Trust (DIA): Mirrors the performance of the Dow Jones Industrial Average, featuring 30 blue-chip U.S. stocks.

-

iShares Core S&P Mid-Cap ETF (IJH): Targets mid-cap U.S. companies, balancing growth and stability.

-

Vanguard Growth ETF (VUG): Invests in large-cap growth stocks, emphasizing technology and consumer sectors.

-

iShares Core U.S. Aggregate Bond ETF (AGG): A leading bond ETF for fixed income exposure, tracking the U.S. investment-grade bond market.

-

SPDR Gold Shares (GLD): The largest gold-backed ETF, providing investors with direct exposure to gold prices.

-

Vanguard Dividend Appreciation ETF (VIG): Focuses on companies with a strong track record of growing dividends year over year.

-

iShares U.S. Real Estate ETF (IYR): Offers exposure to U.S. real estate investment trusts (REITs) and related companies.

-

Financial Select Sector SPDR Fund (XLF): Tracks the financial sector, including banks, insurance, and investment firms.

-

Health Care Select Sector SPDR Fund (XLV): Invests in major U.S. healthcare companies, from pharmaceuticals to medical devices.

-

Technology Select Sector SPDR Fund (XLK): Focuses on leading technology firms, including software, hardware, and IT services.

-

Energy Select Sector SPDR Fund (XLE): Provides access to top U.S. energy companies, including oil, gas, and renewables.

-

Utilities Select Sector SPDR Fund (XLU): Covers the U.S. utilities sector, known for stability and dividends.

-

Consumer Discretionary Select Sector SPDR Fund (XLY): Invests in leading consumer discretionary companies, such as retailers and automakers.

-

Consumer Staples Select Sector SPDR Fund (XLP): Focuses on essential consumer goods companies, including food, beverage, and household products.

-

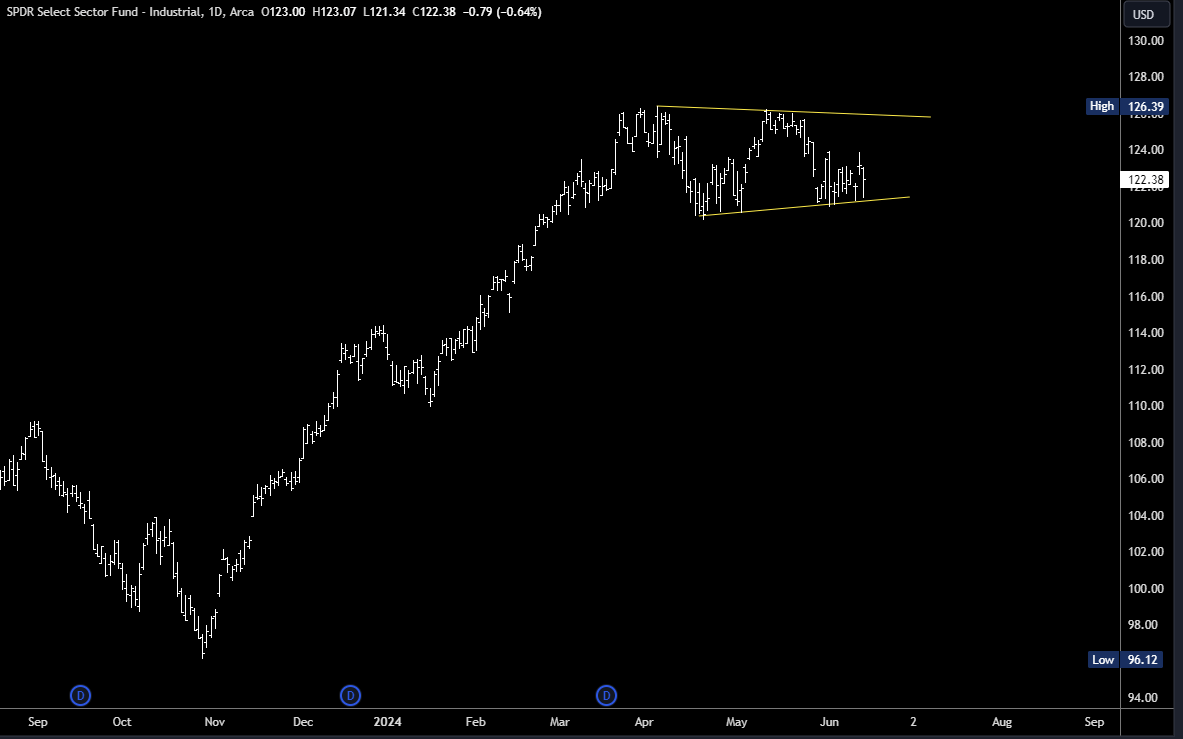

Industrial Select Sector SPDR Fund (XLI): Tracks major U.S. industrial firms, from manufacturing to transportation.

-

Materials Select Sector SPDR Fund (XLB): Invests in companies producing raw materials, chemicals, and construction materials.

-

Real Estate Select Sector SPDR Fund (XLRE): Focuses on real estate management and development companies and REITs.

-

Vanguard Real Estate ETF (VNQ): Offers broad exposure to the U.S. real estate sector via REITs.

-

iShares Core S&P Small-Cap ETF (IJR): Tracks small-cap U.S. stocks, providing growth potential and diversification.

-

SPDR Portfolio S&P 500 Growth ETF (SPYG): Focuses on growth stocks within the S&P 500 index.

-

Vanguard Value ETF (VTV): Invests in large-cap value stocks, offering stability and income.

-

Invesco S&P 500 Equal Weight ETF (RSP): Provides equal-weighted exposure to all S&P 500 constituents, reducing concentration risk.

-

Schwab U.S. Large-Cap ETF (SCHX): Tracks the largest U.S. companies, offering a cost-effective way to invest in blue chips.

-

iShares Edge MSCI Min Vol USA ETF (USMV): Focuses on U.S. stocks with lower volatility, aiming to reduce risk.

-

iShares ESG Aware MSCI USA ETF (ESGU): Invests in U.S. companies with strong environmental, social, and governance practices.

-

VanEck Semiconductor ETF (SMH): Tracks leading semiconductor companies, benefiting from global chip demand.

-

Global X Robotics & Artificial Intelligence ETF (BOTZ): Invests in companies advancing robotics and AI technologies.

-

ARK Next Generation Internet ETF (ARKW): Focuses on disruptive internet and technology companies.

-

First Trust Cloud Computing ETF (SKYY): Invests in cloud computing companies, a key driver of digital transformation.

-

Direxion Daily S&P 500 Bull 3X Shares (SPXL): A leveraged ETF offering triple the daily performance of the S&P 500 index.

-

ProShares UltraPro QQQ (TQQQ): A leveraged ETF targeting triple the daily return of the Nasdaq-100 index.

-

SPDR Portfolio Developed World ex-US ETF (SPDW): Tracks developed markets outside the U.S., providing global diversification.

-

iShares MSCI ACWI ex U.S. ETF (ACWX): Offers exposure to global equities outside the U.S., including emerging and developed markets.

-

Invesco Solar ETF (TAN): Focuses on global solar energy companies, capitalizing on renewable energy trends.

-

Global X Lithium & Battery Tech ETF (LIT): Invests in companies involved in lithium mining and battery technology, powering the EV revolution.

This broad selection allows investors to tailor their strategies, whether it’s tracking the S and amp;P 500 through SPY or VOO, betting on innovation with ARKK or ARKW, targeting income with Vanguard Dividend Appreciation ETF (VIG), or hedging volatility with iShares Edge MSCI Min Vol USA ETF (USMV). Even leveraged products like Direxion Daily S and amp;P 500 Bull 3X Shares (SPXL) and ProShares UltraPro QQQ (TQQQ) are available for sophisticated traders looking for amplified returns.

What Comes Next? Scaling Beyond 100 Assets

The Ondo roadmap is ambitious: expansion toward over 1,000 tokenized assets by year-end will further democratize access to Wall Street for global DeFi users. Planned support for BNB Chain and Solana will add cross-chain flexibility alongside Ethereum’s established ecosystem.

If you’re considering bridging traditional equity investing with blockchain-native benefits, fractionalization, transparency, instant settlement, Ondo Finance is now a leading gateway.

For deep dives into how these mechanisms work behind the scenes or how you can get started trading tokenized stocks yourself, check out our expanded guide at this resource.